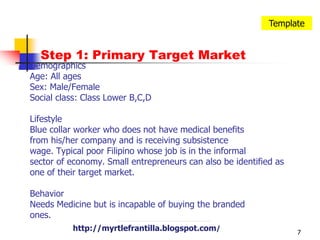

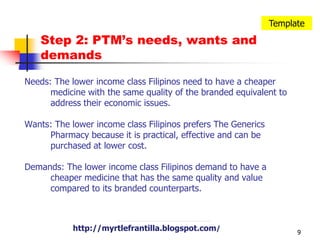

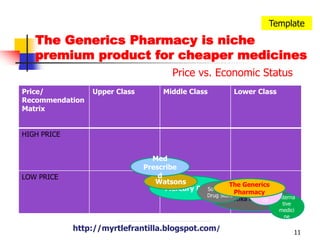

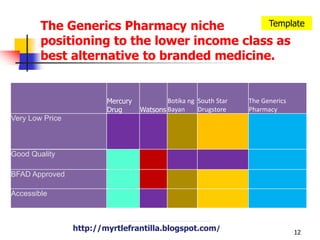

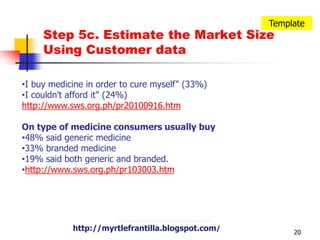

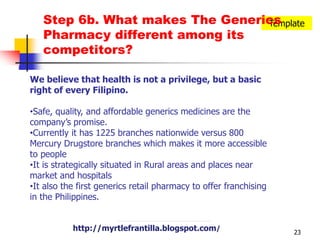

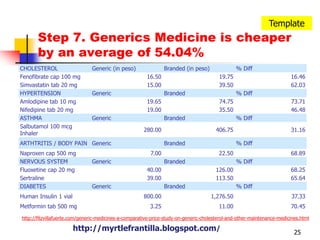

The 10-step marketing plan outlines The Generics Pharmacy's strategy to target lower income Filipinos seeking cheaper medicine alternatives. The plan identifies the target market as Classes B, C, and D Filipinos, analyzes competitors like Mercury Drug and South Star Drug, and estimates that 6 out of 10 Filipinos opt for generic medicines. The Generics Pharmacy differentiates itself by offering generic drugs at a lower price but with the same quality as branded medications, along with over 1,225 branches nationwide.