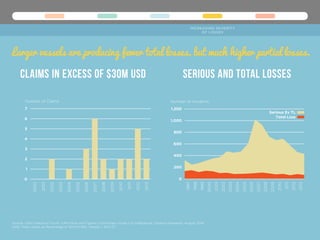

The document discusses five emerging underwriting trends for marine insurers, highlighting significant concerns such as marine cyber risk, political risk, and increasing severity of losses due to larger vessels and extreme weather. It emphasizes the need for effective risk management and awareness of exposures in marine businesses, particularly with the rise of cyber threats. Insurers are urged to prepare for the evolving landscape of risks, which now include complex issues like cyber attacks and political sanctions impacting the marine and shipping industries.