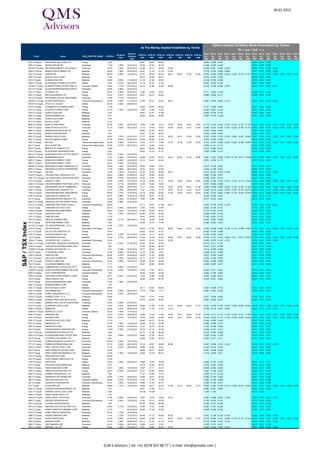

S&P TSX Index - Dividends and Implied Volatility Surface Parameters

- 1. 30.01.2012 Option Implied Volatility Skew Parameters by Terms: At The Money Implied Volatilities by Terms 2 IVt = atx + btx + ct Next Ex- Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Dividend ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - Ticker Name GICS_SECTOR_NAME ATM Ref Dividend (a) - (a) - (a) - (a) - (a) - (a) - (a) - (b) - (b) - (b) - (b) - (b) - (b) - (b) - Yield 30D 60D 90D 6M 12M 18M 24M Date 30D 60D 90D 6M 12M 18M 24M 30D 60D 90D 6M 12M 18M 24M AAV CT Equity ADVANTAGE OIL & GAS LTD Energy 3.65 64.67 66.33 65.26 -0.092 -0.290 -0.236 0.038 0.009 0.006 ARE CT Equity AECON GROUP INC Industrials 11.09 1.80% 16.03.2012 27.58 27.93 25.18 -0.468 -0.054 -0.146 0.076 0.028 0.035 AGF/B CT Equity AGF MANAGEMENT LTD-CLASS B Financials 15.55 7.20% 04.04.2012 23.46 22.17 23.04 23.36 -0.034 0.001 -0.240 -0.275 0.054 0.024 0.022 0.004 AEM CT Equity AGNICO-EAGLE MINES LTD Materials 38.26 1.89% 24.02.2012 42.61 41.34 41.34 41.65 -0.179 -0.100 -0.090 -0.062 0.017 0.007 0.005 0.002 AGU CT Equity AGRIUM INC Materials 80.29 0.56% 12.06.2012 27.81 26.64 26.50 28.43 30.64 31.85 33.06 -0.267 -0.258 -0.280 -0.227 -0.162 -0.134 -0.107 0.032 0.010 0.005 0.002 0.001 0.001 0.001 ASR CT Equity ALACER GOLD CORP Materials 9.39 49.21 44.93 45.41 -0.272 -0.247 -0.225 0.024 0.009 0.005 AGI CT Equity ALAMOS GOLD INC Materials 20.30 0.87% 11.04.2012 41.76 41.94 42.39 -0.416 -0.100 -0.055 0.016 0.005 0.002 AQN CT Equity ALGONQUIN POWER & UTILITIES Utilities 6.08 4.61% 28.03.2012 31.15 27.25 27.35 -0.327 -0.225 -0.134 0.081 0.044 0.028 ATD/B CT Equity ALIMENTATION COUCHE-TARD -B Consumer Staples 29.40 1.12% 20.03.2012 23.10 23.66 23.58 24.88 -0.145 -0.038 -0.048 -0.075 0.042 0.003 0.003 0.001 AP-U CT Equity ALLIED PROPERTIES REAL ESTAT Financials 25.56 5.38% 22.02.2012 ALA CT Equity ALTAGAS LTD Energy 30.43 4.58% 22.02.2012 15.94 16.24 16.01 0.111 -0.032 -0.190 0.028 0.013 0.024 ARX CT Equity ARC RESOURCES LTD Energy 24.43 4.91% 24.02.2012 25.91 25.31 25.65 -0.086 -0.294 -0.317 0.024 0.009 0.013 AX-U CT Equity ARTIS REAL ESTATE INVESTMENT Financials 15.06 7.17% 24.02.2012 ACM/A CT Equity ASTRAL MEDIA INC-A Consumer Discretionary 34.50 4.49% 11.07.2012 21.69 20.47 20.20 20.91 0.028 -0.043 -0.082 -0.113 0.030 0.023 0.016 0.004 ACO/X CT Equity ATCO LTD -CLASS I Utilities 58.16 2.25% 06.06.2012 ATH CT Equity ATHABASCA OIL SANDS CORP Energy 11.36 42.96 46.97 48.34 -0.121 -0.059 -0.052 0.031 0.004 0.004 ATP CT Equity ATLANTIC POWER CORP Utilities 14.79 7.78% 24.02.2012 15.65 14.96 15.20 -0.222 0.007 -0.142 0.064 0.030 0.025 AUQ CT Equity AURICO GOLD INC Materials 9.54 49.92 51.01 51.89 -0.282 -0.165 -0.153 0.027 0.008 0.002 ARZ CT Equity AURIZON MINES LTD Materials 5.57 49.52 46.55 46.04 -0.450 -0.195 -0.109 0.050 0.016 0.008 AVR CT Equity AVION GOLD CORP Materials 1.54 BTO CT Equity B2GOLD CORP Materials 3.74 BMO CT Equity BANK OF MONTREAL Financials 57.80 4.84% 26.04.2012 13.59 14.85 14.41 15.78 16.85 18.33 19.87 -0.110 -0.164 -0.164 -0.227 -0.215 -0.170 -0.125 0.048 0.028 0.022 0.011 0.002 0.002 0.001 BNS CT Equity BANK OF NOVA SCOTIA Financials 51.75 4.25% 30.03.2012 17.73 18.45 18.02 19.05 20.52 21.47 22.45 -0.295 -0.291 -0.255 -0.274 -0.222 -0.180 -0.137 0.044 0.024 0.017 0.007 0.003 0.001 -0.001 BNK CT Equity BANKERS PETROLEUM LTD Energy 5.33 55.90 53.83 53.75 -0.445 -0.295 -0.279 0.026 0.006 0.004 BAA CT Equity BANRO CORPORATION Materials 5.03 97.61 91.26 86.67 -0.754 -0.444 -0.283 0.044 0.015 0.011 ABX CT Equity BARRICK GOLD CORP Materials 49.27 1.22% 24.02.2012 27.17 26.64 27.21 28.52 30.61 32.26 33.92 -0.227 -0.192 -0.155 -0.129 -0.069 -0.057 -0.044 0.027 0.009 0.004 0.002 0.001 0.001 0.001 BTE CT Equity BAYTEX ENERGY CORP Energy 57.40 4.67% 24.02.2012 20.58 22.92 23.25 -0.279 -0.262 -0.362 0.018 0.004 0.009 BCE CT Equity BCE INC Telecommunication Services 40.36 5.38% 13.06.2012 14.57 13.71 13.96 14.72 15.38 17.82 20.33 -0.151 -0.037 -0.068 -0.040 -0.023 -0.058 -0.094 0.045 0.023 0.019 0.009 0.001 0.000 0.000 BA CT Equity BELL ALIANT INC Telecommunication Services 27.89 6.81% 09.03.2012 14.01 12.84 12.62 0.328 0.112 0.110 0.023 0.009 0.014 BIR CT Equity BIRCHCLIFF ENERGY LTD Energy 13.09 