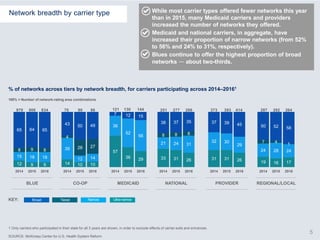

The document analyzes hospital networks on the ACA exchanges over three years (2014-2016). It finds that:

1) The proportion of narrowed networks has remained constant, but the total number of networks has declined due to carrier exits.

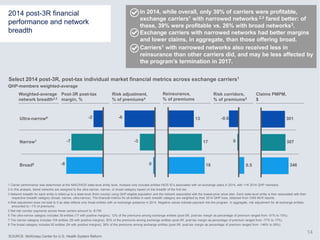

2) Median premiums for narrowed networks have declined further compared to broad networks.

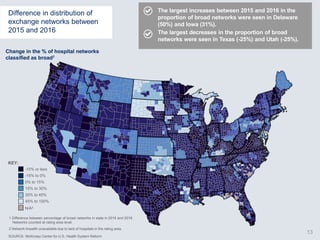

3) Consumer choice has declined, with more consumers only having access to narrowed networks in 2016.