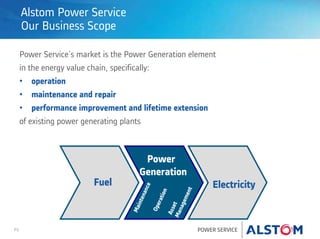

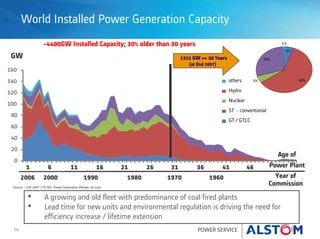

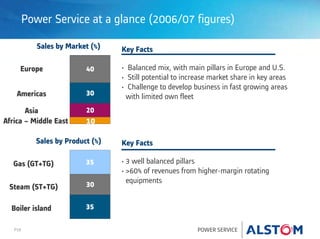

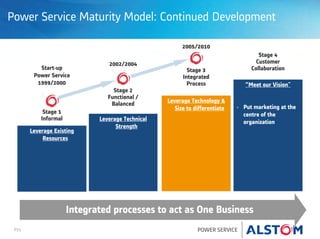

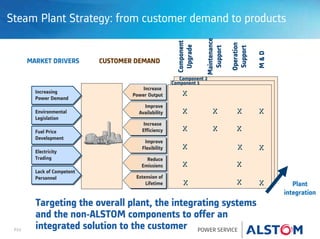

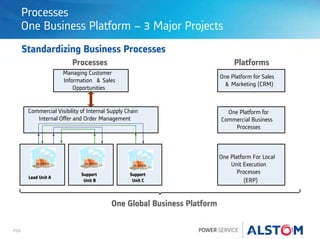

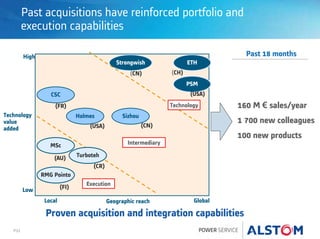

This document provides an overview of Alstom Power Service's strategy. It discusses the power service market opportunity, Alstom's existing fleet and geographic presence, strategic pillars around becoming a full plant service provider, diversifying geographically, differentiating through products, improving processes, and developing people. The strategy focuses on leveraging Alstom's technology leadership and installed base to grow revenues and profitability.