Financial Analysis - EDF SA (Electricite de France) produces, transmits, distributes, imports and exports electricity. The Company, using nuclear power, coal and gas, provides electricity for French energy consumer

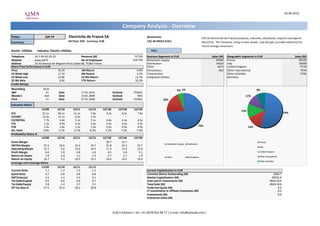

- 1. 24.04.2013 Company Analysis - Overview Ticker: EDF FP Electricite de France SA Benchmark: EDF SA (Electricite de France) produces, transmits, distributes, imports and exports Currency: EN Paris: EDF, Currency: EUR CAC 40 INDEX (CAC) electricity. The Company, using nuclear power, coal and gas, provides electricity for French energy consumers. Sector: Utilities Industry: Electric Utilities Year: Telephone 33-1-40-42-22-22 Revenue (M) 72'729 Business Segments in EUR Sales (M) Geographic Segments in EUR Sales (M) Website www.edf.fr No of Employees 154'730 Generation Supply 54594 France 39120 Address 22-30 Avenue de Wagram Paris Cedex 08, 75382 France Distribution 14625 Italy 10098 Share Price Performance in EUR Other 4073 United Kingdom 9739 Price 16.24 1M Return 6.9% Eliminations -563 Other International 7976 52 Week High 17.19 6M Return 1.1% Transmission Other Activities 5796 52 Week Low 12.86 52 Wk Return 13.7% Integrated Utilities Germany 52 Wk Beta 0.82 YTD Return 16.2% Credit Ratings Bloomberg IG10 6% 1% 8% S&P A+ Date 17.01.2012 Outlook STABLE Moody's Aa3 Date 14.01.2009 Outlook NEG 11% Fitch A+ Date 07.01.2009 Outlook STABLE 20% Valuation Ratios 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E 13% P/E 21.1x 89.1x 11.1x 7.8x 9.3x 8.5x 7.9x 54% EV/EBIT 13.3x 15.1x 9.2x 9.7x - - - EV/EBITDA 7.7x 6.0x 5.1x 5.1x 4.8x 4.6x 4.3x P/S 1.3x 0.9x 0.5x 0.4x 0.4x 0.4x 0.4x P/B 2.6x 1.8x 1.2x 1.0x 0.9x 0.9x 0.9x 73% 14% Div Yield 2.8% 3.7% 6.1% 8.2% 7.2% 7.2% 7.4% Profitability Ratios % 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Gross Margin - - - - 20.7 21.7 - France Generation Supply Distribution EBITDA Margin 27.2 24.0 21.6 19.7 21.8 22.3 22.7 Italy Operating Margin 15.7 9.6 12.0 10.3 11.9 12.4 12.6 Profit Margin 6.6 1.6 4.8 4.6 4.5 4.8 5.1 United Kingdom Return on Assets 1.8 0.4 1.3 1.4 2.7 2.7 1.9 Other Eliminations Other International Return on Equity 14.7 3.3 10.5 12.2 10.6 10.5 10.6 Other Activities Leverage and Coverage Ratios 12/09 12/10 12/11 12/12 Current Ratio 1.1 1.3 1.3 1.2 Current Capitalization in EUR Quick Ratio 0.7 0.8 0.8 0.8 Common Shares Outstanding (M) 1846.7 EBIT/Interest 3.4 2.3 3.4 3.1 Market Capitalization (M) 30025.6 Tot Debt/Capital 0.6 0.6 0.6 0.7 Cash and ST Investments (M) #N/A N/A Tot Debt/Equity 1.8 1.4 1.7 2.1 Total Debt (M) #N/A N/A Eff Tax Rate % 27.5 55.4 28.3 30.8 Preferred Equity (M) 0.0 LT Investments in Affiliate Companies (M) 0.0 Investments (M) 0.0 Enterprise Value (M) Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. Company Analysis - Analysts Ratings Electricite de France SA Target price in EUR Broker Recommendation Buy and Sell Recommendations vs Price and Target Price Price Brokers' Target Price 30 35 100% 4% 4% 4% 8% 17% 30 22% 24% 25% 30% 33% 