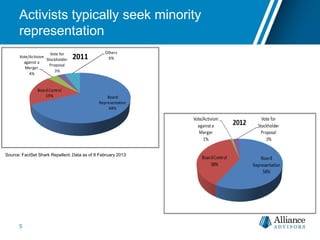

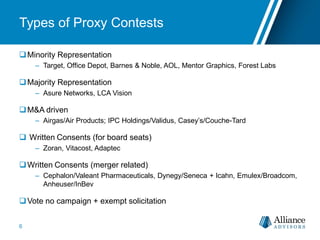

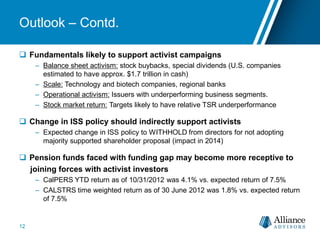

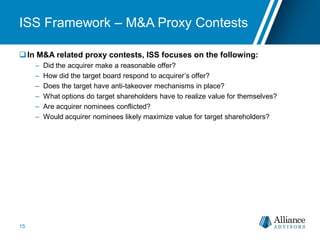

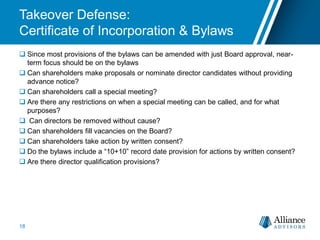

Alliance Advisors is a shareholder communications firm specializing in proxy solicitation and governance consulting founded in 2005. The firm assists over 200 clients, including Fortune 500 companies, with shareholder activism matters. The document discusses trends in shareholder activism such as more activists seeking minority board representation rather than control and the impact of poor stock performance on vulnerability to activism. It also provides an overview of ISS' framework for evaluating proxy contests and contested mergers and outlines considerations for companies facing shareholder activism.