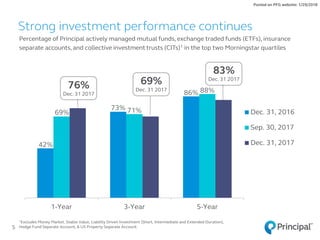

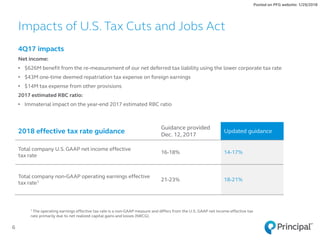

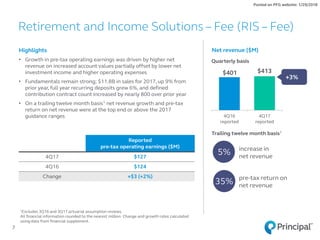

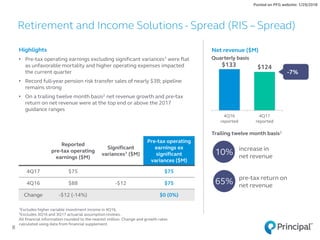

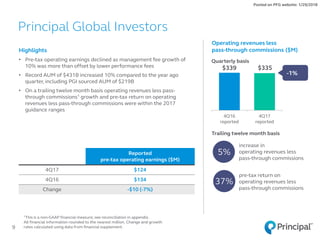

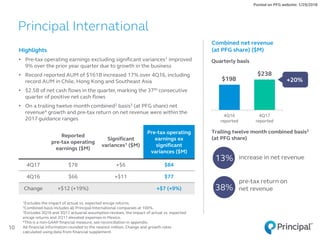

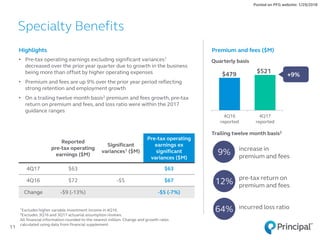

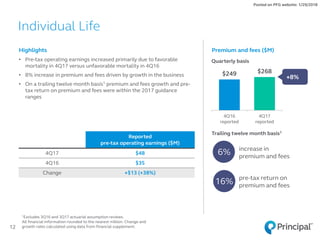

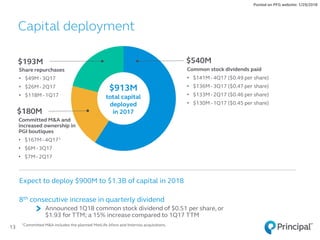

Principal Financial Group reported earnings results for the fourth quarter of 2017. While 2017 was a strong year overall with record non-GAAP operating earnings of $1.5 billion, fourth quarter results declined from the prior year quarter. The tax cuts and Jobs Act resulted in a $568 million benefit to net income. For 2018, the company expects to deploy $900 million to $1.3 billion of capital and announced an increase to the first quarter common stock dividend.