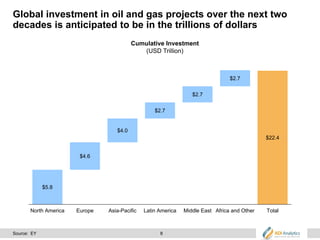

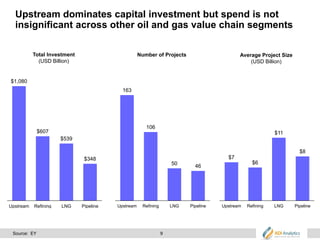

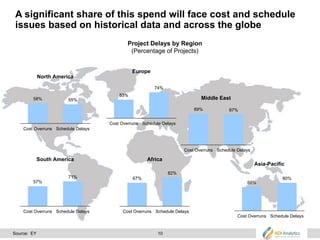

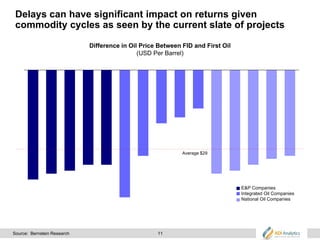

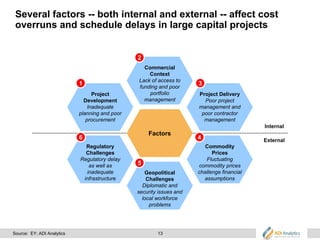

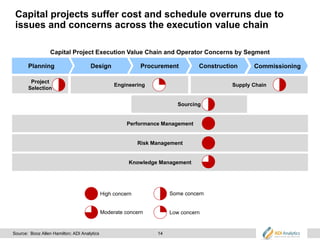

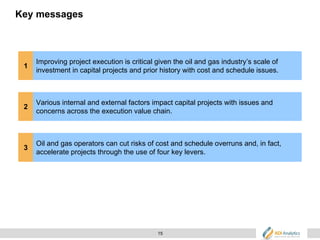

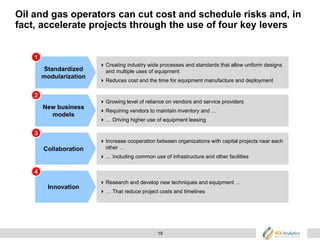

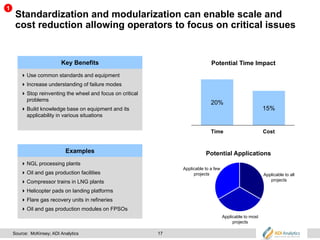

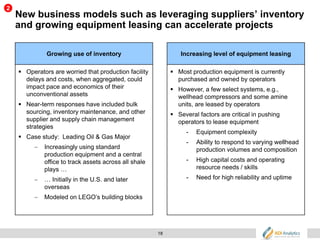

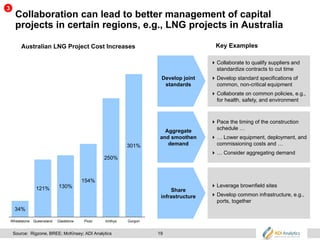

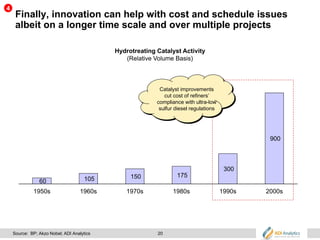

This presentation discusses driving capital projects in oil and gas to best-in-class execution. Global investment in oil and gas projects over the next two decades is anticipated to be in the trillions. However, many projects historically face cost overruns and schedule delays. Both internal factors like planning and external factors like regulations can impact projects. Operators can improve performance through standardized modularization, new business models, collaboration, and innovation to reduce risks and potentially accelerate projects.