Brokerage_Structure.pdf

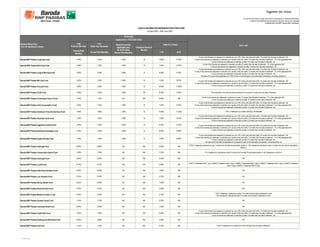

- 1. The word ‘more’ does not imply more returns or assurance of scheme performance. It refers to the additional value provided by the joint venture, as compared to Baroda AMC and BNP Paribas AMC individually. Trail First to Fifth Year Trail Sixth Year Onwards Annual Paid Monthly Annual Paid Monthly T-30 B-30 Baroda BNP Paribas Large Cap Fund 1.45% 1.35% 1.50% 12 7.25% 8.75% If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. Baroda BNP Paribas Multi Cap Fund 1.45% 1.35% 1.50% 12 7.25% 8.75% If units of the Scheme are redeemed or switched out within 3 months from the date of allotment - 1% of the applicable NAV l If units of the scheme are redeemed or switched out after 3 months from the date of allotment - Nil. Baroda BNP Paribas Large & Mid Cap Fund 1.65% 1.55% 1.50% 12 8.25% 9.75% If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. The above Exit Load will be applicable on a FIFO (First-In-First-Out) basis, to all subscription transactions, excluding Switch-Ins. Baroda BNP Paribas Mid Cap Fund 1.45% 1.35% 1.50% 12 7.25% 8.75% Baroda BNP Paribas Focused Fund 1.90% 1.80% 1.50% 12 9.50% 11.00% Baroda BNP Paribas ELSS Fund 1.65% 1.55% 1.50% 36 8.25% 9.75% The investment in the Scheme shall be locked in for a period of 3 years from the date of allotment Baroda BNP Paribas Funds Aqua Fund of Fund 1.20% 1.10% Nil NA 6.00% NA If units of the scheme are redeemed or switched out within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil Baroda BNP Paribas India Consumption Fund 1.45% 1.35% 1.50% 12 7.25% 8.75% If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. Baroda BNP Paribas Banking & Financial Services Fund 1.90% 1.80% 1.50% 12 9.50% 11.00% 1.00% if redeemed on or before 365 days, Nil thereafter Baroda BNP Paribas Business Cycle Fund 1.45% 1.35% 1.50% 12 7.25% 8.75% If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. Baroda BNP Paribas Aggressive Hybrid Fund 1.65% 1.55% 1.50% 12 8.25% 9.75% Baroda BNP Paribas Balanced Advantage Fund 1.30% 1.20% 1.50% 12 6.50% 8.00% Baroda BNP Paribas Equity Savings Fund 1.40% 1.30% 1.50% 12 7.00% 8.50% If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. The above exit load shall be applicable on a prospective basis to all subscription transactions, excluding switch-ins. Baroda BNP Paribas Arbitrage Fund 0.80% 0.80% Nil NA 4.00% NA 0.25% if redeemed/ switched out upto 1 months from the date of subscription /swtich in , Nil if redeemed/ switched out after 1 months from the date of subscription/ switch in. Baroda BNP Paribas Conservative Hybrid Fund 1.45% 1.35% Nil NA 7.25% NA 1% if redeemed or switched-out within 6 months from the date of subscription/switch-in. Nil if redeemed or switch-in. Baroda BNP Paribas Overnight Fund 0.05% 0.05% Nil NA 0.25% NA NIL Baroda BNP Paribas Liquid Fund 0.13% 0.13% Nil NA 0.65% NA 0.007% if redeemed within 1 day, 0.0065% if redeemd within 2 days, 0.0060% if redeemed within 3 days, 0.0055% if redeemed within 4 days, 0.0050% if redeemed within 5 days, 0.0045% if redeemed within 6 days Baroda BNP Paribas Ultra Short Duration Fund 0.20% 0.20% Nil NA 1.00% NA NIL Baroda BNP Paribas Low Duration Fund 0.75% 0.75% Nil NA 3.75% NA NIL Baroda BNP Paribas Money Market Fund 0.25% 0.25% Nil NA 1.25% NA NIL Baroda BNP Paribas Short Duration Fund 0.70% 0.70% Nil NA 3.50% NA NIL Baroda BNP Paribas Medium Duration Fund 0.55% 0.55% Nil NA 2.75% NA 1.00% if redeemed / switched-out within 12 months from the date of allotment of units. Nil if redeemed / switched-out after 12 months from the date of allotment of units Baroda BNP Paribas Dynamic Bond Fund 1.15% 1.15% Nil NA 5.75% NA NIL Baroda BNP Paribas Corporate Bond Fund 0.25% 0.25% Nil NA 1.25% NA NIL Baroda BNP Paribas Credit Risk Fund 1.20% 1.20% Nil NA 6.00% NA If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. Baroda BNP Paribas Banking and PSU Bond Fund 0.50% 0.50% Nil NA 2.50% NA NIL Baroda BNP Paribas Gilt Fund 1.15% 1.15% Nil NA 5.75% NA 0.25% if redeemed on or before one month (30 days) from the date of allotment. If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil. If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. LOAD & DISTRIBUTOR REMUNERATION STRUCTURE 1st April 2022 - 30th June 2022 Scheme Name Plan (For All Application Sizes) Exit Load Brokerage Applicable to T30 & B30 Cities Clawback Period In Months Special Incentive applicable only for B-30 Cities Annual Paid Monthly Total For 5 Years # Classified as Confidential

- 5. Product Exit Load Structure NIL load after the stated load period against each product Trail Day 1 (onwards) (%) Additional Trail Fee for 1st Year - B-30 ONLY (%) (01st APRIL 2022 – 30th APRIL 2022) EQUITY FUNDS Canara Robeco Flexi Cap Fund 1.00% if redeemed within 1 year 1.05 1.75 Canara Robeco Blue Chip Equity Fund 1.00% if redeemed within 1 year 1.05 0.70 Canara Robeco Infrastructure 1.00% if redeemed within 1 year 1.45 1.25 Canara Robeco Emerging Equities 1.00% if redeemed within 1 year 1.00 2.00 Canara Robeco Equity Hybrid Fund For any redemption / switch out upto 10% of units within 1 Year from the date of allotment - Nil. For any redemption / switch out more than 10% of units within 1 Year from the date of allotment - 1%. 1.10 2.00 Canara Robeco Consumer Trends Fund 1.00% if redeemed within 1 year 1.30 2.00 Canara Robeco Equity Tax Saver Fund 3 year lock in 1.20 1.75 Canara Robeco Small Cap 1.00% if redeemed within 1 year 1.20 1.75 Canara Robeco Focused Equity Fund 1% - if redeemed/switched out within 365 days from the date of allotment. 1.35 0.60 Canara Robeco Value Fund 1% - if redeemed/switched out within 365 days from the date of allotment. 1.35 0.50 DEBT FUNDS Canara Robeco Income Fund 1.00% if redeemed within 1 year 1.10 0.00 Canara Robeco Conservative Hybrid Fund For any redemption / switch out upto 10% of units within 1 Year from the date of allotment - Nil. For any redemption / switch out more than 10% of units within 1 Year from the date of allotment - 1%. 1.20 1.00 Canara Robeco Short Duration Fund Nil 0.75 0.00 Canara Robeco Dynamic Bond Fund 0.50% if redeemed within 6 months 1.10 0.00 Canara Robeco Corporate Bond Fund 0.50% If redeemed/switched-out within 90 Days from the date of allotment 0.75 0.00 Canara Robeco Gilt Fund Nil 0.70 0.00 Canara Robeco Savings Fund NIL 0.30 0.00 MONEY MARKET FUNDS Canara Robeco Ultra Short Term Fund Nil 0.55 0.00 Canara Robeco Liquid Fund Day 1: 0.0070%, Day 2: 0.0065%, Day 3: 0.0060%, Day 4: 0.0055%, Day 5: 0.0050%, Day 6: 0.0045%, Day 7 onwards: 0.0000% 0.02 0.00 Canara Robeco Overnight Fund Nil 0.01 0.00 LOAD AND BROKERAGE STRUCTURE FOR LUMPSUM & SIP/STP INVESTMENTS (01st APRIL 2022 – 30th JUNE 2022) Subject to changes in exit load to be effective prospectively

- 6. 31 shall be allowed for submission of the DSC. If the annual DSC is not submitted by Dec 31, the commission withheld for non-submission of DSC shall stand forfeited.

