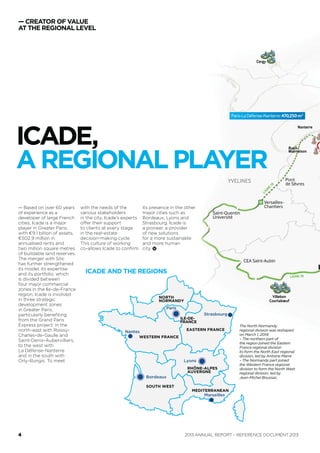

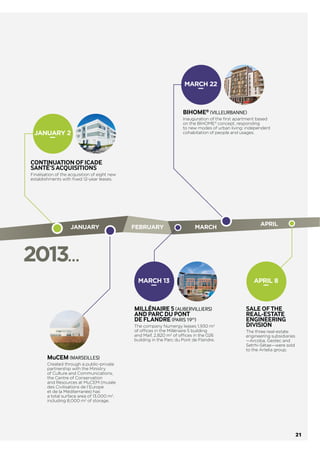

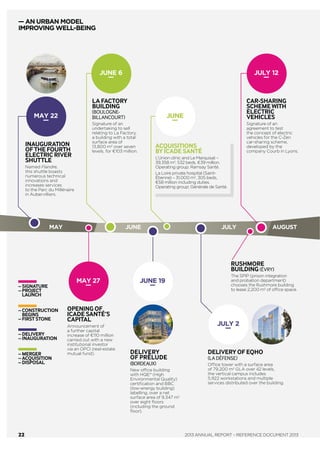

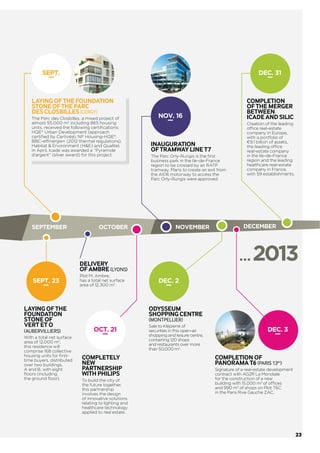

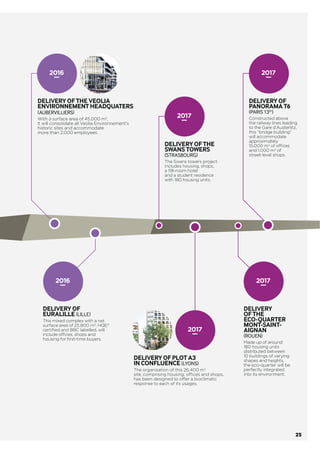

Icade has completed its merger with Silic, making it the leading office property investment company in Europe and major player in Greater Paris. Financially, Icade demonstrated the strength of its economic model and investor strategy through successful bond issues and rating upgrades. Operationally, Icade signed high-quality tenants and lease renewals, confirming the effectiveness of its client strategy. With a more diverse portfolio and strategic locations near development areas in Greater Paris, Icade is well-positioned to support its clients' long-term real estate needs.

![DOPRVW DV PXFK DV ţYDOXHDGGHGŤ LQYHVWPHQWV ZKRVH

YROXPH KDV LQFUHDVHG DOPRVW WKUHHIROG LQ D HDU 7KH PDUNHW ZDV DOVR

PRUH EDODQFHG LQ WHUPV RI WKH VL]H RI WUDQVDFWLRQV ZLWK EHWWHU PDUNHW

GHSWK IRU XQLW DPRXQWV RI EHWZHHQ DQG ſbPLOOLRQ

6RXUFH % 5LFKDUG (OOLV %133](https://image.slidesharecdn.com/20140408-ar-vukannualreporticade-140408111554-phpapp02/85/20140408-Icade-Annual-Report-Reference-Document-2012-131-320.jpg)

