Problem 3-2 (LO 2) Simple equity method adjustments, consolidated .docx

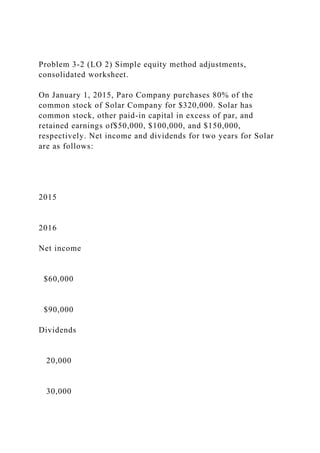

- 1. Problem 3-2 (LO 2) Simple equity method adjustments, consolidated worksheet. On January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. Solar has common stock, other paid-in capital in excess of par, and retained earnings of$50,000, $100,000, and $150,000, respectively. Net income and dividends for two years for Solar are as follows: 2015 2016 Net income $60,000 $90,000 Dividends 20,000 30,000

- 2. On January 1, 2015, the only undervalued tangible assets of Solar are inventory and the building. Inventory, for which FIFO is used, is worth $10,000 more than cost. The inventory is sold in 2015. The building, which is worth $30,000 more than book value, has a remaining life of10 years, and straight-line depreciation is used. The remaining excess of cost over book value is attributed to goodwill. Required 1. Using this information and the information in the following trial balances on December 31, 2016, prepare a value analysis and a determination and distribution of excess schedule: Paro Company Solar Company Inventory, December 31 100,000 50,000 Other Current Assets 136,000

- 3. 180,000 Investment in Solar Company 400,000 Land 50,000 50,000 Buildingsand Equipment 350,000 320,000 Accumulated Depreciation (100,000) (60,000) Goodwill

- 4. Other Intangibles 20,000 Current Liabilities (120,000) (40,000) Bonds Payable (100,000) Other Long-Term Liabilities (200,000)

- 5. Common Stock—Paro Company (200,000) Other Paid-In Capital in Excess of Par—Paro Company (100,000) Retained Earnings—Paro Company (214,000) Common Stock—Solar Company (50,000) Other Paid-In Capital in Excess of Par—Solar Company

- 6. (100,000) Retained Earnings—Solar Company (190,000) Net Sales (520,000) (450,000) Cost of Goods Sold 300,000 260,000 Operating Expenses 120,000

- 7. 100,000 Subsidiary Income (72,000) Dividends Declared—Paro Company 50,000 Dividends Declared—Solar Company 30,000 Totals 0 0 2. Complete a worksheet for consolidated financial

- 8. statements for 2016. Include columns for eliminations and adjustments, consolidated income, NCI, controlling retained earnings, and consolidated balance sheet. Problem 3-10 (LO3, 5) 100%, cost method worksheet, several adjustments, third year. Refer to the preceding information for Paulcraft’s acquisition of Switzer’s common stock. Assume that Paulcraft pays $480,000 for 100% of Switzer common stock. Paulcraft uses the cost method to account for its investment in Switzer. Paulcraft and Switzer have the following trial balances on December 31, 2017 as shown on page 191. Paulcraft Switzer Cash 100,000 110,000 Accounts Receivable 90,000

- 9. 55,000 Inventory 120,000 86,000 Land 100,000 60,000 Investment in Switzer 480,000 Buildings 800,000 250,000 Accumulated Depreciation

- 11. (100,000) Common Stock (100,000) (10,000) Paid-In Capital in Excess of Par (900,000) (90,000) Retained Earnings, January 1, 2017 (315,000) (182,000) Sales (800,000) (350,000) Cost of Goods Sold

- 12. 450,000 210,000 Depreciation Expense—Buildings 30,000 15,000 Depreciation Expense—Equipment 15,000 14,000 Other Expenses 140,000 68,000 Interest Expense

- 13. 8,000 Dividend Income (10,000) Dividends Declared 20,000 10,000 Totals 0 0 Required 1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Switzer. 2. Complete a consolidated worksheet for Paulcraft Corporation and its subsidiary Switzer Corporation as of December 31, 2017. Prepare supporting amortization and income distribution schedules. Worksheet 3-2

- 14. Company P: January 1, 2015, balance $123,000 Net income, 2015 (including Company P’s share of subsidiary income under simple equity method) 62,500* Balance, January 1, 2016 $185,500 * Company P’s own 2015 net income ($100,000 revenue − $60,000 expenses) + Company P’s share of Company S 2015, $25,000 net income ($25,000 × 90%) = $40,000 + $22,500 = $62,500. Company S: January 1, 2015, balance

- 15. $ 70,000 Net income, 2015 25,000 Dividends declared (10,000) Balance, January 1, 2016 $ 85,000 As before, entry (CY1) eliminates the subsidiary income recorded by the parent, and entry (CY2) eliminates the intercompany dividends. Neither subsidiary income nor dividends declared by the subsidiary to the parent should remain in the consolidated statements. In journal form, the entries are as follows:

- 16. Create date alignment and eliminate current-year subsidiary income: (CY1) Investment in Company S 10,800 Subsidiary Loss 10,800 (CY2)

- 17. Investment in Company S 4,500 Dividends Declared (Company S account) 4,500 At this point, the investment account balance is returned to $148,500 ($133,200 on the trial balance + $10,800 loss + $4,500 dividends), which is the balance on January 1, 2016. Date alignment now exists, and elimination of the investment account may proceed. Entry (EL) eliminates 90% of the subsidiary equity accounts against the investment account. Entry (EL) differs in amount from the prior year’s (2015) entry only because Company S’s retained earnings balance has changed. Always eliminate the subsidiary’s equity balances as they appear on the worksheet, not in the original D&D schedule. In journal form, entry (EL) is as follows: Eliminate investment account at beginning-of-year balance:

- 18. (EL) Common Stock—Company S (90%) 45,000 Retained Earnings, January 1, 2016—Company S (90%) 76,500 Investment in Company S

- 19. 121,500 Entries (D) and (NCI) are exactly the same as they were on the 2015 worksheet. We are always adjusting the subsidiary accounts as of the acquisition date. It will be necessary to make this same entry every year until the markup caused by the purchase is fully amortized or the asset is sold. In entry form, entry (D)/(NCI) is as follows: Distribute excess of cost(patent): (D)/(NCI) Patent 30,000 Investment in Company S

- 20. 27,000 NCI (Retained Earnings—Company S) 3,000 Finally, entry (A) includes $3,000 per year amortization of the patent for 2015 and 2016. The expense for 2015 is charged to Company P retained earnings and the NCI in the 90%/10% ratio. The charge is made to both interests because the asset adjustment was made to both interests. In journal form, the entry is as follows: Amortize patent for current and prior year:

- 21. (A) Retained Earnings, January 1, 2016—Company P 2,700 NCI (Retained Earnings—Company S) 300 Patent Amortization Expense (for current year) 3,000

- 22. Patent 6,000 Note that the 2017 worksheet will include three total years of amortization, since the entries made in prior periods’ worksheets have not been recorded in either the parent’s or subsidiary’s books. Even in later years, when the patent is past its 10-year life, it will be necessary to use a revised entry (D), which would adjust all prior years’ amortizations to the patent as follows: Retained Earnings—Company P (10 years × $2,700) 27,000 NCI 3,000 Investment in Company S (the excess)

