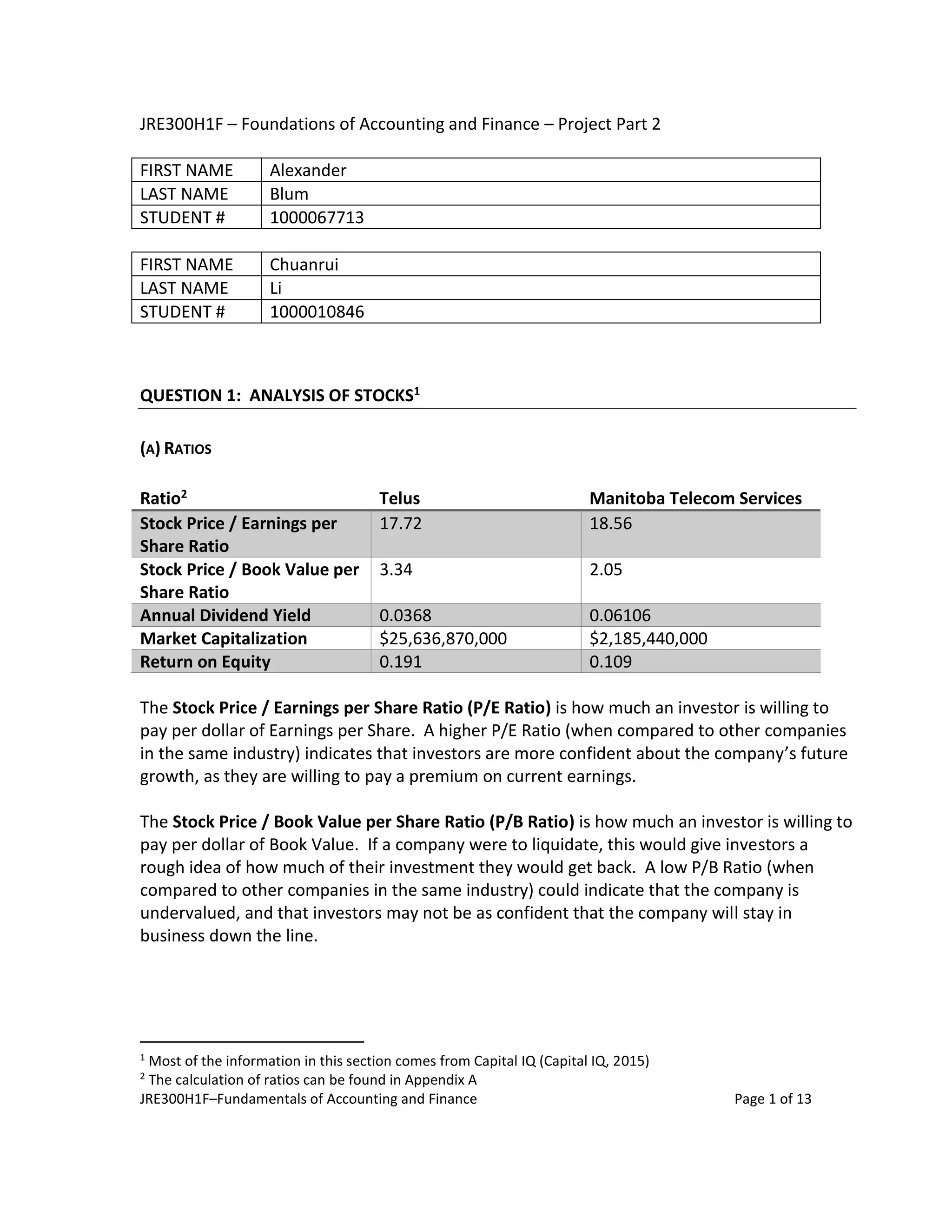

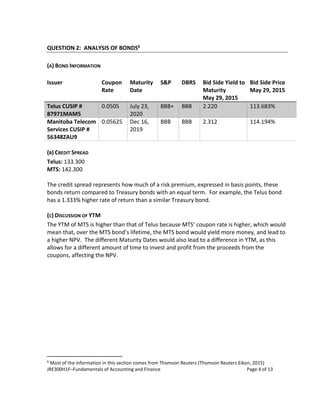

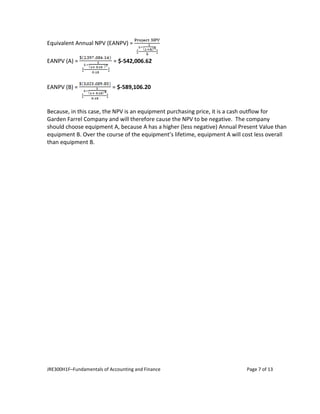

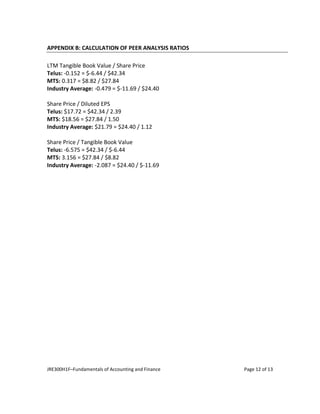

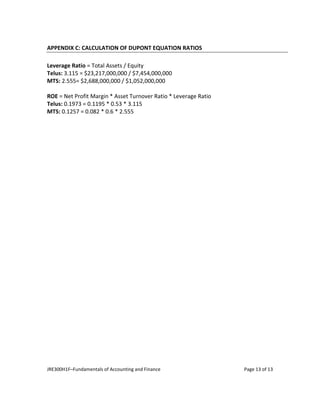

This document analyzes and compares the financial performance of Telus and Manitoba Telecom Services (MTS) through ratios, bond valuations, and discounted cash flow models. It finds that while Telus has a higher return on equity, MTS has a higher dividend yield and may be better valued according to its price-to-book ratio. Both companies' bonds have higher yields than comparable government bonds, but MTS's bonds have a slightly higher yield. Leasing equipment is found to have a lower net present value than purchasing for the situations analyzed. The document also models a potential energy project and finds it has a positive NPV and IRR above the discount rate.