- 7. Advisory to Mutual Fund Distributors from whom the annual DSC is PENDING for the past years Time limit for submission of annual DSC: Effective from the year ended March 31, 2019 onwards, each mutual fund agent/distributor shall submit an annual ‘’Declaration of Self-Certification”(DSC) in the prescribed format within 3 months after the end of each Financial Year, i.e. by June 30, failing which, payment of all accrued commission shall be

- 8. 1 Date: 01-Apr-2022 Structure ref: PT Dear Partner, It gives us immense pleasure to share with you the remuneration structure for the quarter 01st Apr -2022 to 30th Jun-2022. We look forward to your support and continued patronage of our funds. Load and Brokerage Structure for 01-Apr-2022 to 30-Jun-2022 Scheme Name Exit Load Trail - Year 1 Trail- Year 2 Trail- Year 3 Onwards B30 - City Special Incentive Equity Funds – Long Only Edelweiss Flexi Cap Fund Exit load of 1% if redeemed within 12 months 1.40% 1.40% 1.40% 1.75% Edelweiss Large & Mid Cap Fund Exit load of 1% if redeemed within 12 months 1.50% 1.50% 1.50% 1.75% Edelweiss Large Cap Fund Exit load of 1% if redeemed within 12 months 1.65% 1.65% 1.65% 1.75% Edelweiss Long Term Equity Fund (Tax Savings) Nil, Subject to 3 Years Lock-in 1.65% 1.65% 1.65% 1.75% Edelweiss Mid Cap Fund Exit load of 1% if redeemed within 12 months 1.35% 1.35% 1.35% 1.75% Edelweiss Recently Listed IPO Fund Exit load of 2% if redeemed within 6 months 1.40% 1.40% 1.40% 1.75% Edelweiss Small Cap Fund Exit load of 1% if redeemed within 12 months 1.40% 1.40% 1.40% 1.75% Equity Funds – Index Edelweiss Large & Midcap Index Fund Nil 0.65% 0.65% 0.65% Nil Edelweiss Nifty 50 Index Fund Nil 0.50% 0.50% 0.50% Nil Edelweiss Nifty 100 Quality 30 Index Fund Nil 0.60% 0.60% 0.60% Nil Edelweiss MSCI India Domestic & World Healthcare 45 Index Fund Nil 0.60% 0.60% 0.60% Nil Hybrid Funds Edelweiss Balance Advantage Fund Nil for 10% of Units Allotted, For remaining units 1% on or before 365 days, thereafter nil. 1.10% 1.10% 1.10% 1.75% Edelweiss Equity Savings Fund Nil 1.40% 1.40% 1.40% Nil Edelweiss Aggressive Hybrid Fund Nil for 10% of Units Allotted, For remaining units 1% on or before 365 days, thereafter nil. 1.75% 1.75% 1.75% 1.75% Hybrid Funds – Arbitrage Edelweiss Arbitrage Fund Exit load of 0.1%, if redeemed within 30 days 0.70% 0.70% 0.70% Nil Fixed Income Funds Edelweiss Money Market Fund Nil 0.75% 0.75% 0.75% Nil Edelweiss Government Securities Fund Nil 0.70% 0.70% 0.70% Nil Edelweiss Banking and PSU Debt Fund Nil 0.30% 0.30% 0.30% Nil Edelweiss Liquid Fund Nil 0.25% 0.25% 0.25% Nil Edelweiss Overnight Fund Nil 0.05% 0.05% 0.05% Nil Fixed Income Funds – Index Edelweiss CRISIL PSU Plus SDL 50:50 Oct 2025 Index Fund Exit load of 0.10% if redeemed within 30 days 0.15% 0.15% 0.15% Nil Edelweiss NIFTY PSU Bond Plus SDL Index Fund – 2026 Exit load of 0.10% if redeemed within 30 days 0.15% 0.15% 0.15% Nil Edelweiss NIFTY PSU Bond Plus SDL Index Fund – 2027 Exit load of 0.15% if redeemed within 30 days 0.15% 0.15% 0.15% Nil International Fund of Funds Edelweiss ASEAN Equity Off-shore Fund Exit load of 1% if redeemed within 12 months 0.90% 0.90% 0.90% Nil Edelweiss Europe Dynamic Equity Off-shore Fund Exit load of 1% if redeemed within 12 months 0.90% 0.90% 0.90% Nil Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Exit load of 1% if redeemed within 12 months 0.90% 0.90% 0.90% Nil Edelweiss Greater China Equity Off-shore Fund Exit load of 1% if redeemed within 12 months 0.95% 0.95% 0.95% Nil Edelweiss US Value Equity Offshore fund Exit load of 1% if redeemed within 12 months 1.00% 1.00% 1.00% Nil Edelweiss US Technology Equity Fund of Fund Exit load of 1% if redeemed within 12 months 0.95% 0.95% 0.95% Nil