- 23. 30,000 Note that the original D&D schedule prepared on the date of acquisition becomes the foundation for all subsequent worksheets. Once prepared, the schedule is used without modification. REFLECTION Date alignment is needed before an investment can be eliminated. For an equity method investment, date alignment means removing current-year entries to return to the beginning-of-year investment balance. All amortizations of excess resulting from the consolidations process are adjusted to the subsidiary’s IDS. Many distributions of excess must be followed by amortizations that cover the current and prior years. The consolidated net income derived on a worksheet is allocated to the controlling and noncontrolling interests using an income distribution schedule. Each year’s consolidation procedures begin as if there had never been a previous consolidation. Effect of Cost Method on Consolidation OBJECTIVE 3 Complete a consolidated worksheet using the cost method for the parent’s investment account. Recall that parent companies often may choose to record their investments in a subsidiary under the cost method, whereby the investments are maintained at their original costs. Income from the investments is recorded only when dividends are declared by the subsidiary. The use of the cost method means that the

- 24. investment account does not reflect changes in subsidiary equity. Rather than develop a new set of procedures for the elimination of an investment under the cost method, the cost method investment will be converted to its simple equity balance at the beginning of the period to create date alignment. Then, the elimination procedures developed earlier can be applied. Exercise 3-1 PartialName of Company Being AcquiredHuran Company Carol Fischer: Insert Name of Company Being Acquired in this Cell. Name of Acquiring CompanyCardinal Company Carol Fischer: Insert the Name of the Acquiring Company in this cell. Date of AcquisitionJanuary 1, 2015 Carol Fischer: Insert the Date of Acquisition in this Cell. Current YearDate of AcquisitionTrial BalanceHuran CompanyCardinal CompanyHuran CompanyBookMarket Carol Fischer: Insert all market values even if they are the same as the fair values. LifeAssetsCash Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. InventoryCurrent Assets60,00060,000Investment in Subsidiary Land Carol Fischer: Row 16 is reserved for the Land Account. 100,000100,000Equipment

- 25. Carol Fischer: Reserved for a Depreciable Fixed Asset 350,000240,0005Accumulated Depreciation Carol Fischer: Reserved for Accumulated Depreciation (150,000)GoodwillTotal Assets360,000400,000LiabilitiesAccounts Payable Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. (60,000)(60,000) Carol Fischer: Rows 34, 35, and 36 are reserved for Long-Term Liabilities. Row 34 is for Bonds or Long-Term Notes Payable and Row 35 is for any premium or disount on the notes or bonds. Carol Fischer: Insert the Name of the Acquiring Company in this cell. Carol Fischer: Insert the Date of Acquisition in this Cell. Carol Fischer: Insert all market values even if they are the same as the fair values. Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Carol Fischer: Reserved for Accounts Receivable

- 26. Carol Fischer: Do Not insert an account in this cell. Carol Fischer: Row 16 is reserved for the Land Account. Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciaion. Carol Fischer: Reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Reserved for a Depreciable Fixed Asset. Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Rows 23 and, 24, are reserved for intangibles other than goodwill. This intangible may have differing book and market values. Carol Fischer: Reserved for an Intangible other than goodwill where book and market values are identical. Carol Fischer: This Cell should be left Blank

- 27. Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. Total Liabilities(60,000)(60,000)Equity Acquired CompanyCommon Stock(50,000)Paid-in Capital in Excess of Par(100,000)Retained Earnings(150,000)Equity Acquiring CompanyCommon StockPaid-in Capital in Excess of ParRetained EarningsTotal Equity(300,000)Total Liabilities and Equity(360,000)Net Assets at Market of Acquired Co.340,000Dividends Declared Acquired CompanyDividends Declared Acquiring CompanySalesCost of Goods SoldDepreciation Expense of-Equipment-Amortization Expense of---Other ExpensesInterest ExpenseSubsidiary IncomeTotalBalancesBalancesBalancesPurchase PriceCash420,000Number of shares exchangedPar value of a share of stockMarket value of a share of stockMarket value of stock exchanged-Total purchase price420,000Ownership Interest enter as .7 for 70%0.80Goodwill Applicable to NCIImplied Value of NCI Interest105,000.00Estimated Value of NCI interest if not the implied proportional amount--Enter amount or 0- 0Method of Accounting for Investment--Enter Capital C for Cost or Capital E for EquityEYears since Acquisition- 0Value AnalysisCompany Fair ValueParent PriceNCI ValueCompany Fair Value525,000420,000105,000Fair Value of Net Assets Excluding Goodwill340,000272,00068,000Goodwill185,000148,00037,000 Gain on Acquisition-Determination and Distribution of Excess ScheduleImplied Company ValueParent PriceNCI ValueFair Value of Company525,000420,000105,000Less Book Value of Interest AcquiredCommon Stock(50,000)Paid-in Capital in Excess of Par(100,000)Retained Earnings(150,000)Total Equity(300,000)Interest Acquired0.800.20Book Value(240,000)(60,000)Excess of Fair Value over Book Value180,00045,000Elimination EntryKeyCommon Stock40,000ELPaid-in Capital in Excess of Par80,000ELRetained Earnings120,000ELInvestment in Subsidiary(240,000.00)ELAdjustment to Identifiable

- 28. AccountsDebit (Credit)KeyLifeInventory-D-Current Assets-D- Land-D--D-Equipment40,000D5--D---D---D- Goodwill185,000D---D---D---D-Investment in Subsidiary (180,000)DGain Taken to Acquiring Co. RE/Income- 0DAcquired Company RE(45,000)DCheck-Amortization ScheduleAccount AdjustmentAnnual AmountCurrent YearPrior YearsTotalInventory---Equipment8,0008,000-8000----------- Total8,000-8000Amortization EntryDebit (Credit)KeyCost of Goods SoldADepreciation Expense ofA-AEquipment8,000A- AAmortization Expense ofA-A-AInterest ExpenseAAcquired Company RE(1,600)AAcquiring Company RE(6,400)AInventory-A--AAccumulated Depreciation-A--A--A- -A--A--ATotal-Method Adjustment ScheduleDebit (Credit)KeyIs Adjustment Necessary?NOAdjustment to Investment Account-CVAdjustment to Retained Earnings Account-CVDate Alignment ScheduleDebit (Credit)KeyAdjustment to Subsidiary Income Account- CYAdjustment to Subsidiary Dividend Account-CYAdjustment to Investment Account under Equity Method -CYConsolidated WorksheetTrial BalanceEliminationsCardinal CompanyHuran CompanyKeyDebitCreditKeyConsolidated Net IncomeNon Control InterestControlling Retained EarningsConsolidated Balance SheetCash-------Inventory---Current Assets--D00D------ ---Investment in Subsidiary -- (120000)EL(300,000)D0(180000)DCV00CVCY00CYLand-- 00D----D00D----A00A-Equipment-- D400000D40,000Accumulated Depreciation--A00A----D00D---- A00A----D00D-A00A---D00D-A00A----Goodwill-- D1850000D185,000Accounts Payable--------------D00D---- D00D-A00A---D00D-A00ACommon Stock-- EL40,00040,000Paid-in Capital in Excess of Par-- EL80,00080,000Retained Earnings--EL-(45000)D(46,600)A- (1600)ACommon Stock---Paid-in Capital in Excess of Par--- Retained Earnings--0D(6,400)A0(6400)ACV-0CVDividends Declared Acquired Company---CY-Dividends Declared Acquiring Company---Sales---Cost of Goods Sold--A-A-

