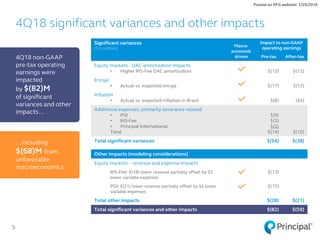

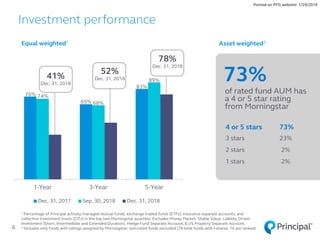

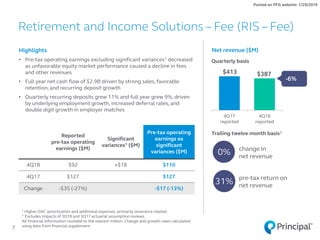

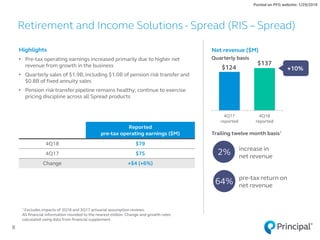

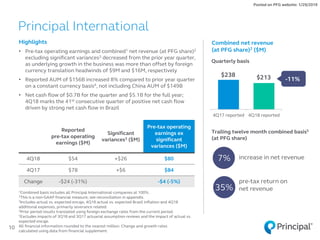

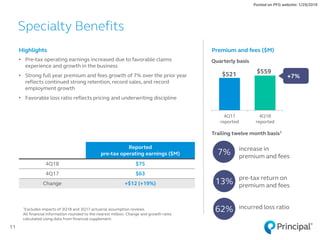

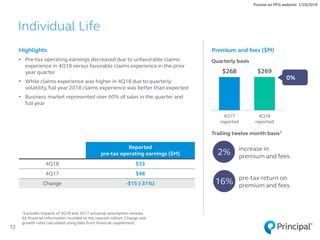

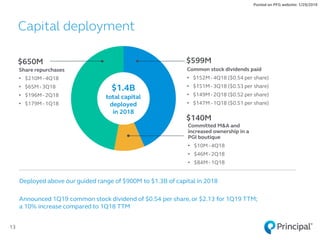

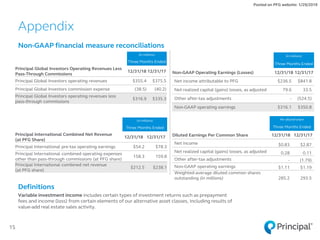

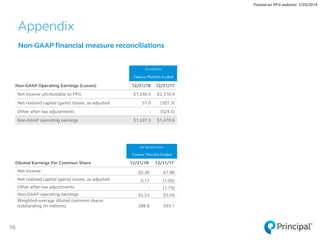

This document summarizes Principal Financial Group's fourth quarter 2018 earnings results. It provides key financial metrics including record full year 2018 non-GAAP operating earnings of $1.6 billion, up 8% over the prior year. It discusses significant variances that impacted 4Q18 results, including higher DAC amortization from equity market performance and lower than expected performance in Brazil. The document also provides details on the company's investment performance, asset management business results, and retirement and income solutions business results.