Cowen initiates coverage of Nikola Corporation with an Outperform rating and $79 price target. Key points:

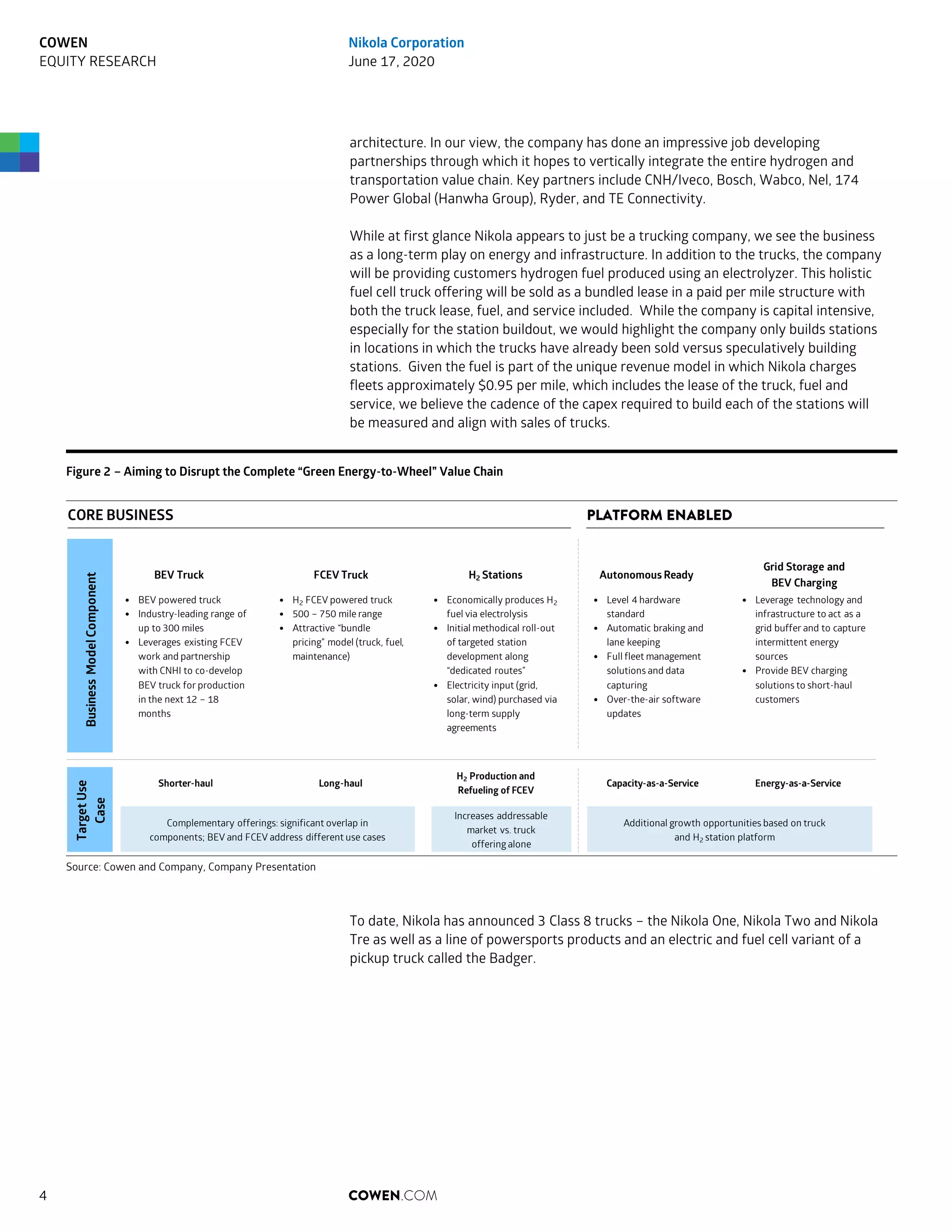

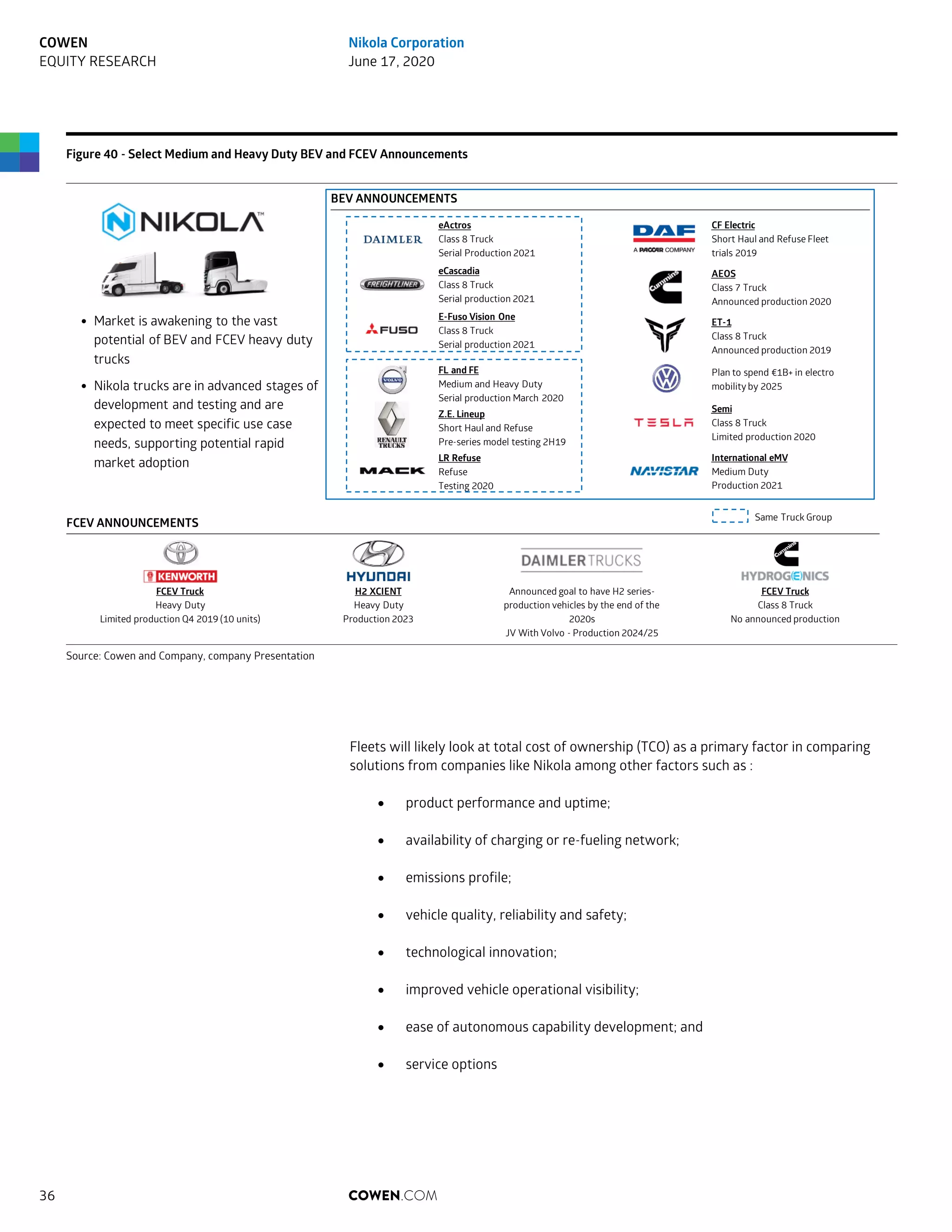

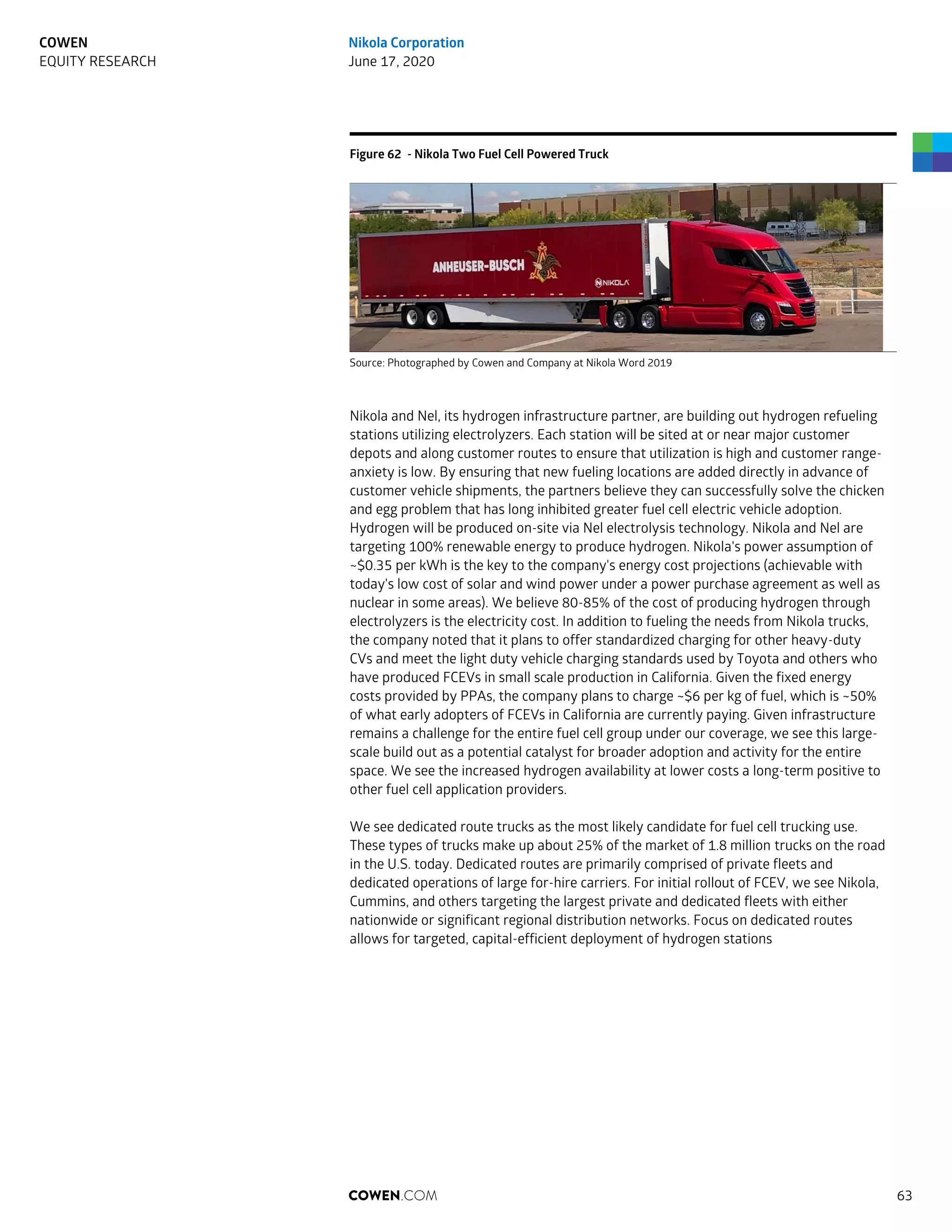

- Nikola is developing battery electric and hydrogen fuel cell trucks as well as building out hydrogen fueling infrastructure.

