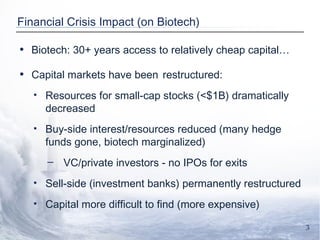

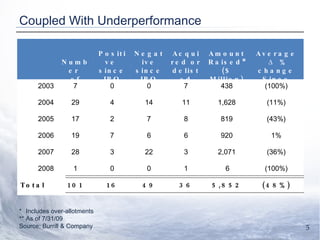

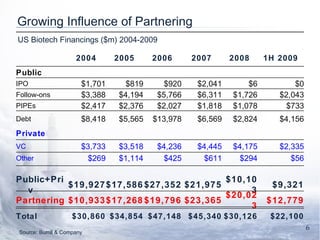

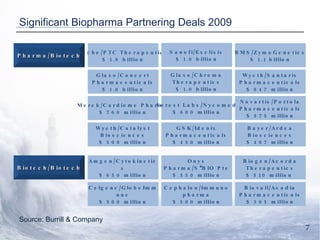

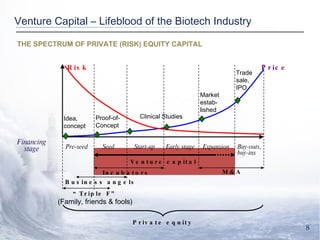

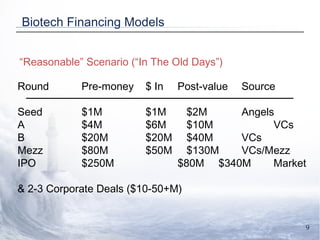

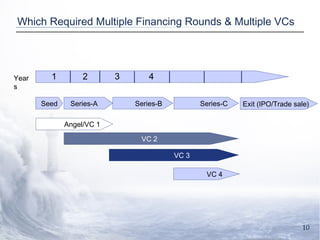

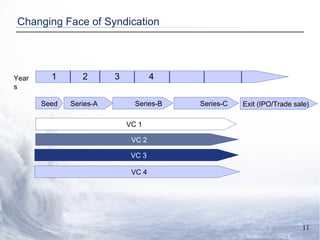

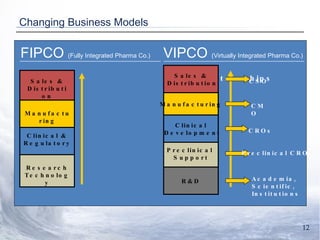

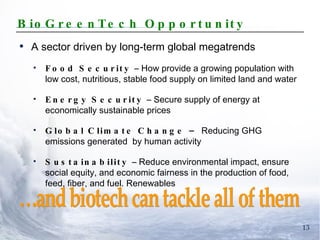

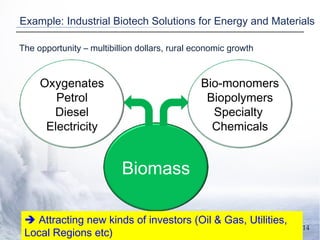

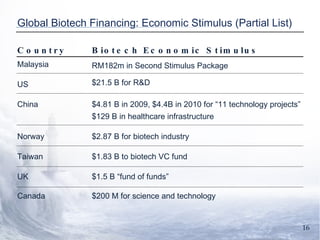

The document discusses the financial landscape of biotech companies from their inception to exit, highlighting how the financial crisis has made capital access more difficult and expensive. It details trends in biotech IPOs and financings from 2004 to 2009, the importance of partnering in the industry, and the role of venture capital as a critical source of funding. Additionally, it explores the impact of global megatrends on biotech opportunities and the economic stimulus provided by various countries to support the biotech sector.