The document discusses accounting periods and methods for partnerships and partners. It addresses the following key points:

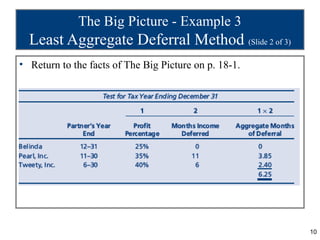

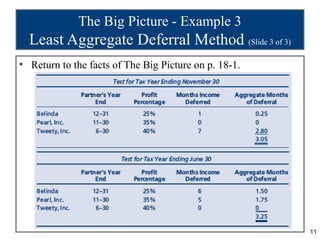

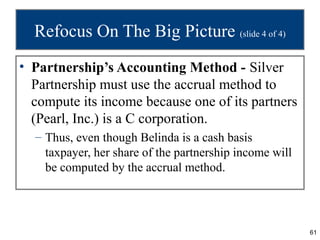

- For the Silver Partnership example, the partnership tax year would end on November 30, as this results in the least aggregate deferral of income for the partners.

- The partners would report their share of Silver's net income/loss on their tax returns for the year in which the partnership's tax year ends.

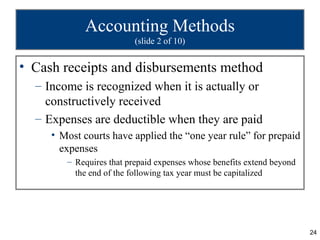

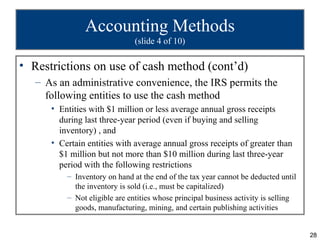

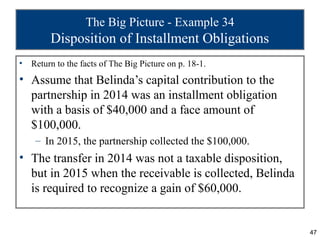

- Belinda, as a cash-basis taxpayer, would report her share of partnership income using the cash method of accounting.

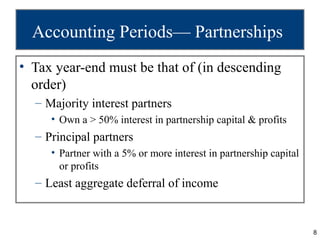

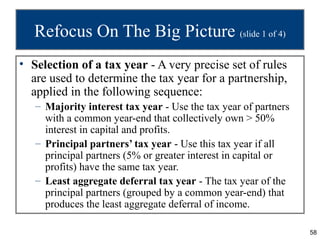

- In general, a partnership tax year is determined based on the tax year of majority interest partners, then principal partners, and finally the method that results