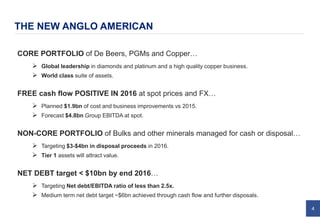

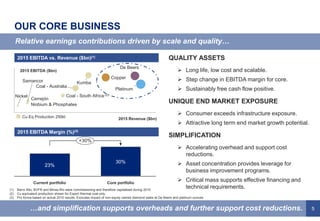

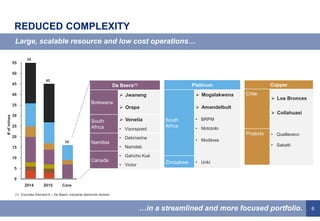

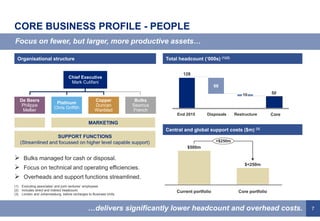

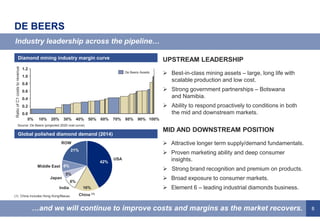

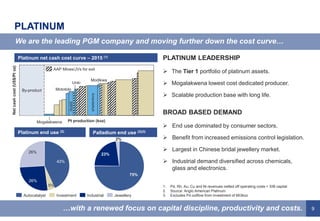

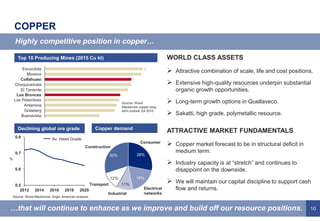

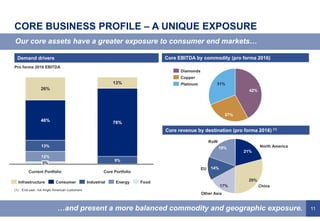

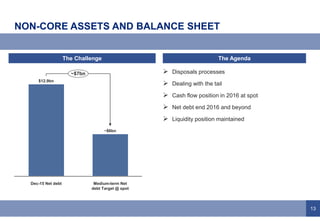

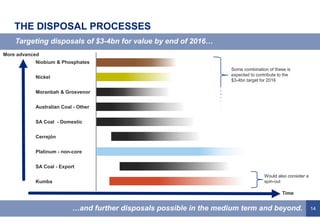

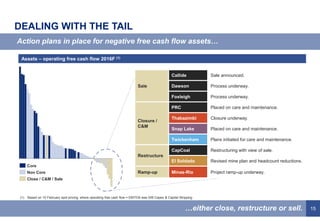

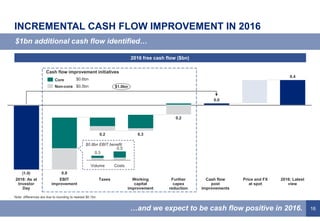

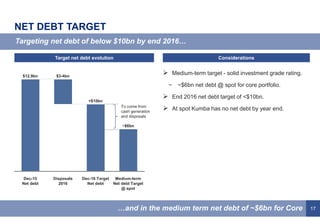

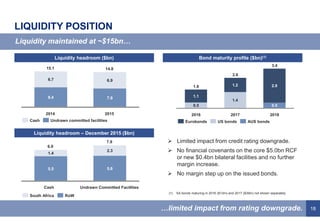

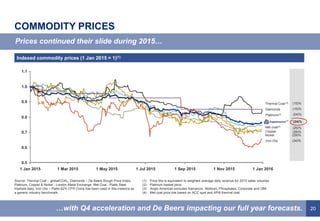

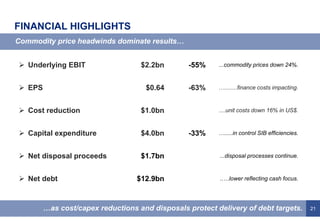

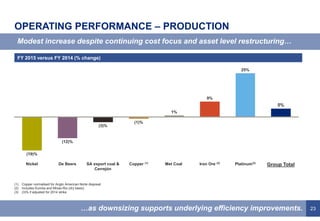

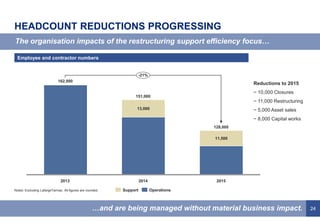

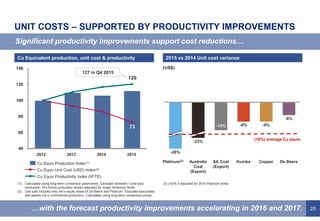

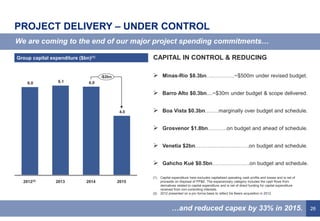

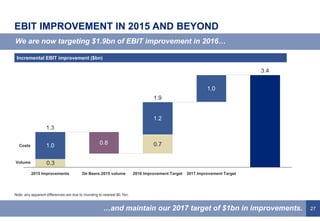

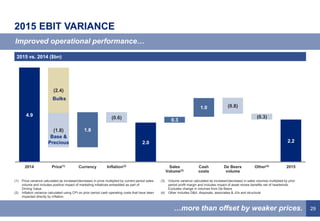

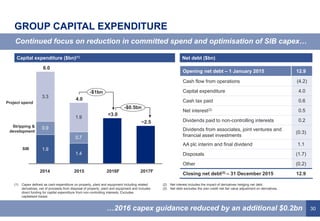

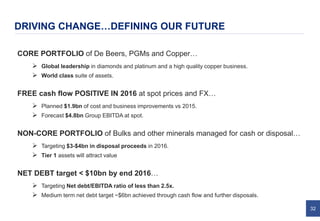

