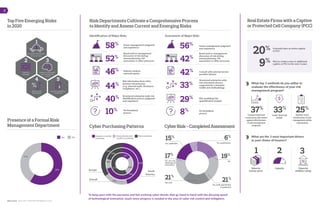

Aon plc is a global provider of risk management and human resource solutions, serving clients in over 120 countries. The document outlines key risks faced by real estate companies, highlighting economic slowdown, reputation damage, and cyber crime among the top concerns. It emphasizes the need for robust risk management practices to navigate complex challenges posed by technological and geopolitical changes.