- 29. Depreciation Expense of------A-A-Equipment--A8,000-A8,000-- -A-A-Amortization Expense of------A-A----A-A-----Other Expenses---Interest Expense--A-A-Subsidiary Income-- CY00CY-Gain on Acquisition of Business0D- TotalBalancesBalances353000(353000)8,000NCI Share(1,600)1,600Controlling Share(6,400)6,400NCI75,00075,000Controlling Retained Earnings--(0)Income Distribution SchedulesHuran CompanyInternally Generated Net (Income) or Loss-Current Year Amortizations8,000Adjusted (Income) or Loss8,000NCI Share(1,600)Controlling Share6,400Cardinal CompanyInternally Generated Net Income-Gain on Acquisitin of Business- Controlling Share of Subsidiary6,400Total6,400 Exercise 3-2 Partial Name of Company Being AcquiredShaw Company Carol Fischer: Insert Name of Company Being Acquired in this Cell. Name of Acquiring CompanyMast Corporation Carol Fischer: Insert the Name of the Acquiring Company in this cell. Date of AcquisitionJanuary 1, 2014 Carol Fischer: Insert the Date of Acquisition in this Cell. Current YearDate of AcquisitionTrial BalanceShaw CompanyMast CorporationShaw CompanyBookMarket Carol Fischer: Insert all market values even if they are the same as the fair values. LifeAssetsCash Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Inventory40,00050,0001Current Assets80,00080,000Investment

- 30. in Subsidiary Land Carol Fischer: Row 16 is reserved for the Land Account. 100,000100,000Buildings and Equipment Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset 200,000300,00020Accumulated Depreciation Carol Fischer: Reserved for Accumulated Depreciaion. -Patent Carol Fischer: Rows 23 and, 24, are reserved for intangibles other than goodwill. This intangible may have differing book and market values. 30,00050,00010GoodwillTotal Assets450,000580,000LiabilitiesCurrent Liabilities Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. (50,000)(50,000) Carol Fischer: Rows 34, 35, and 36 are reserved for Long-Term Liabilities. Row 34 is for Bonds or Long-Term Notes Payable and Row 35 is for any premium or disount on the notes or bonds. Carol Fischer: Insert the Name of the Acquiring Company in this cell. Carol Fischer: Insert the Date of Acquisition in this Cell. Carol Fischer: Insert all market values even if they are the

- 31. same as the fair values. Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Carol Fischer: Reserved for Accounts Receivable Carol Fischer: Do Not insert an account in this cell. Carol Fischer: Row 16 is reserved for the Land Account. Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciaion. Carol Fischer: Reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Reserved for a Depreciable Fixed Asset. Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Rows 23 and, 24, are reserved for intangibles

- 32. other than goodwill. This intangible may have differing book and market values. Carol Fischer: Reserved for an Intangible other than goodwill where book and market values are identical. Carol Fischer: This Cell should be left Blank Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. Total Liabilities(50,000)(50,000)Equity Acquired CompanyCommon Stock(50,000)Paid-in Capital in Excess of Par(150,000)Retained Earnings(200,000)Equity Acquiring CompanyCommon StockPaid-in Capital in Excess of ParRetained EarningsTotal Equity(400,000)Total Liabilities and Equity(450,000)Net Assets at Market of Acquired Co.530,000Dividends Declared Acquired CompanyDividends Declared Acquiring CompanySalesCost of Goods SoldDepreciation Expense ofBuildings and Equipment-- Amortization Expense ofPatent--Other ExpensesInterest ExpenseSubsidiary IncomeTotalBalancesBalancesBalancesPurchase PriceCash462,500Number of shares exchangedPar value of a share of stockMarket value of a share of stockMarket value of stock exchanged-Total purchase price462,500Ownership Interest enter as .7 for 70%0.75Goodwill Applicable to NCIImplied Value of NCI Interest154,166.67Estimated Value of NCI interest if not the implied proportional amount--Enter amount or 0- 0Method of Accounting for Investment--Enter Capital C for Cost or Capital E for EquityEYears since Acquisition- 0Value AnalysisCompany Fair ValueParent PriceNCI ValueCompany Fair Value616,667462,500154,167Fair Value of Net Assets Excluding

- 33. Goodwill530,000397,500132,500Goodwill86,66765,00021,667G ain on Acquisition-Determination and Distribution of Excess ScheduleImplied Company ValueParent PriceNCI ValueFair Value of Company616,667462,500154,167Less Book Value of Interest AcquiredCommon Stock(50,000)Paid-in Capital in Excess of Par(150,000)Retained Earnings(200,000)Total Equity(400,000)Interest Acquired0.750.25Book Value(300,000)(100,000)Excess of Fair Value over Book Value162,50054,167Elimination EntryKeyCommon Stock37,500ELPaid-in Capital in Excess of Par112,500ELRetained Earnings150,000ELInvestment in Subsidiary(300,000.00)ELAdjustment to Identifiable AccountsDebit (Credit)KeyLifeInventory10,000D1Current Assets-D-Land-DBuildings and Equipment100,000D20--D---D- Patent20,000D10--D-Goodwill86,667D---D---D---D-Investment in Subsidiary (162,500)DGain Taken to Acquiring Co. RE/Income- 0DAcquired Company RE(54,167)DCheck- Amortization ScheduleAccount AdjustmentAnnual AmountCurrent YearPrior YearsTotalInventory10,00010,000- 10000-Buildings and Equipment5,0005,000-5000----- Patent2,0002,000-2000-------Total17,000-17000Amortization EntryDebit (Credit)KeyCost of Goods Sold10,000ADepreciation Expense ofABuildings and Equipment5,000A-A-AAmortization Expense ofAPatent2,000A-AInterest ExpenseAAcquired Company RE(4,250)AAcquiring Company RE(12,750)AInventory-AAccumulated Depreciation-A--A-- APatent-A--A--A--ATotal-Method Adjustment ScheduleDebit (Credit)KeyIs Adjustment Necessary?NOAdjustment to Investment Account-CVAdjustment to Retained Earnings Account-CVDate Alignment ScheduleDebit (Credit)KeyAdjustment to Subsidiary Income Account- CYAdjustment to Subsidiary Dividend Account-CYAdjustment to Investment Account under Equity Method -CYConsolidated WorksheetTrial BalanceEliminationsMast CorporationShaw CompanyKeyDebitCreditKeyConsolidated Net IncomeNon Control InterestControlling Retained EarningsConsolidated

- 34. Balance SheetCash-------Inventory---Current Assets--D00D------ ---Investment in Subsidiary -- (150000)EL(312,500)D0(162500)DCV00CVCY00CYLand-- 00D-Buildings and Equipment-- D1000000D100,000Accumulated Depreciation--A00A----D00D- ---A00A----D00D----A00A-Patent--D200000D20,000A00A--- D00D-A00A----Goodwill-- D86666.66666666660D86,667Current Liabilities-------------- D00D----D00D-A00A---D00D-A00ACommon Stock-- EL37,50037,500Paid-in Capital in Excess of Par-- EL112,500112,500Retained Earnings--EL-(54167)D(58,417)A- (4250)ACommon Stock---Paid-in Capital in Excess of Par--- Retained Earnings--0D(12,750)A0(12750)ACV-0CVDividends Declared Acquired Company---CY-Dividends Declared Acquiring Company---Sales---Cost of Goods Sold--A10,000- A10,000Depreciation Expense of---Buildings and Equipment-- A5,000-A5,000---A-A----A-A-Amortization Expense of--- Patent--A2,000-A2,000---A-A-----Other Expenses---Interest Expense--A-A-Subsidiary Income--CY00CY-Gain on Acquisition of Business0D- TotalBalancesBalances373666.666666667(383667)17,000NCI Share(4,250)4,250Controlling Share(12,750)12,750NCI95,83395,833Controlling Retained Earnings--(10,000)Income Distribution SchedulesShaw CompanyInternally Generated Net (Income) or Loss-Current Year Amortizations17,000Adjusted (Income) or Loss17,000NCI Share(4,250)Controlling Share12,750Mast CorporationInternally Generated Net Income-Gain on Acquisitin of Business-Controlling Share of Subsidiary12,750Total12,750 Exercise 3-3 Partial Name of Company Being AcquiredSargent Company Carol Fischer: Insert Name of Company Being Acquired in this Cell. Name of Acquiring CompanyParker Company

- 35. Carol Fischer: Insert the Name of the Acquiring Company in this cell. Date of AcquisitionJanuary 1, 2015 Carol Fischer: Insert the Date of Acquisition in this Cell. Current YearDate of AcquisitionTrial BalanceSargent CompanyParker CompanySargent CompanyBookMarket Carol Fischer: Insert all market values even if they are the same as the fair values. LifeAssetsCash Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. InventoryCurrent Assets100,000100,00010,000130,000Investment in Subsidiary 316,000Depreciable Fixed Assets Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset 200,000250,00010400,000200,000Accumulated Depreciation Carol Fischer: Reserved for Accumulated Depreciaion. -(106,000)(20,000)GoodwillTotal Assets300,000350,000LiabilitiesCurrent Liabilities Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. (50,000)(50,000)(60,000)(40,000) Carol Fischer: Rows 34, 35, and 36 are reserved for Long-Term Liabilities. Row 34 is for Bonds or Long-Term Notes Payable and Row 35 is for any premium or disount on the notes or bonds.

