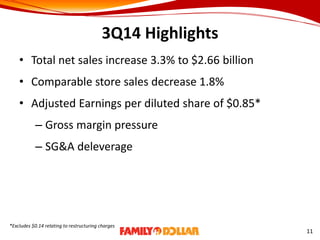

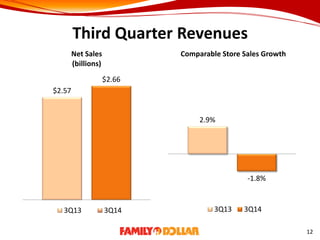

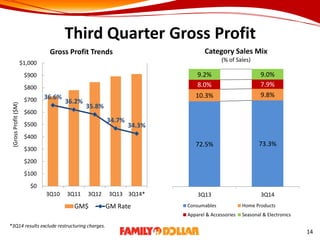

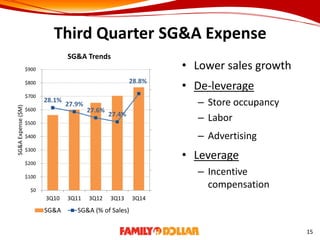

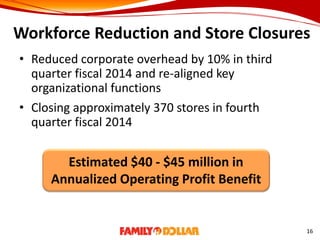

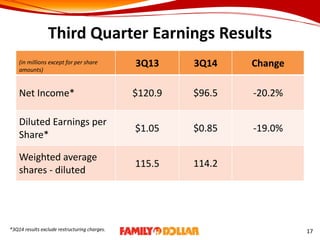

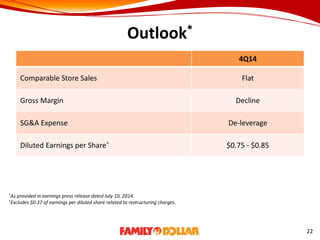

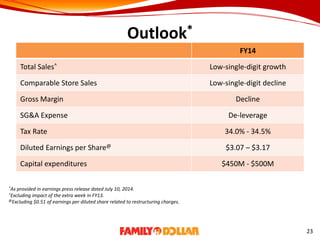

The company reported third quarter earnings that were below expectations due to gross margin pressure and SG&A deleverage in a difficult operating environment. It announced plans to close approximately 370 stores and reduce corporate overhead by 10% to improve profitability. For the fourth quarter, it expects comparable store sales to be flat with gross margin decline and SG&A deleverage impacting earnings per share to be in the range of $0.75 to $0.85. For the full year, it expects low-single-digit sales growth and low-single-digit comparable store sales decline with earnings per share of $3.07 to $3.17.