![KDG FOLPEHG EDFN WR E WKH VWDUW RI

*HRJUDSKLFDO DQG VWUXFWXUDO GLVSDULWLHV DUH VWLOO DV SURQRXQFHG DV HYHU

3DULVVWLOORIIHULQJDUHODWLYHOFRQWDLQHGLPPHGLDWHVXSSOZKLOHDYDLODEOH

VXUIDFH DUHDV DUH DEXQGDQW LQ /D '«IHQVH DQG VXEXUEDQ DUHDV VXFK

DV WKH :HVWHUQ UHVFHQW 3DULV HQWUH :HVW KDV VHHQ LWV LPPHGLDWH

VXSSO LQFUHDVH DQG WKH YDFDQF UDWH WKHUH QRZ VWDQGV DW :KLOH

FRPSHWLWLRQ LV ILHUFH IRU D FHUWDLQ QXPEHU RI VPDOO DQG PHGLXPVL]HG

VXUIDFH DUHDV WKHUH LV VWLOO D VFDUFLW RI SURGXFWV ODUJHU WKDQ bP2

.

3DULV 6RXWK DQG 3DULV 1RUWK (DVW VWLOO KDYH D ORZ OHYHO RI YDFDQF DW

DQG UHVSHFWLYHO DQG RQO D KDQGIXO RI EXLOGLQJV ZLWK VXUIDFH

DUHDV !bP2

.

3UHVVXUH FRQWLQXHV WR ZHLJK GRZQ RQ UHQWDO YDOXHV :HLJKWHG DYHUDJH

IDFHUHQWVLQWKHOHGH)UDQFHIRUQHZUHVWUXFWXUHGRUUHQRYDWHGVXUIDFH

DUHDV JHQHUDOO VWDELOLVHG LQ UHDFKLQJ HXURVP2

HDU H[FO

WD[HV DQG FKDUJHV DW HDUHQG LQ D HDU](https://image.slidesharecdn.com/20140408-ar-vukannualreporticade-140408111554-phpapp02/85/20140408-Icade-Annual-Report-Reference-Document-2012-137-320.jpg)

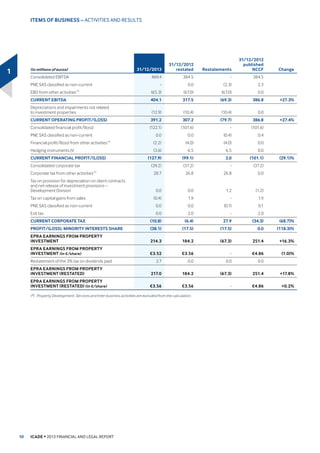

![9DFDQW VXUIDFH DUHDV DV DW b'HFHPEHU UHSUHVHQW bP2

DQGſbPLOOLRQLQSRWHQWLDOUHQWLQFOXGLQJſbPLOOLRQLQWKHVWUDWHJLF

DVVHWV SRUWIROLR EURNHQ GRZQ DV IROORZV

‹ WKH (4+2 7RZHU DORQH UHSUHVHQWV ſbPLOOLRQ RU QHDUO RI

WKH WRWDO SRWHQWLDO UHQW

‹ EXVLQHVV SDUNV UHSUHVHQW ſbPLOOLRQ LQFOXGLQJ ſbPLOOLRQ LQ WKH

6LOLF SRUWIROLR 0DMRU PHDVXUHV KDYH DOUHDG EHHQ WDNHQ SDUWLFXODUO

LQUHVSHFWRIWKH2UO5XQJLVSDUNLQRUGHUWRUHOHWWKHYDFDQWVXUIDFH

areas.

The DYHUDJH IL[HG WHUP RI OHDVHV LV HDUV WDNLQJ LQWR DFFRXQW

D UHVLGXDO IL[HG WHUP RI WKUHH HDUV RQ DYHUDJH IRU WKH 6LOLF SRUWIROLR

,QWHJUDWLRQ RI WKH 6LOLF SRUWIROLR KDV QRW KDG DQ RYHUDOO LPSDFW RQ WKH

average residual term of leases in the large office assets portfolio.

