The document provides information about the Banking Ombudsman scheme in India. Some key points:

1. A Banking Ombudsman is an authority appointed by the Reserve Bank of India to redress customer complaints against deficiency in banking services.

2. There are currently 21 Banking Ombudsmen located across India who can receive complaints against all scheduled commercial banks, regional rural banks, and scheduled primary cooperative banks.

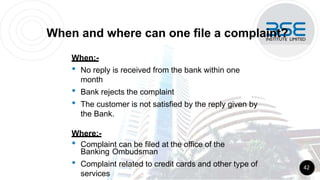

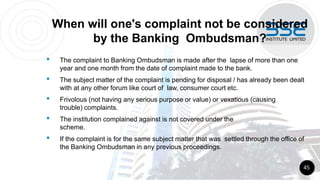

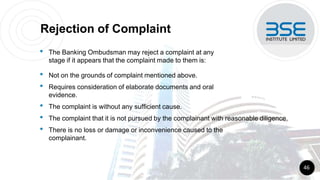

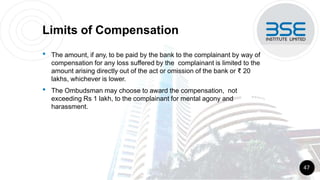

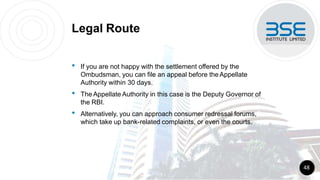

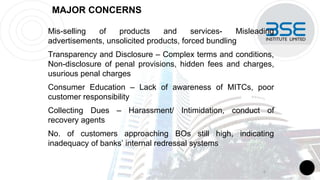

3. Grounds for complaints include issues related to services like non-adherence to working hours, failure to provide facilities, improper handling of loans/advances, among others. Customers can file complaints to the Ombudsman if the bank does not address them satis

![THE MICRO, SMALL AND MEDIUM

ENTERPRISES DEVELOPMENT ACT, 2006

No. 27 oF 2006

[16thJune, 2006.]

An Act to provide for facilitating the promotion and

development and enhancing the competitiveness of

micro, small and medium enterprises iiDd for

matters connected therewith or incidental thereto.

30](https://image.slidesharecdn.com/19and20smefinancecode-230118182451-15cfc32e/85/19-and-20-SME-FINANCE-Code-pptx-29-320.jpg)