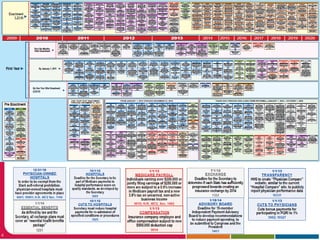

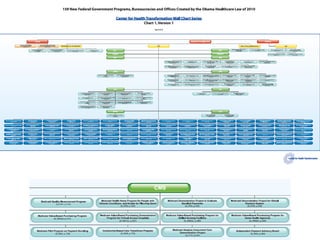

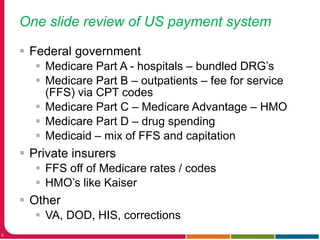

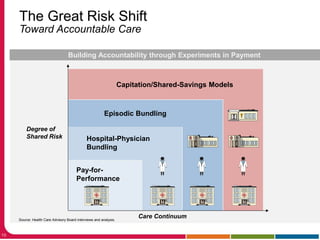

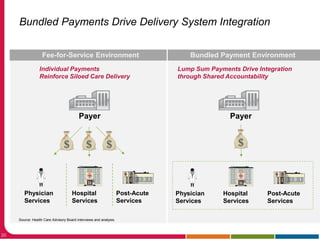

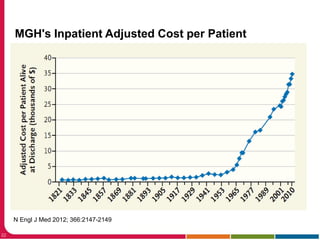

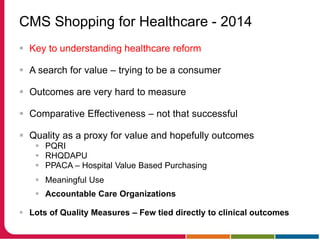

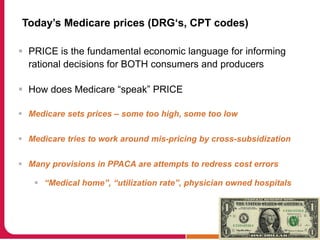

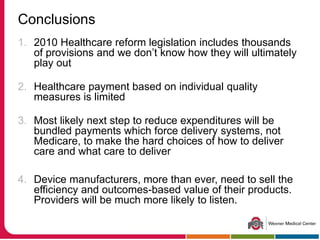

The document discusses the impact of US healthcare reform on medical device development and funding. It summarizes that healthcare reform through the Affordable Care Act and other policies is driving major changes in health insurance purchasing and moving payments from fee-for-service to bundled payments and accountable care organizations. This shift to alternative payment models will require device manufacturers to understand how provider reimbursement is changing to ensure their devices provide value within the new systems.