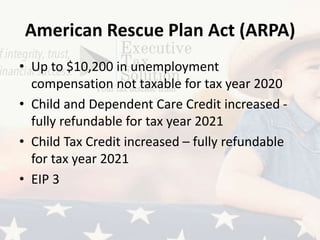

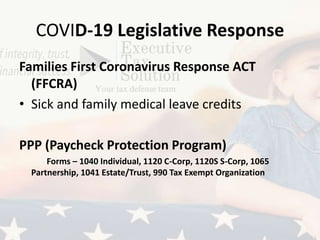

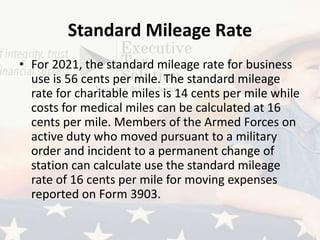

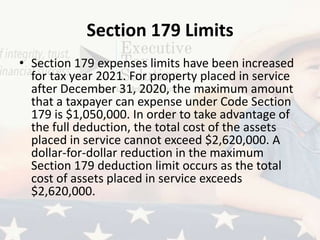

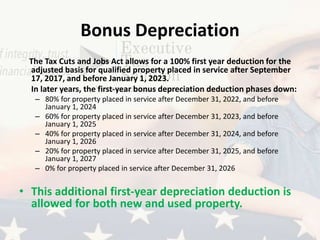

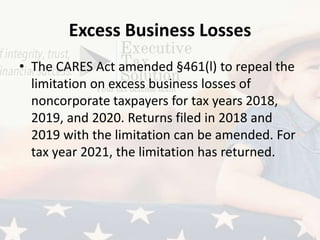

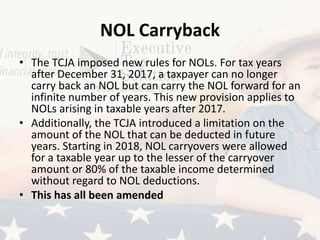

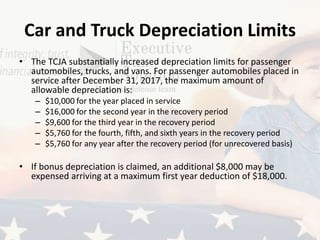

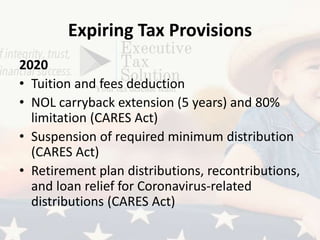

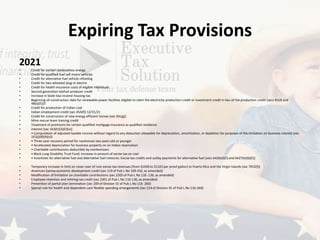

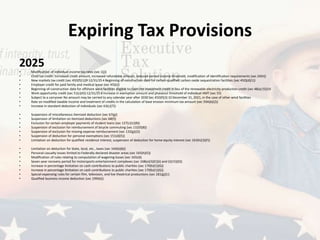

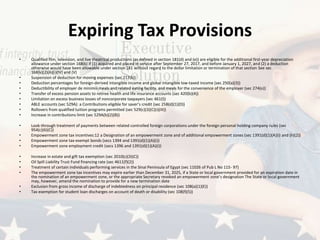

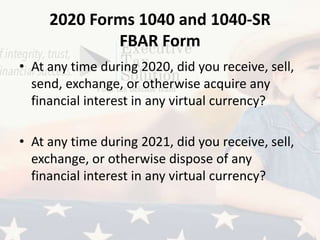

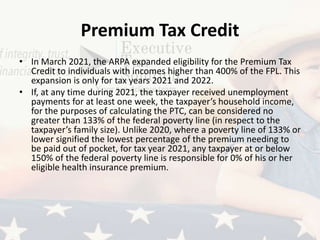

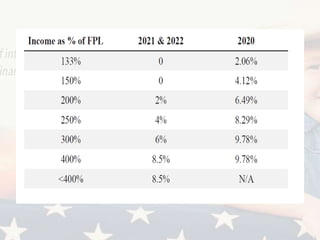

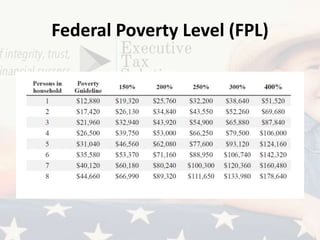

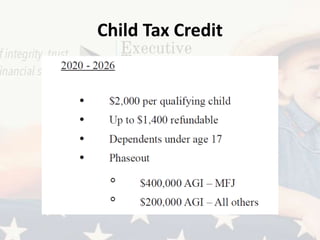

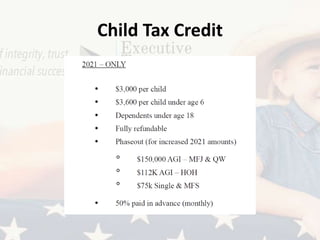

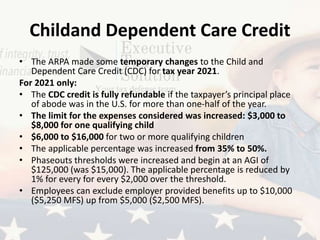

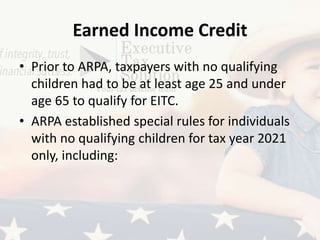

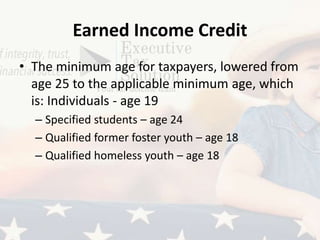

This document provides information for a tax professional on important tax changes and provisions to watch for the 2021 tax filing season. Key points include the American Rescue Plan Act provisions making the first $10,200 of unemployment benefits non-taxable and increasing the child tax credit. It also discusses COVID-19 related credits, PPP loan deductions, mileage rates, bonus depreciation, excess business loss limitations, and many expiring tax provisions to be aware of. Locations and contact information for the tax preparation service are also included.