92.41 88.30 80.26 0.010 0.059 0.014 0.012 0.000 0.005 PXX CT Equity BLACKPEARL RESOURCES INC Energy 5.26 49.04 47.23 47.27 -0.520 -0.250 -0.173 0.035 0.008 0.004 BEI-U CT Equity BOARDWALK REAL ESTATE INVEST Financials 52.25 3.44% 22.02.2012 BBD/B CT Equity BOMBARDIER INC-B Industrials 4.42 2.26% 09.05.2012 42.46 40.03 43.57 44.33 46.50 47.64 48.80 -0.281 -0.301 -0.266 -0.190 -0.118 -0.077 -0.036 0.041 0.018 0.009 0.001 0.001 0.001 0.001 BNP CT Equity BONAVISTA ENERGY CORP Energy 22.64 6.89% 24.02.2012 24.18 24.41 24.93 0.023 -0.236 -0.173 0.031 0.010 0.016 BNE CT Equity BONTERRA ENERGY CORP Energy 54.47 6.32% 13.02.2012 BAM/A CT Equity BROOKFIELD ASSET MANAGE-CL A Financials 30.25 1.83% 25.04.2012 20.22 18.82 19.01 -0.313 -0.156 -0.287 0.031 0.009 0.010 BPO CT Equity BROOKFIELD OFFICE PROPERTIES Financials 17.25 3.26% 28.02.2012 29.24 25.34 24.60 -0.426 -0.180 -0.301 0.048 0.017 0.013 CAE CT Equity CAE INC Industrials 10.95 1.64% 13.03.2012 27.33 25.93 26.64 28.27 -0.013 -0.047 -0.108 -0.185 0.062 0.036 0.024 0.003 CFW CT Equity CALFRAC WELL SERVICES LTD Energy 25.53 0.88% 27.06.2012 34.57 38.82 39.29 0.062 -0.168 -0.277 0.024 0.002 0.004 CWT-U CT Equity CALLOWAY REAL ESTATE INVESTM Financials 26.98 5.74% 24.02.2012 16.42 16.01 15.40 -0.168 0.047 -0.314 0.031 0.019 0.030 CCO CT Equity CAMECO CORP Energy 23.40 2.05% 27.03.2012 33.19 32.65 31.71 33.69 35.90 38.39 40.91 -0.529 -0.249 -0.274 -0.213 -0.132 -0.113 -0.094 0.019 0.004 0.006 0.005 0.001 0.001 0.001 CAR-U CT Equity CAN APARTMENT PROP REAL ESTA Financials 22.72 5.11% 24.02.2012 21.36 19.25 18.62 -0.077 -0.053 -0.290 0.037 0.025 0.031 CM CT Equity CAN IMPERIAL BK OF COMMERCE Financials 75.22 4.95% 26.03.2012 15.11 16.30 15.35 16.92 18.96 20.43 21.96 -0.292 -0.296 -0.260 -0.253 -0.194 -0.162 -0.129 0.045 0.025 0.018 0.009 0.000 0.000 -0.001 CNR CT Equity CANADIAN NATL RAILWAY CO Industrials 75.74 1.98% 06.06.2012 17.87 18.39 18.79 19.81 20.75 21.42 22.10 -0.246 -0.216 -0.243 -0.270 -0.181 -0.127 -0.073 0.043 0.023 0.017 0.005 0.004 0.003 0.002 CNQ CT Equity CANADIAN NATURAL RESOURCES Energy 40.00 1.10% 14.03.2012 27.10 29.02 29.59 31.04 32.59 33.97 35.37 -0.291 -0.270 -0.263 -0.209 -0.115 -0.079 -0.043 0.034 0.012 0.008 0.003 0.001 0.001 0.001 COS CT Equity CANADIAN OIL SANDS LTD Energy 24.70 4.86% 15.02.2012 26.46 26.91 27.92 -0.225 -0.238 -0.233 0.042 0.019 0.012 CP CT Equity CANADIAN PACIFIC RAILWAY LTD Industrials 72.06 1.83% 21.03.2012 19.90 19.85 20.68 -0.471 -0.237 -0.287 0.014 0.004 0.007 REF-U CT Equity CAN REAL ESTATE INVEST TRUST Financials 36.65 3.99% 27.02.2012 CTC/A CT Equity CANADIAN TIRE CORP-CLASS A Consumer Discretionary 62.65 21.11 20.91 21.48 22.27 -0.425 -0.185 -0.209 -0.134 0.023 0.002 0.004 0.001 CU CT Equity CANADIAN UTILITIES LTD-A Utilities 60.13 2.94% 08.05.2012 13.92 15.28 15.44 0.002 -0.128 -0.127 0.010 0.003 0.007 CWB CT Equity CANADIAN WESTERN BANK Financials 26.33 2.43% 13.03.2012 21.08 24.20 22.70 -0.177 -0.127 -0.157 0.026 0.010 0.016 CUS CT Equity CANEXUS CORP Materials 7.23 7.57% 28.03.2012 24.40 24.09 22.85 -0.359 -0.367 -0.144 0.087 0.050 0.035 CFP CT Equity CANFOR CORP Materials 11.63 39.41 34.26 33.70 -0.166 -0.061 -0.132 0.044 0.017 0.008 CPX CT Equity CAPITAL POWER CORP Utilities 24.68 5.11% 28.03.2012 15.54 16.62 16.65 -0.027 -0.007 -0.065 0.026 0.009 0.013 S&P / TSX Index CS CT Equity CAPSTONE MINING CORP Materials 3.50 93.06 74.51 77.84 -0.593 -0.220 -0.222 0.059 0.032 0.010 CCL/B CT Equity CCL INDUSTRIES INC - CL B Materials 31.44 2.27% 13.03.2012 CLS CT Equity CELESTICA INC Information Technology 8.04 38.79 37.24 38.10 39.90 40.85 43.10 45.34 -0.184 -0.328 -0.262 -0.138 -0.116 -0.098 -0.080 0.053 0.021 0.014 0.002 0.001 0.001 0.001 CLT CT Equity CELTIC EXPLORATION LTD Energy 19.43 43.00 42.67 41.27 -0.030 -0.105 -0.098 0.014 0.002 0.003 CVE CT Equity CENOVUS ENERGY INC Energy 36.70 2.40% 07.03.2012 32.24 31.11 30.76 -0.375 -0.220 -0.260 0.026 0.010 0.004 CG CT Equity CENTERRA GOLD INC Materials 19.40 0.77% 08.05.2012 41.03 42.38 40.76 42.88 42.27 44.54 46.45 -0.372 -0.137 -0.104 -0.002 0.011 -0.013 -0.037 0.018 0.004 0.004 0.001 0.001 0.000 0.000 GIB/A CT Equity CGI GROUP INC - CLASS A Information Technology 19.30 24.03 24.16 24.47 25.28 -0.059 -0.076 -0.124 -0.153 0.052 0.013 0.009 0.003 