33% 25 80% 41% 25 50% 50% 48% 46% 20 20 42% 35% 60% 38% 15 45% 15 50% 42% 38% 10 40% 36% 10 5 48% 0 46% 46% 46% 42% 43% Day by Day Bryan Garnier & Cie Morgan Stanley 20% Barclays Main First Bank AG Kepler Capital Markets Raymond James S&P Capital IQ Natixis Exane BNP Paribas Credit Suisse JPMorgan Macquarie Societe Generale HSBC DZ Bank AG EVA Dimensions AlphaValue Berenberg Bank Goldman Sachs Deutsche Bank Landesbank Baden- 38% 5 30% 29% Wuerttemberg 23% 25% 20% 0% 0 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 févr.13 mars.13 Buy Hold Sell Price Target Price Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date 29-Mar-13 29% 38% 33% 24-Apr-13 16.24 15.90 Exane BNP Paribas BENJAMIN LEYRE outperform 20.00 24-Apr-13 28-Feb-13 25% 42% 33% 23-Apr-13 16.28 15.90 Morgan Stanley EMMANUEL TURPIN Overwt/In-Line 19.00 23-Apr-13 31-Jan-13 23% 36% 41% 22-Apr-13 15.90 15.90 Bryan Garnier & Cie JULIEN DESMARETZ sell 12.00 22-Apr-13 31-Dec-12 30% 45% 25% 19-Apr-13 15.77 15.90 Deutsche Bank MARTIN BROUGH sell 12.50 19-Apr-13 30-Nov-12 20% 50% 30% 18-Apr-13 15.54 16.25 Credit Suisse MICHEL DEBS underperform 12.00 18-Apr-13 31-Oct-12 38% 38% 24% 17-Apr-13 15.57 16.56 AlphaValue MYRIAM COHEN add 16.80 18-Apr-13 28-Sep-12 43% 35% 22% 16-Apr-13 15.76 16.54 Goldman Sachs ANDREW MEAD Buy/Neutral 19.60 17-Apr-13 31-Aug-12 42% 42% 17% 15-Apr-13 16.17 16.54 Raymond James EMMANUEL RETIF underperform 12.90 17-Apr-13 31-Jul-12 46% 46% 8% 12-Apr-13 16.16 16.31 Societe Generale VINCENT AYRAL buy 20.00 12-Apr-13 29-Jun-12 48% 48% 4% 11-Apr-13 16.33 16.04 Day by Day VALERIE GASTALDY buy 18.25 10-Apr-13 31-May-12 46% 50% 4% 10-Apr-13 16.37 16.04 HSBC ADAM DICKENS neutral 17.00 5-Apr-13 30-Apr-12 46% 50% 4% 9-Apr-13 15.78 16.04 JPMorgan VINCENT DE BLIC overweight 20.00 4-Apr-13 8-Apr-13 15.54 16.04 Macquarie SHAI HILL outperform 19.00 21-Mar-13 5-Apr-13 15.57 15.83 EVA Dimensions AUSTIN BURKETT hold 25-Feb-13 4-Apr-13 15.59 15.77 S&P Capital IQ CLIVE ROBERTS hold 15.00 21-Feb-13 3-Apr-13 15.29 15.77 Natixis PHILIPPE OURPATIAN neutral 16.20 15-Feb-13 2-Apr-13 15.42 15.95 Barclays JULIE ARAV underweight 13.00 15-Feb-13 1-Apr-13 14.96 15.95 Berenberg Bank TEAM COVERAGE hold 14.60 5-Feb-13 29-Mar-13 14.96 15.95 Main First Bank AG ANDREAS THIELEN underperform 15.50 29-Jan-13 28-Mar-13 14.96 15.95 Kepler Capital Markets INGO BECKER reduce 13.00 14-Jan-13 27-Mar-13 15.07 15.95 Landesbank Baden-Wuerttemberg ERKAN AYCICEK hold 16.50 3-Dec-12 26-Mar-13 15.31 15.95 DZ Bank AG HASIM SENGUEL buy 33.00 15-Nov-11 25-Mar-13 14.95 15.95 22-Mar-13 15.20 16.17 21-Mar-13 15.22 16.17 20-Mar-13 14.95 16.23 19-Mar-13 14.73 16.23 18-Mar-13 14.73 16.23 15-Mar-13 14.65 16.23 14-Mar-13 14.88 16.23 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 24.04.2013 Electricite de France SA Company Analysis - Ownership Ownership Type Ownership Statistics Geographic Ownership Distribution Geographic Ownership 0% Shares Outstanding (M) 1846.7 13% France 98.28% 0% 0% 0% 0% Float 15.5% United States 1.03% 1% 0% Short