- 9. 2

- 10. COMMISSION STRUCTURE - 01 April, 2022 to 30 June, 2022 INDIGO Special Incentive - Trail - Year 1 to 3 ## Trail Year 1 Onwards - APM (p.a) 3 Year Pricing HDFC Asset Allocator Fund of Funds FOF 12 Months - 1.05% 3.15% 1.00% 4.15% HDFC Developed World Indexes Fund of Funds FOF 1 Month - 0.40% 1.20% 0.50% 1.70% Equity Schemes: HDFC Flexi Cap Fund Flexi Cap Fund 12 Months - 0.85% 2.55% 1.50% 4.05% HDFC Multi Cap Fund Multi Cap Fund 12 Months 0.15% 1.05% 3.60% 1.00% 4.60% HDFC Top 100 Fund Large Cap Fund 12 Months - 0.85% 2.55% 1.50% 4.05% HDFC Large and Mid cap Fund Large & Mid Cap Fund 12 Months 0.15% 0.95% 3.30% 1.50% 4.80% HDFC Mid Cap Opportunities Fund Mid Cap Fund 12 Months - 0.85% 2.55% 1.50% 4.05% HDFC Small Cap Fund Small Cap Fund 12 Months - 0.90% 2.70% 1.50% 4.20% HDFC Dividend Yield Fund Dividend Yield Fund 12 Months - 1.10% 3.30% 1.50% 4.80% HDFC Capital Builder Value Fund Value Fund 12 Months - 1.00% 3.00% 1.50% 4.50% HDFC Focused 30 Fund Focused Fund 12 Months 0.15% 1.20% 4.05% 1.50% 5.55% HDFC Infrastructure Fund Sectoral / Thematic Fund 12 Months 0.15% 1.25% 4.20% 1.50% 5.70% HDFC Housing Opportunities Fund Sectoral / Thematic Fund 12 Months 0.15% 1.10% 3.75% 1.50% 5.25% HDFC Banking and Financial Services Fund Sectoral / Thematic Fund 12 Months 0.15% 1.10% 3.75% 1.00% 4.75% HDFC Tax Saver Fund ELSS 3 Years lock-in - 0.90% 2.70% 1.50% 4.20% Hybrid Schemes: HDFC Hybrid Debt Fund Conservative Hybrid Fund 12 Months - 0.95% 2.85% 1.50% 4.35% HDFC Hybrid Equity Fund Aggressive Hybrid Fund 12 Months - 0.90% 2.70% 1.50% 4.20% HDFC Balanced Advantage Fund Balanced Advantage Fund 12 Months - 0.80% 2.40% 1.50% 3.90% HDFC Multi-Asset Fund Multi Asset Allocation 12 Months 0.15% 1.05% 3.60% 1.50% 5.10% HDFC Arbitrage Fund Arbitrage Fund 1 Month - 0.50% 1.50% 0.75% 2.25% HDFC Equity Savings Fund Equity Savings Fund 12 Months - 1.10% 3.30% 1.50% 4.80% Solution Oriented Schemes: HDFC Retirement Savings Fund Retirement Fund $ 0.15% 1.10% 3.75% 1.50% 5.25% HDFC Children's Gift Fund Children’s Fund $$ 0.15% 0.95% 3.30% 1.50% 4.80% Other Schemes: HDFC Index Fund - NIFTY 50 Plan 3 days - 0.15% 0.45% - 0.45% HDFC Index Fund – Sensex Plan 3 days - 0.15% 0.45% - 0.45% HDFC Nifty Next 50 Index Fund NIL - 0.30% 0.90% 0.50% 1.40% HDFC Nifty50 Equal Weight Index Fund NIL - 0.40% 1.20% 0.50% 1.70% HDFC Nifty 100 Index Fund NIL - 0.40% 1.20% 0.50% 1.70% HDFC Nifty100 Equal Weight Index Fund NIL - 0.40% 1.20% 0.50% 1.70% HDFC Dynamic PE Ratio Fund of Funds 12 Months - 0.80% 2.40% - 2.40% HDFC Gold Fund 12 Months - 0.30% 0.90% 1.50% 2.40% Debt Schemes: HDFC Overnight Fund Overnight Fund NIL - 0.05% 0.15% - 0.15% HDFC Liquid Fund Liquid Fund 7 days - 0.05% 0.15% - 0.15% HDFC Ultra Short Term Fund Ultra Short Duration Fund NIL - 0.30% 0.90% - 0.90% HDFC Low Duration Fund Low Duration Fund NIL - 0.60% 1.80% - 1.80% HDFC Money Market Fund Money Market Fund NIL - 0.15% 0.45% - 0.45% HDFC Short Term Debt Fund Short Duration Fund NIL - 0.40% 1.20% 0.75% 1.95% HDFC Medium Term Debt Fund Medium Duration Fund NIL - 0.70% 2.10% 1.00% 3.10% HDFC Income Fund Medium to Long Duration Fund NIL - 1.00% 3.00% 1.50% 4.50% HDFC Dynamic Debt Fund Dynamic Bond Fund NIL - 0.80% 2.40% 1.50% 3.90% HDFC Corporate Bond Fund Corporate Bond Fund NIL - 0.30% 0.90% 0.75% 1.65% HDFC Credit Risk Debt Fund Credit Risk Fund 18 Months - 0.70% 2.10% 1.50% 3.60% HDFC Banking and PSU Debt Fund Banking and PSU Fund NIL - 0.40% 1.20% 0.75% 1.95% HDFC Gilt Fund Gilt Fund NIL - 0.50% 1.50% - 1.50% HDFC Floating Rate Debt Fund Floater Fund NIL - 0.25% 0.75% - 0.75% 3 Years Pricing - B-30 Index FOF Additional Commission B30 Cities Trail Yr 1 - APM (p.a.) # Scheme Name Category Exit Load Period Across all cities - T30 & B30

- 12. Additional Payout for B30 Business$ SCHEME NAME Fund Positioning Exit Load Trail 1st year Trail 2nd year onwards Trail 1st year only ICICI Prudential Asset Allocator Fund (FOF) Fund of Funds 1 Year 1.05% 1.05% 3.15% 1.50% 4.65% EQUITY SCHEMES ICICI Prudential Focused Equity Fund Focused Fund 1 Year 1.00% 1.00% 3.00% 1.75% 4.75% ICICI Prudential Bharat Consumption Fund Thematic 3 Months 1.10% 1.10% 3.30% 1.50% 4.80% ICICI Prudential MNC Fund Thematic 1 Year 1.10% 1.10% 3.30% 1.75% 5.05% ICICI Prudential Commodities Fund Thematic 3 Months 1.15% 1.15% 3.45% 1.75% 5.20% ICICI Prudential ESG Fund Thematic 1 Year 1.10% 1.10% 3.30% 1.50% 4.80% ICICI Prudential Business Cycle Fund Thematic 1 Month 0.95% 0.95% 2.85% 1.75% 4.60% ICICI Prudential Flexicap Fund Flexi Cap Fund 1 Year 0.90% 0.90% 2.70% 1.50% 4.20% ICICI Prudential Midcap Fund Mid Cap Fund 1 Year 1.00% 1.00% 3.00% 1.75% 4.75% ICICI Prudential Smallcap Fund Small Cap Fund 1 Year 1.00% 1.00% 3.00% 1.75% 4.75% ICICI Prudential Exports and Services Fund Thematic 15 Days 0.90% 0.90% 2.70% 1.50% 4.20% ICICI Prudential Pharma Healthcare and Diagnostics (P.H.D.) Fund Thematic 15 Days 1.00% 1.00% 3.00% 1.75% 4.75% ICICI Prudential Manufacturing Fund Thematic 1 Year 1.00% 1.00% 3.00% 1.50% 4.50% ICICI Prudential India Opportunities Fund Thematic 1 Year 1.00% 1.00% 3.00% 1.75% 4.75% ICICI Prudential Technology Fund Sectoral 15 Days 0.80% 0.80% 2.40% 1.50% 3.90% ICICI Prudential FMCG Fund Sectoral 15 Days 1.10% 1.10% 3.30% 1.50% 4.80% ICICI Prudential Dividend Yield Equity Fund Dividend Yield Fund 1 Year 1.15% 1.15% 3.45% 1.75% 5.20% ICICI Prudential Value Discovery Fund Value Fund 1 Year 0.80% 0.80% 2.40% 1.75% 4.15% ICICI Prudential Bluechip Fund Large Cap Fund 1 Year 0.70% 0.70% 2.10% 1.75% 3.85% ICICI Prudential Multicap Fund Multi Cap Fund 1 Year 0.90% 0.90% 2.70% 1.75% 4.45% ICICI Prudential Banking & Financial Services Fund Sectoral 15 Days 1.00% 1.00% 3.00% 1.50% 4.50% ICICI Prudential Infrastructure Fund Thematic 15 Days 1.15% 1.15% 3.45% 1.50% 4.95% ICICI Prudential Large & Mid Cap Fund Large & Mid Cap Fund 1 Month 1.00% 1.00% 3.00% 1.50% 4.50% ICICI Prudential US Bluechip Equity Fund Thematic 1 Month 0.90% 0.90% 2.70% 1.50% 4.20% ICICI Prudential Quant Fund Fund Thematic 3 Months 0.50% 0.50% 1.50% Nil 1.50% ICICI Prudential Long Term Equity Fund (Tax Saving) ELSS 3 yr lock in 0.90% 0.90% 2.70% 1.75% 4.45% HYBRID SCHEMES ICICI Prudential Balanced Advantage Fund Balanced Advantage Fund 1 Year 0.70% 0.70% 2.10% 1.75% 3.85% ICICI Prudential Equity & Debt Fund Aggressive Hybrid Fund 1 Year 0.85% 0.85% 2.55% 1.75% 4.30% ICICI Prudential Multi-Asset Fund Multi Asset Allocation 1 Year 0.95% 0.95% 2.85% 1.50% 4.35% ICICI Prudential Regular Savings Fund Conservative Hybrid Fund 1 Year 0.85% 0.85% 2.55% Nil 2.55% ICICI Prudential Equity Savings Fund Equity Savings Fund 7 Days 0.40% 0.40% 1.20% Nil 1.20% ICICI Prudential Equity Arbitrage Fund Arbitrage Fund 1 Month 0.50% 0.50% 1.50% Nil 1.50% SOLUTION ORIENTED SCHEME ICICI Prudential Child Care Fund (Gift Plan) (5yr lock-in or majority age whichever is earlier) Solution Oriented Scheme Nil 1.10% 1.10% 3.30% 1.50% 4.80% ICICI Prudential Retirement Fund - Pure Equity Plan Solution Oriented Scheme 1.35% 1.35% 4.05% 1.50% 5.55% ICICI Prudential Retirement Fund - Hybrid Aggressive Plan Solution Oriented Scheme 1.35% 1.35% 4.05% 1.50% 5.55% ICICI Prudential Retirement Fund - Hybrid Conservative Plan Solution Oriented Scheme 1.30% 1.30% 3.90% Nil 3.90% ICICI Prudential Retirement Fund - Pure Debt Plan Solution Oriented Scheme 1.10% 1.10% 3.30% Nil 3.30% DEBT SCHEMES ICICI Prudential Credit Risk Fund Credit Risk Fund 1 Year 0.70% 0.70% 2.10% 1.00% 3.10% ICICI Prudential Medium Term Bond Fund Medium Duration Fund 1 Year 0.65% 0.65% 1.95% Nil 1.95% ICICI Prudential All Seasons Bond Fund Dynamic Bond Fund 1 Month 0.65% 0.65% 1.95% Nil 1.95% ICICI Prudential Long Term Bond Fund Long Duration Fund Nil 0.80% 0.80% 2.40% Nil 2.40% ICICI Prudential Short Term Fund Short Duration Fund Nil 0.60% 0.60% 1.80% Nil 1.80% ICICI Prudential Gilt Fund Gilt Fund Nil 0.60% 0.60% 1.80% Nil 1.80% ICICI Prudential Bond Fund Medium to Long Duration Fund Nil 0.40% 0.40% 0.40% Nil 0.40% ICICI Prudential Banking & PSU Debt Fund Banking and PSU Fund Nil 0.30% 0.30% 0.30% Nil 0.30% COMMISSION STRUCTURE - 1st April to 30th June 2022 MFD - iSELECT Only for Select MFD of ICICI Prudential Mutual Fund Across all cities (T30 & B30) T30 Cities 3 year pricing Lumpsum B30 Cities 3 year pricing Lumpsum Nil (5yr lock-in / Retirement age whichever is earlier)

