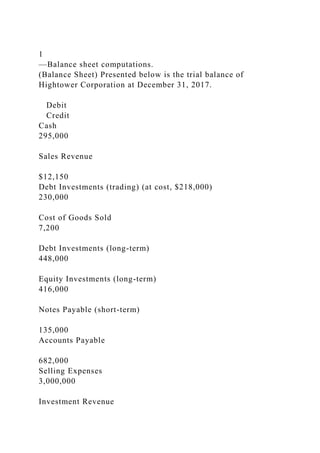

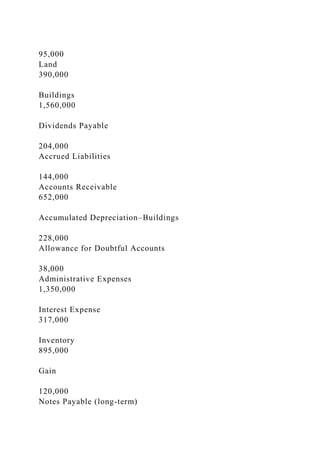

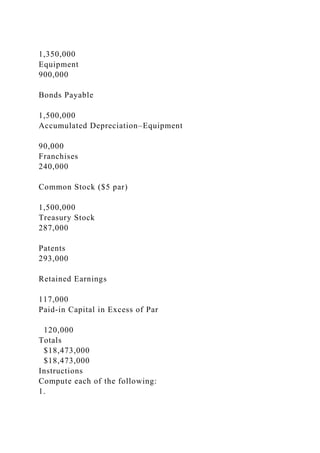

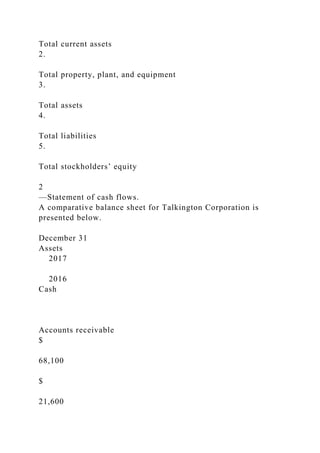

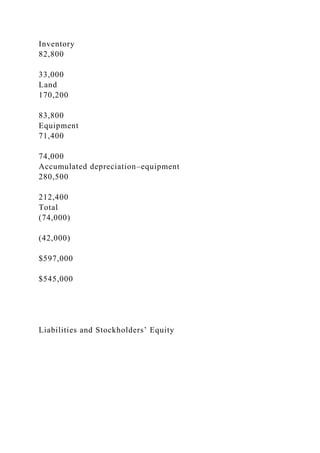

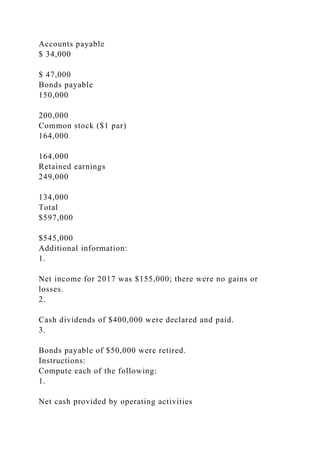

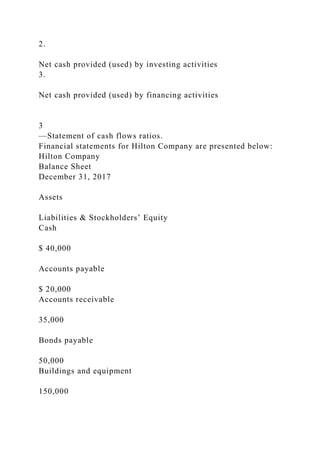

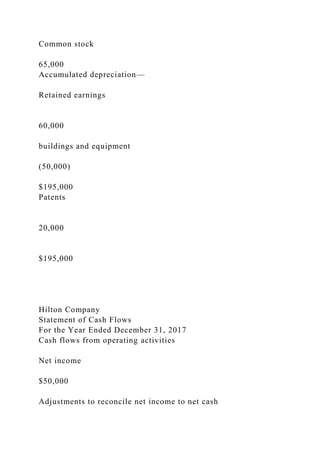

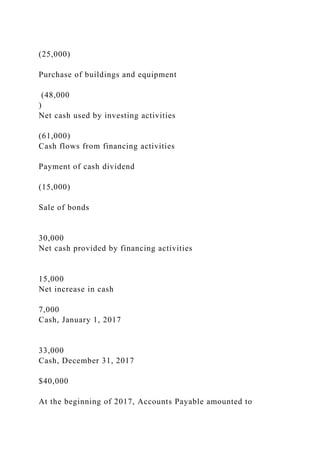

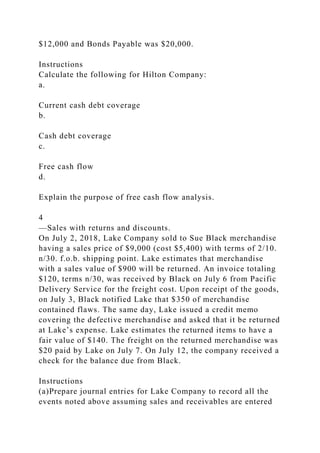

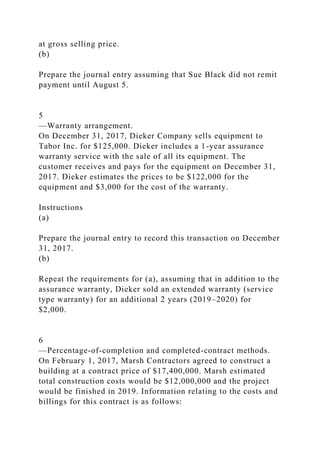

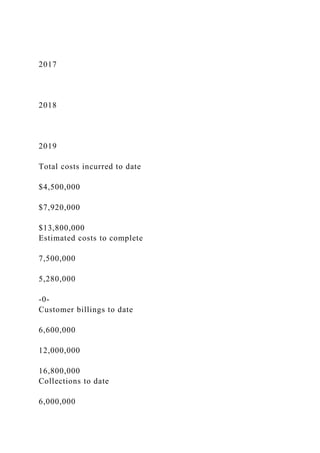

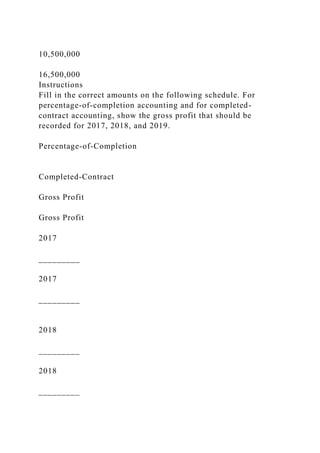

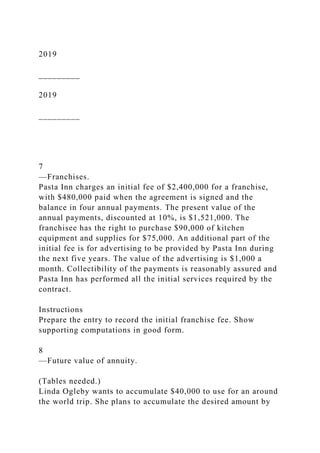

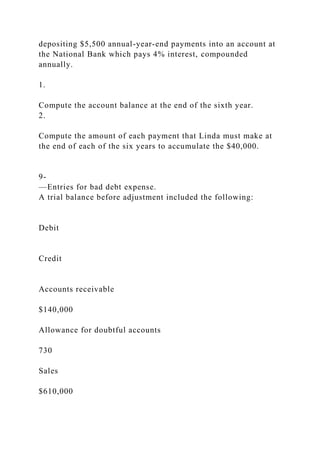

The document outlines various financial scenarios including balance sheet computations, cash flow statements, journal entries for sales and warranties, and contract accounting methods. It includes specific examples from Hightower Corporation, Talkington Corporation, Hilton Company, Lake Company, and Dieker Company to illustrate different accounting practices. Additionally, it provides calculations for cash flows, profits, and annuity values while presenting tasks for the reader to compute based on the provided data.