- 36. Carol Fischer: Insert the Name of the Acquiring Company in this cell. Carol Fischer: Insert the Date of Acquisition in this Cell. Carol Fischer: Insert all market values even if they are the same as the fair values. Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Carol Fischer: Reserved for Accounts Receivable Carol Fischer: Do Not insert an account in this cell. Carol Fischer: Row 16 is reserved for the Land Account. Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciaion. Carol Fischer: Reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciation

- 37. Carol Fischer: Reserved for a Depreciable Fixed Asset. Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Rows 23 and, 24, are reserved for intangibles other than goodwill. This intangible may have differing book and market values. Carol Fischer: Reserved for an Intangible other than goodwill where book and market values are identical. Carol Fischer: This Cell should be left Blank Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. Total Liabilities(50,000)(50,000)Equity Acquired CompanyCommon Stock(100,000)(100,000)Paid-in Capital in Excess of ParRetained Earnings(150,000)(150,000)Equity Acquiring CompanyCommon Stock(300,000)Paid-in Capital in Excess of ParRetained Earnings(200,000)Total Equity(250,000)Total Liabilities and Equity(300,000)Net Assets at Market of Acquired Co.300,000Dividends Declared Acquired Company5,000Dividends Declared Acquiring CompanySales(150,000)(100,000)Cost of Goods SoldDepreciation Expense ofDepreciable Fixed Assets-- Amortization Expense of---Other Expenses110,00075,000Interest ExpenseSubsidiary Income(20,000)TotalBalancesBalancesBalancesPurchase PriceCash300,000Number of shares exchangedPar value of a

- 38. share of stockMarket value of a share of stockMarket value of stock exchanged-Total purchase price300,000Ownership Interest enter as .7 for 70%0.80Goodwill Applicable to NCIImplied Value of NCI Interest75,000.00Estimated Value of NCI interest if not the implied proportional amount--Enter amount or 0- 0Method of Accounting for Investment--Enter Capital C for Cost or Capital E for EquityEYears since Acquisition1.00Value AnalysisCompany Fair ValueParent PriceNCI ValueCompany Fair Value375,000300,00075,000Fair Value of Net Assets Excluding Goodwill300,000240,00060,000Goodwill75,00060,00015,000Ga in on Acquisition-Determination and Distribution of Excess ScheduleImplied Company ValueParent PriceNCI ValueFair Value of Company375,000300,00075,000Less Book Value of Interest AcquiredCommon Stock(100,000)Paid-in Capital in Excess of Par-Retained Earnings(150,000)Total Equity(250,000)Interest Acquired0.800.20Book Value(200,000)(50,000)Excess of Fair Value over Book Value100,00025,000Elimination EntryKeyCommon Stock80,000ELPaid-in Capital in Excess of Par-ELRetained Earnings120,000ELInvestment in Subsidiary(200,000.00)ELAdjustment to Identifiable AccountsDebit (Credit)KeyLifeInventory-D-Current Assets-D--- DDepreciable Fixed Assets50,000D10--D---D---D---D- Goodwill75,000D---D---D---D-Investment in Subsidiary (100,000)DGain Taken to Acquiring Co. RE/Income- 0DAcquired Company RE(25,000)DCheck-Amortization ScheduleAccount AdjustmentAnnual AmountCurrent YearPrior YearsTotalInventory-Depreciable Fixed Assets5,0005,00005,000------------Total5,0000Amortization EntryDebit (Credit)KeyCost of Goods SoldADepreciation Expense ofADepreciable Fixed Assets5,000A-A-AAmortization Expense ofA-A-AInterest ExpenseAAcquired Company RE- AAcquiring Company RE-AInventory-AAccumulated Depreciation(5,000)A--A--A--A--A--A--ATotal-Method Adjustment ScheduleDebit (Credit)KeyIs Adjustment

- 39. Necessary?NOAdjustment to Investment Account- CVAdjustment to Retained Earnings Account-CVDate Alignment ScheduleDebit (Credit)KeyAdjustment to Subsidiary Income Account20,000CYAdjustment to Subsidiary Dividend Account(4,000)CYAdjustment to Investment Account under Equity Method (16,000)CYConsolidated WorksheetTrial BalanceEliminationsParker CompanySargent CompanyKeyDebitCreditKeyConsolidated Net IncomeNon Control InterestControlling Retained EarningsConsolidated Balance SheetCash-------Inventory---Current Assets10,000130,000D00D140,000--------Investment in Subsidiary 316,000-(200000)EL- D0(100000)DCV00CVCY0(16000)CY---00D-Depreciable Fixed Assets400,000200,000D500000D650,000Accumulated Depreciation(106,000)(20,000)A0(5000)A(131,000)---D00D---- A00A----D00D----A00A----D00D-A00A---D00D-A00A---- Goodwill--D750000D75,000Current Liabilities(60,000)(40,000)(100,000)-----------D00D----D00D- A00A---D00D-A00ACommon Stock- (100,000)EL80,000(20,000)Paid-in Capital in Excess of Par-- EL--Retained Earnings- (150,000)EL120,000(25000)D(55,000)A-0ACommon Stock(300,000)-(300,000)Paid-in Capital in Excess of Par--- Retained Earnings(200,000)-0D(200,000)A00ACV- 0CVDividends Declared Acquired Company- 5,000(4,000)CY1,000Dividends Declared Acquiring Company--- Sales(150,000)(100,000)(250,000)Cost of Goods Sold--A-A- Depreciation Expense of---Depreciable Fixed Assets--A5,000- A5,000---A-A----A-A-Amortization Expense of------A-A----A- A-----Other Expenses110,00075,000185,000Interest Expense-- A-A-Subsidiary Income(20,000)-CY200000CY-Gain on Acquisition of Business0D- TotalBalancesBalances350000(350000)(60,000)NCI Share4,000(4,000)Controlling Share56,000(56,000)NCI(78,000)(78,000)Controlling Retained Earnings(256,000)(256,000)BalancesIncome Distribution

- 40. SchedulesSargent CompanyInternally Generated Net (Income) or Loss(25,000)Current Year Amortizations5,000Adjusted (Income) or Loss(20,000)NCI Share4,000Controlling Share(16,000)Parker CompanyInternally Generated Net Income(40,000)Gain on Acquisitin of Business-Controlling Share of Subsidiary(16,000)Total(56,000) Exercise 3-4 Partial Name of Company Being AcquiredSargemt Company Carol Fischer: Insert Name of Company Being Acquired in this Cell. Name of Acquiring CompanyParker Company Carol Fischer: Insert the Name of the Acquiring Company in this cell. Date of AcquisitionJanuary 1, 2015 Carol Fischer: Insert the Date of Acquisition in this Cell. Current YearDate of AcquisitionTrial BalanceSargemt CompanyParker CompanySargemt CompanyBookMarket Carol Fischer: Insert all market values even if they are the same as the fair values. LifeAssetsCash Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. InventoryCurrent Assets100,000100,000102,000115,000Investment in Subsidiary 320,000Depreciable Fixed Asset Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset 200,000250,00010400,000200,000Accumulated Depreciation

