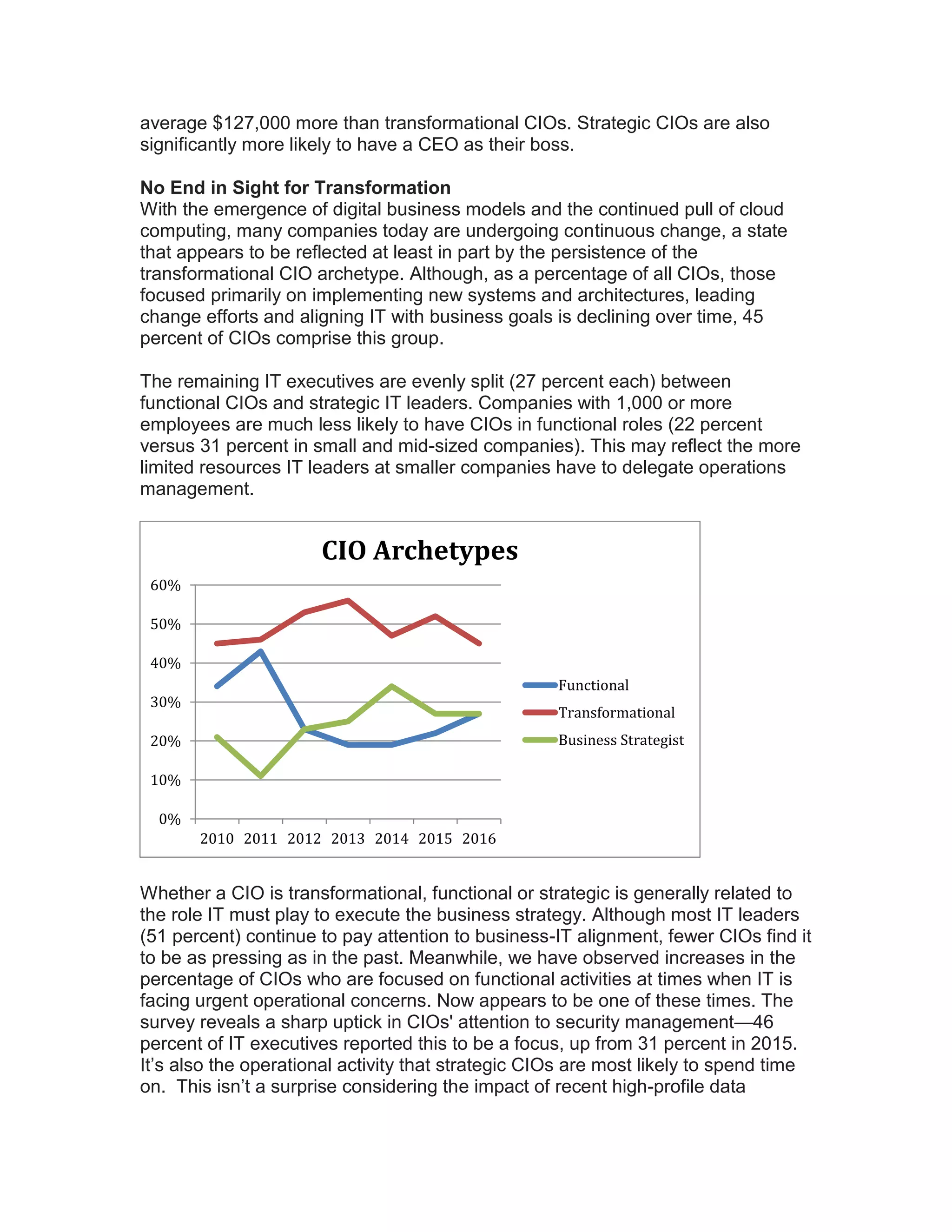

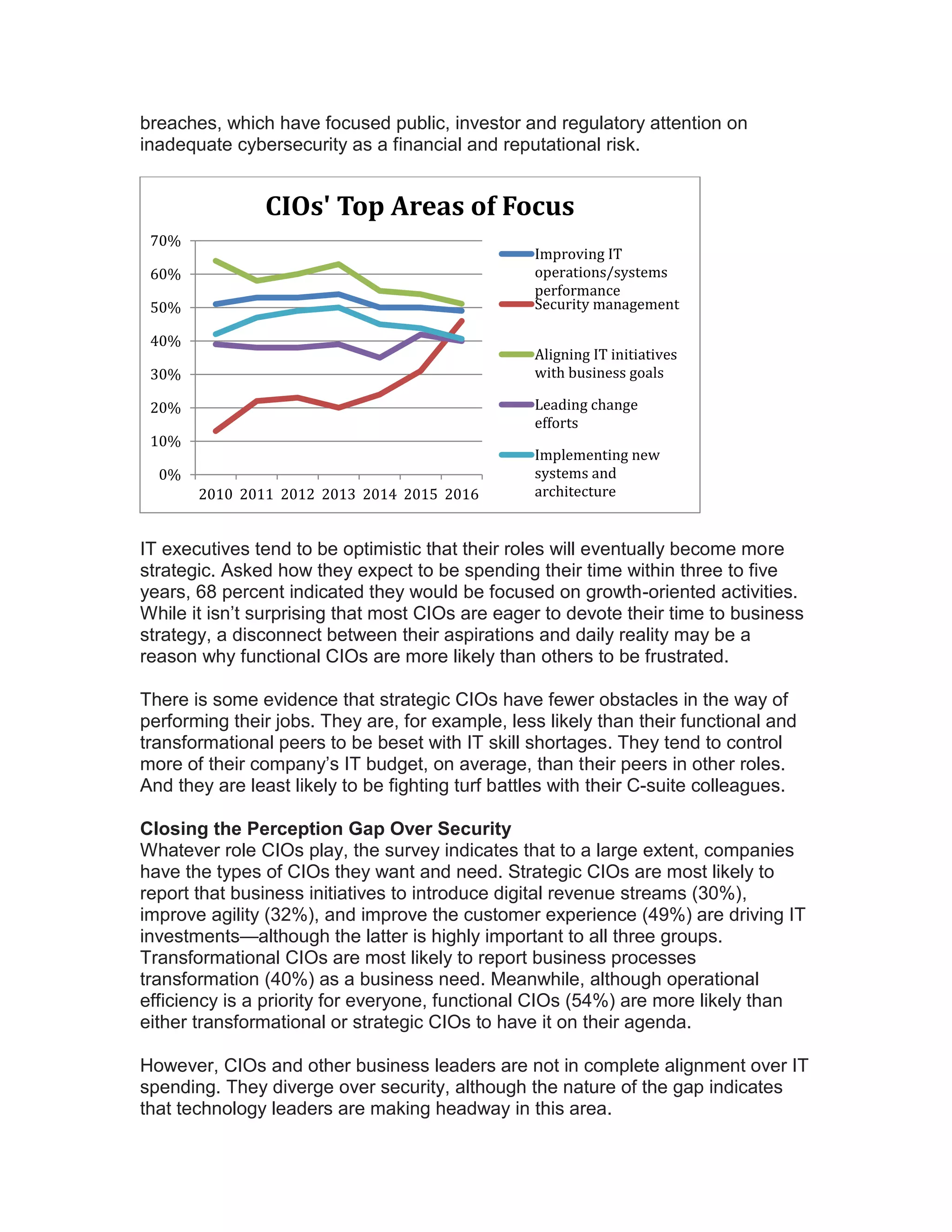

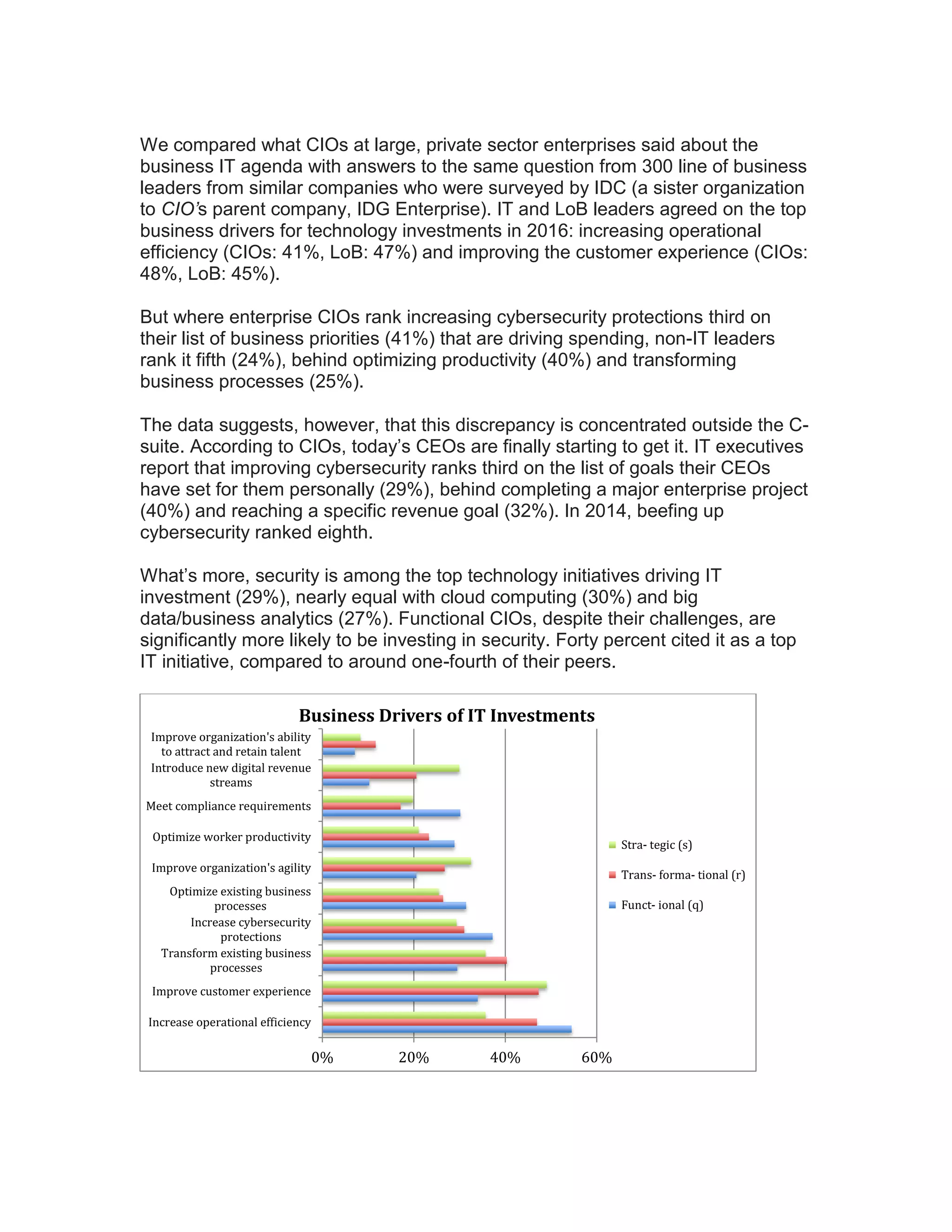

The document summarizes the findings of a survey of 571 CIOs about the current state of their role. It finds that CIOs who have more strategic, business-focused roles fare better than functional CIOs focused mainly on IT operations. Strategic CIOs earn more money, have more job satisfaction, and are better able to address challenges like cybersecurity. While most CIOs say their jobs are challenging, strategic CIOs find their work more rewarding. The survey also shows CIOs are increasingly focusing on security issues due to high-profile data breaches.