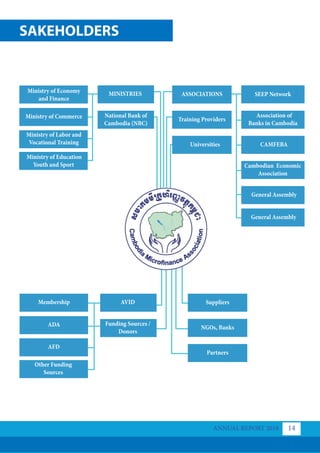

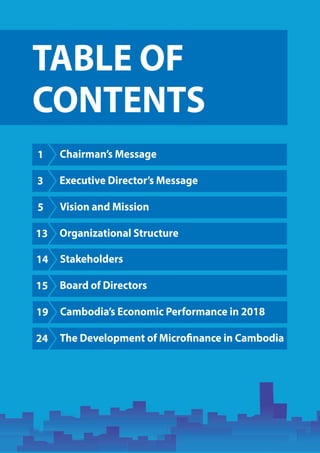

The document provides an overview of the Cambodia Microfinance Association (CMA) including its:

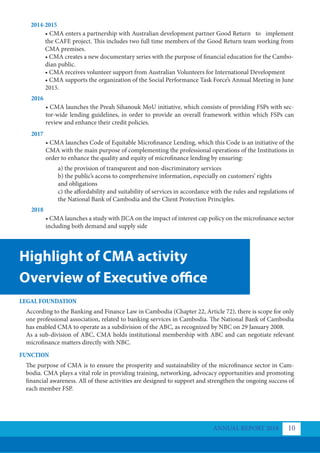

1) Legal foundation and functions as a sub-division of the Association of Banks in Cambodia recognized by the National Bank of Cambodia.

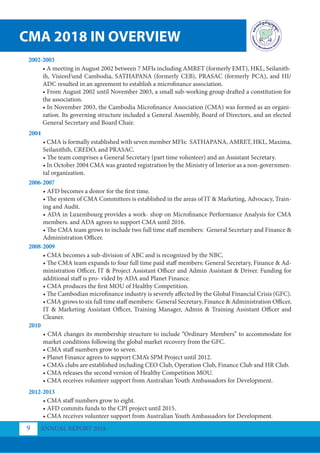

2) Highlights of CMA activity from 2002-2018 including establishing committees, growing staff size, implementing projects on topics like social performance, financial inclusion, and client protection.

3) CMA's strategic plan for 2018-2022 with pillars around sustainability, representation, information/research, and financial inclusion.

![EXCUTIVE DIRECTOR’S MESSAGE

ANNUAL REPORT 2018

3 ANNUAL REPORT 2018

3

I am pleased to introduce a new edition of the an-

nual report to brief all relevant stakeholders of the

progress and achievements of the microfinance

sector in 2018. All of these progresses should be

viewed in the context of the work of CMA on be-

half of all members. CMA always strives to play a

leading role in the ongoing growth of the industry.

Our chairman has highlighted many of our actions

for 2017. These happen in conjunction with CMA

core activities, which include, but not limited to:

• Facilitating new sources of funding, local and in-

ternational,

• Ensuring smooth relations between CMA mem-

bers and key stakeholders,

• Promoting and advocating for the interest of the

sector at both national and international levels,

providing our members and partners with net-

working opportunities,

• Providing our members with capacity building and training opportunities, promoting fair competi-

tion, client protection, prevention of over-indebtedness, and financial inclusion.

Looking ahead to 2018, I am confident that the industry will continue to perform strongly if we con-

tinue to ensure professionalism and lend responsibly – putting the interests of our clients at the heart

of what we do. I believe “it isn’t the mountains ahead that wear you out, it’s the pebble in your shoe”

that we should pay attention to risks to microfinance in Cambodia, and to remain vigilant. Our main

challenges lie in the promotion of financial inclusion while ensuring sustainable growth of the sector

with an increased level of financial literacy. It encompasses many areas where improvement has to be

made in the face of slow growth – yet, maintaining it at a sustainable level, promoting transparent com-

petition between FSPs, promoting social performance, and improving the implementation of Client

Protection initiatives.

In this report, you will find information related to the structure of our governance, including the com-

mittees and clubs [advisory committees] established to guide and ensure the objectives of CMA are

being met. You will also find updates about the main activities and projects we have implemented to-

gether with our partners.

On behalf of the management and staff, I warmly welcome our new members to the CMA family.

Moreover, I would like to express my sincere gratitude to our outgoing Chairman, Oknha Hout Ieng

Tong, our new Chairman, Mr. Kea Borann, and all members of the Board of Directors for their lead-

ership and tenacity for the well-being and representation of the sector. I also thank Agence Française

de Développement and Appuis au Développement Autonome, our main funding partners that have

enabled us to go from strength to strength.](https://image.slidesharecdn.com/20210331-cma-annual-report-2018final-220413093600/85/20210331-CMA-Annual-Report-2018_Final-pdf-8-320.jpg)