CSH-U CT Equity CHARTWELL SENIORS HOUSING RE Financials 8.77 6.16% 27.02.2012 33.97 24.52 22.70 -0.412 -0.211 -0.137 0.095 0.062 0.045 CGG CT Equity CHINA GOLD INTERNATIONAL RES Materials 3.20 87.23 83.86 88.35 -0.347 -0.341 -0.356 0.021 0.013 -0.002 CHR/B CT Equity CHORUS AVIATION INC - B Industrials 3.37 17.80% 28.03.2012 93.77 59.22 45.27 -0.719 -0.390 -0.209 0.050 0.044 0.038 CIX CT Equity CI FINANCIAL CORP Financials 21.40 4.46% 24.02.2012 14.10 15.94 15.61 -0.364 -0.212 -0.359 0.027 0.011 0.014 CGX CT Equity CINEPLEX INC Consumer Discretionary 25.46 5.07% 24.02.2012 25.03 21.63 20.58 0.073 -0.079 -0.082 0.017 0.004 0.005 CLC CT Equity CML HEALTHCARE INC Health Care 10.46 7.22% 24.02.2012 22.17 22.01 22.09 -0.285 -0.140 -0.202 0.091 0.049 0.033 CCA CT Equity COGECO CABLE INC Consumer Discretionary 47.42 2.85% 16.04.2012 25.98 24.56 26.28 0.357 -0.092 -0.089 0.020 0.007 0.001 CSI CT Equity COLOSSUS MINERALS INC Materials 7.17 63.61 56.88 55.06 -0.353 -0.287 -0.217 0.011 0.010 0.005 CUF-U CT Equity COMINAR REAL ESTATE INV-TR U Financials 21.57 6.80% 22.02.2012 CJR/B CT Equity CORUS ENTERTAINMENT INC-B SH Consumer Discretionary 20.75 4.63% 14.05.2012 16.38 17.87 20.21 -0.258 0.011 -0.263 0.034 0.011 0.012 BCB CT Equity COTT CORPORATION Consumer Staples 7.00 35.48 35.55 34.46 -0.252 -0.155 -0.253 0.054 0.025 0.011 CPG CT Equity CRESCENT POINT ENERGY CORP Energy 45.71 6.04% 24.02.2012 15.44 15.98 15.92 -0.253 -0.220 -0.212 0.052 0.029 0.019 CR CT Equity CREW ENERGY INC Energy 13.00 33.95 36.44 34.76 -0.474 -0.281 -0.242 0.043 0.011 0.007 DH CT Equity DAVIS & HENDERSON CORP Financials 17.85 7.06% 27.02.2012 DML CT Equity DENISON MINES CORP Energy 1.76 DGC CT Equity DETOUR GOLD CORP Materials 28.00 35.11 39.05 39.42 -0.254 -0.206 -0.192 0.031 0.007 0.005 DOL CT Equity DOLLARAMA INC Consumer Discretionary 42.45 0.85% 02.04.2012 15.18 16.36 17.71 -0.007 -0.081 -0.226 0.023 0.014 0.013 DII/B CT Equity DOREL INDUSTRIES-CL B Consumer Discretionary 24.83 2.43% 28.02.2012 DC/A CT Equity DUNDEE CORP -CL A Financials 24.00 15.63 17.41 19.45 -0.571 -0.300 -0.354 0.030 0.010 0.015 DPM CT Equity DUNDEE PRECIOUS METALS INC Materials 9.44 45.73 45.29 43.63 -0.497 -0.263 -0.231 0.026 0.010 0.006 D-U CT Equity DUNDEE REAL ESTATE INVESTMEN Financials 33.34 6.94% 27.02.2012 ELD CT Equity ELDORADO GOLD CORP Materials 14.92 0.87% 08.08.2012 40.59 41.68 41.94 41.77 42.93 45.32 47.75 -0.241 -0.220 -0.190 -0.100 -0.020 -0.030 -0.040 0.029 0.006 0.005 0.002 0.001 0.000 -0.001 EMA CT Equity EMERA INC Utilities 32.62 4.22% 30.04.2012 13.56 11.74 12.37 14.23 -0.196 -0.116 -0.067 -0.093 0.042 0.013 0.012 0.007 EMP/A CT Equity EMPIRE CO LTD 'A' Consumer Staples 56.20 1.68% 11.04.2012 ENB CT Equity ENBRIDGE INC Energy 37.23 3.04% 09.05.2012 16.88 17.29 17.49 18.62 19.31 20.36 21.42 -0.175 -0.171 -0.172 -0.176 -0.133 -0.141 -0.149 0.054 0.030 0.020 0.007 0.003 0.002 0.002 ECA CT Equity ENCANA CORP Energy 19.42 4.14% 12.03.2012 39.76 36.53 35.68 34.02 34.27 35.89 37.55 -0.184 -0.125 -0.114 -0.133 -0.076 -0.063 -0.049 0.026 0.009 0.003 0.001 0.000 0.000 0.000 EDR CT Equity ENDEAVOUR SILVER CORP Materials 11.14 46.48 48.37 52.99 -0.344 -0.283 -0.349 0.021 0.006 0.000 EFX CT Equity ENERFLEX LTD Energy 12.40 1.94% 12.03.2012 38.99 34.43 32.26 -0.486 -0.460 -0.210 0.066 0.028 0.019 ERF CT Equity ENERPLUS CORP Energy 23.84 9.23% 07.03.2012 21.37 22.75 22.16 0.130 -0.206 -0.202 0.038 0.013 0.021 ESI CT Equity ENSIGN ENERGY SERVICES INC Energy 15.59 2.76% 21.03.2012 35.15 37.15 35.70 -0.165 -0.227 -0.212 0.041 0.008 0.007 EGU CT Equity EUROPEAN GOLDFIELDS LTD Materials 12.59 61.77 61.28 60.43 -0.410 -0.420 -0.404 0.011 0.006 0.003 EXE-U CT Equity EXTENDICARE REAL ESTATE INVE Financials 8.45 9.94% 22.02.2012 49.84 37.59 39.32 -0.533 -0.422 -0.169 0.070 0.041 0.017 XG CT Equity EXTORRE GOLD MINES LTD Materials 9.67 38.69 33.06 35.34 -0.609 -0.517 -0.711 0.057 0.040 0.038 FFH CT Equity FAIRFAX FINANCIAL HLDGS LTD Financials 415.22 2.42% 15.01.2013 FTT CT Equity FINNING INTERNATIONAL INC Industrials 27.15 2.03% 06.03.2012 31.18 28.81 28.66 28.98 -0.457 -0.228 -0.215 -0.140 0.029 0.021 0.015 0.003 FCR CT Equity FIRST CAPITAL REALTY INC Financials 17.67 4.53% 28.03.2012 16.88 19.83 18.51 -0.145 -0.013 -0.243 0.045 0.018 0.022 FR CT Equity FIRST