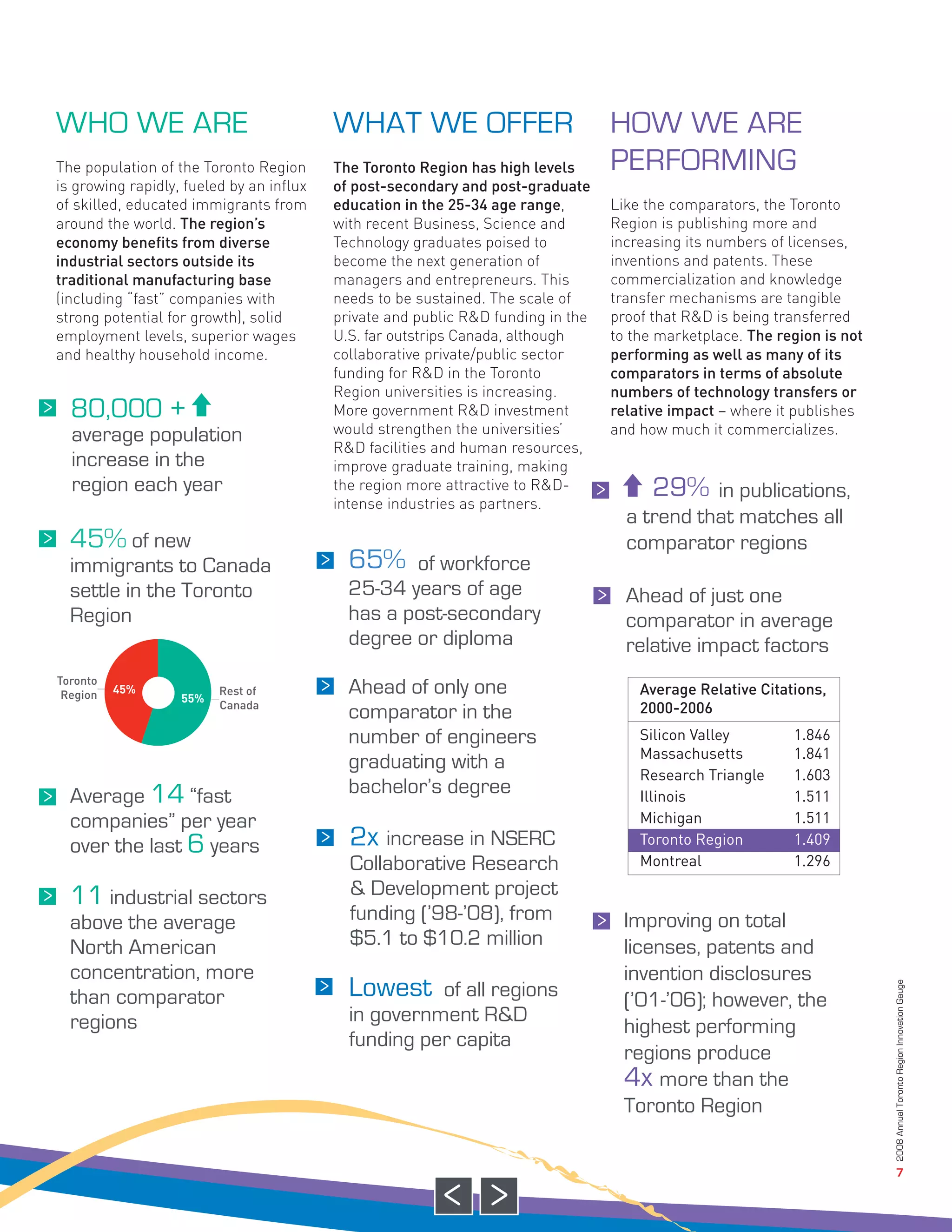

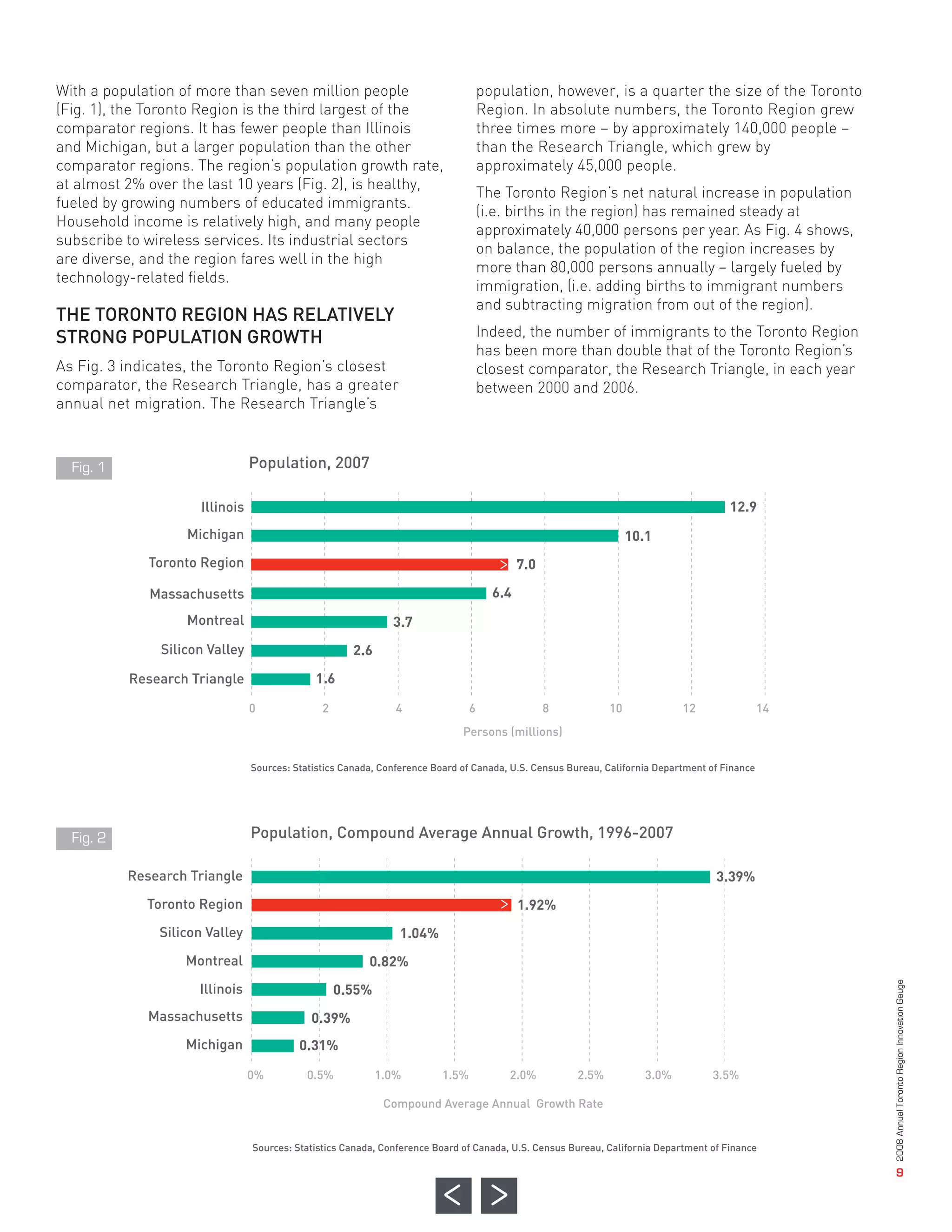

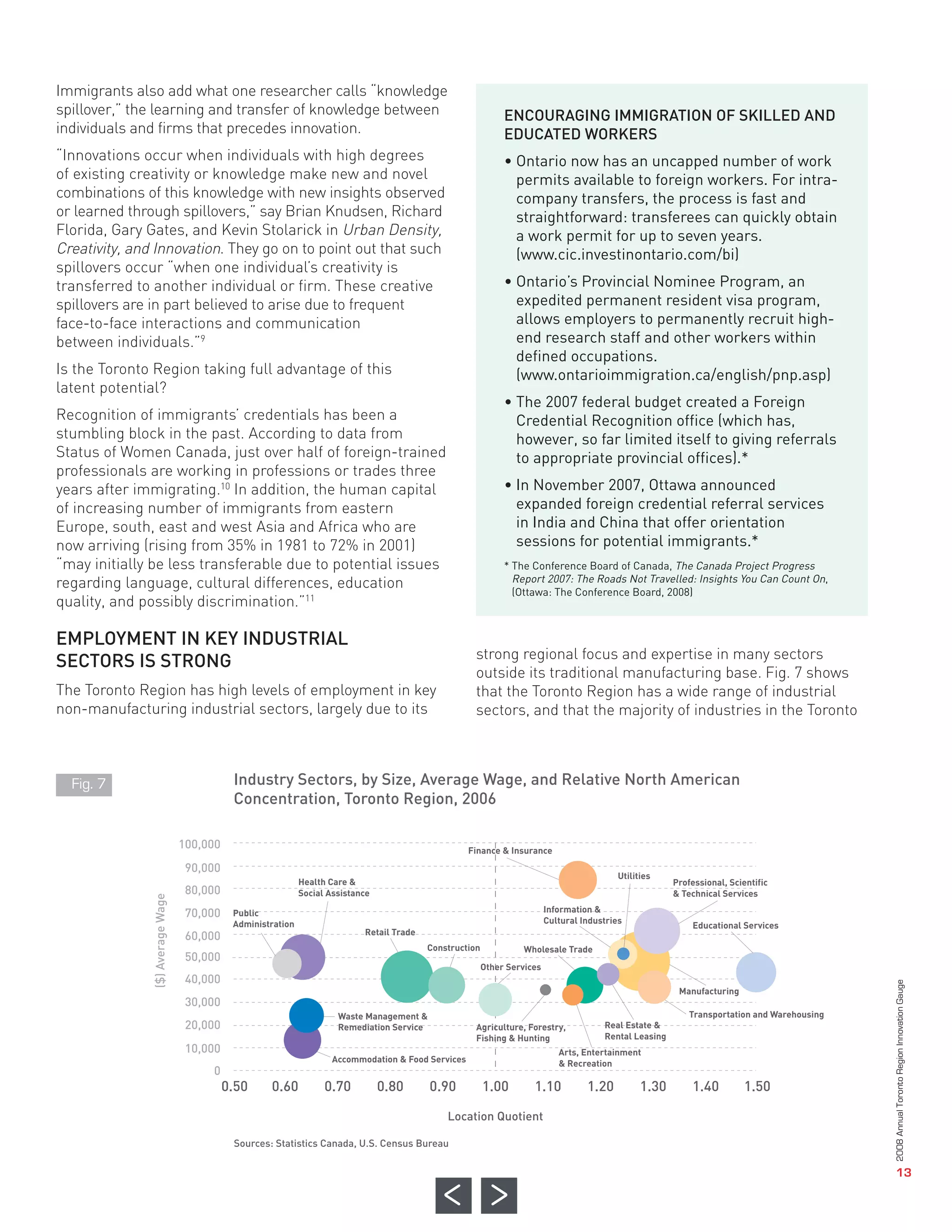

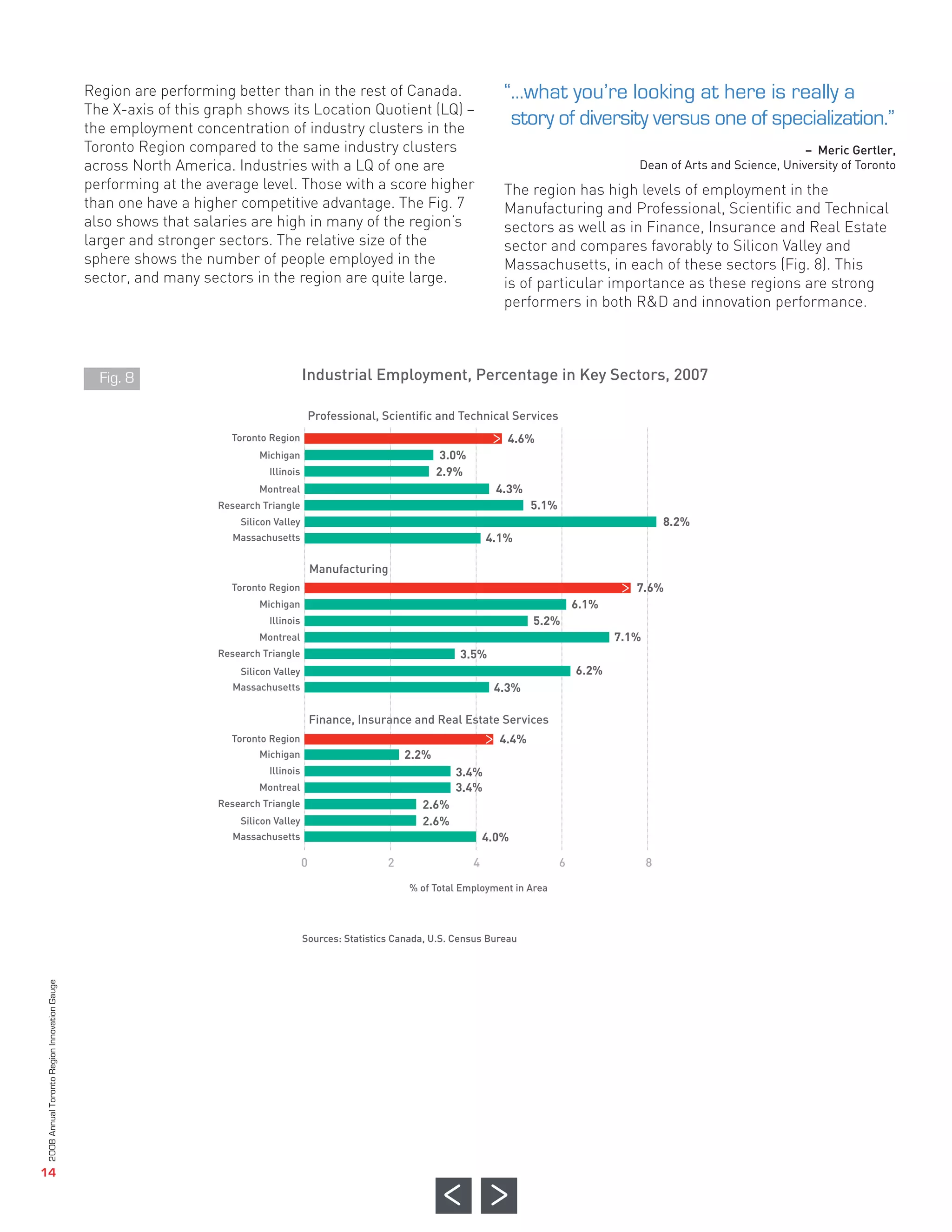

