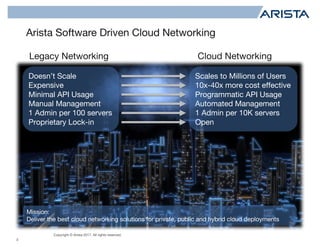

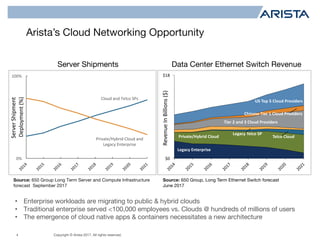

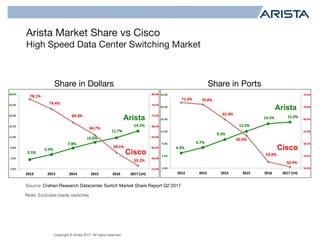

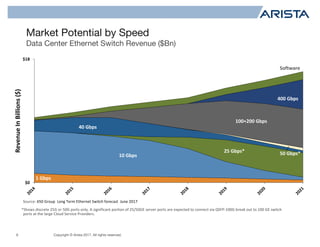

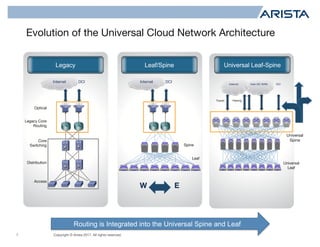

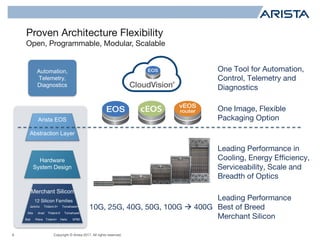

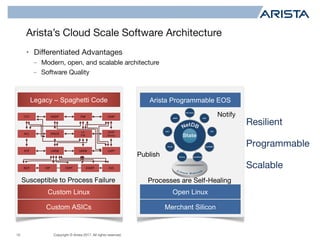

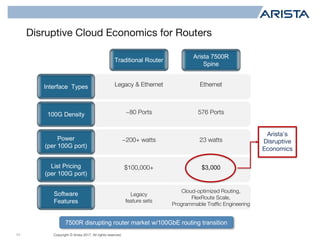

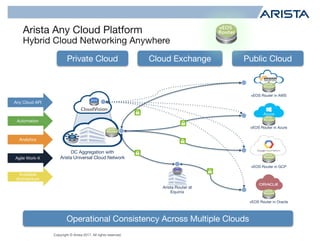

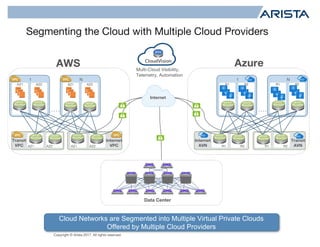

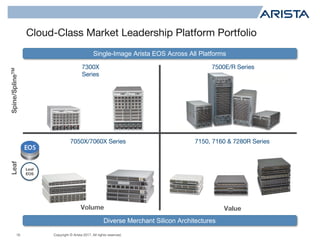

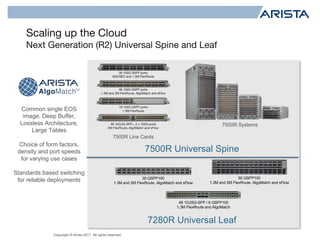

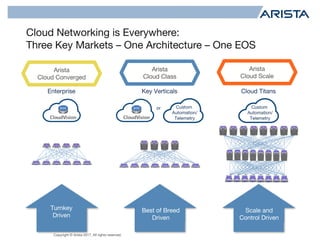

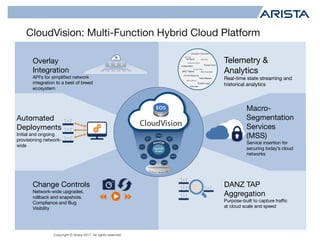

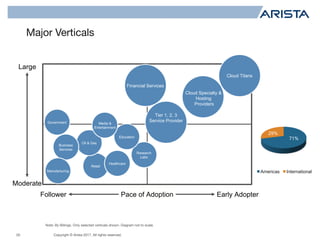

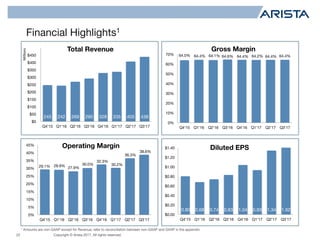

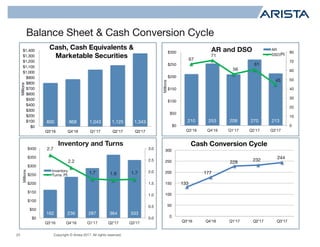

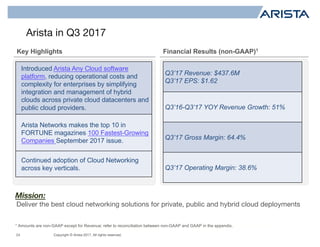

The document discusses Arista's Q3 2017 performance and provides an overview of its cloud networking solutions. It notes that Arista experienced rapid growth and gained market share against Cisco in the high-speed switching market. It also outlines Arista's total addressable market opportunity as enterprise workloads migrate to public and hybrid clouds. Finally, it describes Arista's software-driven, open and automated approach to cloud networking compared to legacy networking architectures.