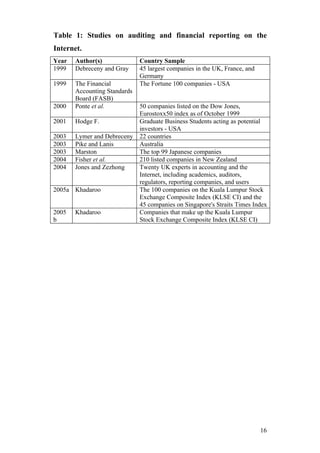

This document summarizes a study investigating financial reporting on the internet by Saudi joint stock companies and its impact on the audit profession. The study analyzed the content of websites for 86 listed Saudi companies. 35 companies were found to have websites containing financial information. All 35 published audited financial reports and the corresponding audit report. However, audited and unaudited information were not clearly distinguished. None of the audit reports referred to electronic presentation of financial statements or responsibilities regarding websites. Most audit reports were located on company websites, making it difficult for auditors to control. The study recommends Saudi professional bodies issue rules to help ensure reliability of internet financial reporting.