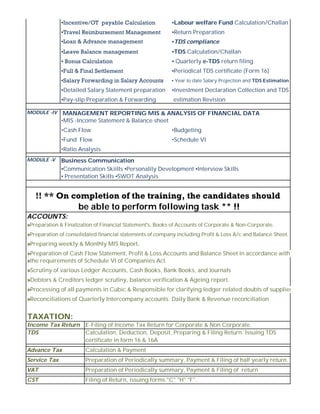

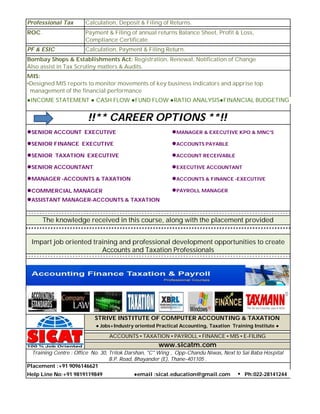

The document advertises an accounting and taxation certificate course offered by Strive Institute of Computer Accounting & Taxation. The 5 module course provides practical training in financial accounting, direct and indirect taxation, payroll processing, management reporting, and business communication skills. On completion, candidates will be equipped to perform accounting, taxation, and financial reporting tasks in entry-level jobs. The institute promises affordable fees, flexible timings, qualified faculty, lifetime support, and 100% placement assistance upon course completion.