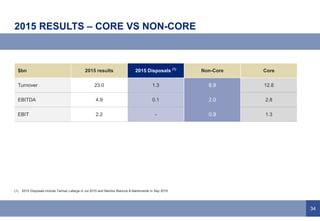

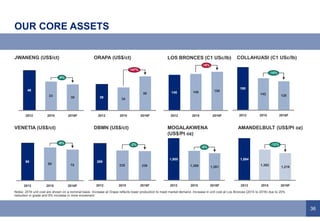

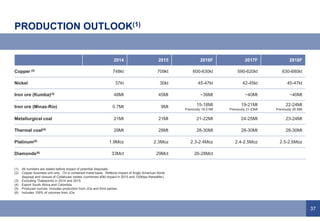

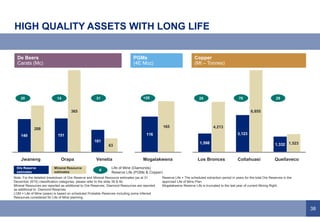

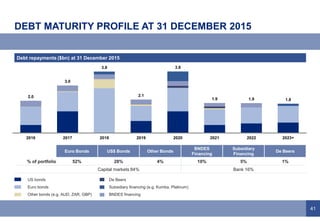

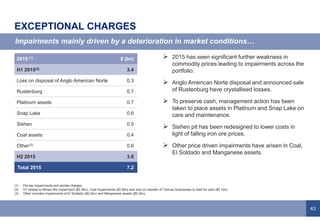

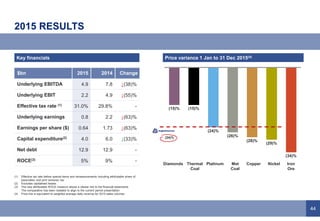

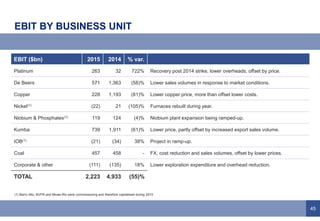

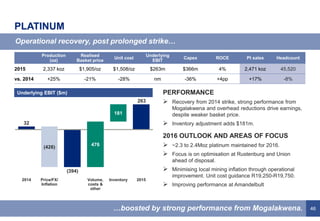

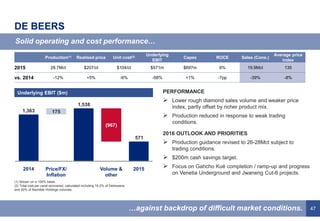

Anglo American's investor update outlines preliminary results for 2015 and highlights a strategic refocus on core assets, particularly in diamonds, platinum, and copper, while managing a non-core portfolio for cash or disposal. The company aims to achieve $3-$4 billion in disposal proceeds in 2016, target net debt under $10 billion by year-end, and maintain a solid liquidity position. Despite a challenging market and declining commodity prices, Anglo American expects to be cash flow positive in 2016 through cost improvements and operational efficiencies.