- 41. Carol Fischer: Reserved for Accumulated Depreciaion. -(130,000)(40,000)GoodwillTotal Assets300,000350,000LiabilitiesCurrent Liabilities Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. (50,000)(50,000)(80,000) Carol Fischer: Rows 34, 35, and 36 are reserved for Long-Term Liabilities. Row 34 is for Bonds or Long-Term Notes Payable and Row 35 is for any premium or disount on the notes or bonds. Carol Fischer: Insert the Name of the Acquiring Company in this cell. Carol Fischer: Insert the Date of Acquisition in this Cell. Carol Fischer: Insert all market values even if they are the same as the fair values. Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Carol Fischer: Reserved for Accounts Receivable Carol Fischer: Do Not insert an account in this cell. Carol Fischer: Row 16 is reserved for the Land Account.

- 42. Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciaion. Carol Fischer: Reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Reserved for a Depreciable Fixed Asset. Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Rows 23 and, 24, are reserved for intangibles other than goodwill. This intangible may have differing book and market values. Carol Fischer: Reserved for an Intangible other than goodwill where book and market values are identical. Carol Fischer: This Cell should be left Blank Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. Total Liabilities(50,000)(50,000)Equity Acquired

- 43. CompanyCommon Stock(100,000)(100,000)Paid-in Capital in Excess of ParRetained Earnings(150,000)(170,000)Equity Acquiring CompanyCommon Stock(300,000)Paid-in Capital in Excess of ParRetained Earnings(260,000)Total Equity(250,000)Total Liabilities and Equity(300,000)Net Assets at Market of Acquired Co.300,000Dividends Declared Acquired Company10,000Dividends Declared Acquiring CompanySales(200,000)(100,000)Cost of Goods SoldDepreciation Expense ofDepreciable Fixed Asset-- Amortization Expense of---Other Expenses160,00085,000Interest ExpenseSubsidiary Income(12,000)TotalBalancesBalancesBalancesPurchase PriceCash300,000Number of shares exchangedPar value of a share of stockMarket value of a share of stockMarket value of stock exchanged-Total purchase price300,000Ownership Interest enter as .7 for 70%0.80Goodwill Applicable to NCIImplied Value of NCI Interest75,000.00Estimated Value of NCI interest if not the implied proportional amount--Enter amount or 0- 0Method of Accounting for Investment--Enter Capital C for Cost or Capital E for EquityEYears since Acquisition2.00Value AnalysisCompany Fair ValueParent PriceNCI ValueCompany Fair Value375,000300,00075,000Fair Value of Net Assets Excluding Goodwill300,000240,00060,000Goodwill75,00060,00015,000Ga in on Acquisition-Determination and Distribution of Excess ScheduleImplied Company ValueParent PriceNCI ValueFair Value of Company375,000300,00075,000Less Book Value of Interest AcquiredCommon Stock(100,000)Paid-in Capital in Excess of Par-Retained Earnings(150,000)Total Equity(250,000)Interest Acquired0.800.20Book Value(200,000)(50,000)Excess of Fair Value over Book Value100,00025,000Elimination EntryKeyCommon Stock80,000ELPaid-in Capital in Excess of Par-ELRetained Earnings120,000ELInvestment in Subsidiary(200,000.00)ELAdjustment to Identifiable AccountsDebit (Credit)KeyLifeInventory-D-Current Assets-D---

- 44. DDepreciable Fixed Asset50,000D10--D---D---D---D- Goodwill75,000D---D---D---D-Investment in Subsidiary (100,000)DGain Taken to Acquiring Co. RE/Income- 0DAcquired Company RE(25,000)DCheck-Amortization ScheduleAccount AdjustmentAnnual AmountCurrent YearPrior YearsTotalInventory-Depreciable Fixed Asset5,0005,000500010,000------------ Total5,0005000Amortization EntryDebit (Credit)KeyCost of Goods SoldADepreciation Expense ofADepreciable Fixed Asset5,000A-A-AAmortization Expense ofA-A-AInterest ExpenseAAcquired Company RE1,000AAcquiring Company RE4,000AInventory-AAccumulated Depreciation(10,000)A--A-- A--A--A--A--ATotal-Method Adjustment ScheduleDebit (Credit)KeyIs Adjustment Necessary?NOAdjustment to Investment Account-CVAdjustment to Retained Earnings Account-CVDate Alignment ScheduleDebit (Credit)KeyAdjustment to Subsidiary Income Account12,000CYAdjustment to Subsidiary Dividend Account(8,000)CYAdjustment to Investment Account under Equity Method (4,000)CYConsolidated WorksheetTrial BalanceEliminationsParker CompanySargemt CompanyKeyDebitCreditKeyConsolidated Net IncomeNon Control InterestControlling Retained EarningsConsolidated Balance SheetCash-------Inventory---Current Assets102,000115,000D00D217,000--------Investment in Subsidiary 320,000-(216000)EL- (100000)DCV00CVCY0(4000)CY---00D-Depreciable Fixed Asset400,000200,000D500000D650,000Accumulated Depreciation(130,000)(40,000)A0(10000)A(180,000)---D00D--- -A00A----D00D----A00A----D00D-A00A---D00D-A00A---- Goodwill--D750000D75,000Current Liabilities(80,000)- (80,000)-----------D00D----D00D-A00A---D00D-A00ACommon Stock-(100,000)EL80,000(20,000)Paid-in Capital in Excess of Par--EL--Retained Earnings- (170,000)EL136,000(25000)D(58,000)A1,0000ACommon Stock(300,000)-(300,000)Paid-in Capital in Excess of Par---

- 45. Retained Earnings(260,000)-0D(256,000)A4,0000ACV- 0CVDividends Declared Acquired Company- 10,000(8,000)CY2,000Dividends Declared Acquiring Company- --Sales(200,000)(100,000)(300,000)Cost of Goods Sold--A-A- Depreciation Expense of---Depreciable Fixed Asset--A5,000- A5,000---A-A----A-A-Amortization Expense of------A-A----A- A-----Other Expenses160,00085,000245,000Interest Expense-- A-A-Subsidiary Income(12,000)-CY120000CY-Gain on Acquisition of Business0D- TotalBalancesBalances363000(363000)(50,000)NCI Share2,000(2,000)Controlling Share48,000(48,000)NCI(78,000)(78,000)Controlling Retained Earnings(304,000)(304,000)BalancesIncome Distribution SchedulesSargemt CompanyInternally Generated Net (Income) or Loss(15,000)Current Year Amortizations5,000Adjusted (Income) or Loss(10,000)NCI Share2,000Controlling Share(8,000)Parker CompanyInternally Generated Net Income(40,000)Gain on Acquisitin of Business-Controlling Share of Subsidiary(8,000)Total(48,000) Exercise 3-5 Partial Name of Company Being AcquiredSargent Company Carol Fischer: Insert Name of Company Being Acquired in this Cell. Name of Acquiring CompanyParker Company Carol Fischer: Insert the Name of the Acquiring Company in this cell. Date of AcquisitionJanuary 1, 2015 Carol Fischer: Insert the Date of Acquisition in this Cell. Current YearDate of AcquisitionTrial BalanceSargent CompanyParker CompanySargent CompanyBookMarket Carol Fischer: Insert all market values even if they are the same as the fair values.