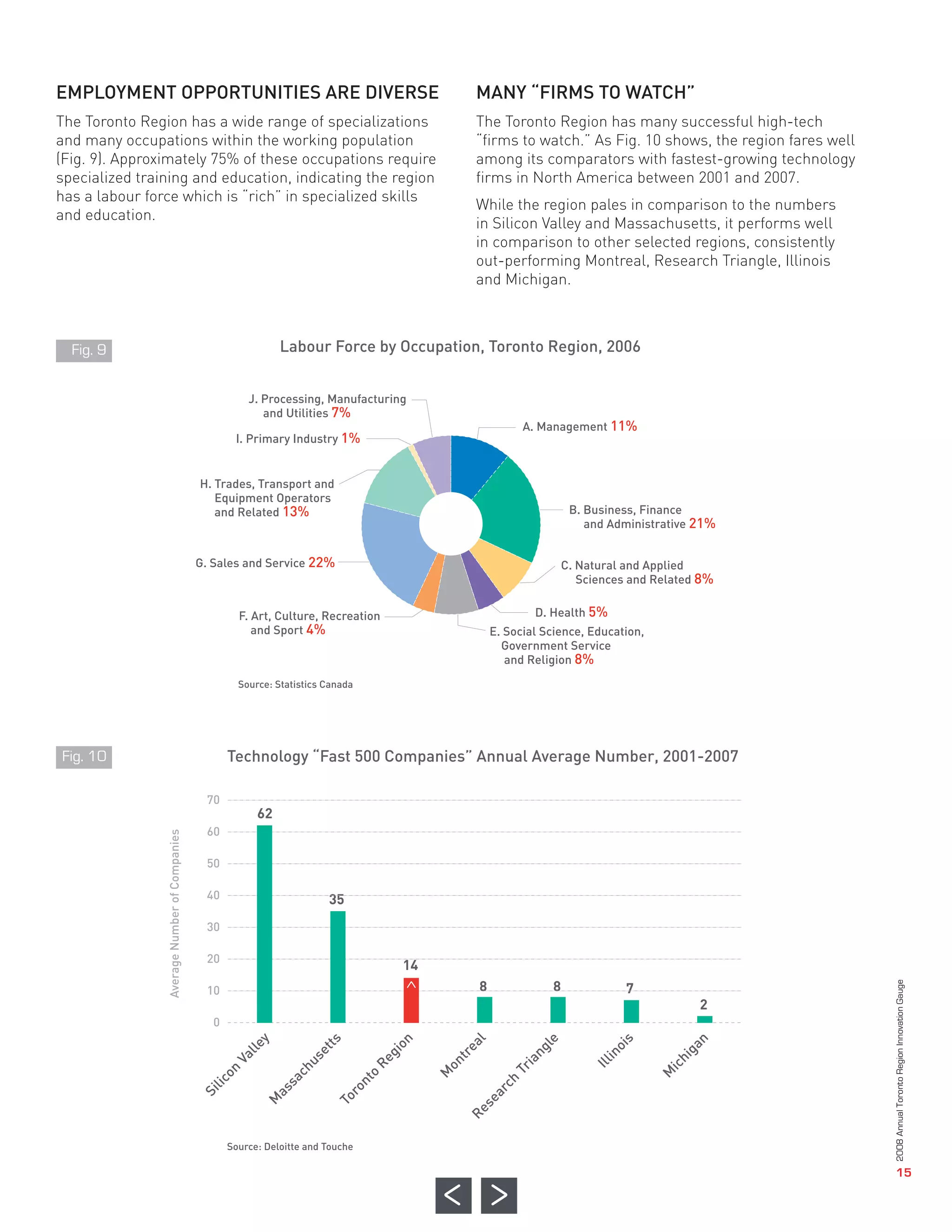

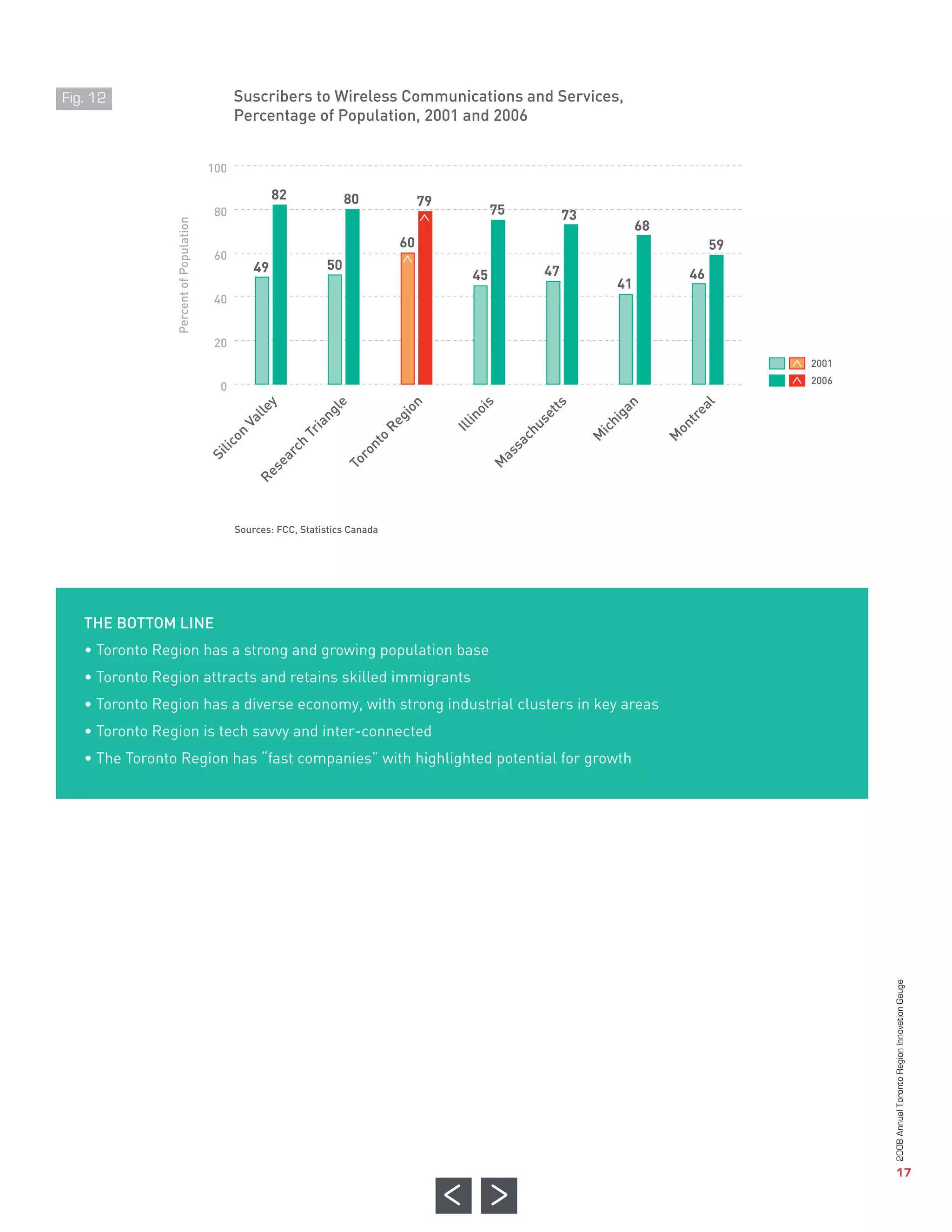

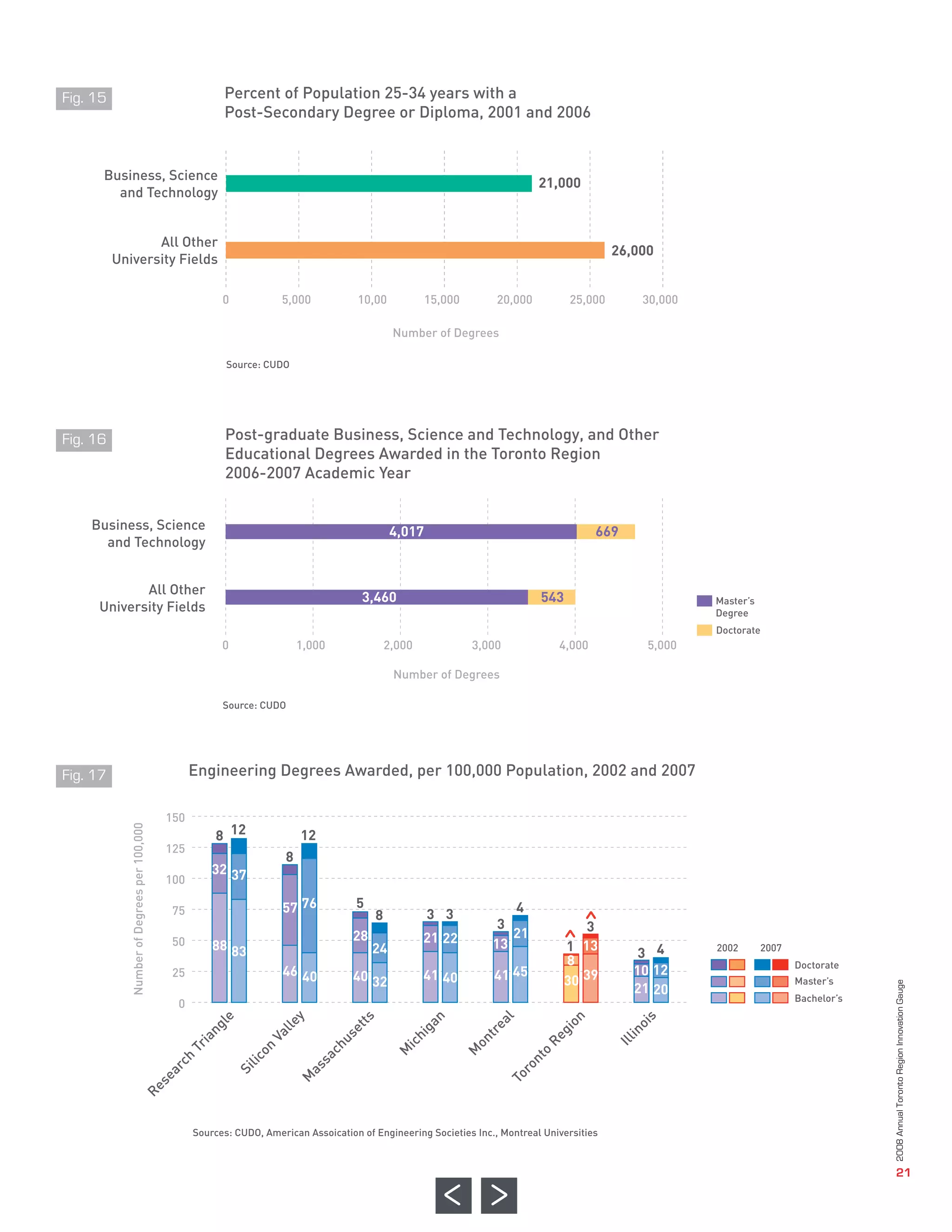

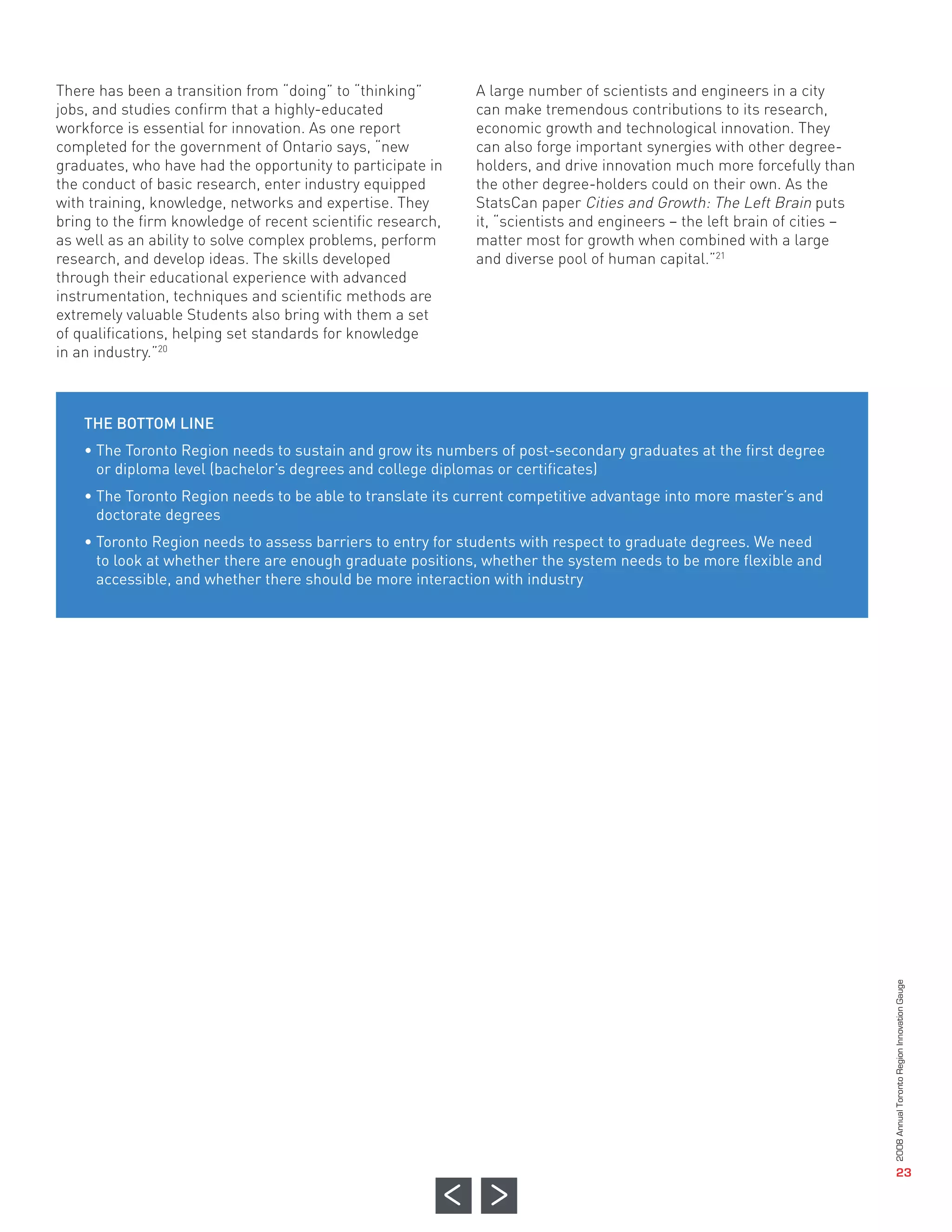

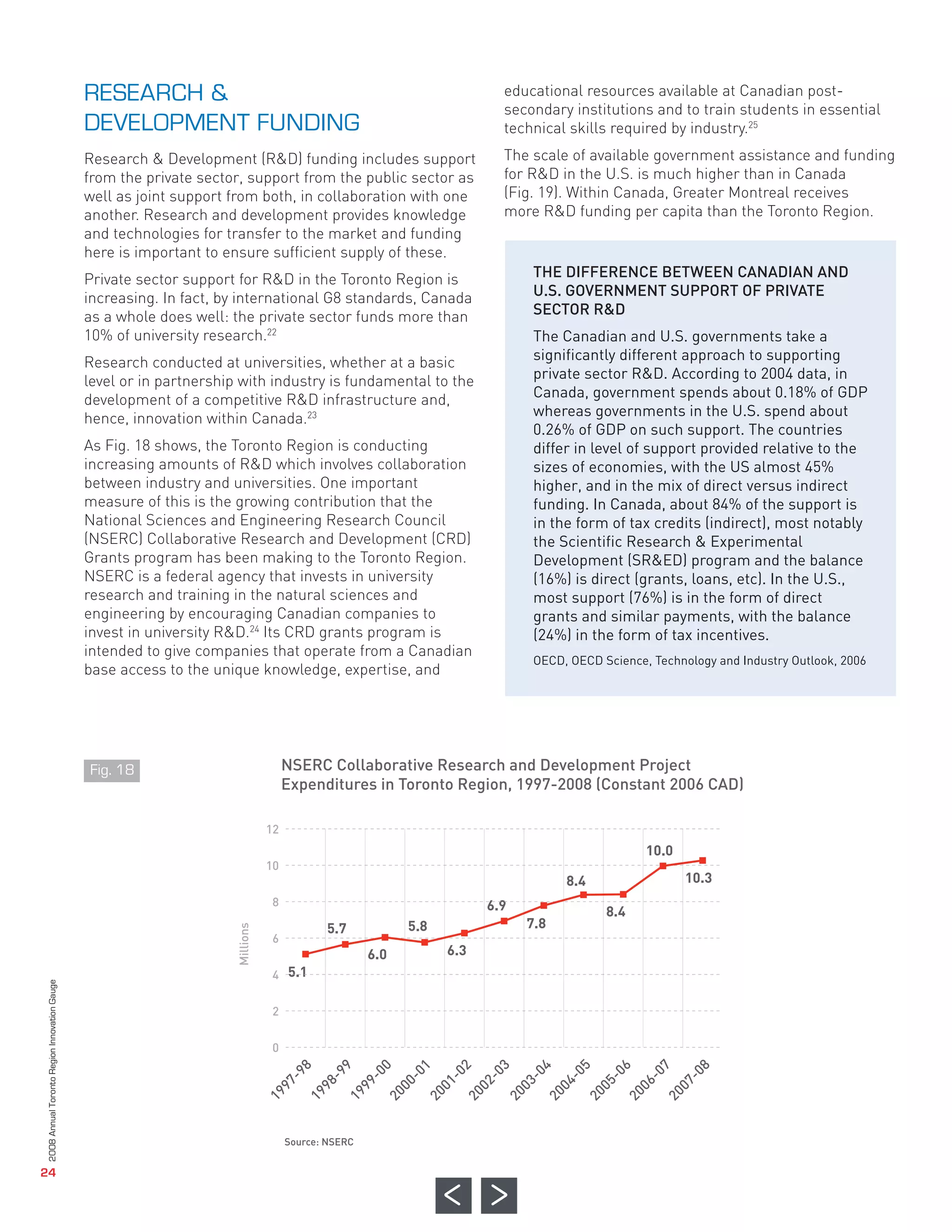

