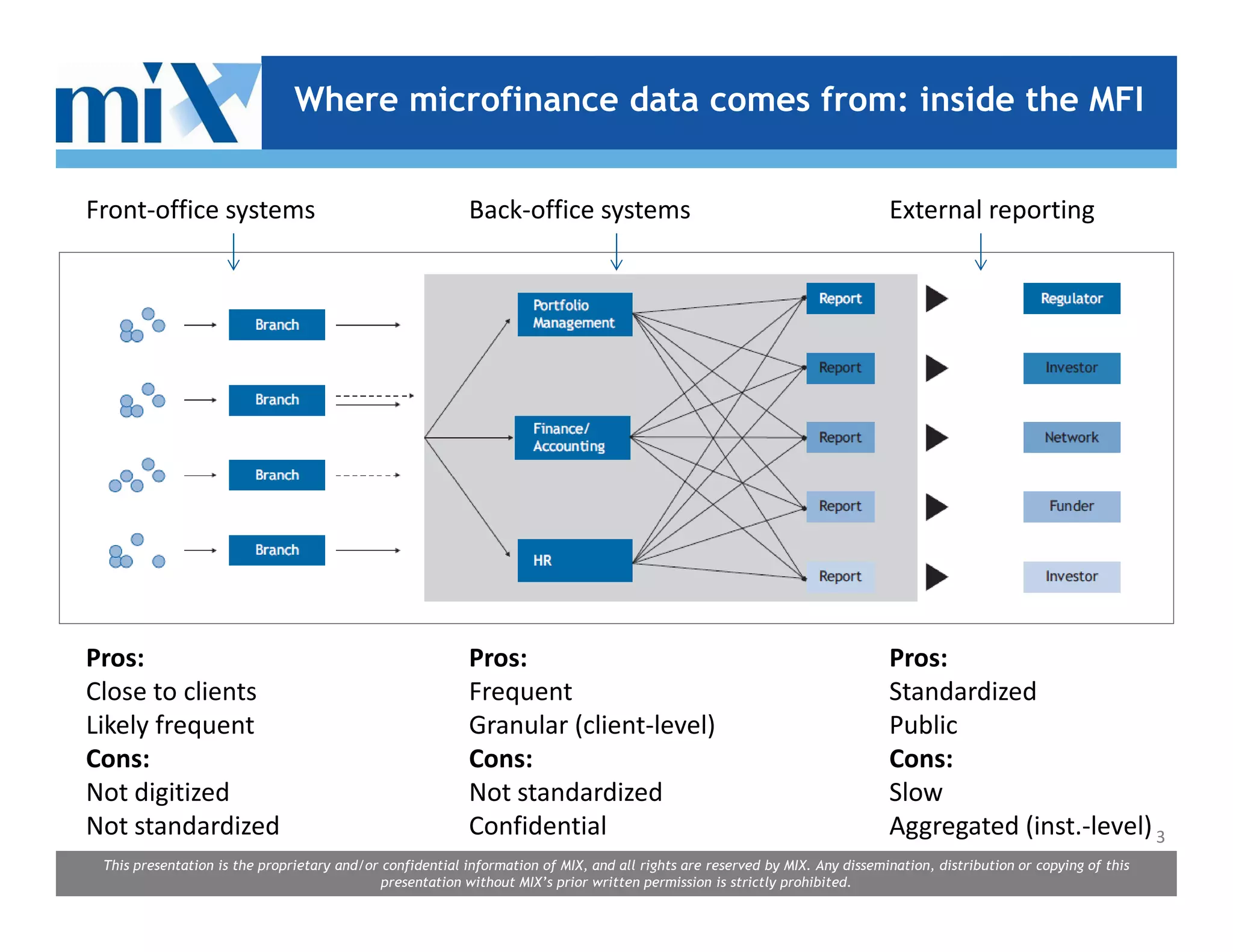

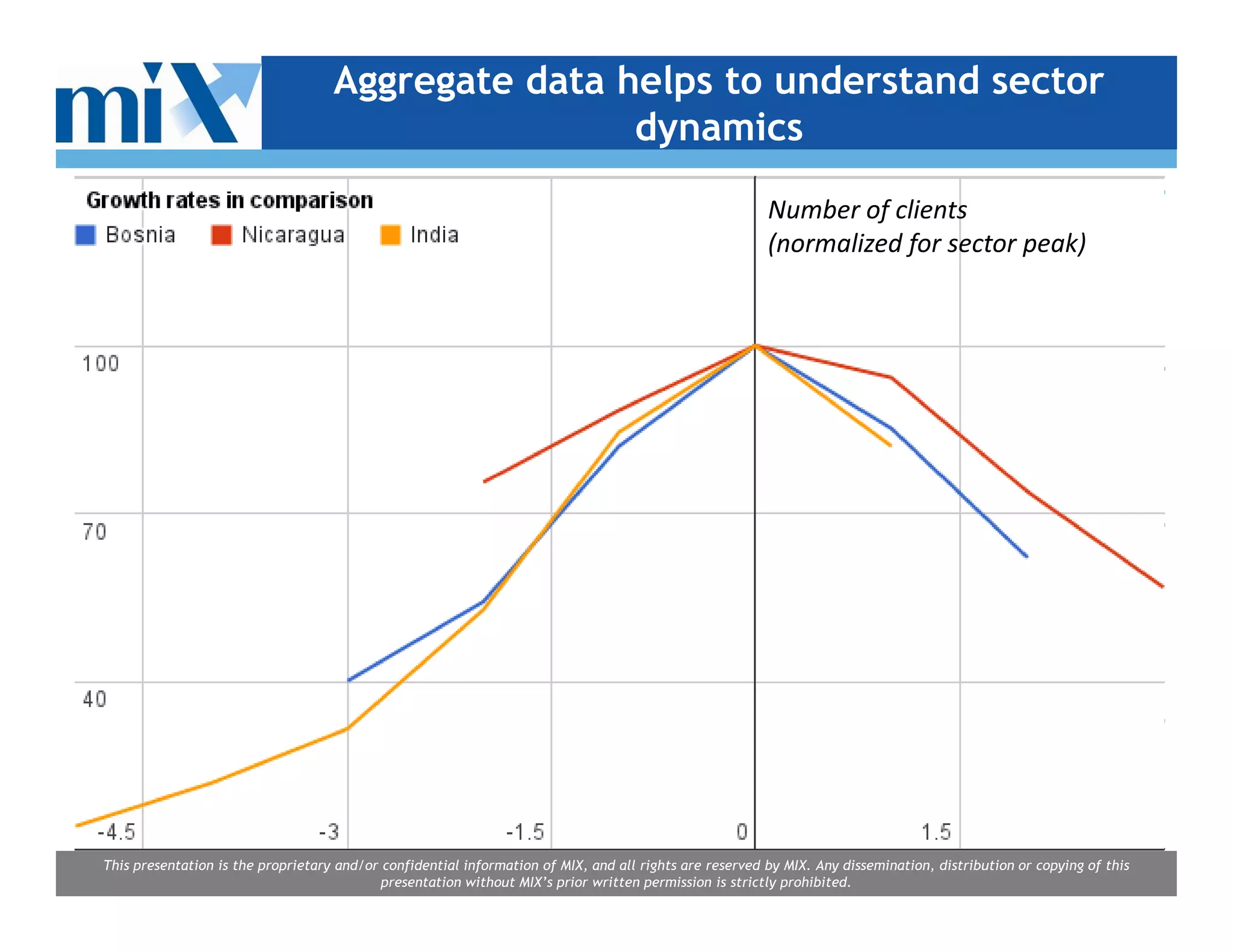

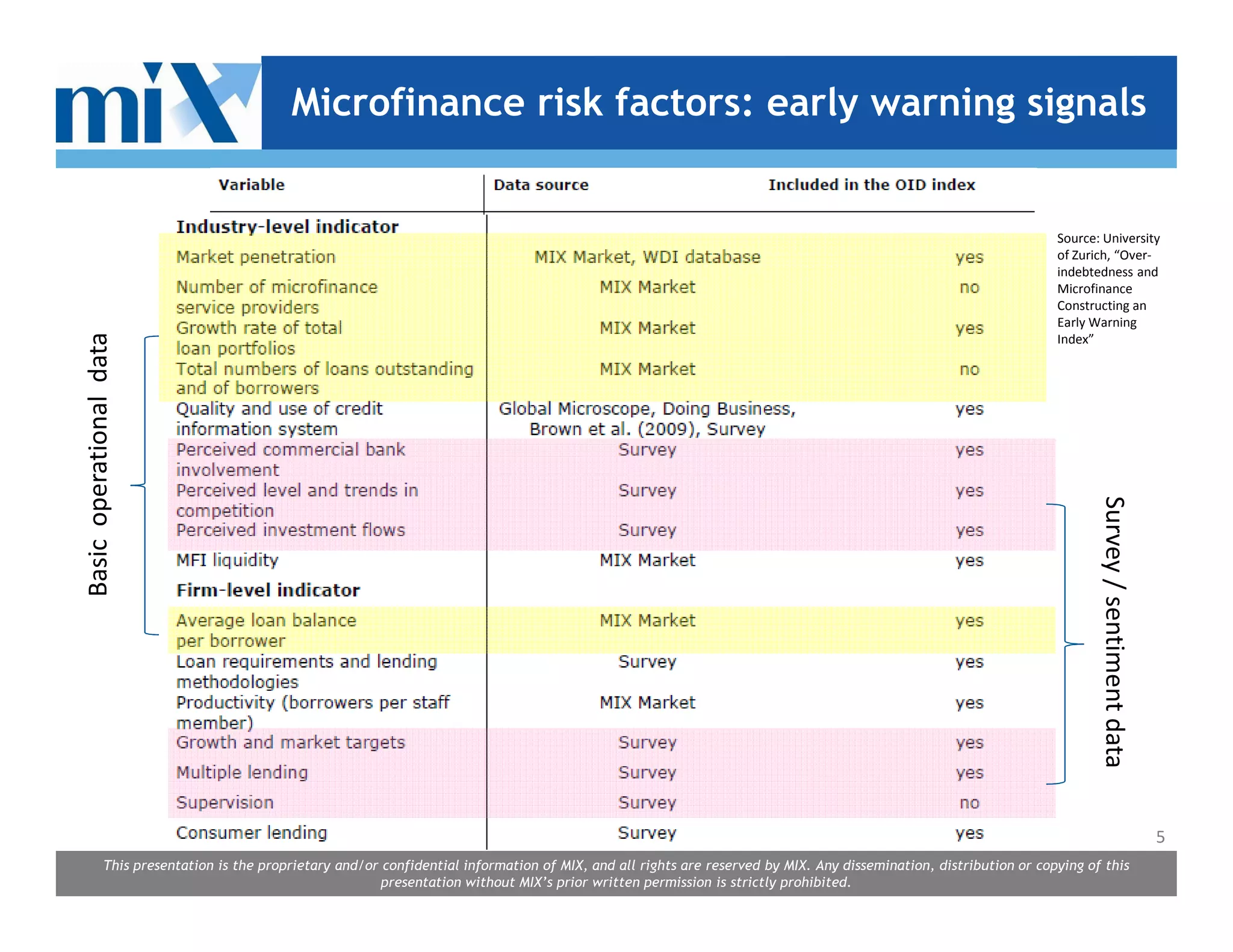

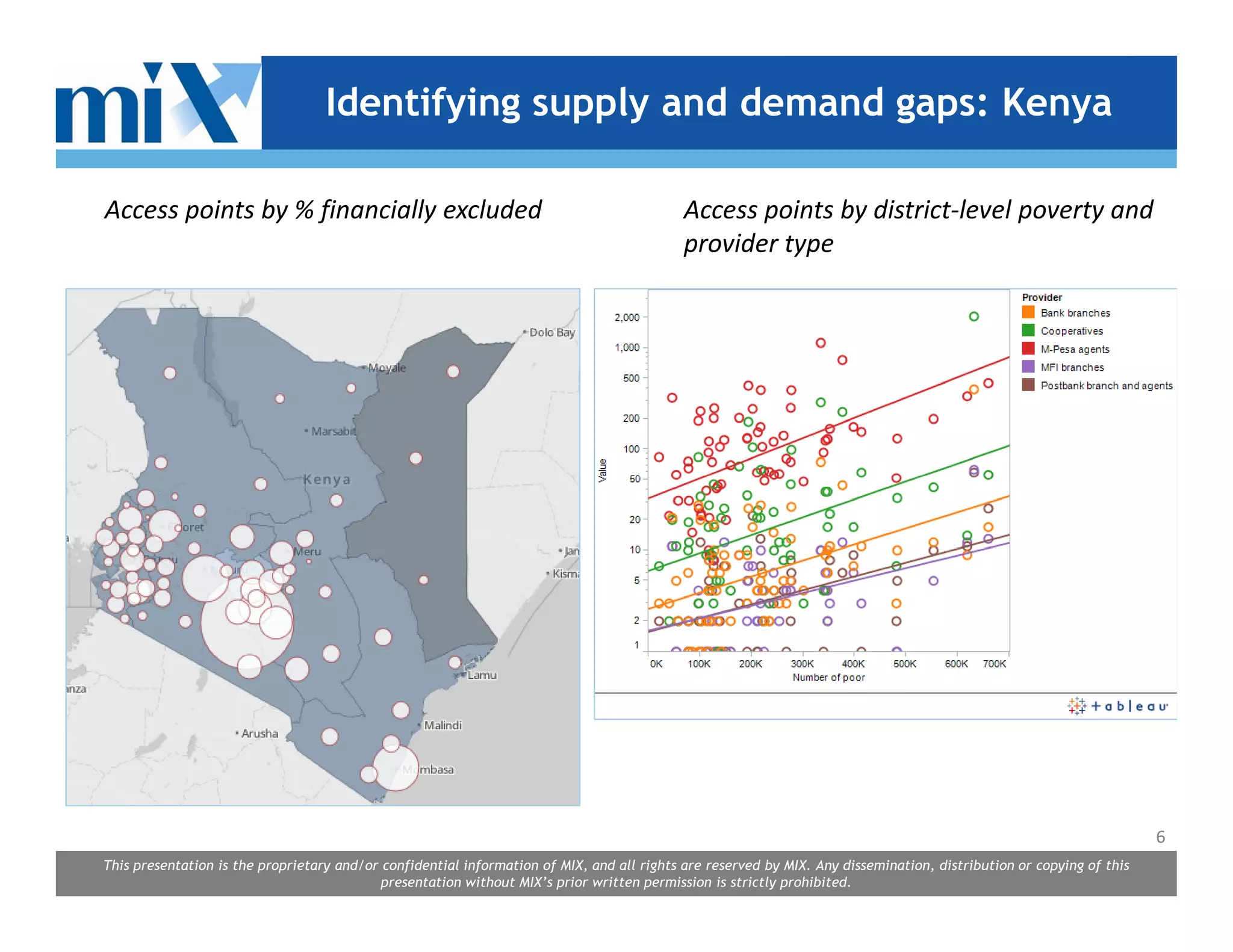