- 46. LifeAssetsCash Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. InventoryCurrent Assets100,000100,00010,000130,000Investment in Subsidiary 312,000Depreciable Fixed Assets Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset 200,000250,00010400,000200,000Accumulated Depreciation Carol Fischer: Reserved for Accumulated Depreciaion. -(106,000)(20,000)GoodwillTotal Assets300,000350,000LiabilitiesCurrent Liabilities Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. (50,000)(50,000)(60,000)(40,000) Carol Fischer: Rows 34, 35, and 36 are reserved for Long-Term Liabilities. Row 34 is for Bonds or Long-Term Notes Payable and Row 35 is for any premium or disount on the notes or bonds. Carol Fischer: Insert the Name of the Acquiring Company in this cell. Carol Fischer: Insert the Date of Acquisition in this Cell. Carol Fischer: Insert all market values even if they are the same as the fair values.

- 47. Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Carol Fischer: Reserved for Accounts Receivable Carol Fischer: Do Not insert an account in this cell. Carol Fischer: Row 16 is reserved for the Land Account. Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciaion. Carol Fischer: Reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Reserved for a Depreciable Fixed Asset. Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Rows 23 and, 24, are reserved for intangibles other than goodwill. This intangible may have differing book

- 48. and market values. Carol Fischer: Reserved for an Intangible other than goodwill where book and market values are identical. Carol Fischer: This Cell should be left Blank Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. Total Liabilities(50,000)(50,000)Equity Acquired CompanyCommon Stock(100,000)(100,000)Paid-in Capital in Excess of ParRetained Earnings(150,000)(150,000)Equity Acquiring CompanyCommon Stock(300,000)Paid-in Capital in Excess of ParRetained Earnings(200,000)Total Equity(250,000)Total Liabilities and Equity(300,000)Net Assets at Market of Acquired Co.300,000Dividends Declared Acquired Company5,000Dividends Declared Acquiring CompanySales(150,000)(100,000)Cost of Goods SoldDepreciation Expense ofDepreciable Fixed Assets-- Amortization Expense of---Other Expenses110,00075,000Interest ExpenseSubsidiary Income(16,000)TotalBalancesBalancesBalancesPurchase PriceCash300,000Number of shares exchangedPar value of a share of stockMarket value of a share of stockMarket value of stock exchanged-Total purchase price300,000Ownership Interest enter as .7 for 70%0.80Goodwill Applicable to NCIImplied Value of NCI Interest75,000.00Estimated Value of NCI interest if not the implied proportional amount--Enter amount or 0- 0Method of Accounting for Investment--Enter Capital C for Cost or Capital E for EquityEYears since Acquisition1.00Value AnalysisCompany Fair ValueParent PriceNCI ValueCompany Fair Value375,000300,00075,000Fair Value of Net Assets Excluding

- 49. Goodwill300,000240,00060,000Goodwill75,00060,00015,000Ga in on Acquisition-Determination and Distribution of Excess ScheduleImplied Company ValueParent PriceNCI ValueFair Value of Company375,000300,00075,000Less Book Value of Interest AcquiredCommon Stock(100,000)Paid-in Capital in Excess of Par-Retained Earnings(150,000)Total Equity(250,000)Interest Acquired0.800.20Book Value(200,000)(50,000)Excess of Fair Value over Book Value100,00025,000Elimination EntryKeyCommon Stock80,000ELPaid-in Capital in Excess of Par-ELRetained Earnings120,000ELInvestment in Subsidiary(200,000.00)ELAdjustment to Identifiable AccountsDebit (Credit)KeyLifeInventory-D-Current Assets-D--- DDepreciable Fixed Assets50,000D10--D---D---D---D- Goodwill75,000D---D---D---D-Investment in Subsidiary (100,000)DGain Taken to Acquiring Co. RE/Income- 0DAcquired Company RE(25,000)DCheck-Amortization ScheduleAccount AdjustmentAnnual AmountCurrent YearPrior YearsTotalInventory-Depreciable Fixed Assets5,0005,00005,000------------Total5,0000Amortization EntryDebit (Credit)KeyCost of Goods SoldADepreciation Expense ofADepreciable Fixed Assets5,000A-A-AAmortization Expense ofA-A-AInterest ExpenseAAcquired Company RE- AAcquiring Company RE-AInventory-AAccumulated Depreciation(5,000)A--A--A--A--A--A--ATotal-Method Adjustment ScheduleDebit (Credit)KeyIs Adjustment Necessary?NOAdjustment to Investment Account- CVAdjustment to Retained Earnings Account-CVDate Alignment ScheduleDebit (Credit)KeyAdjustment to Subsidiary Income Account16,000CYAdjustment to Subsidiary Dividend Account(4,000)CYAdjustment to Investment Account under Equity Method (12,000)CYConsolidated WorksheetTrial BalanceEliminationsParker CompanySargent CompanyKeyDebitCreditKeyConsolidated Net IncomeNon Control InterestControlling Retained EarningsConsolidated Balance SheetCash-------Inventory---Current

- 50. Assets10,000130,000D00D140,000--------Investment in Subsidiary 312,000-(200000)EL- D0(100000)DCV00CVCY0(12000)CY---00D-Depreciable Fixed Assets400,000200,000D500000D650,000Accumulated Depreciation(106,000)(20,000)A0(5000)A(131,000)---D00D---- A00A----D00D----A00A----D00D-A00A---D00D-A00A---- Goodwill--D750000D75,000Current Liabilities(60,000)(40,000)(100,000)-----------D00D----D00D- A00A---D00D-A00ACommon Stock- (100,000)EL80,000(20,000)Paid-in Capital in Excess of Par-- EL--Retained Earnings- (150,000)EL120,000(25000)D(55,000)A-0ACommon Stock(300,000)-(300,000)Paid-in Capital in Excess of Par--- Retained Earnings(200,000)-0D(200,000)A00ACV- 0CVDividends Declared Acquired Company- 5,000(4,000)CY1,000Dividends Declared Acquiring Company--- Sales(150,000)(100,000)(250,000)Cost of Goods Sold--A-A- Depreciation Expense of---Depreciable Fixed Assets--A5,000- A5,000---A-A----A-A-Amortization Expense of------A-A----A- A-----Other Expenses110,00075,000185,000Interest Expense-- A-A-Subsidiary Income(16,000)-CY160000CY-Gain on Acquisition of Business0D- TotalBalancesBalances346000(346000)(60,000)NCI Share4,000(4,000)Controlling Share56,000(56,000)NCI(78,000)(78,000)Controlling Retained Earnings(256,000)(256,000)BalancesIncome Distribution SchedulesSargent CompanyInternally Generated Net (Income) or Loss(25,000)Current Year Amortizations5,000Adjusted (Income) or Loss(20,000)NCI Share4,000Controlling Share(16,000)Parker CompanyInternally Generated Net Income(40,000)Gain on Acquisitin of Business-Controlling Share of Subsidiary(16,000)Total(56,000) Problem 3-2 Name of Company Being AcquiredSolar Company Carol Fischer: Insert Name of Company Being Acquired in this Cell.