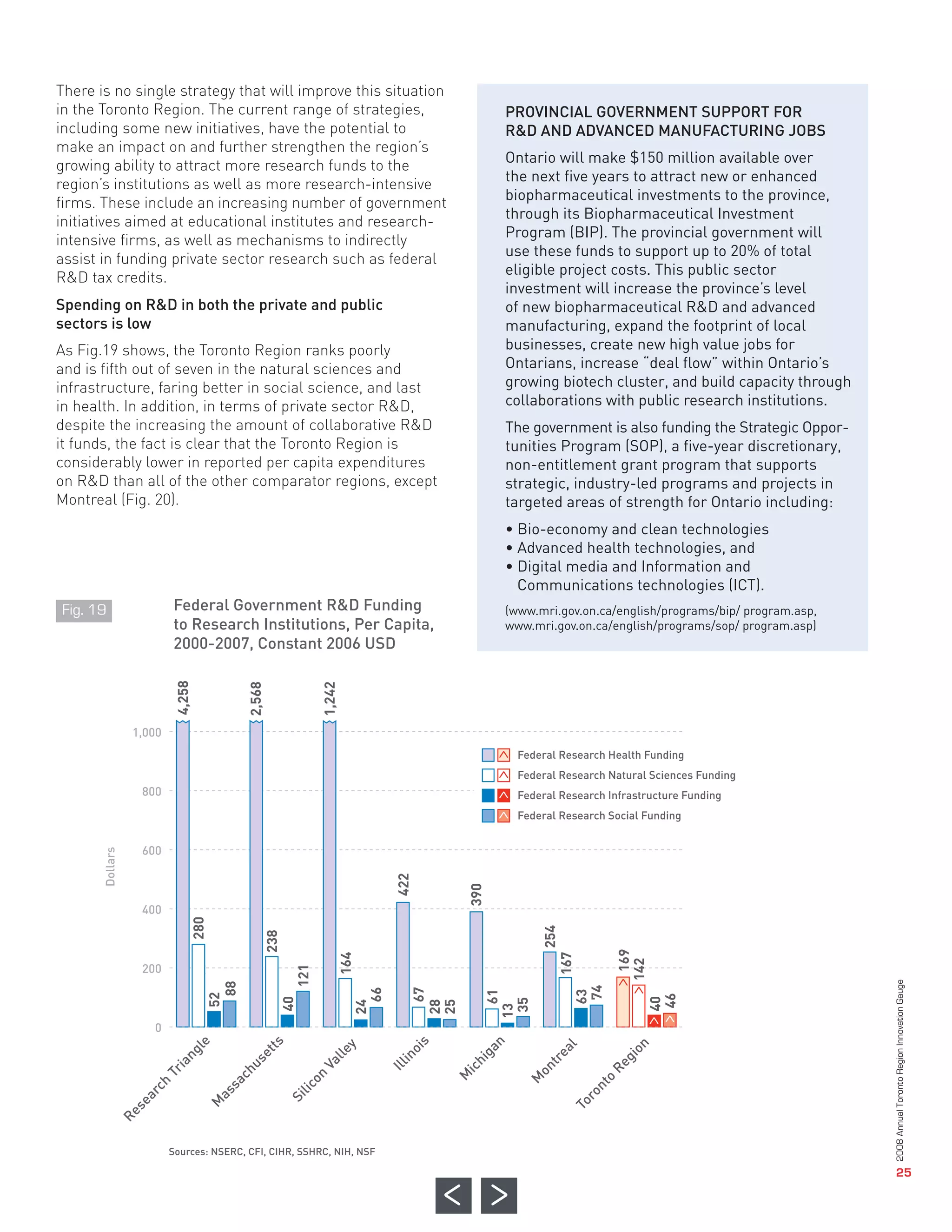

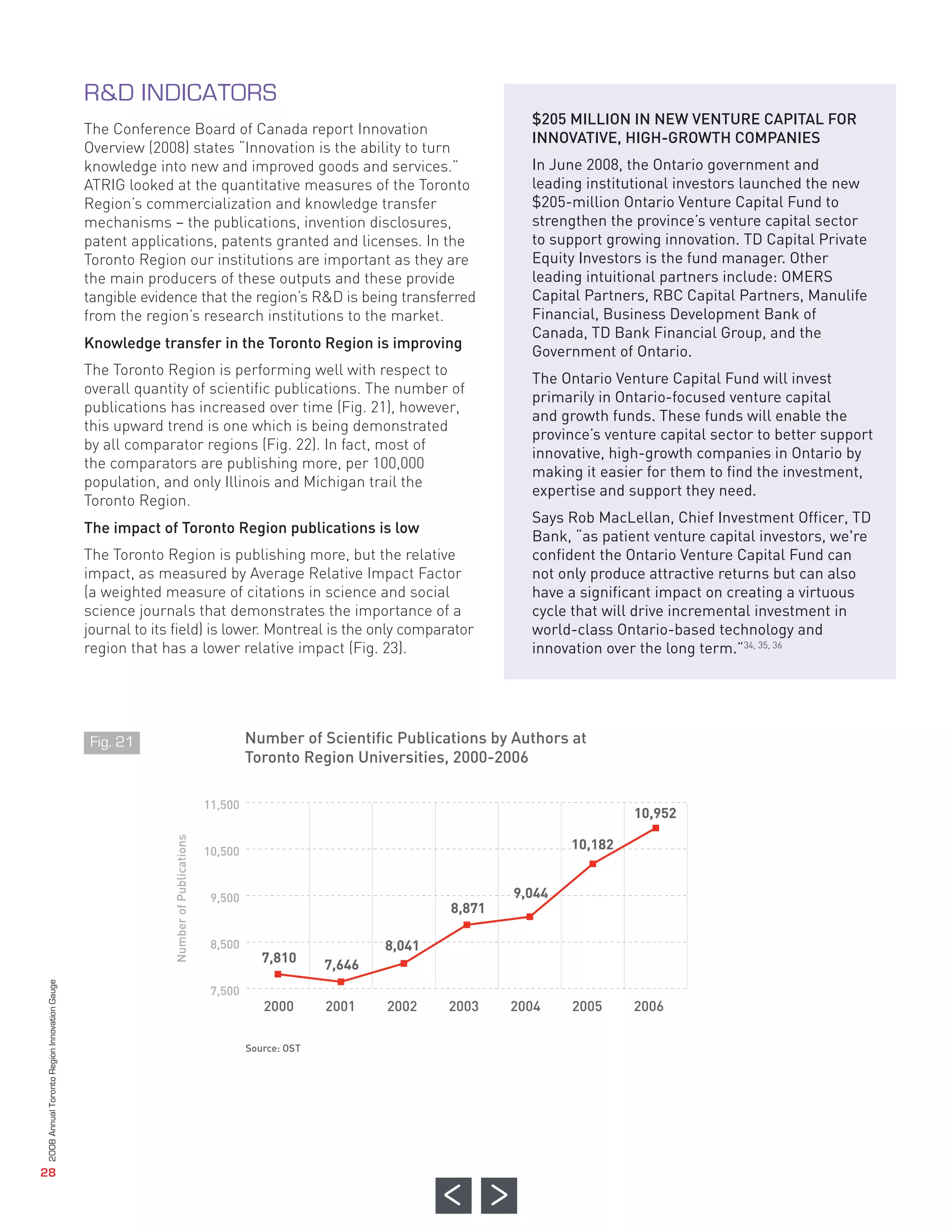

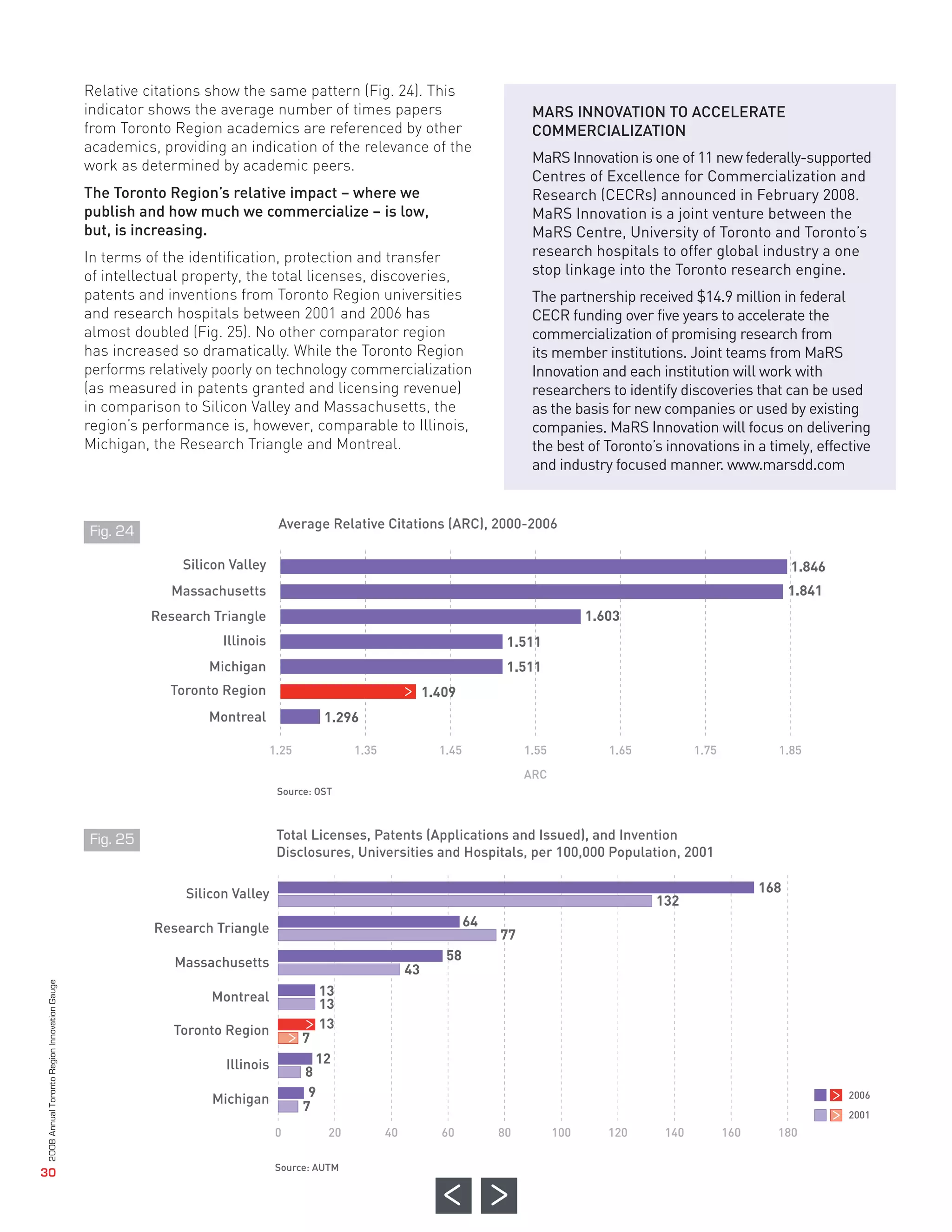

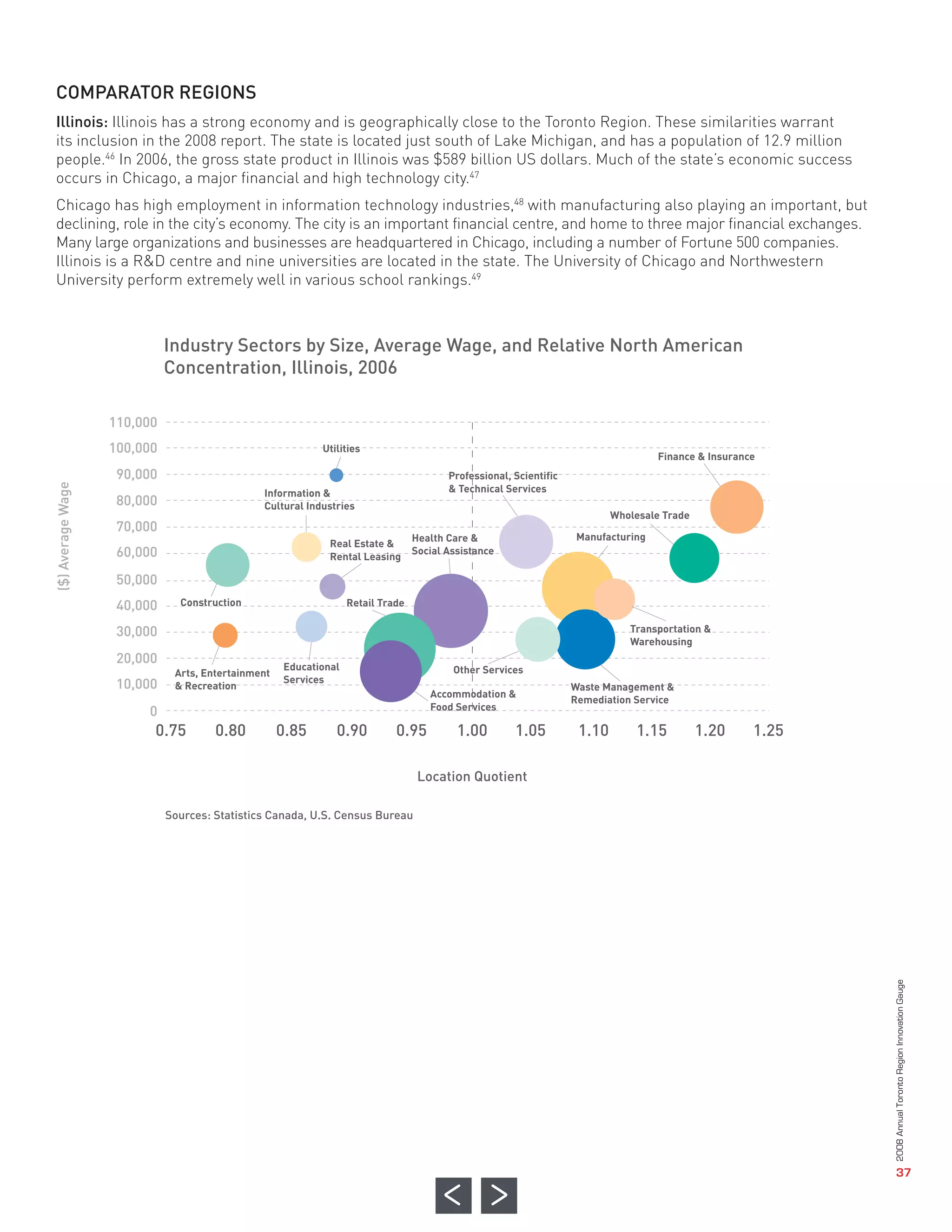