- 13. COMMISSION STRUCTURE - 1st April to 30th June 2022 MFD - iSELECT Additional Payout for B30 Business$ SCHEME NAME Fund Positioning Exit Load Trail 1st year Trail 2nd year onwards Trail 1st year only DEBT SCHEMES ICICI Prudential Floating Interest Fund Floater Fund Nil 0.65% 0.65% 0.65% Nil 0.65% ICICI Prudential Ultra Short Term Fund Ultra Short Duration Fund Nil 0.35% 0.35% 0.35% Nil 0.35% ICICI Prudential Corporate Bond Fund Corporate Bond Fund Nil 0.20% 0.20% 0.20% Nil 0.20% ICICI Prudential Constant Maturity Gilt Fund Gilt Fund with 10 Year Constant maturity Nil 0.15% 0.15% 0.15% Nil 0.15% ICICI Prudential Money Market Fund Money Market Fund Nil 0.05% 0.05% 0.05% Nil 0.05% ICICI Prudential Savings Fund Low Duration Fund Nil 0.10% 0.05% 0.10% Nil 0.10% ICICI Prudential Overnight Fund Overnight Fund Nil 0.05% 0.05% 0.05% Nil 0.05% ICICI Prudential Liquid Fund Liquid Fund 6 Days^ 0.05% 0.05% 0.05% Nil 0.05% OTHER SCHEMES Index Funds ICICI Prudential Nifty Next 50 Index Fund Index Funds Nil 0.30% 0.30% 0.30% Nil 0.30% ICICI Prudential Nifty Index Fund Index Funds Nil 0.10% 0.10% 0.10% Nil 0.10% ICICI Prudential Sensex Index Fund Index Funds Nil 0.10% 0.10% 0.10% Nil 0.10% ICICI Prudential PSU Bond plus SDL 40:60 Index Fund - Sep 2027 Index Funds Nil 0.15% 0.15% 0.15% Nil 0.15% ICICI Prudential NASDAQ 100 Index Fund Index Funds Nil 0.45% 0.45% 0.45% Nil 0.45% ICICI Prudential Smallcap Index Fund Index Funds Nil 0.60% 0.60% 0.60% Nil 0.60% ICICI Prudential Midcap 150 Index Fund Index Funds Nil 0.70% 0.70% 0.70% Nil 0.70% ICICI Prudential Nifty Bank Index Fund Index Funds Nil 0.50% 0.50% 0.50% Nil 0.50% ICICI Prudential Nifty SDL Sep 2027 Index Fund Index Funds Nil 0.10% 0.10% 0.10% Nil 0.10% Fund of Funds ICICI Prudential India Equity (FOF) Fund of Funds 1 Year 0.50% 0.50% 0.50% 1.50% 2.00% ICICI Prudential Global Stable Equity Fund (FOF) Fund of Funds 1 Month 0.90% 0.90% 0.90% 1.50% 2.40% ICICI Prudential Global Advantage Fund (FOF) Fund of Funds 1 Year 0.75% 0.75% 0.75% 1.75% 2.50% ICICI Prudential Thematic Advantage Fund (FOF) Fund of Funds 1 Year 1.10% 1.10% 1.10% 1.50% 2.60% ICICI Prudential Debt Management Fund (FOF) Fund of Funds 1 Month 0.15% 0.15% 0.15% Nil 0.15% ICICI Prudential Passive Strategy Fund (FOF) Fund of Funds 1 Year 0.20% 0.20% 0.20% Nil 0.20% ICICI Prudential Income Optimizer Fund (FOF) Fund of Funds 1 Year 0.20% 0.20% 0.20% Nil 0.20% ICICI Prudential Nifty Low Vol 30 ETF (FOF) Fund of Funds Nil 0.40% 0.40% 0.40% Nil 0.40% ICICI Prudential Alpha Low Vol 30 ETF (FOF) Fund of Funds Nil 0.45% 0.45% 0.45% Nil 0.45% ICICI Prudential S&P BSE 500 ETF (FOF) Fund of Funds Nil 0.40% 0.40% 0.40% Nil 0.40% ICICI Prudential Passive Multi-Asset Fund of Funds Fund of Funds 1 Year 0.30% 0.30% 0.30% Nil 0.30% ICICI Prudential Silver ETF Fund of Fund Fund of Funds 15 Days 0.40% 0.40% 0.40% Nil 0.40% ICICI Prudential Regular Gold Savings Fund (FOF) Fund of Funds 15 Days 0.30% 0.30% 0.30% 1.00% 1.30% B30 Cities 1 year pricing Lumpsum New SIP/STP registered - Trail brokerage would be applicable as on Trade date / Installment date. COMMISSION STRUCTURE - 1st April to 30th June 2022 MFD - iSELECT Only for Select MFD of ICICI Prudential Mutual Fund Across all cities (T30 & B30) T30 Cities 1 year pricing Lumpsum

