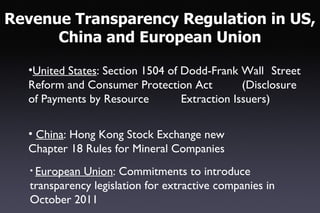

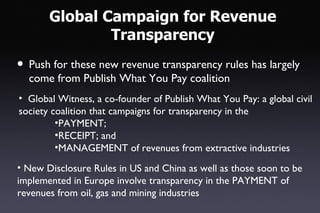

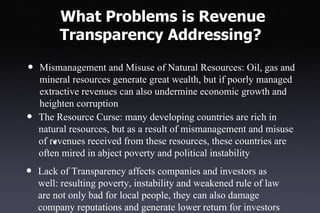

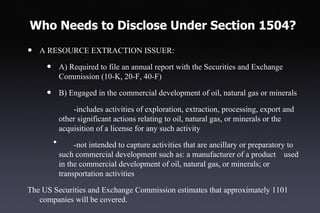

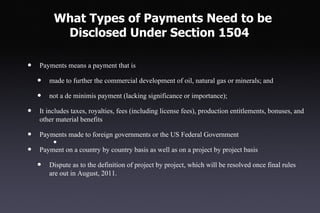

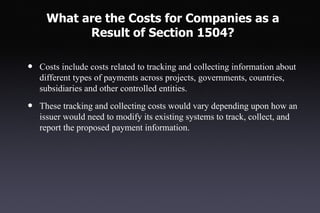

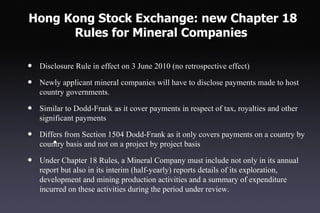

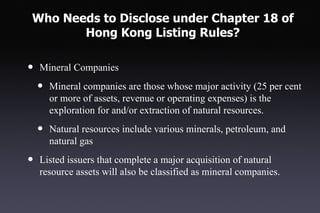

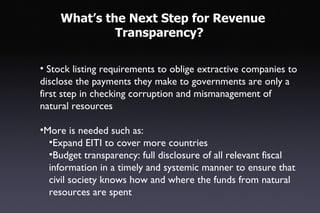

The document discusses new disclosure rules for extractive industries aimed at enhancing revenue transparency for publicly listed companies in the US, China, and EU. It highlights the need for companies to disclose payments made to governments to address issues of resource mismanagement and corruption, exemplified by Nigeria's oil industry failures. The ultimate goal is to hold governments accountable for how natural resource revenues are managed, thereby fostering better governance and protecting investor interests.