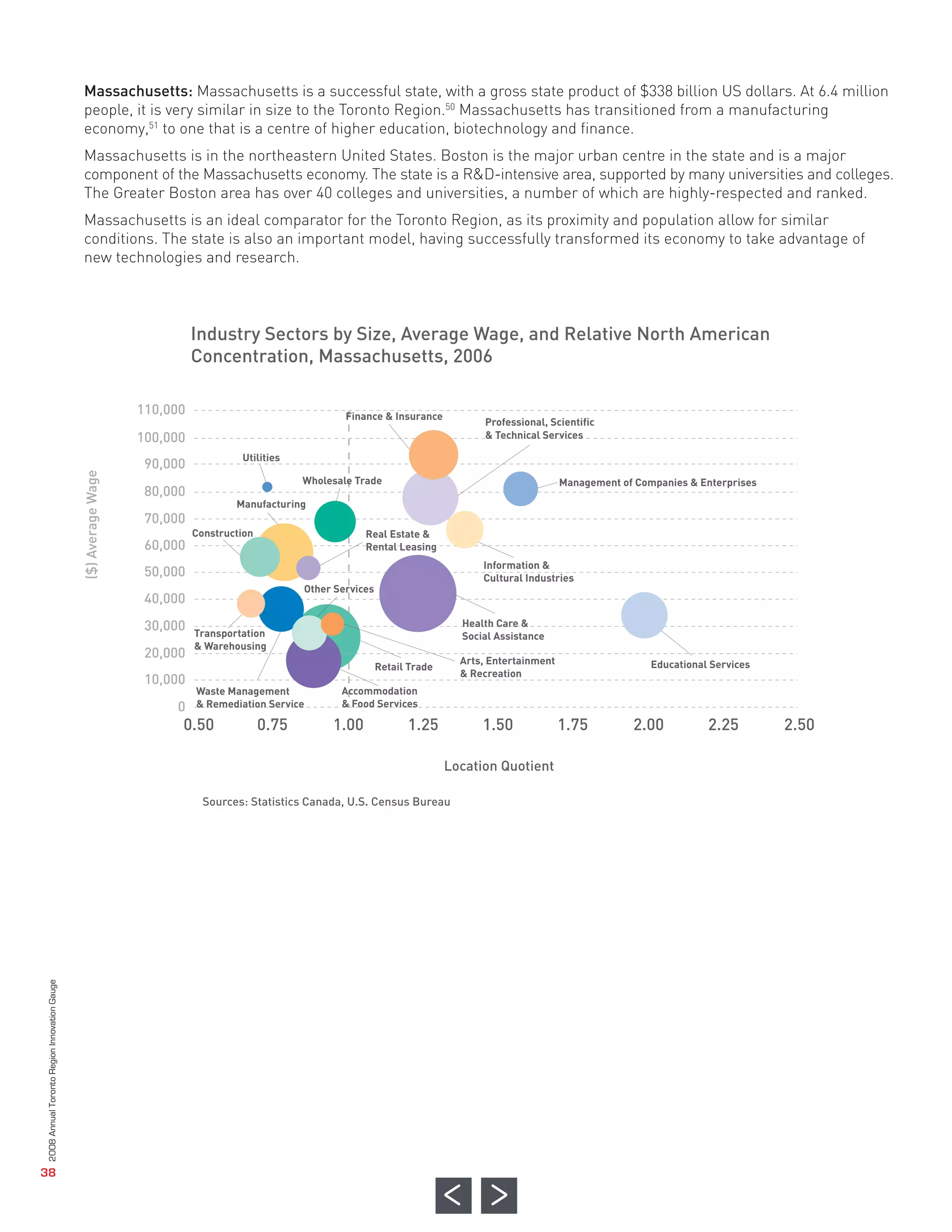

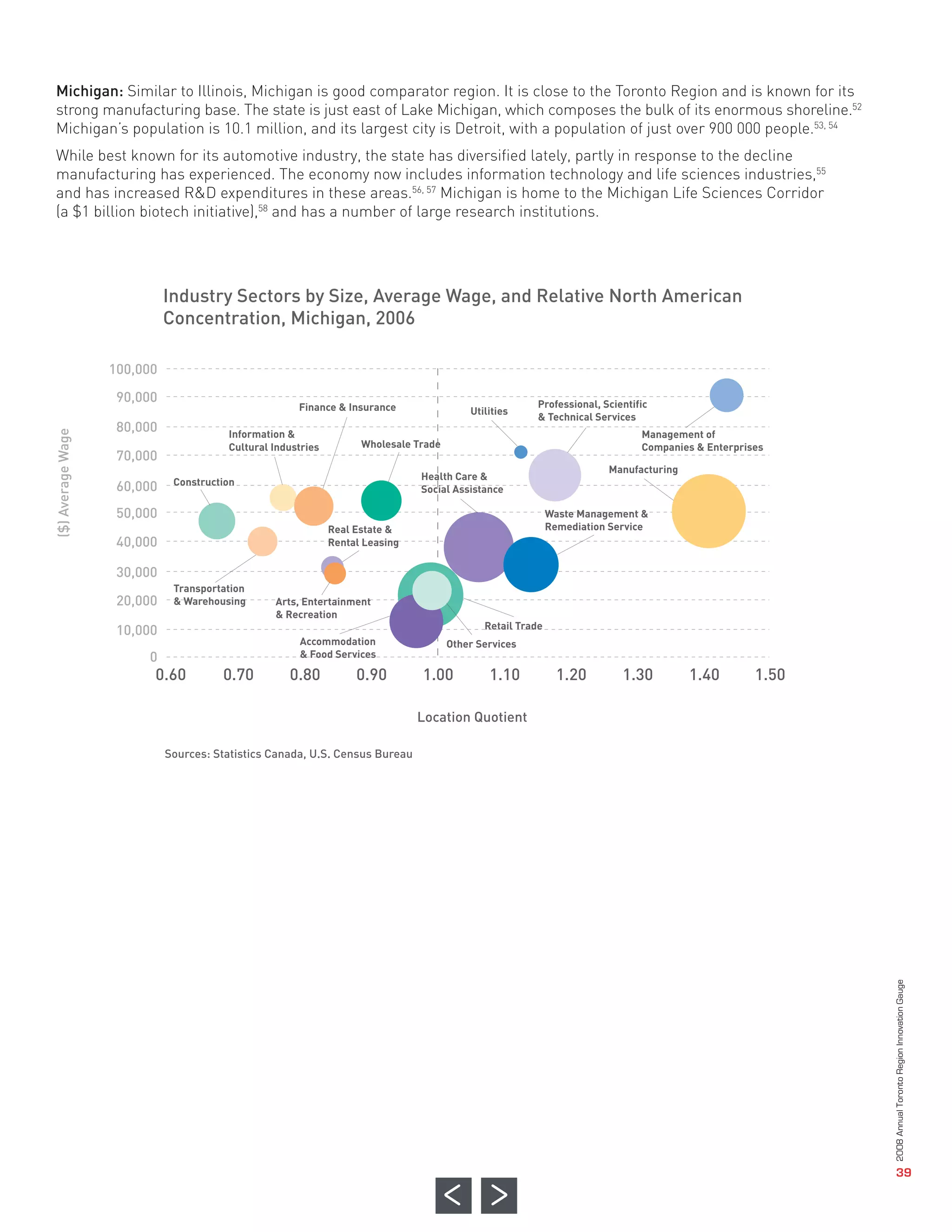

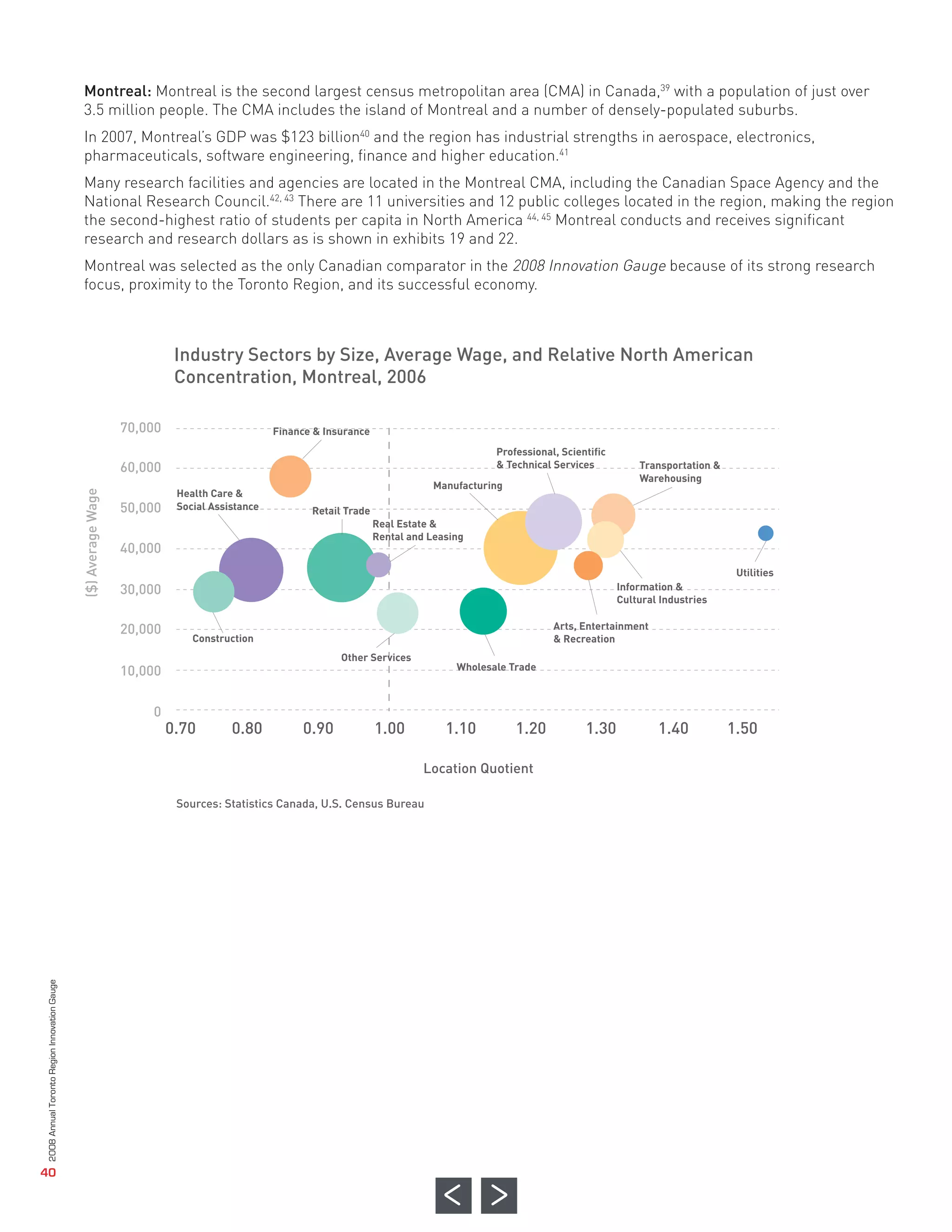

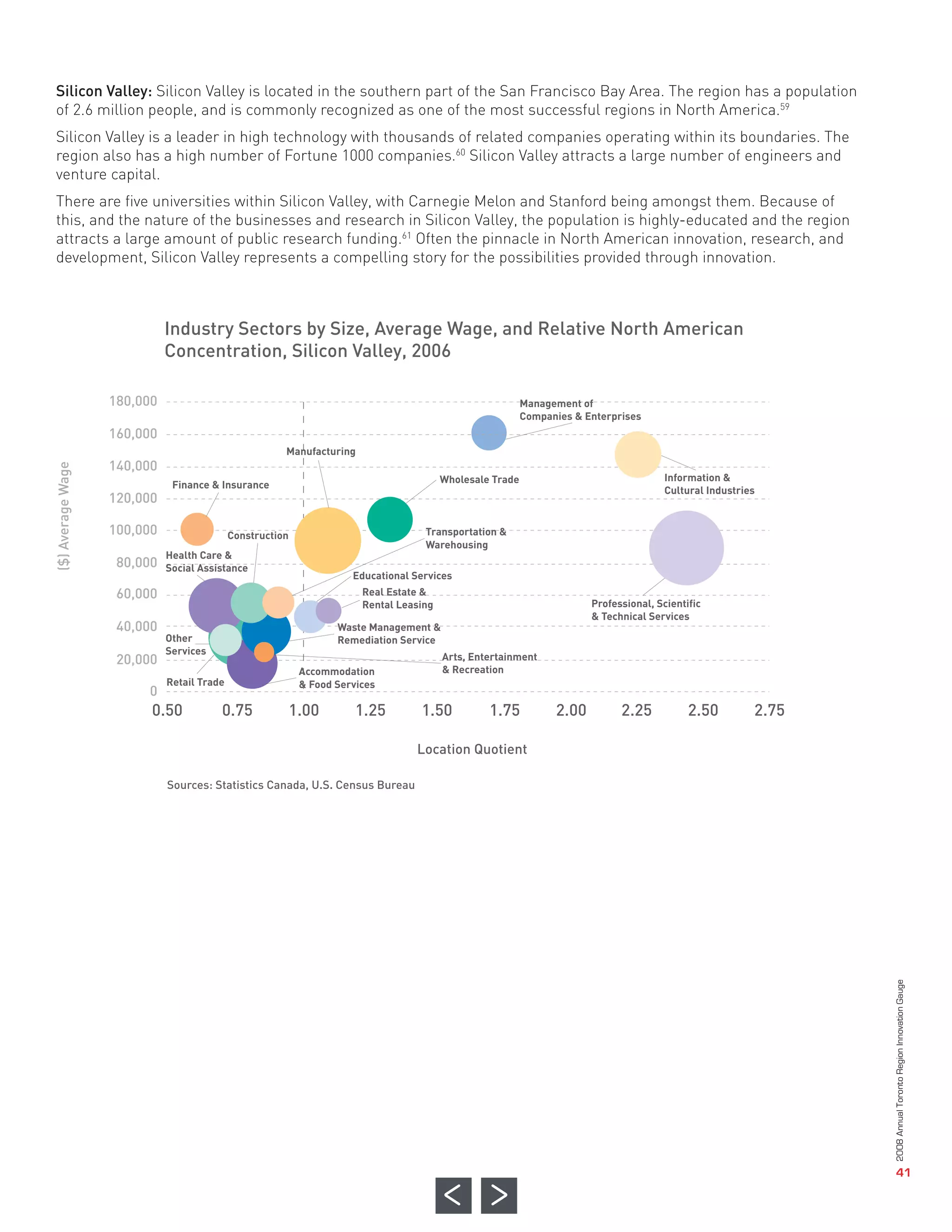

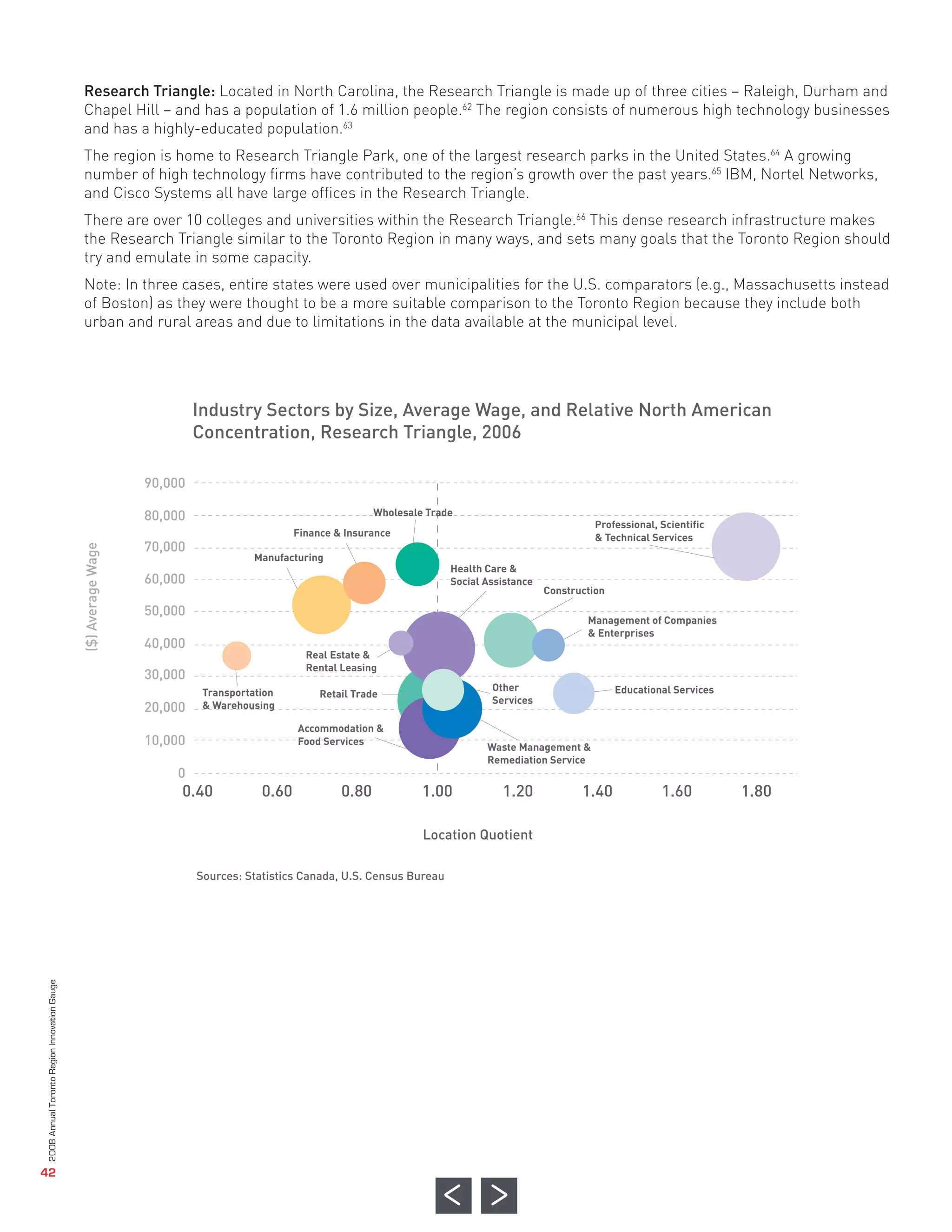

