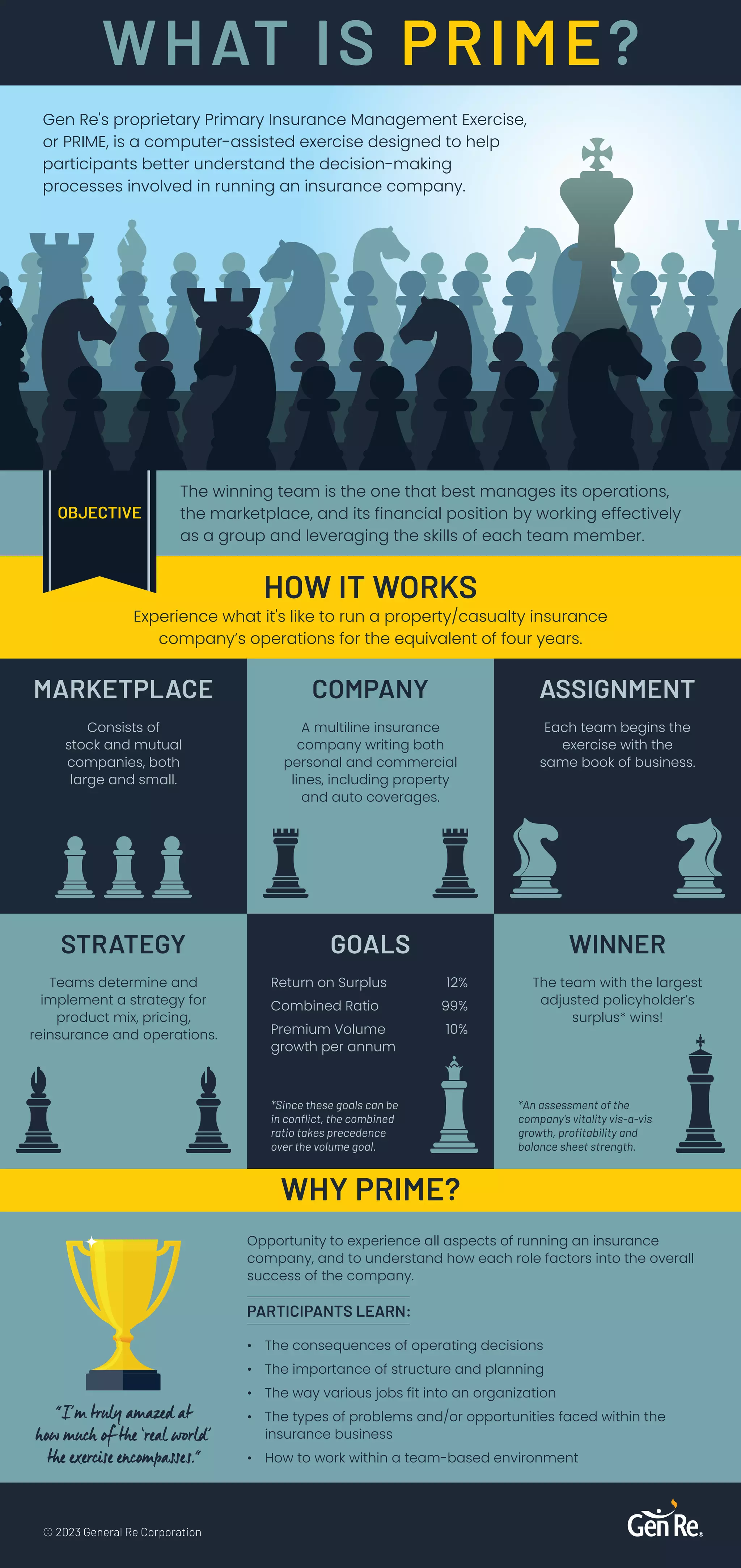

Gen Re's PRIME is a computer-assisted exercise that simulates managing an insurance company, allowing participants to learn about decision-making in various roles and the overall success of the organization. Through teamwork, participants face challenges related to operations, growth, and profitability to determine the winning team based on financial performance metrics. The exercise aims to provide a comprehensive understanding of the insurance industry and enhance collaborative skills.