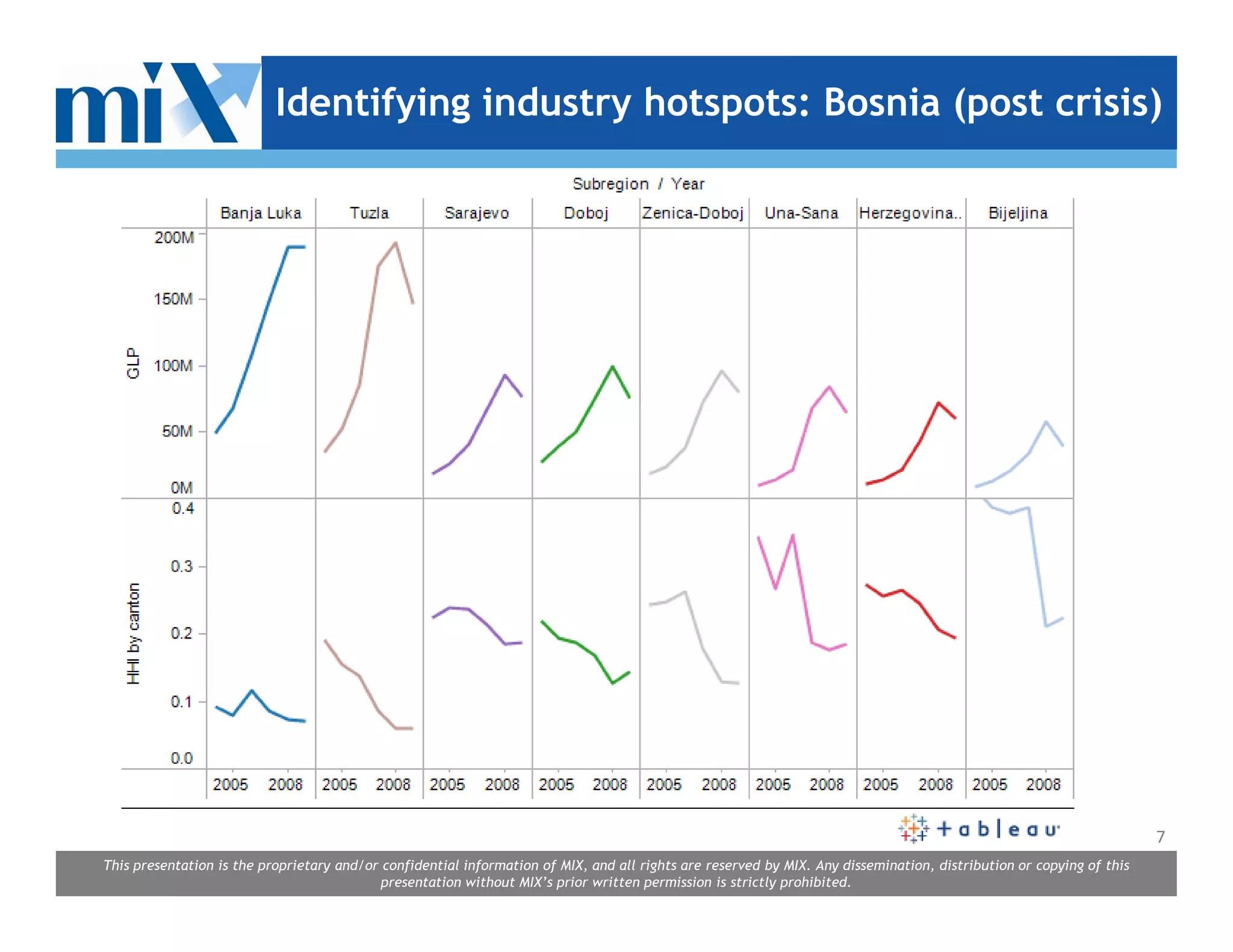

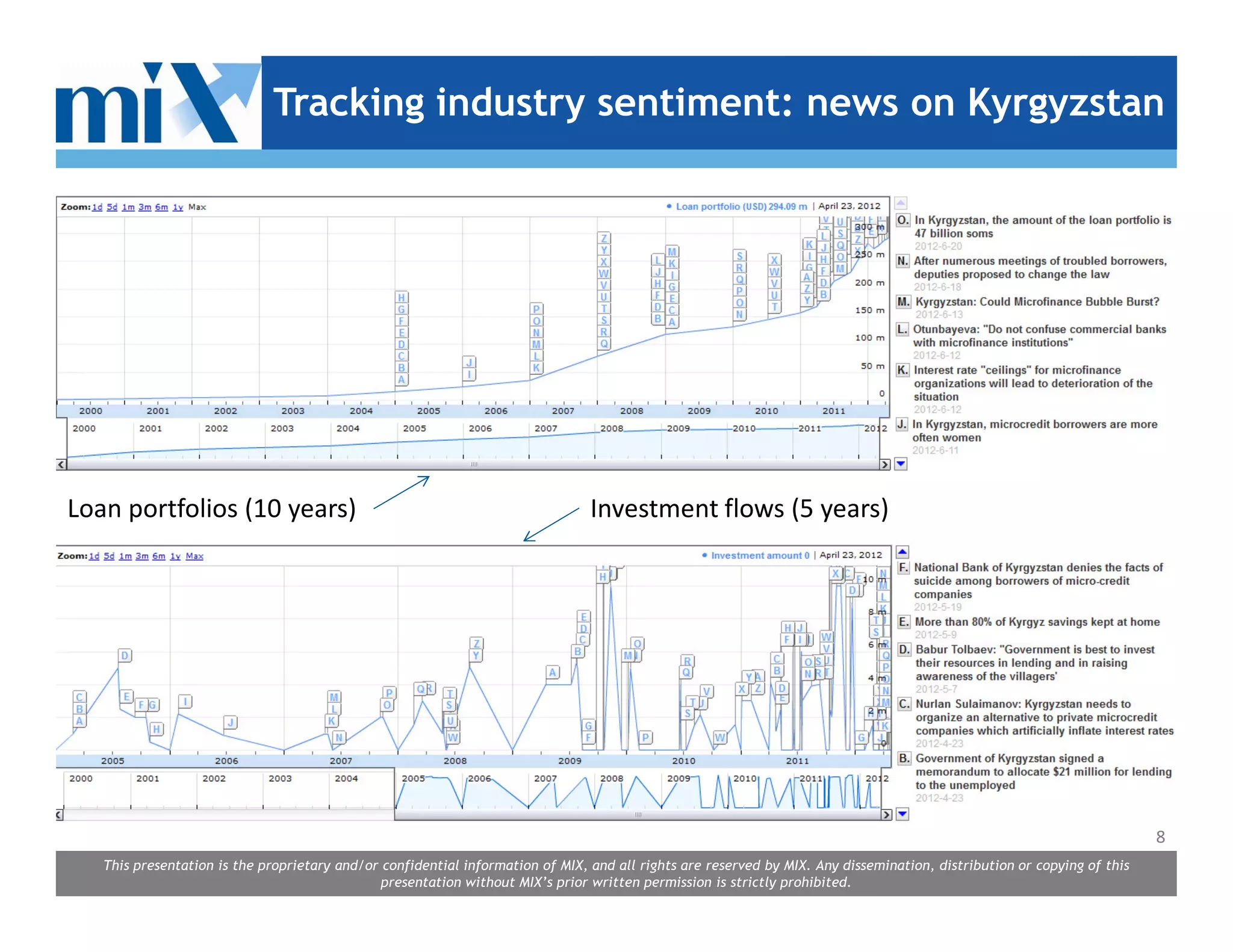

The document discusses microfinance data and its sources. Microfinance serves over 140 million poor clients globally through business investments and basic needs loans. Microfinance data comes from internal financial institution systems and external reporting, though it can be difficult to obtain. Aggregate microfinance data helps understand industry trends and identify supply and demand gaps. Risk indicators and outside data provide context to interpret credit growth and savings trends. The Microfinance Information Exchange is a nonprofit that partners with industry leaders to collect, analyze and disseminate microfinance data.