+RZHYHU WKH WSH RI XVHUV LQ PRVW 6LOLF SDUNV Ş VPDOO DQG PHGLXP

VL]HG FRPSDQLHV Ş PHDQV D SUHGRPLQDQFH RI OHDVHV ZKLFK DUH

VWDQGDUG IRU WKLV WSH RI RSHUDWRU DXWRPDWLFDOO UHGXFLQJ WKLV LQGLFDWRU

across the whole portfolio.

$V DW b'HFHPEHU WKH ELJJHVW WHQDQWV DFFRXQWHG IRU WRWDO

DQQXDOUHQWVRIſbPLOOLRQ RIDQQXDOUHQWVIURPDVVHWVH[FOXGLQJ

+HDOWKFDUH](https://image.slidesharecdn.com/20140408-ar-vukannualreporticade-140408111554-phpapp02/85/20140408-Icade-Annual-Report-Reference-Document-2012-221-320.jpg)

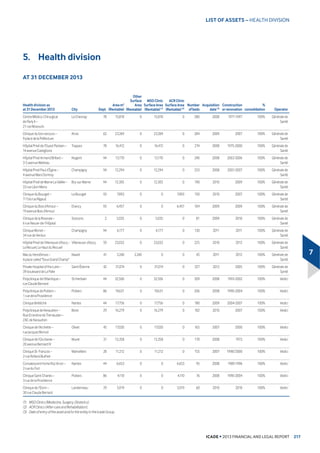

![‹ alternativeassets:thismainlyrelatedtotheconstructionorextension

RI FOLQLFV IRU ſbPLOOLRQ IRU ZKLFK WKH UHQWDO FRQGLWLRQV DJUHHG

FRQWUDFWXDOODWWKHWLPHRIDFTXLVLWLRQZLOOLQFOXGHDUHQWVXSSOHPHQW

on delivery.

5HQRYDWLRQV0DMRU PDLQWHQDQFH UHSDLUV

0DLQO UHIHU WR WKH H[SHQVHV RI UHQRYDWLRQ ZRUN RQ EXVLQHVV SDUNV DQG

incentives (tenant works).

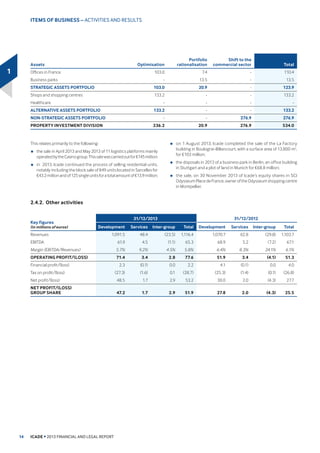

$UELWUDJH

,FDGH LV FDUULQJ RXW DQ DFWLYH WUDGHRII SROLF RQ LWV DVVHWV EDVHG RQ

three main principles:

‹ optimisation and turnover: VDOH RI PDWXUH DVVHWV IRU ZKLFK PRVW RI

WKH DVVHW PDQDJHPHQW ZRUN KDV EHHQ GRQH DQG ZKHUH WKHUH LV D

KLJK SUREDELOLW RI FDSLWDO JDLQ RQ WKH VDOHV

‹ portfolio rationalisation: VDOH RI DVVHWV RI PRGHVW VL]H RU KHOG XQGHU

MRLQW RZQHUVKLS

‹ VKLIW WR WKH FRPPHUFLDO VHFWRU GLVSRVDO RI QRQVWUDWHJLF DVVHWV

VDOH RI DVVHWV ZKLFK GR QRW EHORQJ LQ WKH FRUH RI WKH RPPHUFLDO

Property Investments Division.

7KH YDOXH RI VDOHV UHDOLVHG GXULQJ ZDV ſbPLOOLRQ](https://image.slidesharecdn.com/20140408-ar-vukannualreporticade-140408111554-phpapp02/85/20140408-Icade-Annual-Report-Reference-Document-2012-245-320.jpg)