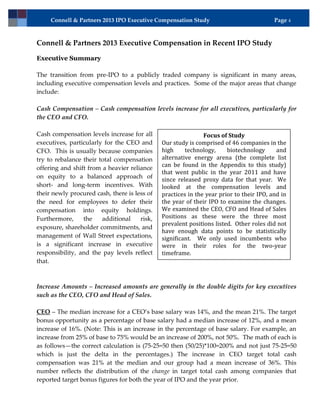

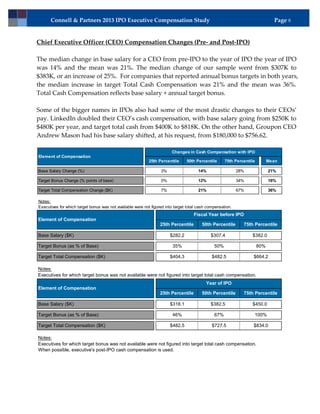

The document summarizes a study on executive compensation levels and practices for companies that went public in 2011. It finds that cash compensation increased significantly for CEOs and CFOs around the time of the IPO as their responsibilities increased. Base salaries rose by a median of 14% for CEOs and 5% for CFOs. Bonus targets also increased substantially. Equity dilution and share usage increased around the IPO date due to new stock grants and employee stock purchase plans. Post-IPO, companies began shifting away from stock options to restricted stock and performance-based awards to manage dilution. Severance and change in control protections were also enhanced for executives around the time of the IPO.