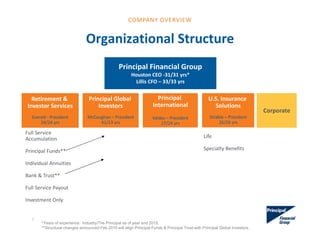

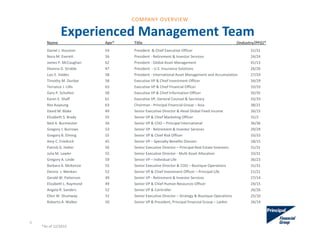

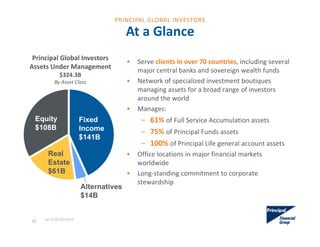

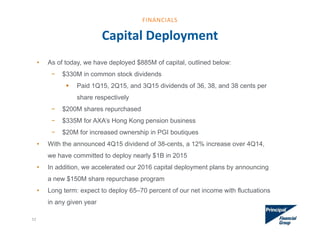

Principal Financial Group is a 136-year-old Fortune 500 company that provides retirement and investment services, asset management, and insurance solutions. It has $516 billion in assets under management from its divisions, which include Retirement and Investor Services, Principal Global Investors, Principal International, and U.S. Insurance Solutions. The company uses non-GAAP measures to evaluate performance alongside GAAP, and provides reconciliations between the two. It operates globally and has over 20 million customers.