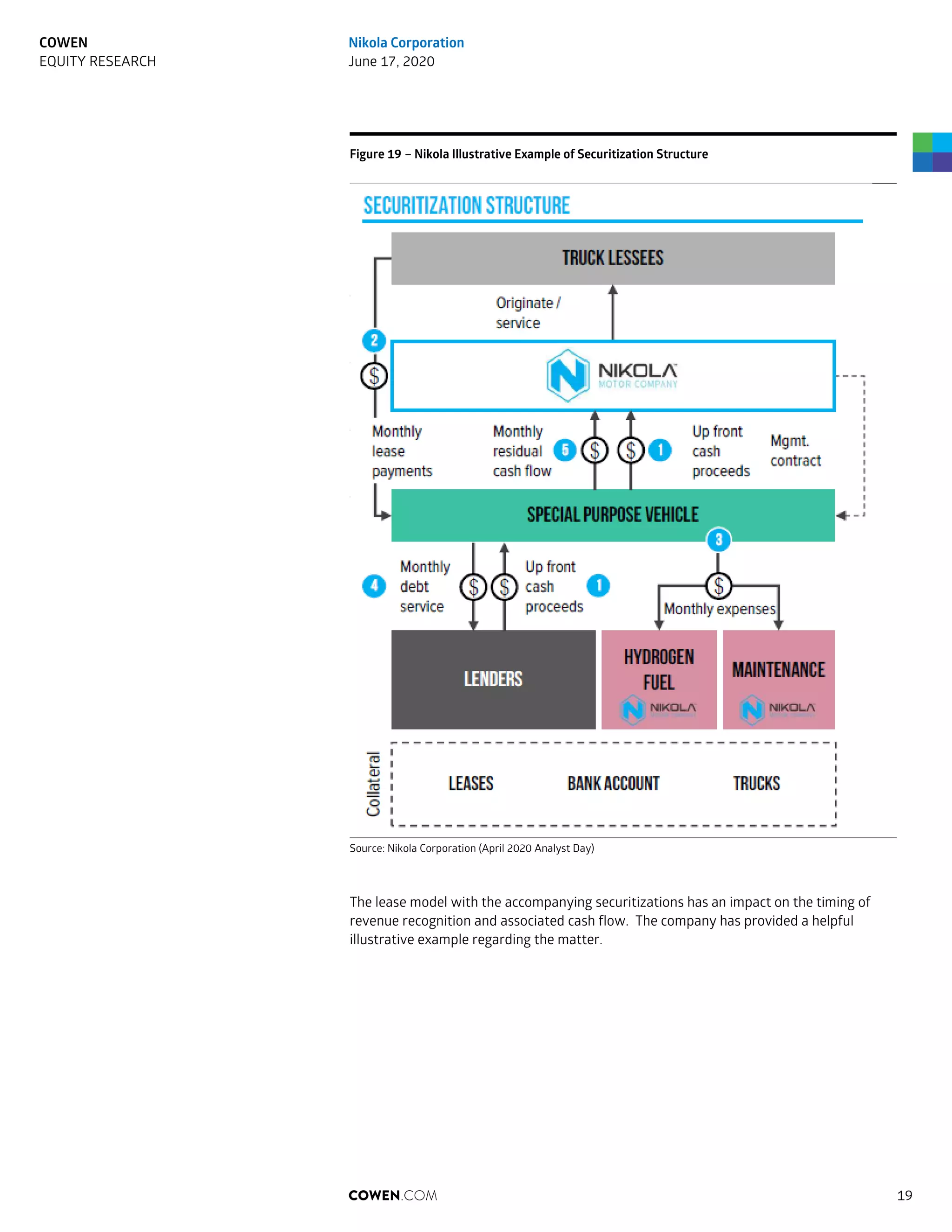

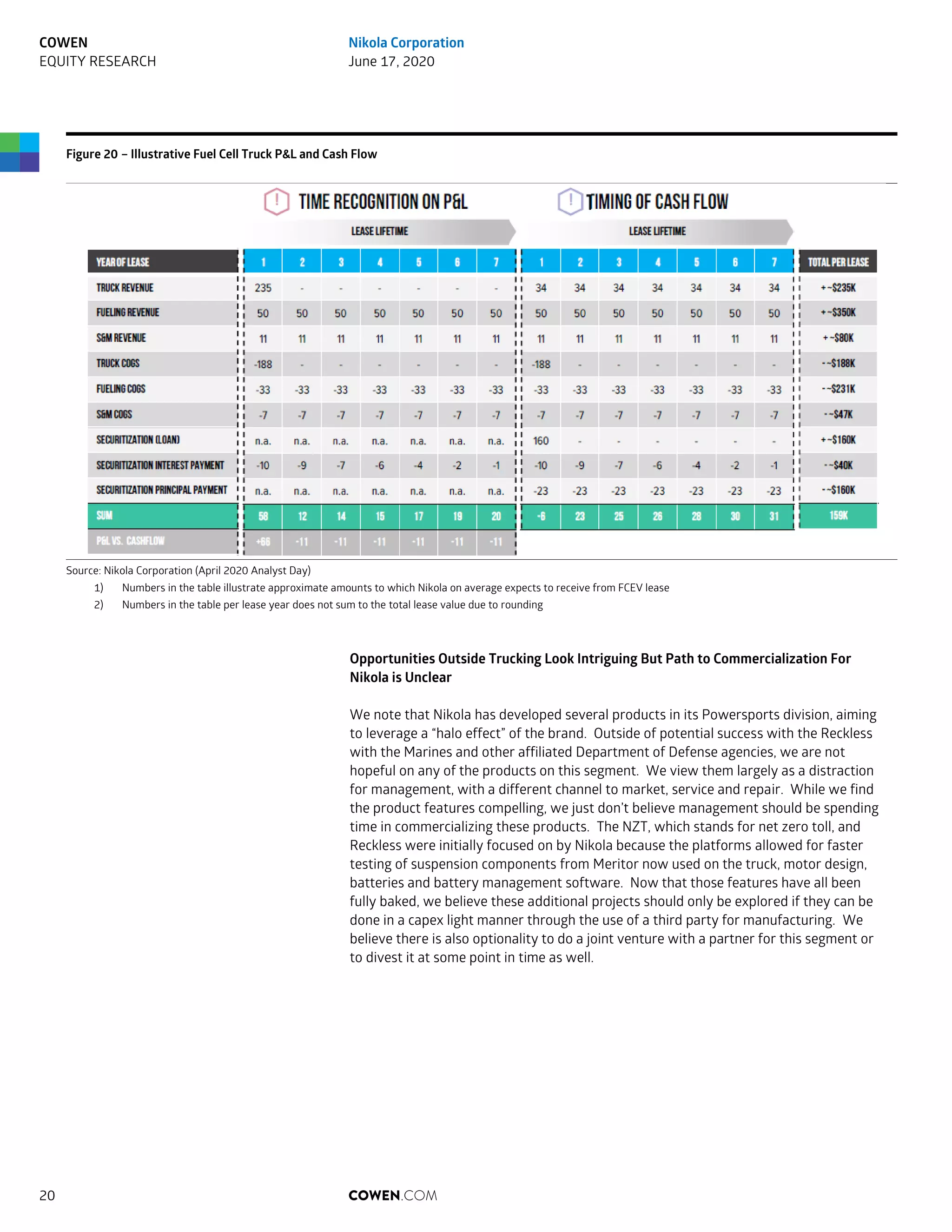

- The company aims to sell trucks through a bundled lease program covering the vehicle, fuel, and maintenance for $0.95/mile.

- Strategic partnerships with companies like Bosch and CNH/Iveco should help Nikola ramp up production smoothly starting in 2021.

- In addition to trucks, Nikola is pursuing other markets like power sports and has a planned electric pickup called the Badger.