- 51. Name of Acquiring CompanyParo Company Carol Fischer: Insert the Name of the Acquiring Company in this cell. Date of AcquisitionJanuary 1, 2015 Carol Fischer: Insert the Date of Acquisition in this Cell. Current YearDate of AcquisitionTrial BalanceSolar CompanyParo CompanySolar CompanyBookMarket Carol Fischer: Insert all market values even if they are the same as the fair values. LifeAssetsCash Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Inventory100,000Current Assets50,000Investment in Subsidiary Land Carol Fischer: Row 16 is reserved for the Land Account. Buildings and Equipment Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset 150,000Accumulated Depreciation Carol Fischer: Reserved for Accumulated Depreciaion. Other Intangibles Carol Fischer: Rows 23 and, 24, are reserved for intangibles other than goodwill. This intangible may have differing book and market values. GoodwillTotal Assets300,000-LiabilitiesCurrent Liabilities Carol Fischer: Rows 31, 32, and 33 are reserved for Current

- 52. Liabilities. Bonds Payable Carol Fischer: Rows 34, 35, and 36 are reserved for Long-Term Liabilities. Row 34 is for Bonds or Long-Term Notes Payable and Row 35 is for any premium or disount on the notes or bonds. Carol Fischer: Insert the Name of the Acquiring Company in this cell. Carol Fischer: Insert the Date of Acquisition in this Cell. Carol Fischer: Insert all market values even if they are the same as the fair values. Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Carol Fischer: Reserved for Accounts Receivable Carol Fischer: Do Not insert an account in this cell. Carol Fischer: Row 16 is reserved for the Land Account. Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset

- 53. Carol Fischer: Reserved for Accumulated Depreciaion. Carol Fischer: Reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Reserved for a Depreciable Fixed Asset. Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Rows 23 and, 24, are reserved for intangibles other than goodwill. This intangible may have differing book and market values. Carol Fischer: Reserved for an Intangible other than goodwill where book and market values are identical. Carol Fischer: This Cell should be left Blank Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. Other Long-Term LiabilitiesTotal Liabilities-Equity Acquired CompanyCommon StockPaid-in Capital in Excess of ParRetained EarningsEquity Acquiring CompanyCommon StockPaid-in Capital in Excess of ParRetained EarningsTotal Equity-Total Liabilities and Equity-Net Assets at Market of Acquired Co.-Dividends Declared Acquired CompanyDividends

- 54. Declared Acquiring CompanySalesCost of Goods SoldDepreciation Expense ofBuildings and Equipment-- Amortization Expense ofOther Intangibles--Other ExpensesInterest ExpenseSubsidiary IncomeTotal300,000BalancesBalancesPurchase PriceCashNumber of shares exchangedPar value of a share of stockMarket value of a share of stockMarket value of stock exchanged-Total purchase price-Ownership Interest enter as .7 for 70%Goodwill Applicable to NCIImplied Value of NCI InterestERROR:#DIV/0!Estimated Value of NCI interest if not the implied proportional amount--Enter amount or 0- 0Method of Accounting for Investment--Enter Capital C for Cost or Capital E for EquityEYears since AcquisitionValue AnalysisCompany Fair ValueParent PriceNCI ValueCompany Fair ValueERROR:#DIV/0!-ERROR:#DIV/0!Fair Value of Net Assets Excluding Goodwill---GoodwillERROR:#DIV/0!- ERROR:#DIV/0!Gain on AcquisitionERROR:#DIV/0!Determination and Distribution of Excess ScheduleImplied Company ValueParent PriceNCI ValueFair Value of CompanyERROR:#DIV/0!- ERROR:#DIV/0!Less Book Value of Interest AcquiredCommon Stock-Paid-in Capital in Excess of Par-Retained Earnings-Total Equity-Interest Acquired- 01.00Book Value0-Excess of Fair Value over Book Value-ERROR:#DIV/0!Elimination EntryKeyCommon Stock-ELPaid-in Capital in Excess of Par- ELRetained Earnings-ELInvestment in Subsidiary- 0ELAdjustment to Identifiable AccountsDebit (Credit)KeyLifeInventory(100,000)D-Current Assets(50,000)D- Land-DBuildings and Equipment(150,000)D---D---D-Other Intangibles-D---D-GoodwillERROR:#DIV/0!D-Bonds Payable- D---D-Other Long-Term Liabilities-D-Investment in Subsidiary -DGain Taken to Acquiring Co. RE/IncomeERROR:#DIV/0!DAcquired Company REERROR:#DIV/0!DCheckERROR:#DIV/0!Amortization ScheduleAccount AdjustmentAnnual AmountCurrent YearPrior YearsTotalInventory-Buildings and Equipment-----Other

- 55. Intangibles-----Other Long-Term Liabilities- Total00Amortization EntryDebit (Credit)KeyCost of Goods SoldADepreciation Expense ofABuildings and EquipmentA-A- AAmortization Expense ofAOther IntangiblesA-AInterest ExpenseAAcquired Company RE-AAcquiring Company RE- AInventory-AAccumulated Depreciation-A--A--AOther Intangibles-A--A--AOther Long-Term Liabilities-ATotal- Method Adjustment ScheduleDebit (Credit)KeyIs Adjustment Necessary?NOAdjustment to Investment Account- CVAdjustment to Retained Earnings Account-CVDate Alignment ScheduleDebit (Credit)KeyAdjustment to Subsidiary Income Account-CYAdjustment to Subsidiary Dividend Account-CYAdjustment to Investment Account under Equity Method -CYConsolidated WorksheetTrial BalanceEliminationsParo CompanySolar CompanyKeyDebitCreditKeyConsolidated Net IncomeNon Control InterestControlling Retained EarningsConsolidated Balance SheetCash-------Inventory---Current Assets-- D0(50000)D(50,000)--------Investment in Subsidiary --0EL- D00DCV00CVCY00CYLand--00D-Buildings and Equipment-- D0(150000)D(150,000)Accumulated Depreciation--A00A---- D00D----A00A----D00D----A00A-Other Intangibles--D00D- A00A---D00D-A00A----Goodwill-- DERROR:#DIV/0!ERROR:#DIV/0!DERROR:#DIV/0!Current Liabilities-----------Bonds Payable--D00D----D00D-A00AOther Long-Term Liabilities--D00D-A00ACommon Stock--EL--Paid- in Capital in Excess of Par--EL--Retained Earnings--EL- ERROR:#DIV/0!DERROR:#DIV/0!A-0ACommon Stock---Paid- in Capital in Excess of Par---Retained Earnings-- ERROR:#DIV/0!DERROR:#DIV/0!A00ACV-0CVDividends Declared Acquired Company---CY-Dividends Declared Acquiring Company---Sales---Cost of Goods Sold--A-A- Depreciation Expense of---Buildings and Equipment--A-A----A- A----A-A-Amortization Expense of---Other Intangibles--A-A---- A-A-----Other Expenses---Interest Expense--A-A-Subsidiary Income--CY00CY-Gain on Acquisition of

- 56. BusinessERROR:#DIV/0!DERROR:#DIV/0!TotalBalancesBalan cesERROR:#DIV/0!ERROR:#DIV/0!ERROR:#DIV/0!NCI Share--Controlling ShareERROR:#DIV/0!ERROR:#DIV/0!NCIERROR:#DIV/0!ER ROR:#DIV/0!Controlling Retained EarningsERROR:#DIV/0!ERROR:#DIV/0!ERROR:#DIV/0!Inco me Distribution SchedulesSolar CompanyInternally Generated Net (Income) or Loss-Current Year Amortizations0Adjusted (Income) or Loss-NCI Share-Controlling Share-Paro CompanyInternally Generated Net Income-Gain on Acquisitin of BusinessERROR:#DIV/0!Controlling Share of Subsidiary- TotalERROR:#DIV/0! Problem 3-10Name of Company Being AcquiredSwitzer Corporation Carol Fischer: Insert Name of Company Being Acquired in this Cell. Name of Acquiring CompanyPaulcraft Corporation Carol Fischer: Insert the Name of the Acquiring Company in this cell. Date of AcquisitionJanuary 1, 2015 Carol Fischer: Insert the Date of Acquisition in this Cell. Current YearDate of AcquisitionTrial BalanceSwitzer CorporationPaulcraft CorporationSwitzer CorporationBookMarket Carol Fischer: Insert all market values even if they are the same as the fair values. LifeAssetsCash Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Accounts Receivable

- 57. Carol Fischer: Reserved for Accounts Receivable InventoryInvestment in Subsidiary Land Carol Fischer: Row 16 is reserved for the Land Account. Buildings Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset Accumulated Depreciation Carol Fischer: Reserved for Accumulated Depreciaion. Equipment Carol Fischer: Reserved for a Depreciable Fixed Asset Accumulated Depreciation Carol Fischer: Reserved for Accumulated Depreciation GoodwillTotal Assets--LiabilitiesCurrent Liabilities Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. Bonds Payable Carol Fischer: Rows 34, 35, and 36 are reserved for Long-Term Liabilities. Row 34 is for Bonds or Long-Term Notes Payable and Row 35 is for any premium or disount on the notes or bonds. Carol Fischer: Insert the Name of the Acquiring Company in this cell. Carol Fischer: Insert the Date of Acquisition in this Cell.