MAJESTIC SILVER CORP Materials 20.29 48.52 48.77 48.59 -0.457 -0.438 -0.324 0.018 0.006 0.006 FM CT Equity FIRST QUANTUM MINERALS LTD Materials 21.65 1.26% 10.04.2012 55.06 57.19 56.27 -0.415 -0.362 -0.311 0.018 0.005 0.004 FSV CT Equity FIRSTSERVICE CORP Financials 29.36 FES CT Equity FLINT ENERGY SERVICES LTD Energy 14.00 FTS CT Equity FORTIS INC Utilities 33.43 3.59% 09.05.2012 15.86 15.49 16.08 -0.090 -0.123 -0.240 0.025 0.012 0.011 FVI CT Equity FORTUNA SILVER MINES INC Materials 6.75 53.18 51.20 56.16 -0.610 -0.581 -0.306 0.075 0.019 0.002 FNV CT Equity FRANCO-NEVADA CORP Materials 44.37 1.25% 10.04.2012 19.57 21.11 23.13 -0.642 -0.352 -0.260 0.026 0.012 0.007 FRU CT Equity FREEHOLD ROYALTIES LTD Energy 20.73 8.30% 24.02.2012 20.31 22.92 22.52 -0.401 -0.195 -0.274 0.043 0.011 0.010 GBU CT Equity GABRIEL RESOURCES LTD Materials 5.94 77.37 74.94 74.14 -0.085 -0.117 -0.159 0.011 0.007 0.009 MIC CT Equity GENWORTH MI CANADA INC Financials 22.85 5.16% 09.02.2012 28.69 25.41 25.24 -0.366 -0.184 -0.263 0.021 0.007 0.009 WN CT Equity WESTON (GEORGE) LTD Consumer Staples 64.50 2.23% 07.03.2012 17.23 17.86 17.98 0.020 -0.109 -0.099 0.009 0.003 0.004 GIL CT Equity GILDAN ACTIVEWEAR INC Consumer Discretionary 21.91 1.83% 15.02.2012 45.64 37.42 34.75 -0.340 -0.146 -0.213 0.014 0.002 0.005 G CT Equity GOLDCORP INC Materials 48.82 1.31% 14.02.2012 28.85 29.77 30.12 31.90 34.12 35.94 37.75 -0.305 -0.203 -0.162 -0.110 -0.038 -0.031 -0.025 0.021 0.007 0.005 0.002 0.001 0.000 0.000 GSC CT Equity GOLDEN STAR RESOURCES LTD Materials 2.13 78.61 77.90 73.14 0.085 0.025 -0.009 0.007 -0.004 -0.002 GCE CT Equity GRANDE CACHE COAL CORP Materials 9.56 161.59 131.69 -1.766 -1.154 0.219 0.090 GBG CT Equity GREAT BASIN GOLD LTD Materials 1.24 GWO CT Equity GREAT-WEST LIFECO INC Financials 21.64 5.68% 29.02.2012 19.67 16.74 15.94 18.14 -0.382 -0.096 -0.263 -0.188 0.039 0.015 0.018 0.012 AIM CT Equity GROUPE AEROPLAN INC Consumer Discretionary 11.99 5.00% 13.03.2012 21.08 25.15 25.08 -0.135 -0.005 -0.161 0.070 0.025 0.016 GUY CT Equity GUYANA GOLDFIELDS INC Materials 7.64 81.83 78.26 80.85 -0.184 -0.214 -0.038 0.013 0.006 -0.002 HR-U CT Equity H&R REAL ESTATE INV-REIT UTS Financials 23.07 5.15% 15.03.2012 19.96 17.32 15.98 0.230 0.133 -0.226 0.037 0.028 0.040 HW CT Equity HARRY WINSTON DIAMOND CORP Materials 11.97 22.03.2012 38.46 37.42 37.69 -0.448 -0.329 -0.253 0.053 0.017 0.009 HCG CT Equity HOME CAPITAL GROUP INC Financials 50.74 1.77% 15.02.2012 HBM CT Equity HUDBAY MINERALS INC Materials 11.61 1.72% 15.03.2012 40.49 41.13 40.95 40.39 -0.241 -0.136 -0.134 -0.124 0.026 0.008 0.006 0.002 HSE CT Equity HUSKY ENERGY INC Energy 24.28 4.94% 21.03.2012 20.48 20.86 19.11 20.70 24.42 25.93 27.47 -0.315 -0.282 -0.211 -0.206 -0.179 -0.161 -0.143 0.053 0.028 0.018 0.008 0.002 0.002 0.001 IMG CT Equity IAMGOLD CORP Materials 16.78 1.68% 29.06.2012 40.11 41.34 41.19 41.50 -0.170 -0.220 -0.184 -0.110 0.029 0.005 0.004 0.003 IGM CT Equity IGM FINANCIAL INC Financials 45.19 5.03% 29.03.2012 16.89 14.37 13.67 -0.153 -0.157 -0.217 0.018 0.012 0.010 IMO CT Equity IMPERIAL OIL LTD Energy 46.86 1.00% 29.02.2012 23.01 25.86 26.49 27.28 -0.526 -0.248 -0.256 -0.212 0.027 0.003 0.004 0.004 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. 30.01.2012 Option Implied Volatility Skew Parameters by Terms: At The Money Implied Volatilities by Terms IVt = atx + btx2 + ct Next Ex- Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Dividend ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - Ticker Name GICS_SECTOR_NAME ATM Ref Dividend (a) - (a) - (a) - (a) - (a) - (a) - (a) - (b) - (b) - (b) - (b) - (b) - (b) - (b) - Yield 30D 60D 90D 6M 12M 18M 24M Date 30D 60D 90D 6M 12M 18M 24M 30D 60D 90D 6M 12M 18M 24M IAG CT Equity INDUSTRIAL ALLIANCE INSURANC Financials 25.95 4.08% 29.02.2012 30.85 28.38 28.25 28.30 -0.091 -0.031 -0.051 -0.057 0.012 0.011 0.007 0.000 IMN CT Equity INMET MINING CORPORATION Materials 68.08 0.29% 23.05.2012 36.51 35.89 37.23 -0.341 -0.216 -0.203 0.009 0.005 0.005 IFC CT Equity INTACT FINANCIAL CORP Financials 56.97 2.81% 07.03.2012 19.50 18.01 17.74 -0.034 -0.085 -0.225 0.010 0.004 0.005 IPL-U CT Equity INTER PIPELINE FUND LP-A Energy 17.37 6.13% 21.02.2012 IVN CT Equity IVANHOE MINES LTD Materials 16.16 54.92 61.18 