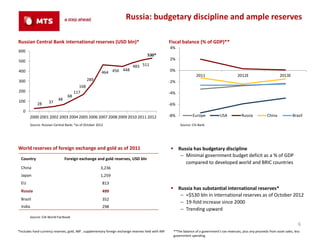

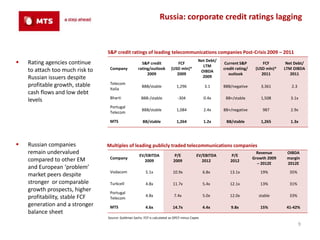

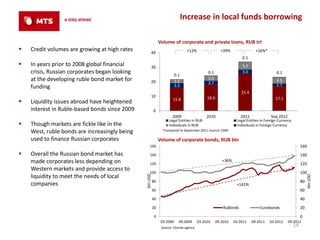

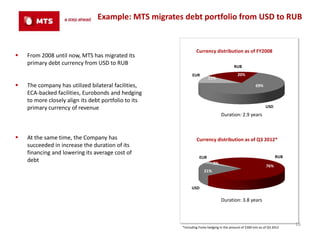

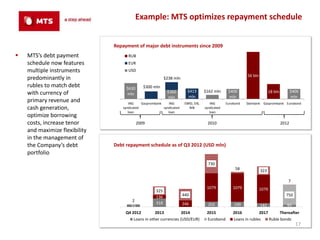

The document discusses the emergence of local liquidity and financing in Russia. Since 2009, the Central Bank of Russia has stimulated local capital markets by providing liquidity support, which has enabled Russian companies to access reasonable borrowing rates through various debt instruments. This has attracted other investors and allowed banks to increase lending. As a result, major Russian companies can now access credit locally when Western markets are constrained. The Central Bank influences interest rates and the economy by managing its balance sheet and refinancing operations.