- 14. 0-12 Months 13-24 Months 25-36 Months IDFC Core Equity Fund Large and Midcap Fund 1.20% 2.00% 12 Months IDFC Large Cap Fund Large Cap Fund 1.35% 2.00% 12 Months IDFC Focused Equity Fund Focussed Fund 1.25% 2.00% 12 Months IDFC Infrastructure Fund Sectoral Fund 1.50% 2.00% 12 Months IDFC Sterling Value Fund Value Fund 1.10% 1.75% 12 Months IDFC Flexi Cap Fund Flexicap Fund 1.10% 2.00% 12 Months IDFC Tax Advantage (ELSS) Fund ELSS 1.10% 1.75% NA IDFC Emerging Businesses Fund Small Cap Fund 1.30% 1.65% 12 Months IDFC Multi Cap Fund Multi Cap Fund 1.40% 1.50% 12 Months IDFC Banking & PSU Debt Fund Banking and PSU Fund 0.25% Nil NA IDFC Cash Fund Liquid Fund 0.05% Nil NA IDFC Overnight Fund Overnight Fund 0.08% Nil NA IDFC Money Manager Fund Money Market Fund 0.60% Nil NA IDFC Low Duration Fund Low Duration Fund 0.20% Nil NA IDFC Corporate Bond Fund Corporate Bond Fund 0.30% Nil NA IDFC Credit Risk Fund Credit Risk Fund 0.90% 1.00% 12 Months IDFC Bond Fund - Short Term Plan Short Duration Fund 0.45% Nil NA IDFC Bond Fund - Medium Term Plan Medium Duration Fund 0.70% 0.50% 12 Months IDFC Dynamic Bond Fund Dynamic Bond Fund 1.00% Nil NA IDFC Bond Fund - Income Plan Medium to Long Duration 1.00% Nil NA IDFC Government Securities Fund - Investment Plan Gilt Fund 0.60% Nil NA IDFC Government Securities Fund - Constant Maturity Plan Gilt - Constant Maturity Fund 0.20% Nil NA IDFC Ultra Short Term Fund Ultra Short-Term Fund 0.15% Nil NA IDFC Floating Rate Fund Floating Rate Fund 0.40% Nil NA IDFC Gilt 2027 Index Fund Gilt Index Fund 0.20% Nil NA IDFC Gilt 2028 Index Fund Gilt Index Fund 0.20% Nil NA IDFC Hybrid Equity Fund Aggressive Hybrid Fund 1.40% 1.00% 12 Months IDFC Balanced Advantage Fund Balanced Advantage Fund 1.20% 2.00% 12 Months IDFC Regular Savings Fund Conservative Hybrid Plan 1.30% 0.75% 12 Months IDFC Arbitrage Fund Arbitrage Fund 0.70% Nil NA IDFC Equity Savings Fund Equity Savings Fund 0.95% 1.00% 12 Months IDFC US Equity Fund of Fund FOF-Overseas 1.00% 1.00% 12 Months IDFC Asset Allocation Fund - FOF - Moderate Plan Fund of Fund Scheme 0.60% Nil NA IDFC Asset Allocation Fund - FOF - Aggressive Plan Fund of Fund Scheme 0.70% Nil NA IDFC Asset Allocation Fund - FOF - Conservative Plan Fund of Fund Scheme 0.45% Nil NA IDFC Nifty Fund Index Fund 0.20% Nil NA IDFC Nifty 100 Index Fund Index Fund 0.50% Nil NA IDFC All Seasons Bond Fund Fund of Fund Scheme 0.35% Nil NA * B30 incentive is applicable w.e.f 15th April 2019. ** Applicable on B30 Incentive 0.20% 0.50% 0.35% 0.95% 1.00% 0.60% 0.70% 0.45% 0.20% 1.40% 1.20% 1.30% 0.70% 0.60% 0.20% 0.15% 0.40% 0.20% 0.90% 0.45% 0.70% 1.00% 1.00% Trail Brokerage Structure of ARN-47959 applicable from 01-Apr-2022 till further notice Equity Funds Fixed Income Funds Hybrid funds Other Funds Scheme Day 1 to Till 3 Years Gilt Index Fund Scheme Category 4th Year Onwards B-30 Incentive * 1.20% 1.35% 1.25% 1.50% Schemewise Clawback if Redeemed / Switched ** 1.10% 1.10% 1.10% 1.30% 1.40% 0.25% 0.05% 0.08% 0.60% 0.20% 0.30%

- 16. (For Lump sum, SIP & STP Investments) Scheme Name Category Additional B30 Incentive (APM*) T30 Trail(APM*)- From Day 1 Special Additional T30 Trail(APM*)- From Day 1 Total T30 Trail (APM*) Equity L&T India Large Cap Fund Large Cap Fund 1.75% 1.30% 0.20% 1.50% L&T Focused Equity Fund Focused Fund 1.75% 1.30% 0.20% 1.50% L&T Large and Midcap Fund Large & Mid Cap Fund 1.75% 1.30% 0.20% 1.50% L&T Infrastructure Fund Sectoral Fund 1.75% 1.30% 0.20% 1.50% L&T Business Cycles Fund Thematic Fund 1.75% 1.30% 0.20% 1.50% L&T Balanced Advantage Fund Dynamic Asset Allocation Fund 1.75% 1.20% 0.15% 1.35% L&T Flexicap Fund Flexi Cap Fund 1.75% 1.20% 0.15% 1.35% L&T Hybrid Equity Fund Aggressive Hybrid Fund 1.75% 1.20% 0.15% 1.35% L&T Tax Advantage Fund ELSS Fund 1.75% 1.20% 0.15% 1.35% L&T India Value Fund Value Fund 1.75% 1.15% 0.10% 1.25% L&T Midcap Fund Mid Cap Fund 1.75% 1.15% 0.10% 1.25% L&T Emerging Businesses Fund Small Cap Fund 1.75% 1.15% 0.10% 1.25% L&T Conservative Hybrid Fund Conservative Hybrid Fund - 1.05% 0.20% 1.25% L&T Equity Savings Fund Equity Savings Fund - 0.70% 0.20% 0.90% Index Based L&T Nifty 50 Index Fund Index Fund - 0.40% 0.05% 0.45% L&T Nifty Next 50 Index Fund - 0.40% 0.05% 0.45% Arbitrage Based L&T Arbitrage Opportunities Fund Arbitrage Fund - 0.60% - 0.60% Debt Funds L&T Triple Ace Bond Fund Corporate Bond Fund - 0.30% - 0.30% L&T Banking & PSU Debt Fund Banking and PSU Fund - 0.40% - 0.40% L&T Short Term Bond Fund Short Duration Fund - 0.50% - 0.50% L&T Resurgent India Bond Fund Medium Duration Fund - 0.90% - 0.90% L&T Credit Risk Fund Credit Risk Fund - 0.90% - 0.90% L&T Gilt Fund Gilt Fund - 1.25% - 1.25% L&T Flexi Bond Fund Dynamic Bond Fund - 0.90% - 0.90% L&T Low Duration Fund Low Duration Fund - 0.65% - 0.65% L&T Ultra Short Term Fund Ultra-Short-Term Duration Fund - 0.15% - 0.15% L&T Money Market Fund Money Market Fund - 0.50% - 0.50% Liquid Funds L&T Overnight Fund Overnight Fund - 0.10% - 0.10% L&T Liquid Fund Liquid Fund - 0.05% - 0.05% * ANNUALISED PAYABLE MONTHLY Commission Structure for L&T Mutual Fund (1st April 2022 to 30th April 2022) A R N - 4 7 9 5 9