59.20 56.68 0.023 -0.097 -0.148 -0.175 0.010 0.003 0.005 0.005 JAG CT Equity JAGUAR MINING INC Materials 7.27 177.83 119.69 78.66 -2.612 -2.139 -0.418 -0.058 0.003 0.007 PJC/A CT Equity JEAN COUTU GROUP INC-CLASS A Consumer Staples 13.29 2.11% 09.05.2012 18.74 17.76 17.55 -0.332 -0.262 -0.293 0.050 0.030 0.021 JE CT Equity JUST ENERGY GROUP INC Utilities 12.21 10.16% 13.02.2012 25.54 23.90 22.54 -0.257 -0.065 -0.143 0.048 0.019 0.020 KEY CT Equity KEYERA CORP Energy 46.07 4.58% 20.02.2012 21.97 20.24 19.54 0.290 0.002 -0.008 0.027 0.009 0.011 K CT Equity KINROSS GOLD CORP Materials 11.46 1.14% 20.03.2012 43.84 42.05 41.56 40.89 41.95 44.25 46.61 -0.141 -0.056 -0.038 -0.019 0.051 0.042 0.033 0.022 0.008 0.005 0.002 0.001 -0.001 -0.003 KGI CT Equity KIRKLAND LAKE GOLD INC Materials 17.55 47.21 46.07 46.52 -0.557 -0.293 -0.319 0.025 0.006 0.007 LIF-U CT Equity LABRADOR IRON ORE ROYALTY CO Materials 36.60 2.73% 28.03.2012 LSG CT Equity LAKE SHORE GOLD CORP Materials 1.47 141.18 119.68 125.69 0.000 0.000 0.000 0.000 0.000 0.000 LB CT Equity LAURENTIAN BANK OF CANADA Financials 45.80 4.19% 28.03.2012 LEG CT Equity LEGACY OIL + GAS INC Energy 11.96 38.38 39.23 38.84 -0.400 -0.261 -0.284 0.033 0.011 0.008 LNR CT Equity LINAMAR CORP Consumer Discretionary 16.80 2.38% 28.03.2012 L CT Equity LOBLAW COMPANIES LTD Consumer Staples 36.48 2.30% 07.03.2012 18.67 19.14 18.71 -0.033 -0.055 -0.144 0.027 0.014 0.020 LUN CT Equity LUNDIN MINING CORP Materials 4.94 65.01 63.93 64.28 -0.327 -0.357 -0.233 0.014 0.007 -0.002 MDA CT Equity MACDONALD DETTWILER & ASSOC Information Technology 43.52 2.30% 13.03.2012 24.21 24.33 24.65 0.302 -0.035 -0.015 0.021 0.002 0.003 MG CT Equity MAGNA INTERNATIONAL INC Consumer Discretionary 42.01 2.39% 09.03.2012 26.13 28.97 29.96 31.63 -0.231 -0.204 -0.218 -0.181 0.034 0.002 0.003 0.003 MDI CT Equity MAJOR DRILLING GROUP INTL Materials 16.47 1.03% 04.04.2012 35.78 37.05 35.89 -0.500 -0.277 -0.243 0.040 0.007 0.006 MBT CT Equity MANITOBA TELECOM SVCS INC Telecommunication Services 31.92 5.33% 07.03.2012 15.76 15.71 16.05 -0.049 0.105 -0.013 0.027 0.014 0.019 MFC CT Equity MANULIFE FINANCIAL CORP Financials 11.75 4.43% 17.02.2012 34.92 34.63 33.31 35.11 38.16 39.28 40.56 -0.290 -0.269 -0.300 -0.271 -0.161 -0.156 -0.152 0.035 0.011 0.009 0.002 -0.001 0.000 0.000 MFI CT Equity MAPLE LEAF FOODS INC Consumer Staples 10.91 1.47% 07.03.2012 21.37 21.59 23.48 -0.332 -0.120 -0.099 0.082 0.046 0.027 MEG CT Equity MEG ENERGY CORP Energy 44.04 44.74 43.86 46.24 -0.315 -0.193 -0.235 0.010 0.000 0.000 ML CT Equity MERCATOR MINERALS LTD Materials 1.84 133.37 108.21 98.85 0.617 0.219 0.053 0.033 0.012 0.003 MX CT Equity METHANEX CORP Materials 27.34 2.66% 14.03.2012 30.22 29.90 29.89 -0.548 -0.155 -0.267 0.024 0.005 0.006 MRU/A CT Equity METRO INC -A Consumer Staples 53.39 1.50% 08.02.2012 20.34 19.92 20.42 21.64 -0.172 -0.320 -0.261 -0.119 0.013 0.016 0.011 0.002 MFL CT Equity MINEFINDERS CORP Materials 14.34 69.16 61.01 58.98 -1.410 -0.655 -0.341 0.044 0.012 0.000 MTL CT Equity MULLEN GROUP LTD Energy 19.16 5.22% 28.03.2012 21.62 24.24 24.21 -0.100 -0.191 -0.215 0.029 0.012 0.015 NAE CT Equity NAL ENERGY CORP Energy 7.50 8.00% 21.02.2012 39.95 37.29 37.30 -0.319 -0.151 -0.251 0.076 0.028 0.010 NA CT Equity NATIONAL BANK OF CANADA Financials 75.00 4.28% 20.03.2012 15.01 17.03 16.03 17.54 18.89 20.31 21.79 -0.208 -0.232 -0.185 -0.231 -0.167 -0.153 -0.140 0.046 0.026 0.019 0.007 0.003 0.003 0.002 NEM CT Equity NEO MATERIAL TECHNOLOGIES IN Materials 8.33 64.91 63.59 63.37 -0.442 -0.431 -0.219 0.022 0.009 0.004 NSU CT Equity NEVSUN RESOURCES LTD Materials 6.64 1.51% 27.06.2012 58.22 59.65 59.94 -0.561 -0.338 -0.291 0.023 0.002 0.003 NGD CT Equity NEW GOLD INC Materials 11.66 43.08 45.94 44.94 -0.315 -0.192 -0.184 0.019 0.005 0.003 NXY CT Equity NEXEN INC Energy 18.31 1.09% 07.03.2012 37.33 36.20 36.74 37.28 38.57 39.77 40.97 -0.290 -0.208 -0.194 -0.172 -0.129 -0.119 -0.110 0.028 0.013 0.008 0.003 0.001 0.001 0.001 NKO CT Equity NIKO RESOURCES LTD Energy 48.82 0.49% 27.03.2012 44.43 44.48 43.79 -0.285 -0.156 -0.187 0.008 0.002 0.003 NDN CT Equity NORDION INC Health Care 9.54 4.21% 14.03.2012 29.06 24.76 24.70 26.89 -0.349 -0.278 -0.184 -0.075 0.079 0.042 0.030 0.007 PDL CT Equity NORTH AMER PALLADIUM