- 58. Carol Fischer: Insert all market values even if they are the same as the fair values. Carol Fischer: Insert Current Assets in Cell A8 through A13. Cell A8 is reserved for Cash. Carol Fischer: Reserved for Accounts Receivable Carol Fischer: Do Not insert an account in this cell. Carol Fischer: Row 16 is reserved for the Land Account. Carol Fischer: Row 17 is reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciaion. Carol Fischer: Reserved for a Depreciable Fixed Asset Carol Fischer: Reserved for Accumulated Depreciation Carol Fischer: Reserved for a Depreciable Fixed Asset. Carol Fischer: Reserved for Accumulated Depreciation

- 59. Carol Fischer: Rows 23 and, 24, are reserved for intangibles other than goodwill. This intangible may have differing book and market values. Carol Fischer: Reserved for an Intangible other than goodwill where book and market values are identical. Carol Fischer: This Cell should be left Blank Carol Fischer: Rows 31, 32, and 33 are reserved for Current Liabilities. Discount on Bonds PayableTotal Liabilities--Equity Acquired CompanyCommon StockPaid-in Capital in Excess of ParRetained EarningsEquity Acquiring CompanyCommon StockPaid-in Capital in Excess of ParRetained EarningsTotal Equity-Total Liabilities and Equity-Net Assets at Market of Acquired Co.-Dividends Declared Acquired CompanyDividends Declared Acquiring CompanySalesCost of Goods SoldDepreciation Expense ofBuildingsEquipment-Amortization Expense of---Other ExpensesInterest ExpenseSubsidiary IncomeTotalBalancesBalancesBalancesPurchase PriceCashNumber of shares exchangedPar value of a share of stockMarket value of a share of stockMarket value of stock exchanged-Total purchase price-Ownership Interest enter as .7 for 70%Goodwill Applicable to NCIImplied Value of NCI InterestERROR:#DIV/0!Estimated Value of NCI interest if not the implied proportional amount--Enter amount or 0- 0Method of Accounting for Investment--Enter Capital C for Cost or Capital E for EquityYears since AcquisitionValue AnalysisCompany Fair ValueParent PriceNCI ValueCompany Fair ValueERROR:#DIV/0!-ERROR:#DIV/0!Fair Value of Net Assets Excluding Goodwill---GoodwillERROR:#DIV/0!-

- 60. ERROR:#DIV/0!Gain on AcquisitionERROR:#DIV/0!Determination and Distribution of Excess ScheduleImplied Company ValueParent PriceNCI ValueFair Value of CompanyERROR:#DIV/0!- ERROR:#DIV/0!Less Book Value of Interest AcquiredCommon Stock-Paid-in Capital in Excess of Par-Retained Earnings-Total Equity-Interest Acquired- 01.00Book Value0-Excess of Fair Value over Book Value-ERROR:#DIV/0!Elimination EntryKeyCommon Stock-ELPaid-in Capital in Excess of Par- ELRetained Earnings-ELInvestment in Subsidiary- 0ELAdjustment to Identifiable AccountsDebit (Credit)KeyLifeInventory-D---D-Land-DBuildings-D- Equipment-D---D---D---D-GoodwillERROR:#DIV/0!D-Bonds Payable-D-Discount on Bonds Payable-D---D-Investment in Subsidiary -DGain Taken to Acquiring Co. RE/IncomeERROR:#DIV/0!DAcquired Company REERROR:#DIV/0!DCheckERROR:#DIV/0!Amortization ScheduleAccount AdjustmentAnnual AmountCurrent YearPrior YearsTotalInventory-Buildings-Equipment-------Discount on Bonds Payable---Total00Amortization EntryDebit (Credit)KeyCost of Goods SoldADepreciation Expense ofABuildingsAEquipmentA-AAmortization Expense ofA-A- AInterest ExpenseAAcquired Company RE-AAcquiring Company RE-AInventory-AAccumulated Depreciation- AAccumulated Depreciation-A--A--A--ADiscount on Bonds Payable-A--ATotal-Method Adjustment ScheduleDebit (Credit)KeyIs Adjustment Necessary?NOAdjustment to Investment Account-CVAdjustment to Retained Earnings Account-CVDate Alignment ScheduleDebit (Credit)KeyAdjustment to Subsidiary Income Account- CYAdjustment to Subsidiary Dividend Account-CYAdjustment to Investment Account under Equity Method -CYConsolidated WorksheetTrial BalanceEliminationsPaulcraft CorporationSwitzer CorporationKeyDebitCreditKeyConsolidated Net IncomeNon Control InterestControlling Retained EarningsConsolidated

- 61. Balance SheetCash---Accounts Receivable---Inventory------ D00D---------Investment in Subsidiary --0EL- D00DCV00CVCY00CYLand--00D-Buildings--D00D- Accumulated Depreciation--A00A-Equipment--D00D- Accumulated Depreciation--A00A----D00D----A00A----D00D- A00A---D00D-A00A----Goodwill-- DERROR:#DIV/0!ERROR:#DIV/0!DERROR:#DIV/0!Current Liabilities-----------Bonds Payable--D00D-Discount on Bonds Payable--D00D-A00A---D00D-A00ACommon Stock--EL--Paid- in Capital in Excess of Par--EL--Retained Earnings--EL- ERROR:#DIV/0!DERROR:#DIV/0!A-0ACommon Stock---Paid- in Capital in Excess of Par---Retained Earnings-- ERROR:#DIV/0!DERROR:#DIV/0!A00ACV-0CVDividends Declared Acquired Company---CY-Dividends Declared Acquiring Company---Sales---Cost of Goods Sold--A-A- Depreciation Expense of---Buildings--A-A-Equipment--A-A---- A-A-Amortization Expense of------A-A----A-A-----Other Expenses---Interest Expense--A-A-Subsidiary Income-- CY00CY-Gain on Acquisition of BusinessERROR:#DIV/0!DERROR:#DIV/0!TotalBalancesBalan cesERROR:#DIV/0!ERROR:#DIV/0!ERROR:#DIV/0!NCI Share--Controlling ShareERROR:#DIV/0!ERROR:#DIV/0!NCIERROR:#DIV/0!ER ROR:#DIV/0!Controlling Retained EarningsERROR:#DIV/0!ERROR:#DIV/0!ERROR:#DIV/0!Inco me Distribution SchedulesSwitzer CorporationInternally Generated Net (Income) or Loss-Current Year Amortizations0Adjusted (Income) or Loss-NCI Share- Controlling Share-Paulcraft CorporationInternally Generated Net Income-Gain on Acquisitin of BusinessERROR:#DIV/0!Controlling Share of Subsidiary- TotalERROR:#DIV/0!