- 18. *B30 Special Incentive will be paid as Trail Fee for 1st Year only Asset Class Scheme name Distribution Incentive # Upfront Fee B30 Special Incentive Trailer Fees (Per Annum) Paid on Average Per Month* 1st year 2nd year 3rd year 4th year & Onwards Debt Mirae Asset Banking And PSU Debt Fund 00.00 % 00.00 % 00.40 % 00.40 % 00.40 % 00.40 % Debt Mirae Asset Cash Management Fund 00.00 % 00.00 % 00.10 % 00.10 % 00.10 % 00.10 % Debt Mirae Asset Corporate Bond Fund 00.00 % 00.00 % 00.40 % 00.40 % 00.40 % 00.40 % Debt Mirae Asset Dynamic Bond Fund 00.00 % 00.00 % 00.75 % 00.75 % 00.75 % 00.75 % Debt Mirae Asset Money Market Fund 00.00 % 00.00 % 00.35 % 00.35 % 00.35 % 00.35 % Debt Mirae Asset Overnight Fund 00.00 % 00.00 % 00.10 % 00.10 % 00.10 % 00.10 % Debt Mirae Asset Savings Fund 00.00 % 00.00 % 00.50 % 00.50 % 00.50 % 00.50 % Debt Mirae Asset Short Term Fund 00.00 % 00.00 % 00.85 % 00.85 % 00.85 % 00.85 % Debt Mirae Asset Ultra Short Duration Fund 00.00 % 00.00 % 00.15 % 00.15 % 00.15 % 00.15 % Equity Mirae Asset Arbitrage Fund 00.00 % 00.00 % 00.65 % 00.65 % 00.65 % 00.65 % Equity Mirae Asset Banking and Financial Services Fund 00.00 % 01.50 % 01.30 % 01.30 % 01.30 % 01.30 % Equity Mirae Asset Emerging Bluechip Fund 00.00 % 01.00 % 00.85 % 00.85 % 00.85 % 00.85 % Equity Mirae Asset Equity Savings Fund 00.00 % 01.50 % 00.95 % 00.95 % 00.95 % 00.95 % Equity Mirae Asset Focused Fund 00.00 % 01.50 % 00.75 % 00.75 % 00.75 % 00.75 % Equity Mirae Asset Great Consumer Fund 00.00 % 01.50 % 01.40 % 01.40 % 01.40 % 01.40 % Equity Mirae Asset Healthcare Fund 00.00 % 01.50 % 01.40 % 01.40 % 01.40 % 01.40 % Equity Mirae Asset Hybrid - Equity Fund 00.00 % 01.50 % 01.15 % 01.15 % 01.15 % 01.15 % Equity Mirae Asset Large Cap Fund 00.00 % 01.00 % 00.95 % 00.95 % 00.95 % 00.95 % Equity Mirae Asset Midcap fund 00.00 % 01.50 % 00.75 % 00.75 % 00.75 % 00.75 % Equity Mirae Asset Tax Saver Fund 00.00 % 01.50 % 00.65 % 00.65 % 00.65 % 00.65 % Equity FOF Mirae Asset Equity Allocator Fund of Fund 00.00 % 00.05 % 00.05 % 00.05 % 00.05 % 00.05 % Equity FOF Mirae Asset ESG Sector Leaders Fund of Fund 00.00 % 00.25 % 00.40 % 00.40 % 00.40 % 00.40 % Equity FOF Mirae Asset Hang Seng TECH ETF Fund of Fund 00.00 % 00.25 % 00.40 % 00.40 % 00.40 % 00.40 % Equity FOF Mirae Asset Nifty India Manufacturing ETF Fund of Fund 00.00 % 00.25 % 00.40 % 00.40 % 00.40 % 00.40 % Equity FOF Mirae Asset Nifty SDL Jun 2027 Index Fund 00.00 % 00.00 % 00.15 % 00.15 % 00.15 % 00.15 % Equity FOF Mirae Asset NYSE FANG+ ETF Fund of Fund 00.00 % 00.25 % 00.40 % 00.40 % 00.40 % 00.40 % Equity FOF Mirae Asset S&P 500 Top 50 ETF Fund of Fund 00.00 % 00.25 % 00.40 % 00.40 % 00.40 % 00.40 %

- 20. Mutual Fund Distributor Revenue Structure Period: April 2022 - June 2022 Scheme Trail Commission (in bps per annum) Perpetual B-30 (1st Year) Motilal Oswal Long Term Equity Fund (ELSS) 105 175 Motilal Oswal Focused 25 Fund 115 175 Motilal Oswal Midcap 30 Fund 105 175 Motilal Oswal Flexi Cap Fund 85 175 Motilal Oswal Large and Midcap Fund 120 175 Motilal Oswal Dynamic Fund 110 175 Motilal Oswal Equity Hybrid Fund 130 175 Motilal Oswal Multi-Asset Fund 125 175 Motilal Oswal Ultra Short Term Fund 70 - Motilal Oswal Liquid Fund 15 - Motilal Oswal Nifty Bank Fund 80 - Motilal Oswal Nifty Midcap 150 Fund 80 - Motilal Oswal Nifty 500 Fund 65 - Motilal Oswal Nifty Small cap 250 Fund 75 - Motilal Oswal Nifty Next 50 Index Fund 65 - Motilal Oswal S&P 500 Index Fund 55 - Motilal Oswal MSCI EFAE Top 100 Select Index Fund 55 - Motilal Oswal Nifty 200 Momentum 30 Index Fund 70 Motilal Oswal S & P BSE low Volatility Index Fund 60 Motilal Oswal Asset allocation Passive Funds of Fund – Conservative 60 - Motilal Oswal Asset allocation Passive Funds of Fund – Aggressive 60 - Motilal Oswal Nasdaq 100 Fund of Fund 40 - Motilal Oswal Nifty 50 Index Fund 40 - Motilal Oswal 5 Year G – Sec Fund of Fund 7 -

