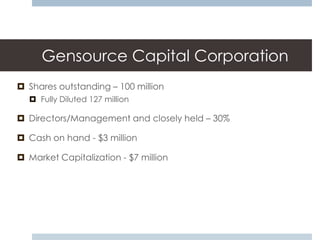

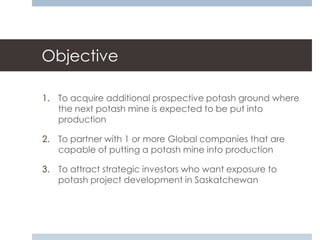

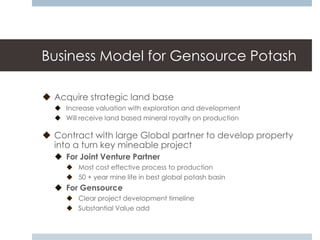

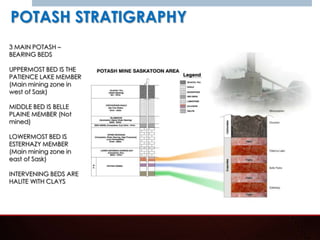

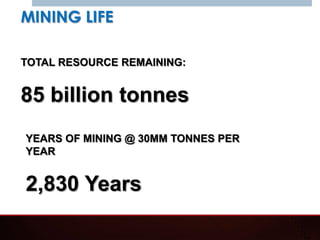

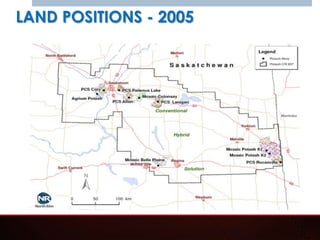

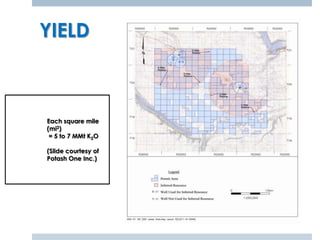

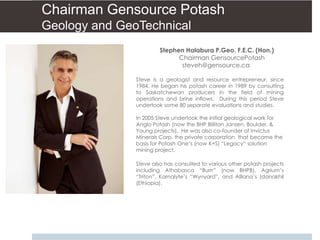

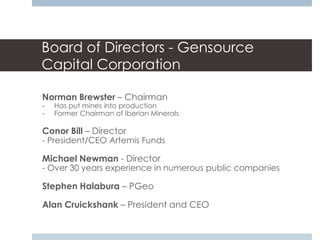

The document presents a detailed overview of Gensource Capital Corporation and its strategy for developing potash resources in Saskatchewan. It outlines the company's strengths, including its experienced management team, strategic land position, and the demand for potash, while also warning investors of the inherent risks and uncertainties associated with forward-looking statements. Key aspects include Gensource's business model focusing on acquiring land, partnering with global firms, and achieving long-term production goals.