This document discusses valuation of intellectual property. It provides an overview of valuation methods including cost approach, market approach, and income approach. The income approach uses discounted cash flow (DCF) analysis to determine the value of intellectual property. The document outlines the steps of DCF valuation, including predicting sales revenues, calculating cash flows, and addressing factors that influence cash flows such as investments, depreciation, and working capital. It also discusses how valuation methods are applied in different contexts such as licensing, mergers and acquisitions, investment, and financing situations involving intellectual property.

![145

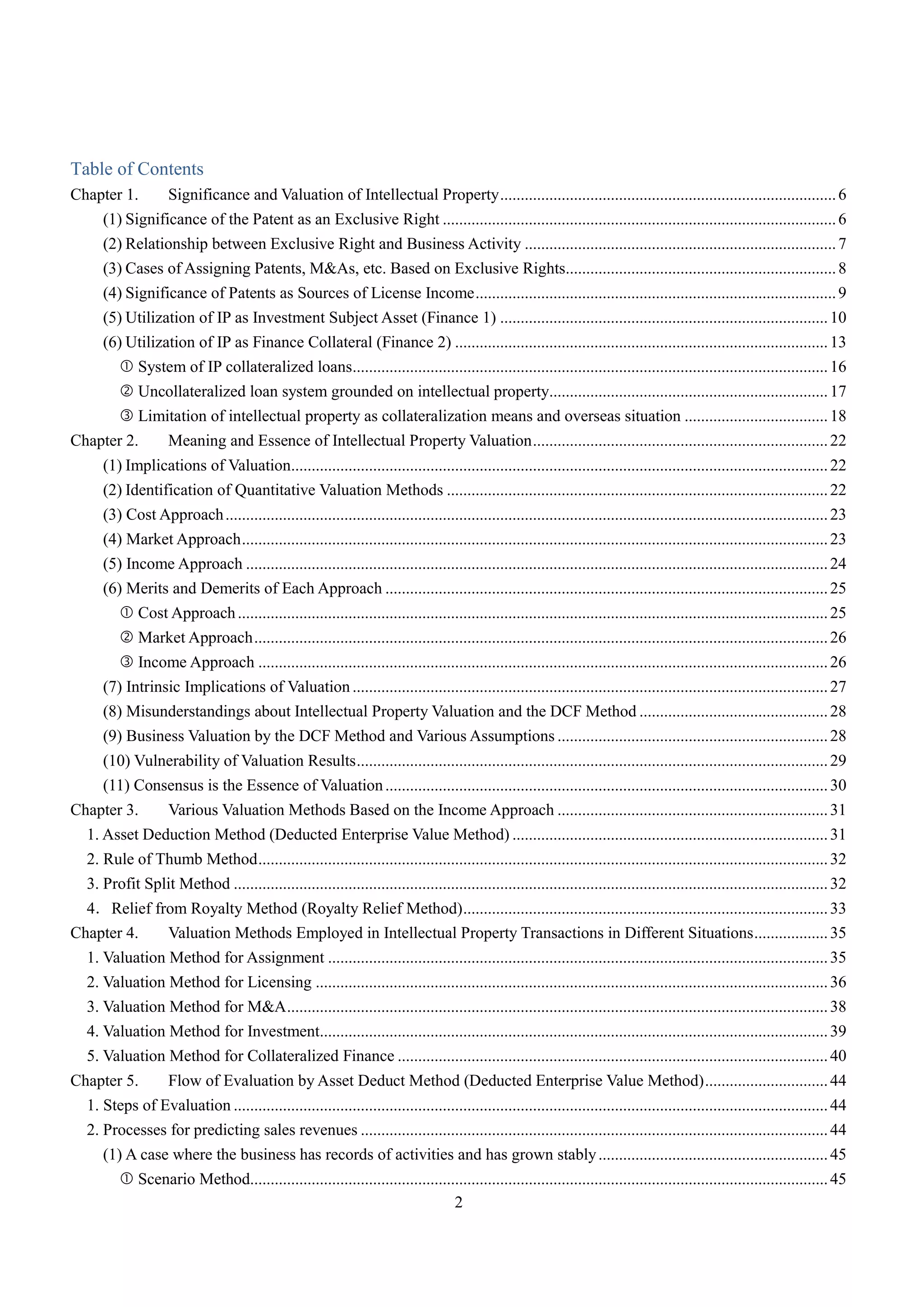

As a result of these efforts, sales of Bypass Vitamin C grew steadily and reached 100 million yen in

2007 and 2008. The economic depression caused by the Lehman Shock in 2008 and rumors about

radioactive contamination in the aftermath of the Great East Japan Earthquake in 2011 caused a fall in

beef prices, leading to business difficulties for cattle fattening companies. This resulted in a decrease in

sales of this product. According to Kansai TLO, however, running royalties on this technology are still

being paid by YPTECH to Kansai TLO.

Thus, the fact that a technology generated in a university has contributed to creating a hit product of

a company is a typical successful case of transfer of university technology to the private sector.

4. Valuation methods in licensing, etc. of university technology

Incidentally, in the transfer of university technology to the private sector as we have discussed so far,

how are the technologies subject to licensing or assignment valuated? In other words, how are the

license royalties or assignment fees calculated?

Honestly, there is almost no information available on this point. My personal impression from my

interview surveys at universities, etc. is that in the case of technology assignment, they set a relatively

low fixed fee instead of calculating the valuation amount based on a prediction of income expected

from the technology, because the university technology subject to assignment often has little business

potential. It is questionable, though, whether this method should be maintained in the future. Such

waste disposal-like assignment is suicidal for university intellectual property and therefore should be

corrected. As we saw earlier in “FY2014 Status of Industry-Academia Collaboration at Universities,

etc.” by the Ministry of Education, Culture, Sports, Science and Technology, technology assignment

contracts account for 23.6% of the total technology transfer deals. If each assignment fee rises, a

substantial increase in the amount of royalties paid to universities can be expected.

Now what about the method to calculate running royalties in technology licensing? I heard from

several universities that they employ the Profit Split approach. For some researchers who have created a

technology at a university, valuation of the technology as one-third of the profit of the company may be

unacceptable. However, in order to generate profit from research results, business processes such as

manufacturing and sales are necessary. While seeking the understanding of researchers on this point, the

shares of the university and the company are roughly determined between them according to Profit Split,

based on which the total amount of royalty, the ratio of lump-sum and running royalties and the specific

rate of running royalties are decided. In many cases, however, the company side requests a reduction in

royalty fees through further dividing the one-third share of profit, while the university has to accept it to

some extent.

Profit Split is a method that has been commonly employed in technology licensing in Japan, and

there is evidence that this method is also commonly employed in licensing of university technology. For

example, the reference documents distributed at the UNITT Annual Conference 2016 in Sendai held by

the University Network for Innovation and Technology Transfer in May 2016 contained a report stating,

“calculate by profit split the contribution of technology to profits [...] based on which determine the

amounts of lump-sum payment and the rate of royalties to annual sales.”

Profit Split is a valuation method as simple as or even simpler than Relief from Royalty. In practice,

complicated valuation methods, such as valuation through calculation of business cash flows, are

probably not adopted. Considering the difficulty in prediction, relying on a simple method is rather](https://image.slidesharecdn.com/1-170907042016/75/1-valuation-of-intellectual_property-145-2048.jpg)