LTD Materials 2.70 68.15 61.94 58.66 -0.030 -0.128 -0.129 0.010 0.003 0.002 NWC CT Equity NORTH WEST CO INC/THE Consumer Staples 19.50 4.92% 28.03.2012 NDM CT Equity NORTHERN DYNASTY MINERALS Materials 7.61 54.32 56.48 56.65 -0.243 -0.202 -0.267 0.039 0.013 0.009 NPI CT Equity NORTHLAND POWER INC Utilities 16.91 6.39% 24.02.2012 22.28 22.68 22.98 0.118 -0.015 -0.034 0.045 0.017 0.018 NG CT Equity NOVAGOLD RESOURCES INC Materials 10.61 63.08 62.65 61.68 -0.138 -0.367 -0.490 0.009 0.009 0.007 NVA CT Equity NUVISTA ENERGY LTD Energy 4.32 27.03.2012 73.34 67.31 63.16 -0.443 -0.244 -0.376 0.027 0.011 0.011 OGC CT Equity OCEANAGOLD CORP Materials 2.56 OCX CT Equity ONEX CORPORATION Financials 34.65 0.32% 04.04.2012 16.96 17.96 18.84 20.93 -0.394 -0.235 -0.228 -0.186 0.039 0.026 0.018 0.004 OTC CT Equity OPEN TEXT CORP Information Technology 53.23 43.99 36.74 34.80 -0.151 -0.175 -0.172 0.003 0.003 0.001 OSK CT Equity OSISKO MINING CORP Materials 11.83 41.83 43.72 42.31 43.88 45.21 47.08 48.95 -0.442 -0.257 -0.239 -0.139 -0.081 -0.077 -0.073 0.016 0.007 0.011 0.003 0.002 0.000 -0.002 PRE CT Equity PACIFIC RUBIALES ENERGY CORP Energy 24.75 1.51% 14.03.2012 37.56 38.51 38.24 38.33 39.72 46.52 53.37 -0.476 -0.273 -0.288 -0.203 -0.137 -0.028 0.083 0.016 0.006 0.007 0.005 0.001 -0.005 -0.011 PAA CT Equity PAN AMERICAN SILVER CORP Materials 23.00 0.44% 23.02.2012 48.72 46.44 45.77 44.87 -0.247 -0.167 -0.149 -0.091 0.009 0.004 0.003 0.001 POU CT Equity PARAMOUNT RESOURCES LTD -A Energy 34.01 33.24 36.08 36.49 37.32 -0.210 -0.122 -0.134 -0.092 0.029 0.002 0.002 0.000 PKI CT Equity PARKLAND FUEL CORP Energy 12.86 7.93% 21.02.2012 PSI CT Equity PASON SYSTEMS INC Energy 12.99 3.31% 11.06.2012 PPL CT Equity PEMBINA PIPELINE CORP Energy 26.71 5.84% 22.02.2012 19.72 18.53 17.85 0.405 0.044 -0.022 0.026 0.011 0.017 PGF CT Equity PENGROWTH ENERGY CORP Energy 10.12 8.30% 21.02.2012 24.37 27.56 24.19 -0.169 -0.062 -0.108 0.076 0.029 0.021 S&P / TSX Index PWT CT Equity PENN WEST PETROLEUM LTD Energy 21.58 5.00% 28.03.2012 27.69 28.79 29.32 30.61 -0.439 -0.270 -0.282 -0.240 0.031 0.007 0.007 0.006 PBN CT Equity PETROBAKKEN ENERGY LTD-A Energy 15.00 6.40% 24.02.2012 45.65 45.16 47.89 -0.220 -0.249 -0.362 0.023 0.009 0.002 PBG CT Equity PETROBANK ENERGY & RESOURCES Energy 14.19 51.22 50.24 49.07 -0.331 -0.196 -0.205 0.024 0.009 0.008 PMG CT Equity PETROMINERALES LTD Energy 20.80 2.55% 27.03.2012 48.60 48.26 47.11 -0.346 -0.148 -0.145 0.011 0.004 0.005 PEY CT Equity PEYTO EXPLORATION & DEV CORP Energy 19.52 3.69% 27.04.2012 33.03 34.18 33.00 0.111 -0.177 -0.139 0.030 0.004 0.003 POT CT Equity POTASH CORP OF SASKATCHEWAN Materials 47.26 1.19% 11.07.2012 30.10 30.85 30.71 32.65 33.84 35.42 37.01 -0.230 -0.183 -0.173 -0.170 -0.120 -0.101 -0.082 0.022 0.007 0.004 0.002 0.000 0.000 0.000 POW CT Equity POWER CORP OF CANADA Financials 24.09 5.06% 21.03.2012 19.28 20.32 20.30 -0.187 -0.084 -0.316 0.041 0.014 0.016 PWF CT Equity POWER FINANCIAL CORP Financials 26.11 5.40% 28.03.2012 18.06 18.80 17.34 -0.248 -0.169 -0.229 0.020 0.007 0.013 PD CT Equity PRECISION DRILLING CORP Energy 9.97 47.21 44.10 42.51 -0.351 -0.365 -0.331 0.028 0.012 0.007 PG CT Equity PREMIER GOLD MINES LTD Materials 5.82 71.09 64.87 63.23 -0.899 -0.787 -0.762 0.059 0.030 0.023 PMZ-U CT Equity PRIMARIS RETAIL REAL ESTATE Financials 21.51 5.67% 24.02.2012 37.56 26.98 23.53 -0.271 -0.214 -0.351 0.048 0.036 0.038 PRQ CT Equity PROGRESS ENERGY RESOURCES CO Energy 10.70 3.74% 27.03.2012 37.88 39.28 36.87 -0.292 -0.162 -0.194 0.051 0.017 0.008 BIN CT Equity PROGRESSIVE WASTE SOLUTIONS Industrials 22.66 2.47% 28.03.2012 16.90 18.49 18.41 -0.748 -0.388 -0.302 0.034 0.014 0.016 PVE CT Equity PROVIDENT ENERGY LTD Energy 11.15 4.84% 22.02.2012 30.05 23.59 23.46 -0.541 -0.261 -0.254 0.078 0.048 0.035 QUX CT Equity QUADRA FNX MINING LTD Materials 14.97 32.59 49.13 35.68 -0.543 -0.633 -0.954 0.152 0.074 0.050 QBR/B CT Equity QUEBECOR INC -CL B Consumer Discretionary 34.35 0.58% 21.03.2012 RET/A CT Equity REITMANS (CANADA) LTD-A Consumer Discretionary 14.74 5.43% 10.04.2012 RIM CT Equity RESEARCH IN MOTION Information Technology 16.63 64.04 63.33 62.65 60.46 59.48 59.34 59.19 -0.071 -0.075 -0.067 -0.067 -0.044 -0.058 -0.072 0.013 0.006 0.004 0.000 0.000 0.000 0.000 REI-U CT