- 22. Full Trail Model - Apr'22 Brokerage Structure Proposed Category Scheme Name Exit Load(*) Claw Back Period 1st Yr. Trail (p.a.) 2nd Yr. to 5th Yr. Trail (p.a.) 6th Yr. Onwards Trail (p.a) Total 1st yr Payout 5 yr Payout Total 1st yr Payout 5 yr Payout Large Cap NIPPON INDIA LARGE CAP FUND 7 days 12 months 1.00% 1.00% 0.95% 1.50% 1.00% 5.00% 2.50% 6.50% Large & Mid Cap NIPPON INDIA VISION FUND 12 Months 12 months 0.90% 0.90% 0.80% 1.50% 0.90% 4.50% 2.40% 6.00% Multi Cap NIPPON INDIA MULTI CAP FUND 12 Months 12 months 1.15% 1.15% 0.95% 1.50% 1.15% 5.75% 2.65% 7.25% Focused Fund - Multi Cap NIPPON INDIA FOCUSSED EQUITY FUND 12 Months 12 months 1.05% 1.05% 0.80% 1.50% 1.05% 5.25% 2.55% 6.75% Mid Cap NIPPON INDIA GROWTH FUND 1 Month 12 months 1.05% 1.05% 1.05% 1.50% 1.05% 5.25% 2.55% 6.75% Small Cap NIPPON INDIA SMALL CAP FUND 1 Month 12 months 0.75% 0.75% 0.75% 1.50% 0.75% 3.75% 2.25% 5.25% Value Fund NIPPON INDIA VALUE FUND 12 Months 12 months 1.15% 1.15% 1.10% 1.50% 1.15% 5.75% 2.65% 7.25% Flexi Cap NIPPON INDIA FLEXI CAP FUND 12 Months 12 months 1.20% 1.20% 1.15% 1.50% 1.20% 6.00% 2.70% 7.50% NIPPON INDIA BANKING & FINANCIAL SERVICES FUND 1 Month 12 months 0.90% 0.90% 0.80% 1.50% 0.90% 4.50% 2.40% 6.00% NIPPON INDIA PHARMA FUND 1 Month 12 months 1.05% 1.05% 0.95% 1.50% 1.05% 5.25% 2.55% 6.75% NIPPON INDIA CONSUMPTION FUND 1 Month 12 months 1.00% 1.00% 0.85% 1.50% 1.00% 5.00% 2.50% 6.50% NIPPON INDIA POWER & INFRA FUND 1 Month 12 months 1.15% 1.15% 0.80% 1.50% 1.15% 5.75% 2.65% 7.25% Quant NIPPON INDIA QUANT FUND 1 month 12 months 0.65% 0.65% 0.65% 1.50% 0.65% 3.25% 2.15% 4.75% NIPPON INDIA JAPAN EQUITY FUND 12 Months 12 months 0.90% 0.90% 0.75% 1.50% 0.90% 4.50% 2.40% 6.00% NIPPON INDIA US EQUITYOPPORTUNITIES FUND 12 Months 12 months 0.90% 0.90% 0.75% 1.50% 0.90% 4.50% 2.40% 6.00% NIPPON INDIA TAIWAN EQUITY FUND 12 Months 12 months 1.30% 1.30% 1.30% 1.50% 1.30% 6.50% 2.80% 8.00% Conservative Hybrid NIPPON INDIA HYBRID BOND FUND 12 Months 12 months 1.10% 1.10% 1.10% 1.00% 1.10% 5.50% 2.10% 6.50% Aggressive Hybrid NIPPON INDIA EQUITY HYBRID FUND 12 Months 12 months 1.15% 1.15% 1.15% 1.50% 1.15% 5.75% 2.65% 7.25% Equity Savings NIPPON INDIA EQUITY SAVINGS FUND 12 Months 12 months 1.15% 1.15% 1.15% 1.50% 1.15% 5.75% 2.65% 7.25% Balanced Advantage NIPPON INDIA BALANCED ADVANTAGE FUND 12 Months 12 months 1.15% 1.15% 1.15% 1.50% 1.15% 5.75% 2.65% 7.25% Asset Allocator NIPPON INDIA ASSET ALLOCATOR FoF 12 Months No Clawback 0.90% 0.90% 0.90% NIL 0.90% 4.50% 0.90% 4.50% Passive Flexicap NIPPON INDIA PASSIVE FLEXICAP FoF NIL 12 months 0.35% 0.35% 0.35% 1.00% 0.35% 1.75% 1.35% 2.75% Multi Asset NIPPON INDIA MULTI ASSET FUND 12 Months 12 months 1.20% 1.20% 1.15% 1.50% 1.20% 6.00% 2.70% 7.50% ELSS NIPPON INDIA TAX SAVER FUND 3 yr lock in 3 yr lock in 1.00% 1.00% 0.85% 1.75% 1.00% 5.00% 2.75% 6.75% NIPPON INDIA RETIREMENT FUND - WEALTH CREATION 5 yr lock in 5 yr lock in 1.30% 1.30% 1.15% 1.50% 1.30% 6.50% 2.80% 8.00% NIPPON INDIA RETIREMENT FUND - INCOME GENERATION 5 yr lock in 5 yr lock in 1.05% 1.05% 1.05% 1.50% 1.05% 5.25% 2.55% 6.75% NIPPON INDIA INDEX FUND - NIFTY PLAN 7 days No Clawback 0.65% 0.65% 0.65% NIL 0.65% 3.25% 0.65% 3.25% NIPPON INDIA INDEX FUND - SENSEX PLAN 7 days No Clawback 0.15% 0.15% 0.15% NIL 0.15% 0.75% 0.15% 0.75% NIPPON INDIA NIFTY SMALL CAP 250 INDEX FUND 7 days No Clawback 0.60% 0.60% 0.60% NIL 0.60% 3.00% 0.60% 3.00% NIPPON INDIA NIFTY 50 VALUE 20 INDEX FUND NIL No Clawback 0.45% 0.45% 0.45% NIL 0.45% 2.25% 0.45% 2.25% NIPPON INDIA NIFTY MIDCAP 150 INDEX FUND NIL No Clawback 0.45% 0.45% 0.45% NIL 0.45% 2.25% 0.45% 2.25% NIPPON INDIA JUNIOR BEES FOF NIL No Clawback 0.15% 0.15% 0.15% NIL 0.15% 0.75% 0.15% 0.75% Nippon India Nifty AAA CPSE Bond Plus SDL - Apr 2027 Maturity 60-40 Index Fund NIL No Clawback 0.15% 0.15% 0.15% NIL 0.15% 0.75% 0.15% 0.75% NIPPON INDIA GOLD SAVINGS FUND 15 days 12 months 0.30% 0.30% 0.30% 0.50% 0.30% 1.50% 0.80% 2.00% NIPPON INDIA SILVER ETF FOF 15 days 12 months 0.30% 0.30% 0.30% 0.20% 0.30% 1.50% 0.50% 1.70% Low Duration Fund NIPPON INDIA LOW DURATION FUND NIL No Clawback 0.55% 0.55% 0.55% NIL 0.55% 2.75% 0.55% 2.75% Corporate Bond NIPPON INDIA CORPORATE BOND FUND NIL No Clawback 0.35% 0.35% 0.35% NIL 0.35% 1.75% 0.35% 1.75% Short Duration Fund NIPPON INDIA SHORT TERM FUND NIL No Clawback 0.70% 0.50% 0.50% NIL 0.70% 2.70% 0.70% 2.70% Long Duration Fund NIPPON INDIA NIVESH LAKSHYA FUND 36 Months 12 months 0.25% 0.25% 0.25% 1.25% 0.25% 1.25% 1.50% 2.50% Banking & PSU NIPPON INDIA BANKING & PSU FUND NIL No Clawback 0.35% 0.35% 0.35% NIL 0.35% 1.75% 0.35% 1.75% Floater NIPPON INDIA FLOATING RATE FUND NIL No Clawback 0.25% 0.25% 0.25% NIL 0.25% 1.25% 0.25% 1.25% Credit Risk NIPPON INDIA CREDIT RISK FUND 12 Months 12 months 1.00% 1.00% 1.00% 0.50% 1.00% 5.00% 1.50% 5.50% Medium Duration NIPPON INDIA STRATEGIC DEBT FUND 12 Months No Clawback 0.80% 0.80% 0.80% NIL 0.80% 4.00% 0.80% 4.00% Dynamic Bond NIPPON INDIA DYNAMIC BOND FUND NIL 12 months 0.35% 0.35% 0.35% 1.25% 0.35% 1.75% 1.60% 3.00% Medium & Long Duration NIPPON INDIA INCOME FUND NIL 12 months 1.10% 1.10% 0.90% 1.25% 1.10% 5.50% 2.35% 6.75% Gilt NIPPON INDIA GILT SECURITIES FUND NIL No Clawback 0.90% 0.90% 0.90% NIL 0.90% 4.50% 0.90% 4.50% Arbitrage NIPPON INDIA ARBITRAGE FUND 1 month No Clawback 0.55% 0.55% 0.55% NIL 0.55% 2.75% 0.55% 2.75% Liquid Fund NIPPON INDIA LIQUID FUND 7 Days No Clawback 0.05% 0.05% 0.05% NIL 0.05% 0.25% 0.05% 0.25% Liquid Fund NIPPON INDIA OVERNIGHT FUND NIL No Clawback 0.07% 0.07% 0.07% NIL 0.07% 0.35% 0.07% 0.35% Money Market NIPPON INDIA MONEY MARKET FUND NIL No Clawback 0.05% 0.05% 0.05% NIL 0.05% 0.25% 0.05% 0.25% Ultra Short Duration NIPPON INDIA ULTRA SHORT DURATION FUND NIL No Clawback 0.65% 0.65% 0.65% NIL 0.65% 3.25% 0.65% 3.25% Please refer annexure for detailed terms & conditions and SIP Insure brokerage and applicability of ARI-Annual Retention Trail Incentive. (*) Kindly refer SID International FOF (Gold & Silver) Index In pursuant to AMFI communication dated January 30, 2022 and as advised by SEBI, International schemes are suspended temporary for subscription. B-30 Hybrid & Asset Allocator Goal Based Retirement Equity (Lumpsum & SIP Investments) Annual Retention Incentive for B- 30 Locations- in Trail (p.a.) T-30 Liquid/Ultra Liquid Index & FOF Debt Arbitrage Sectoral Thematic

- 23. PPFAS Mutual Fund Schemes Trail Commission (Jan. to Mar. 2022) B-30 Commission (March, 2022) Parag Parikh Flexi Cap Fund 0.85% p.a. 1.72% p.a. Parag Parikh Liquid Fund 0.10% p.a. Not Applicable Parag Parikh Conservative Hybrid Fund 0.30% p.a. Not Applicable Parag Parikh Tax Saver Fund Jan & Feb 2022 2nd Mar. 2022 onwards 1.35% p.a. 1.00% p.a. 1.10% p.a.

