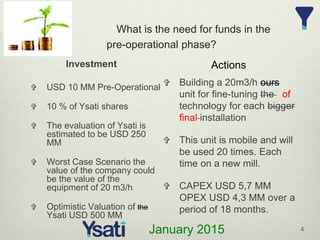

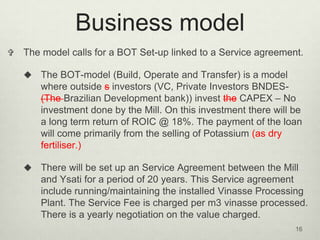

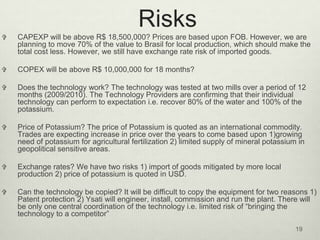

Ysati has developed a technology to transform vinasse, a waste byproduct of ethanol production, into clean water and organic potassium fertilizer. This solves environmental problems caused by current vinasse disposal methods while generating revenue. Ysati will build and operate mobile 20m3/hour pilot plants to fine-tune the technology, then scale up to full 300m3/hour commercial plants. Initial funding of $10 million is sought to build the pilot plant and operate for 18 months, establishing proof of concept. Long term, Ysati aims to install 20 commercial plants over 10 years, generating an 18% return on the $500 million total investment. The technology, partnerships, financial projections, and environmental/economic benefits are