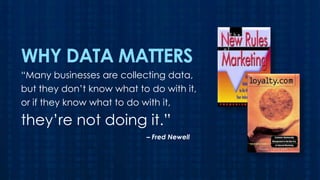

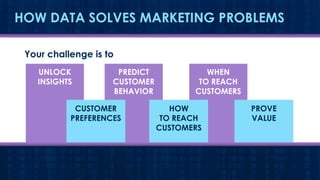

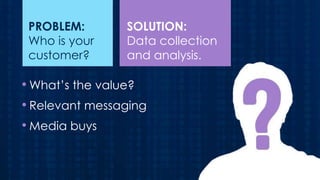

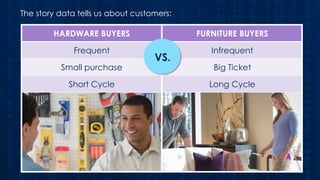

This document discusses how companies can use data to solve marketing problems and measure success. It provides examples of how two companies - a hardware store and furniture retailer - have used customer data to develop targeted marketing strategies. The hardware store implemented a loyalty card program and seasonal promotions tailored to customer purchase patterns. The furniture retailer used data to identify infrequent large-ticket buyers and timed promotions to when customers enter relocation/renovation cycles. Both companies continually test marketing initiatives and improve predictive models to optimize customer reach and prove return on investment.