- 25. T - 30 & B - 30 Trail 1st Year Onwards Tata Retirement Savings Fund -PP Refer SID 1.45% 2.00% Tata Retirement Savings Fund -MP Refer SID 1.45% 1.50% Tata Retirement Savings Fund -CP Refer SID 1.35% 1.50% Tata Young Citizens Fund Refer SID 1.60% 1.50% Tata India Tax Savings Fund Refer SID 1.05% 1.00% Tata Small Cap Fund 1% - 12 months 1.25% 1.50% Tata Mid Cap Growth Fund 1% - 365 Days 1.25% 2.00% Tata Ethical Fund Refer SID 1.30% 1.50% Tata Flexicap Fund 1% - 12 months 1.20% 1.00% Tata Equity P/E Fund 1% - 12 months 1.15% 2.00% Tata Large & Mid Cap Fund 1% - 365 Days 1.25% 2.00% Tata Large Cap Fund 1% - 365 Days 1.40% 2.00% Tata Hybrid Equity Fund 1% - 365 Days 1.20% 2.00% Tata Balanced Advantage Fund Refer SID 1.20% 0.75% Tata Focused Equity Fund Refer SID 1.25% 0.50% Tata Quant Fund Refer SID 1.30% 0.00% Tata Multiasset Opportunities Fund 1% - 365 Days 1.45% 1.00% Tata Dividend Yield Fund Refer SID 1.60% 0.60% Tata Business Cycle Fund Refer SID 1.30% 0.75% Tata Equity Savings Fund 0.25% - 90 Days 0.60% 1.50% Tata Banking & Financial Services Fund Refer SID 1.40% 1.50% Tata Digital India Fund Refer SID 1.15% 0.75% Tata India Consumer Fund Refer SID 1.25% 1.25% Tata India Pharma & Health Care Fund Refer SID 1.35% 1.10% Tata Resources & Energy Fund Refer SID 1.60% 1.00% Tata Infrastructure Fund Refer SID 1.40% 2.00% Tata Arbitrage Fund 0.25% - 1 months 0.65% TATA Index Fund - NIFTY A 0.25% - 7 Days 0.30% TATA Index Fund - SENSEX A 0.25% - 7 Days 0.30% Tata Short Term Bond Fund NIL 0.65% Tata Dynamic Bond Fund NIL 0.40% Tata Income Fund NIL 0.90% Tata Medium Term Fund Refer SID 0.90% Tata Banking & PSU Debt Fund NIL 0.40% Tata Corporate Bond Fund NIL 0.50% Tata Gilt Securities Fund NIL 0.75% Tata Treasury Advantage Fund NIL 0.20% Tata Ultra Short Term Fund NIL 0.70% Tata Overnight Fund NIL 0.10% Tata Floating Rate Fund NIL 0.35% Tata Money Market Fund NIL 0.25% Tata Liquid Fund NIL 0.05% Solutions Brokerage Structure Applicable from 1st April 2022 to 30th June 2022 Scheme Name Exit Load (B-30) Special Incentive 1st Year Trail (apm) ELSS Equity Funds Arbitrage Fund Index Funds Debt Funds Gilt Funds Ultra Short Funds Liquid Funds

- 27. Information Classification: UTI AMC - Private T30 B30 Equity Schemes UTI - Flexi Cap Fund Flexi Cap Fund < 1 Year - 1% 0.95% 1.50% 2.85% 4.35% UTI - Mastershare Unit Scheme Large Cap Fund < 1 Year - 1% 1.05% 1.50% 3.15% 4.65% UTI - Value Opportunities Fund Value Fund < 1 Year - 1% 1.05% 1.50% 3.15% 4.65% UTI - Mid Cap Fund Mid Cap Fund < 1 Year - 1% 1.05% 1.50% 3.15% 4.65% UTI - Dividend Yield Fund Dividend Yield Fund < 1 Year - 1% 1.10% 1.50% 3.30% 4.80% UTI - MNC Fund Thematic - MNC < 1 Year - 1% 1.10% 1.50% 3.30% 4.80% UTI Focused Equity Fund Focused Fund < 1 Year - 1% 1.15% 1.50% 3.45% 4.95% UTI - Small Cap Fund Small Cap < 1 Year - 1% 1.20% 1.50% 3.60% 5.10% UTI Long Term Equity Fund (Tax Saving) ELSS NIL 1.20% 1.50% 3.60% 5.10% UTI Core Equity Fund Large & Mid Cap Fund < 1 Year - 1% 1.20% 1.50% 3.60% 5.10% UTI - Infrastructure Fund Thematic - Infrastructure < 30 days – 1% 1.25% 1.50% 3.75% 5.25% UTI - Transportation and Logistics Fund Thematic - Transportation & Logistics < 30 days – 1% 1.25% 1.50% 3.75% 5.25% UTI Healthcare Fund Sectoral - Healthcare < 30 days – 1% 1.25% 1.50% 3.75% 5.25% UTI Banking and Financial Services Fund Sectoral - Banking and Financial Services < 30 days – 1% 1.25% 1.50% 3.75% 5.25% UTI - India Consumer Fund Thematic - Consumption < 30 days – 1% 1.60% 1.50% 4.80% 6.30% UTI Nifty Index Fund Index Fund NIL 0.10% -- 0.30% 0.30% UTI Sensex Index Fund Index Fund NIL 0.10% -- 0.30% 0.30% UTI Nifty 200 Momentum 30 Index Fund Index Fund NIL 0.50% -- 1.50% 1.50% UTI Nifty Next 50 Index Fund Index Fund NIL 0.50% -- 1.50% 1.50% UTI S&P BSE Low Volatility Index Fund Index Fund NIL 0.50% -- 1.50% 1.50% Hybrid & Solutions UTI Arbritage Fund Arbritrage < 21 days - 0.25% 0.60% -- 1.80% 1.80% UTI Retirement Benefit Pension Fund Retirement Fund NIL 0.85% 1.50% 2.55% 4.05% UTI Childrens Career Fund - Savings Plan Children's Fund NIL 0.90% 1.50% 2.70% 4.20% UTI Unit Linked Insurance Plan Dynamic Asset Allocation Premature Withdrawal - 2% 0.90% 1.50% 2.70% 4.20% UTI Equity Savings Fund Equity Savings < 1 Year - 1% 0.90% -- 2.70% 2.70% UTI Hybrid Equity Fund Aggressive Hybrid < 1 Year - 1% 1.15% 1.50% 3.45% 4.95% UTI Regular Savings Fund Conservative Hybrid < 1 Year - 1% 1.15% -- 3.45% 3.45% UTI Multi Asset Fund Multi Asset Allocation < 1 Year - 1% 1.15% 1.50% 3.45% 4.95% UTI Childrens Career Fund - Investment Plan Children's Fund NIL 1.40% 1.50% 4.20% 5.70% Fixed Income & Cash UTI - Banking & PSU Debt Fund Banking & PSU NIL 0.10% -- 0.30% 0.30% UTI - Corporate Bond Fund Corporate Bond NIL 0.30% -- 0.90% 0.90% UTI - Gilt Fund Gilt NIL 0.50% -- 1.50% 1.50% UTI - Short Term Income Fund Short Duration NIL 0.55% -- 1.65% 1.65% 3 Years Total Scheme Classification Exit Load Trail (P.A.) Additional 1st Year Trail for B30 (P.A) 3 Private & Confidential UTI Asset Management Company Limited Commission structure Payable to Distributor (Retail) Validity Period: 1st April 2022 to 30th June 2022 M1-Q1(FY2022-23) Page 1 Information Classification: UTI AMC - Private

- 28. Information Classification: UTI AMC - Private T30 B30 3 Years Total Scheme Classification Exit Load Trail (P.A.) Additional 1st Year Trail for B30 (P.A) 3 < 3Month - 3% Between 3 to 6 Months -2% Between 6 to 12 Months -1% < 3Month - 3% Between 3 to 6 Months -2% Between 6 to 12 Months -1% UTI - Medium Term Fund Medium Duration Beyond 10% of alloted units < 1 Year - 1% 0.95% -- 2.85% 2.85% UTI - Credit Risk Fund Credit Risk Beyond 10% of alloted units < 1 Year - 1% 1.00% -- 3.00% 3.00% UTI - Money Market Fund Money Market NIL 0.05% -- 0.15% 0.15% UTI - Treasury Advantage Fund Low Duration NIL 0.15% -- 0.45% 0.45% UTI - Floater Fund Floater NIL 0.40% -- 1.20% 1.20% UTI - Ultra Short Term Fund Ultra Short Duration NIL 0.55% -- 1.65% 1.65% UTI - Overnight Fund Overnight NIL 0.05% -- 0.15% 0.15% UTI - Liquid Cash Plan Liquid Cash Within 1 day - 0.007%, 2 day 0.0065%, 3 day 0.0060%, 4th day 0.0055% , 5th day 0.0050% and 6th day 0.0045% 0.05% -- 0.15% 0.15% 2.85% UTI - Dynamic Bond Fund Dynamic Bond 0.95% -- 2.85% 2.85% UTI - Bond Fund Medium to Long Duration 0.95% -- 2.85%