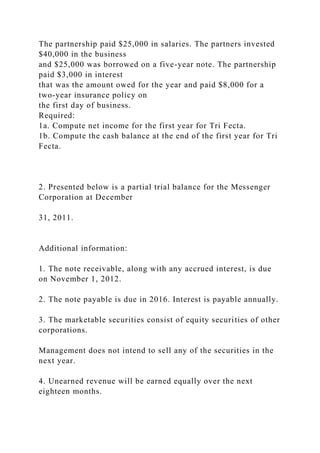

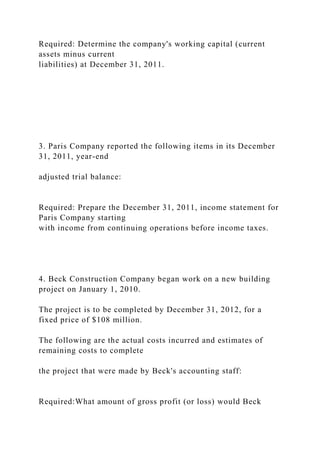

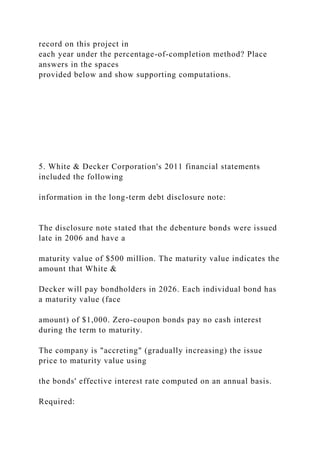

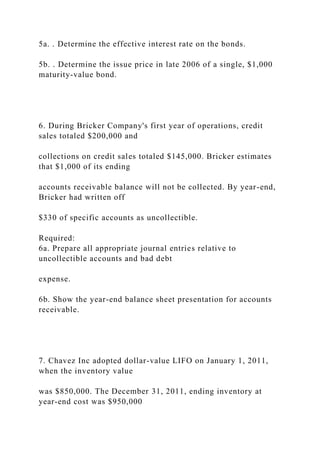

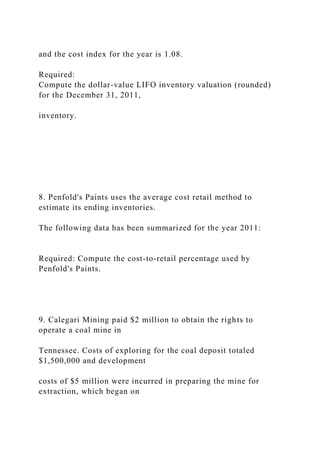

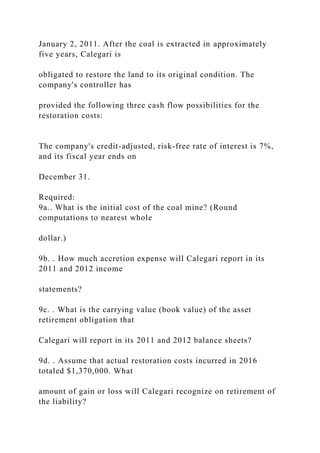

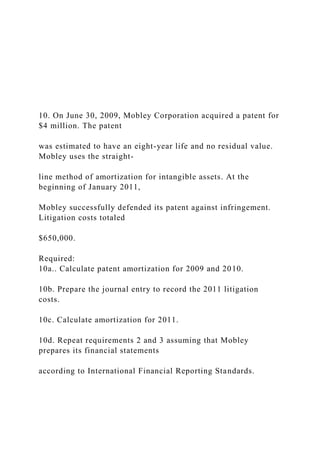

The document is an exam booklet containing various accounting problems that require calculations related to inventory methods, asset valuation, financial statements, and break-even analysis. It includes both multiple-part questions for detailed computations and specific requirements for each situation presented. Overall, it covers practical accounting applications and theoretical knowledge needed for intermediate accounting.