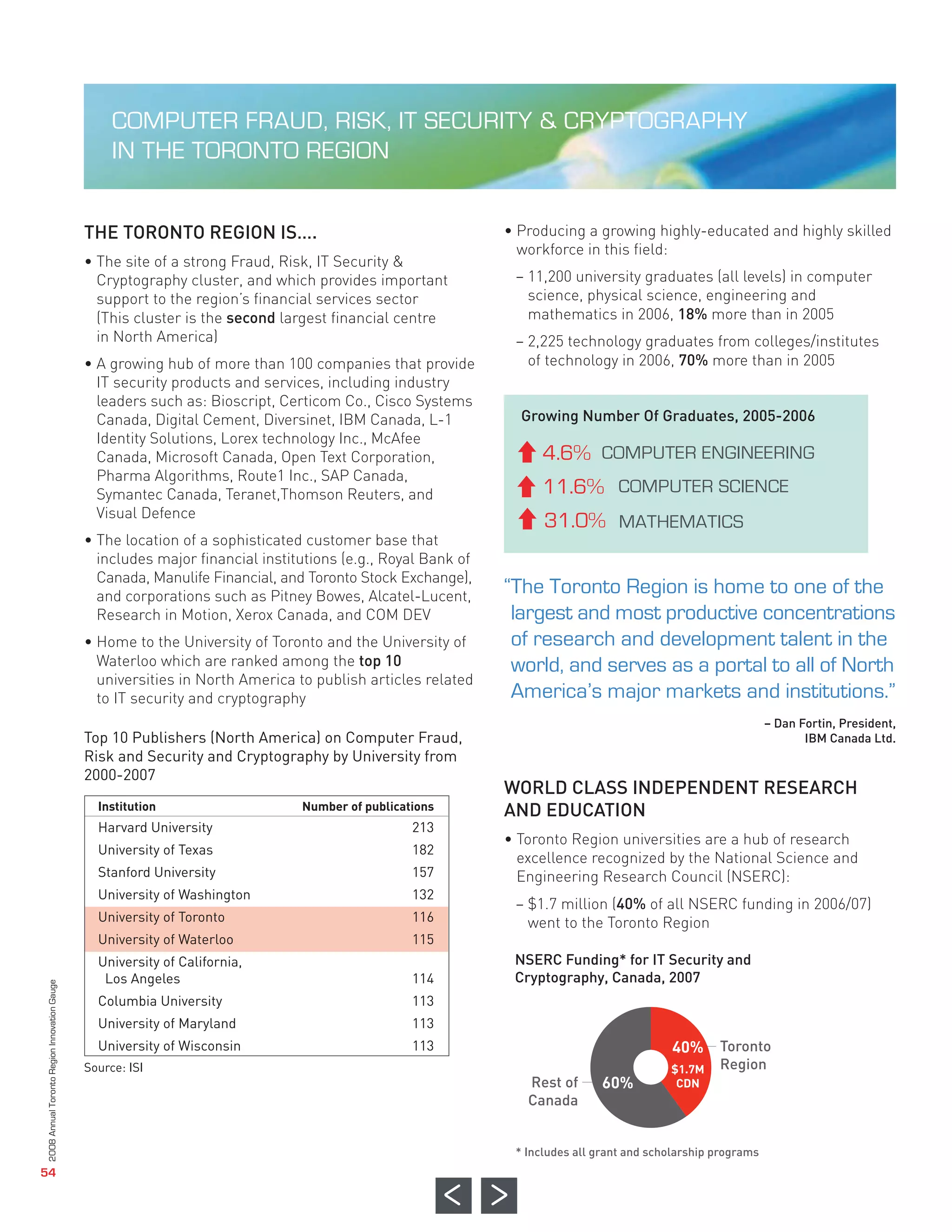

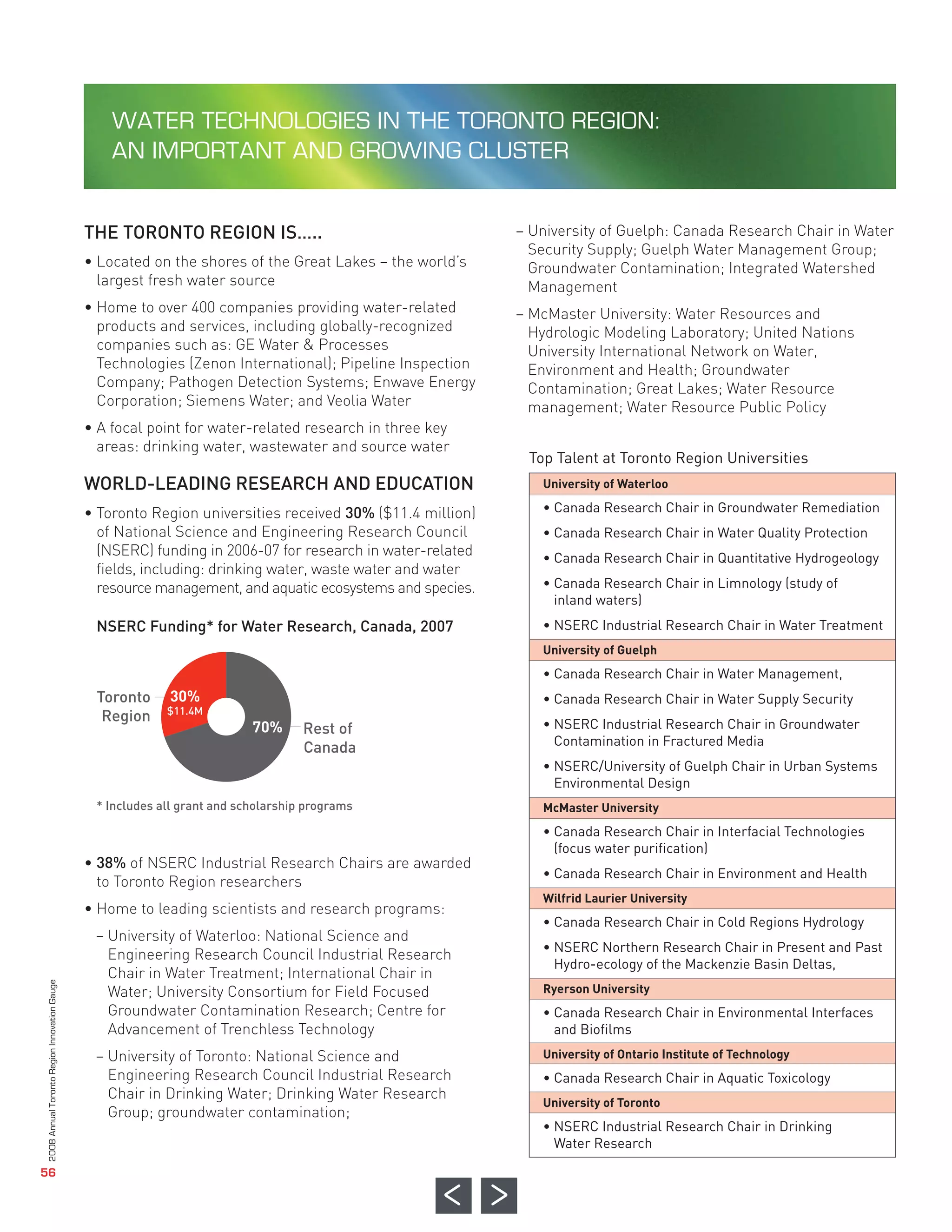

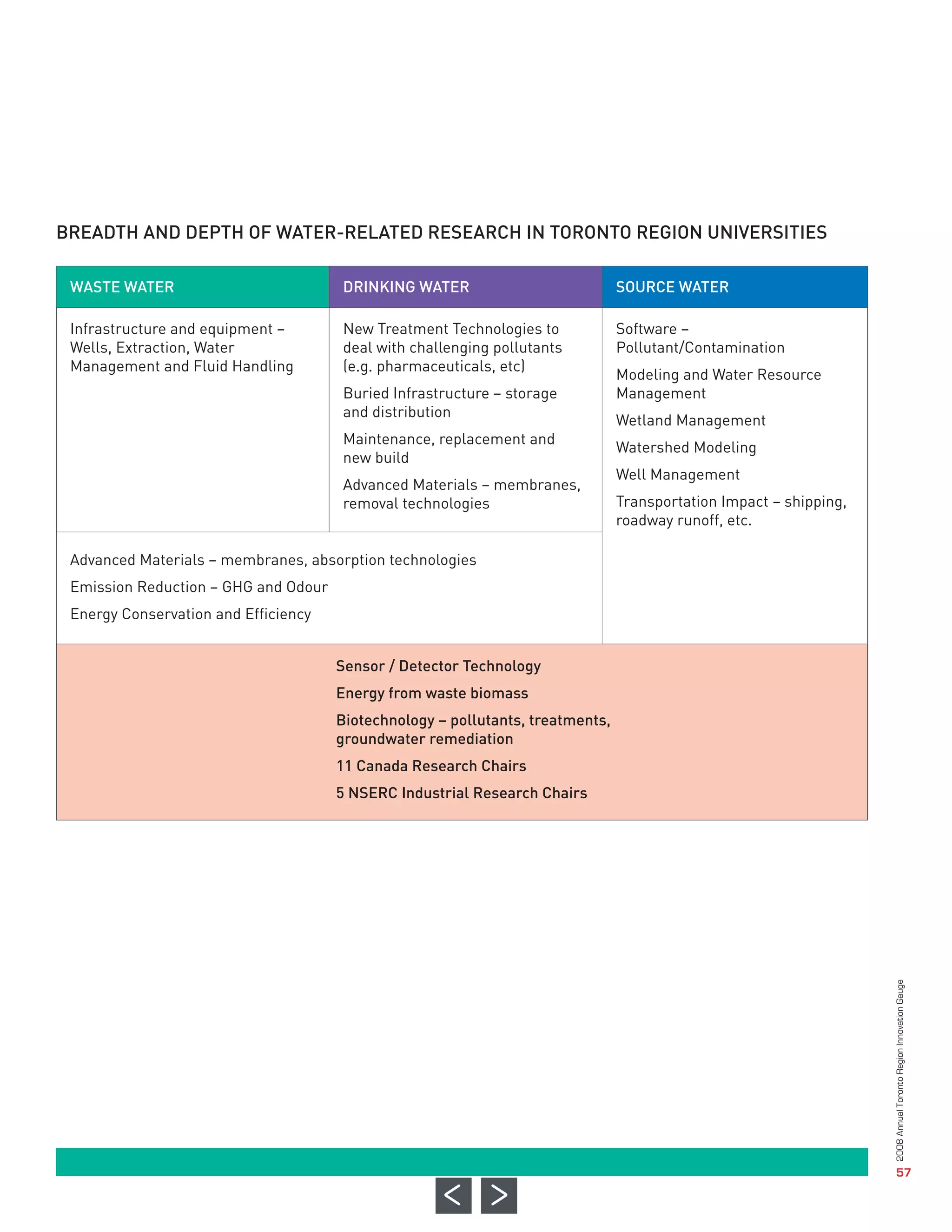

The 2008 Annual Toronto Region Innovation Gauge Report analyzes the strengths and weaknesses of the Toronto region's innovation system compared to other competitive regions like Silicon Valley and Massachusetts. While the region possesses a highly educated population and growing research activities, it faces significant challenges in government funding and private sector R&D that hinder its potential as a top research capital. The report underscores the need for collaborative efforts between government, industry, and education sectors to enhance innovation performance and competitiveness.