Equity RIOCAN REAL ESTATE INVST TR Financials 26.02 5.50% 24.02.2012 20.61 18.76 18.28 0.211 0.183 -0.015 0.030 0.017 0.019 RCI/B CT Equity ROGERS COMMUNICATIONS INC-B Telecommunication Services 38.27 4.08% 14.03.2012 18.40 18.95 18.87 19.82 20.99 21.73 22.47 -0.223 -0.202 -0.176 -0.175 -0.106 -0.068 -0.030 0.049 0.025 0.016 0.004 0.002 0.001 0.001 R CT Equity ROMARCO MINERALS INC Materials 1.27 RON CT Equity RONA INC Consumer Discretionary 9.48 1.48% 07.03.2012 30.04 27.96 27.63 27.96 -0.253 -0.137 -0.168 -0.167 0.043 0.018 0.014 0.006 RY CT Equity ROYAL BANK OF CANADA Financials 52.30 4.28% 24.04.2012 15.19 16.97 16.64 18.27 19.33 21.14 23.01 -0.316 -0.306 -0.308 -0.287 -0.245 -0.214 -0.181 0.048 0.027 0.019 0.008 0.003 0.002 0.001 RMX CT Equity RUBICON MINERALS CORP Materials 4.29 59.62 56.77 57.72 -0.467 -0.445 -0.224 0.027 0.012 0.004 RUS CT Equity RUSSEL METALS INC Industrials 24.88 5.23% 23.02.2012 24.87 22.25 21.91 -0.463 -0.191 -0.340 0.025 0.005 0.008 SGR CT Equity SAN GOLD CORP Materials 1.92 SAP CT Equity SAPUTO INC Consumer Staples 38.44 2.08% 01.03.2012 23.54 24.32 25.10 -0.241 -0.145 -0.155 0.016 0.005 0.011 SVY CT Equity SAVANNA ENERGY SERVICES CORP Energy 7.02 07.03.2012 34.93 36.61 35.99 -0.346 -0.282 -0.271 0.067 0.023 0.013 SMF CT Equity SEMAFO INC Materials 7.45 55.44 49.94 48.86 -0.182 -0.182 -0.175 0.021 0.012 0.005 SJR/B CT Equity SHAW COMMUNICATIONS INC-B Consumer Discretionary 19.72 4.90% 13.06.2012 15.78 15.30 16.24 18.50 0.233 0.013 -0.061 -0.134 0.032 0.022 0.019 0.008 SCL/A CT Equity SHAWCOR LTD-CLASS A Energy 29.46 1.14% 14.03.2012 38.53 39.81 37.68 -0.199 -0.046 -0.062 0.020 -0.005 -0.001 S CT Equity SHERRITT INTERNATIONAL CORP Materials 6.33 2.43% 27.03.2012 44.90 38.68 38.65 -0.367 -0.230 -0.210 0.034 0.017 0.008 SC CT Equity SHOPPERS DRUG MART CORP Consumer Staples 40.76 2.65% 28.03.2012 18.88 18.00 17.73 18.87 20.11 21.37 22.65 -0.177 -0.190 -0.271 -0.158 -0.132 -0.120 -0.108 0.022 0.014 0.015 0.002 0.002 0.001 0.000 SSO CT Equity SILVER STANDARD RESOURCES Materials 17.86 49.51 50.71 50.69 -0.380 -0.150 -0.111 0.016 0.005 0.003 SLW CT Equity SILVER WHEATON CORP Materials 35.78 1.09% 14.03.2012 35.90 38.60 39.49 41.79 -0.401 -0.179 -0.157 -0.097 0.019 0.005 0.004 0.001 SVM CT Equity SILVERCORP METALS INC Materials 8.20 1.34% 28.03.2012 51.61 50.05 50.07 -0.454 -0.239 -0.198 0.036 0.014 0.004 SNC CT Equity SNC-LAVALIN GROUP INC Industrials 52.00 1.92% 14.03.2012 26.65 28.38 28.95 30.48 -0.412 -0.392 -0.347 -0.205 0.032 0.013 0.009 0.002 SGQ CT Equity SOUTHGOBI RESOURCES LTD Energy 7.10 67.23 64.41 63.86 -0.568 -0.213 -0.262 0.033 0.007 0.001 STN CT Equity STANTEC INC Industrials 27.55 20.69 23.71 23.61 -0.143 -0.224 -0.278 0.016 0.005 0.009 SLF CT Equity SUN LIFE FINANCIAL INC Financials 19.78 7.48% 27.02.2012 28.56 27.11 26.12 27.09 28.64 30.96 33.43 -0.251 -0.142 -0.172 -0.231 -0.166 -0.143 -0.120 0.033 0.014 0.013 0.003 0.002 0.001 0.001 SU CT Equity SUNCOR ENERGY INC Energy 34.21 1.37% 29.02.2012 26.99 27.48 27.32 28.41 31.60 32.68 33.78 -0.506 -0.337 -0.329 -0.314 -0.249 -0.203 -0.157 0.030 0.016 0.012 0.004 0.001 0.001 0.001 SPB CT Equity SUPERIOR PLUS CORP Industrials 6.34 9.46% 24.02.2012 47.88 45.82 42.64 -0.299 -0.162 -0.193 0.032 0.011 0.007 SXC CT Equity SXC HEALTH SOLUTIONS CORP Health Care 62.17 40.00 40.60 39.47 -0.170 -0.066 -0.122 0.003 0.001 0.005 THO CT Equity TAHOE RESOURCES INC Materials 21.20 40.81 41.46 41.95 -0.553 -0.229 -0.205 0.020 0.006 0.006 TLM CT Equity TALISMAN ENERGY INC Energy 12.03 2.46% 30.05.2012 42.10 40.86 40.54 40.66 42.51 43.55 44.60 -0.310 -0.273 -0.239 -0.163 -0.114 -0.108 -0.102 0.031 0.011 0.008 0.001 0.000 -0.001 -0.001 TKO CT Equity TASEKO MINES LTD Materials 3.50 68.01 69.48 68.87 -0.519 -0.115 -0.139 0.029 0.011 0.009 TCK/B CT Equity TECK RESOURCES LTD-CLS B Materials 42.25 1.89% 12.06.2012 35.92 35.15 35.92 37.63 39.00 41.51 44.04 -0.427 -0.400 -0.358 -0.267 -0.216 -0.196 -0.176 0.026 0.007 0.005 0.004 0.002 0.001 0.001 T CT Equity TELUS CORP Telecommunication Services 56.35 4.33% 07.03.2012 16.20 16.62 17.47 19.09 20.13 21.31 22.54 -0.239 -0.141 -0.113 -0.038 0.000 -0.011 -0.022 0.042 0.022 0.014 0.003 0.001 0.001 0.000 TCM CT Equity THOMPSON CREEK METALS CO INC Materials 8.57 46.70 48.59 48.05 -0.247 -0.239 -0.226 0.030 0.009 0.005 TRI CT Equity THOMSON REUTERS CORP Consumer Discretionary 27.67 4.79% 20.02.2012 25.58 23.68 23.19 23.52 -0.233 -0.136 -0.174 -0.211 0.043 0.018 0.013 0.004 THI CT Equity TIM HORTONS INC Consumer Discretionary 48.59 1.65% 05.03.2012 19.32 20.01 19.94 -0.084 -0.159 -0.212 0.013 0.007 0.009 X CT Equity TMX GROUP INC Financials 41.87 4.01% 22.02.2012 33.43 28.39 -0.192 -0.205 0.007 0.003 TIH CT Equity TOROMONT INDUSTRIES LTD Industrials 22.15 2.17% 07.03.2012 22.31 22.36 22.22 -0.751 -0.316 -0.269 0.034 0.012 0.011 TD CT Equity TORONTO-DOMINION BANK Financials 77.49 3.66% 03.04.2012 16.89 18.11 17.45 19.01 21.20 24.83 28.54 -0.294 -0.326 -0.327 -0.308 -0.220 -0.160 -0.100 0.042 0.022 0.016 0.007 0.001 -0.003 -0.007 TOU CT Equity TOURMALINE OIL CORP Energy 25.16 7.00 34.31 33.77 -0.279 -0.177 -0.145 0.033 0.008 0.008 TA CT Equity TRANSALTA CORP Utilities 20.24 5.73% 30.05.2012 13.89 13.93 14.13 14.43 0.017 0.032 -0.008 -0.081 0.039 0.025 0.002 0.013 TRP CT Equity TRANSCANADA CORP Energy 41.33 4.26% 27.03.2012 18.37 17.87 17.43 17.98 22.22 26.47 30.82 -0.309 -0.197 -0.151 -0.173 -0.151 -0.076 0.001 0.047 0.025 0.020 0.008 0.000 0.006 0.012 TCL/A CT Equity TRANSCONTINENTAL INC-CL A Industrials 12.56 4.78% 29.03.2012 32.10 34.84 34.74 -0.321 -0.165 -0.174 0.059 0.008 0.007 TFI CT Equity TRANSFORCE INC Industrials 16.15 2.85% 28.03.2012 27.67 27.97 25.54 -0.552 -0.244 -0.291 0.040 0.006 0.011 TGL CT Equity TRANSGLOBE ENERGY CORP Energy 9.34 60.51 58.93 62.78 -0.170 -0.231 -0.172 0.029 0.015 0.007 TCW CT Equity TRICAN WELL SERVICE LTD Energy 16.27 0.61% 27.06.2012 42.01 42.94 43.04 42.25 -0.297 -0.196 -0.213 -0.147 0.027 0.005 0.004 0.002 TET CT Equity TRILOGY ENERGY CORP Energy 31.19 2.08% 24.02.2012 32.45 35.30 34.81 -0.002 -0.201 -0.219 0.019 0.005 0.006 TDG CT Equity TRINIDAD DRILLING LTD Energy 6.59 3.03% 28.03.2012 50.64 47.30 45.77 -0.260 -0.308 -0.290 0.034 0.010 0.006 UUU CT Equity URANIUM ONE INC Energy 2.75 70.83 66.76 63.54 -0.260 -0.179 -0.064 0.026 0.013 0.009 VRX CT Equity VALEANT PHARMACEUTICALS INTE Health Care 49.00 37.25 38.27 38.15 -0.242 -0.199 -0.244 0.006 0.002 0.004 VSN CT Equity VERESEN INC Energy 15.22 6.57% 24.02.2012 18.86 20.21 17.61 -0.053 -0.056 -0.165 0.063 0.036 0.032 VET CT Equity VERMILION ENERGY INC Energy 45.70 5.01% 24.02.2012 18.45 24.08 23.21 -0.133 -0.227 -0.223 0.022 0.006 0.010 VT CT Equity VITERRA INC Consumer Staples 10.27 1.46% 04.07.2012 26.17 24.90 23.96 -0.282 -0.203 -0.180 0.059 0.028 0.018 WFT CT Equity WEST FRASER TIMBER CO LTD Materials 48.01 1.17% 15.03.2012 WJA CT Equity WESTJET AIRLINES LTD Industrials 12.34 1.62% 12.03.2012 31.90 30.21 30.11 -0.377 -0.208 -0.134 0.042 0.020 0.015 WPT CT Equity WESTPORT INNOVATIONS INC Industrials 38.65 47.70 47.32 48.42 -0.468 -0.303 -0.260 0.014 0.007 0.005 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 30.01.2012 Option Implied Volatility Skew Parameters by Terms: At The Money Implied Volatilities by Terms 2 IVt = atx + btx + ct Next Ex- Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Dividend ATM2 ATM2 ATM2 ATM2 ATM2 ATM2 ATM2 Ticker Name GICS_SECTOR_NAME ATM2 Ref Dividend (a) - (a) - (a) - (a) - (a) - (a) - (a) - (b) - (b) - (b) - (b) - (b) - (b) - (b) - Yield Vol - 30D Vol - 60D Vol - 90D Vol - 6M Vol - 12M Vol - 18M Vol - 24M Date 30D 60D 90D 6M 12M 18M 24M 30D 60D 90D 6M 12M 18M 24M WPT CT Equity WESTPORT INNOVATIONS INC Industrials 38.65 47.70 47.32 48.42 -0.468 -0.303 -0.260 0.014 0.007 0.005 WTE-U CT Equity WESTSHORE TERMINALS INVESTME Industrials 24.73 4.69% 28.03.2012 WIN CT Equity WI-LAN INC Information Technology 5.49 2.55% 13.03.2012 72.48 62.54 61.97 -0.437 -0.034 -0.082 0.012 0.006 0.003 YRI CT Equity YAMANA GOLD INC Materials 17.36 1.19% 27.03.2012 34.75 36.10 36.13 36.71 38.22 40.09 41.98 -0.289 -0.156 -0.120 -0.057 -0.028 -0.052 -0.075 0.021 0.008 0.006 0.002 0.001 0.001 0.001 YLO CT Equity YELLOW MEDIA INC Consumer Discretionary 0.20 28.03.2012 285.80 285.80 0.000 0.000 0.000 0.000 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security S&P / TSX Index 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security 0 #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security #N/A Invalid Security Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |