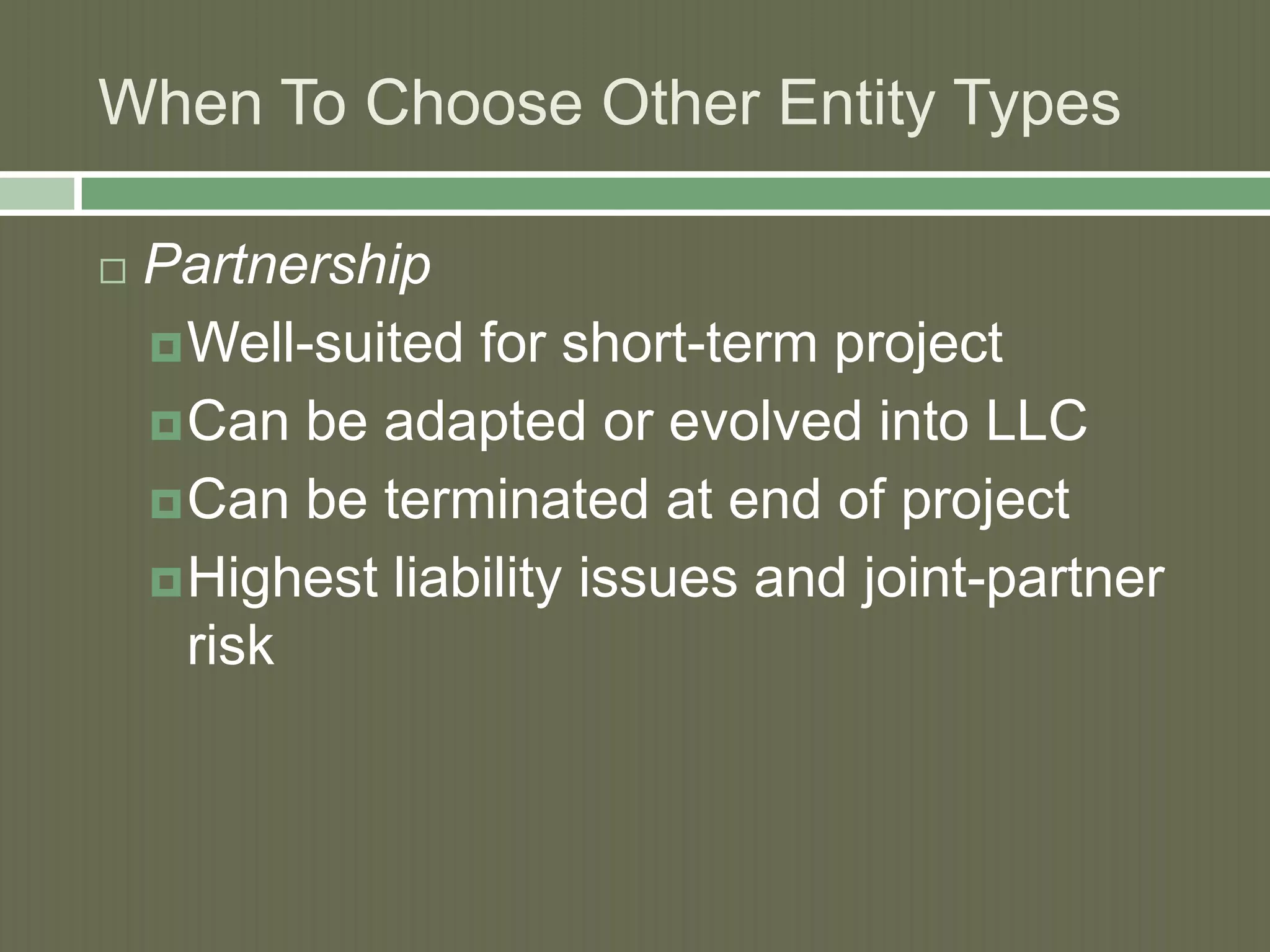

This document discusses legal and tax considerations for business structures. It notes that limited liability companies (LLCs) or S corporations are typically preferred as they provide flexibility, tax benefits, and taxation at the owner's rate. Multiple entities can provide greater flexibility by separating different business operations like equipment, land, and livestock. The document also discusses entity choice considerations, tax implications of different structures, risk management strategies, and planning for intergenerational transition of the farm business.