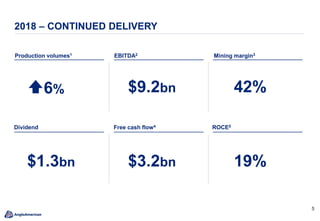

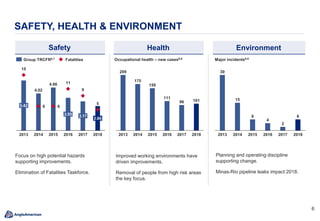

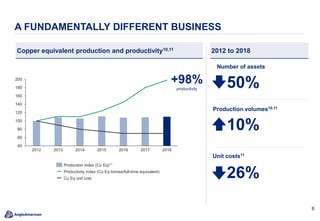

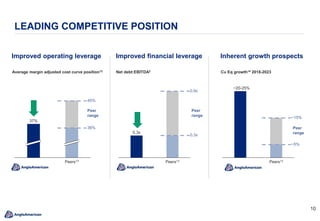

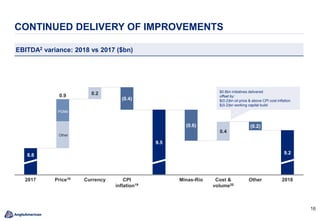

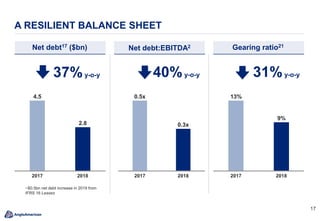

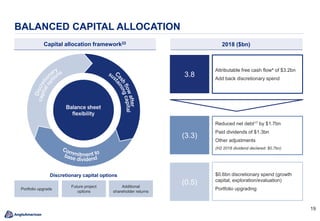

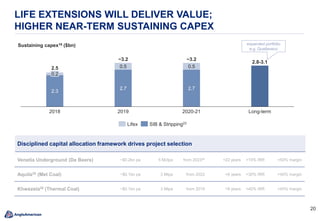

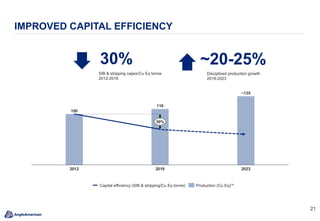

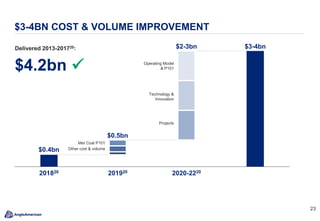

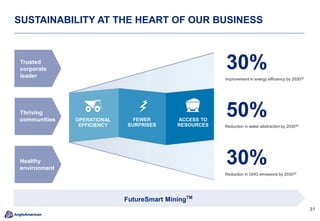

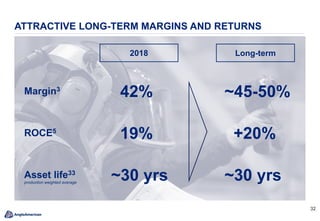

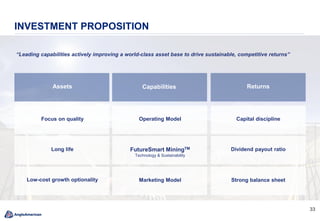

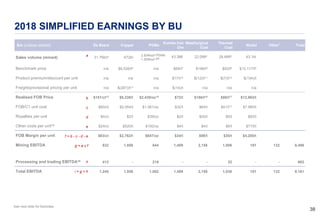

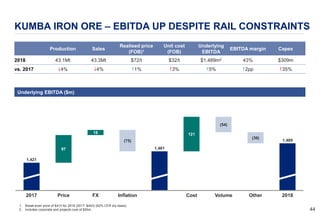

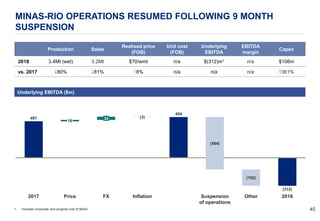

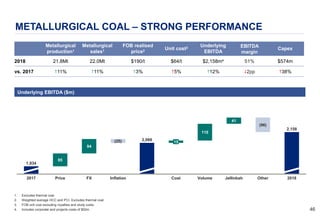

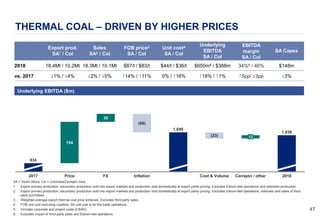

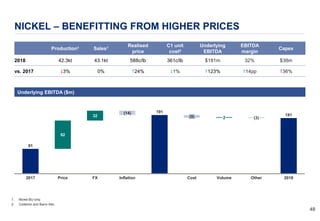

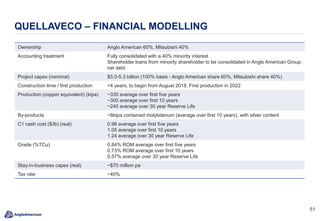

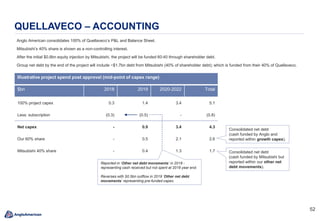

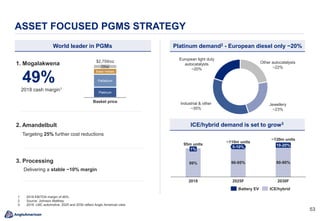

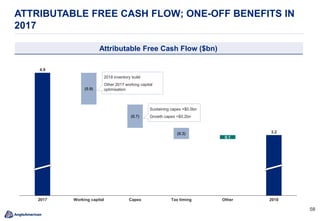

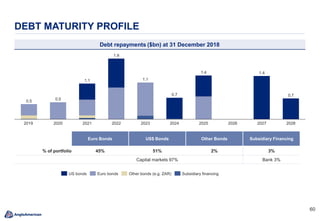

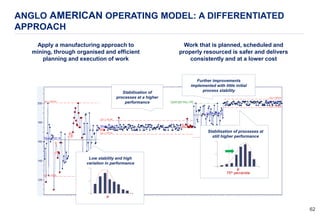

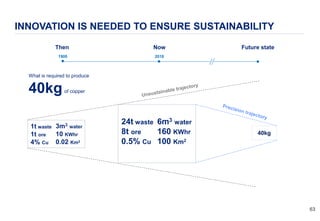

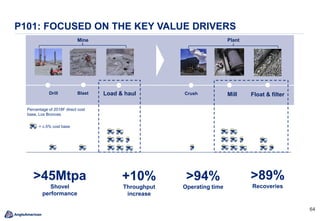

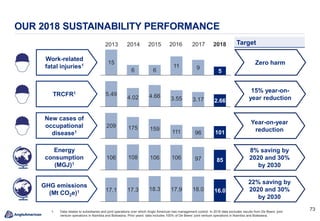

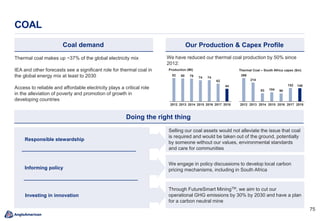

The document presents Anglo American's financial results for 2018, highlighting significant achievements and cautioning against reliance on forward-looking statements due to inherent uncertainties. Key performance indicators indicate a strong balance sheet with $9.2 billion EBITDA and a focus on safety and sustainability within operations. The presentation emphasizes capital allocation strategies aimed at disciplined project selections to enhance production efficiency and shareholder returns.