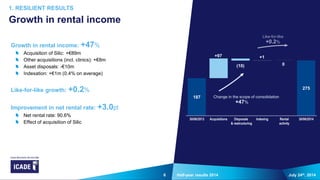

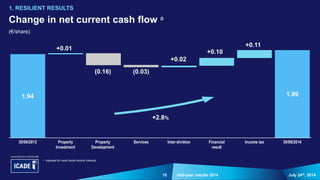

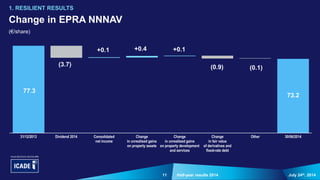

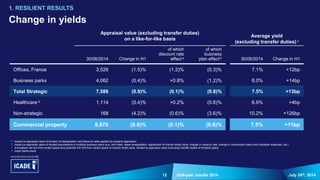

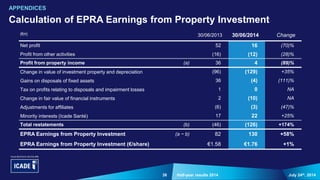

1) Icade reported resilient results in the first half of 2014 in a market that remains under pressure, with rental income up 47% due to acquisitions. Key strengths such as positioning in promising areas helped withstand conditions.

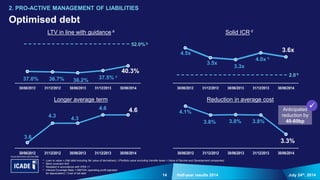

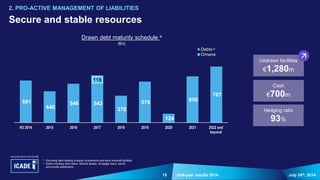

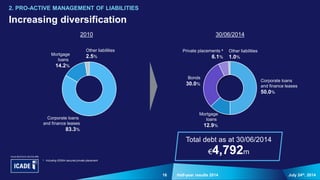

2) Debt management was pro-active, with the average cost of debt reduced to 3.8% and average term extended to 4.6 years. LTV and ICR ratios remained in line with guidance.

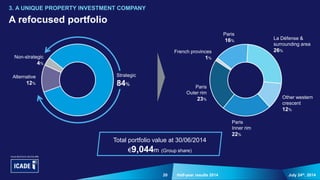

3) Icade has a unique business model as a property investment company generating recurring cash flow from offices and business parks, with potential for value creation from land reserves and alternative assets such as healthcare. The portfolio is focused on key areas in and around Paris that will