Interest (M) Luxembourg 0.23% Short Interest as % of Float Britain 0.09% Days to Cover Shorts Ireland 0.08% Institutional Ownership 86.56% Spain 0.06% Retail Ownership 13.44% Germany 0.04% Insider Ownership 0.00% Others 0.19% Institutional Ownership Distribution 87% 99% Government 97.62% Investment Advisor 2.37% Insurance Company 0.01% Institutional Ownership Retail Ownership Insider Ownership Individual 0.00% France United States Luxembourg Britain Pricing data is in EUR Others 0.00% Ireland Spain Germany Others Top 20 Owners: TOP 20 ALL Institutional Ownership Holder Name Position Position Change Market Value % of Ownership Report Date Source Country FRENCH STATE 1'561'222'705 0 25'354'256'729 84.44% 31.12.2011 Co File FRANCE 0% 0% 0% THORNBURG INVESTMENT 3'709'100 -650'900 60'235'784 0.20% 28.02.2013 MF-AGG UNITED STATES 2% NATIXIS ASSET MANAGE 3'302'225 -33'501 53'628'134 0.18% 28.03.2013 MF-AGG FRANCE ALLIANCE BERNSTEIN 2'489'471 1'033'639 40'429'009 0.13% 28.02.2013 ULT-AGG UNITED STATES VANGUARD GROUP INC 2'448'957 61'552 39'771'062 0.13% 31.03.2013 MF-AGG UNITED STATES BLACKROCK 2'285'754 -4'180 37'120'645 0.12% 22.04.2013 ULT-AGG UNITED STATES ING INTERNATIONAL AD 1'950'132 227'402 31'670'144 0.11% 31.12.2012 MF-AGG LUXEMBOURG NUVEEN ASSET MANAGEM 1'830'103 -118'251 29'720'873 0.10% 31.03.2013 MF-AGG UNITED STATES AVIVA PLC 1'574'700 0 25'573'128 0.09% 28.03.2013 MF-AGG BRITAIN ELECTRICITE DE FRANC 1'175'594 0 19'091'647 0.06% 31.12.2011 Co File FRANCE 98% JP MORGAN 972'086 116'930 15'786'677 0.05% 28.02.2013 ULT-AGG AMUNDI 889'716 -15'345 14'448'988 0.05% 30.11.2012 MF-AGG FRANCE AMUNDI 828'591 0 13'456'318 0.04% 30.11.2012 MF-AGG FRANCE Government Investment Advisor Insurance Company STATE STREET 807'076 -13'911 13'106'914 0.04% 23.04.2013 ULT-AGG UNITED STATES Individual Others BANK OF NEW YORK MEL 668'765 0 10'860'744 0.04% 23.04.2013 MF-AGG UNITED STATES FMR LLC 662'193 59'201 10'754'014 0.04% 28.02.2013 ULT-AGG UNITED STATES SANFORD C BERNSTEIN 656'530 0 10'662'047 0.04% 30.11.2012 MF-AGG UNITED STATES AGICAM 644'691 0 10'469'782 0.03% 28.02.2013 MF-AGG FRANCE ROTHSCHILD & COMPAGN 640'000 0 10'393'600 0.03% 31.01.2013 MF-AGG FRANCE TAUBE HODSON STONEX 610'970 0 9'922'153 0.03% 31.01.2013 MF-AGG BRITAIN Top 5 Insiders: Holder Name Position Position Change Market Value % of Ownership Report Date Source GRILLAT ALEXANDRE 328 5'327 0.00% 31.12.2011 Co File CROUZET PHILIPPE 200 3'248 0.00% 31.12.2011 Co File JAY MICHAEL 200 3'248 0.00% 31.12.2011 Co File LAFONT BRUNO 150 2'436 0.00% 31.12.2011 Co File FAUGERE MIREILLE 106 1'721 0.00% 31.12.2011 Co File Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 4. Company Analysis - Financials I/IV Electricite de France SA Financial information is in EUR (M) Equivalent Estimates Periodicity: Fiscal Year 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Income Statement Revenue 48'359 44'919 46'788 51'047 58'932 59'637 63'847 59'140 65'320 65'307 72'729 73'496 75'671 78'233 - Cost of Goods Sold Gross Income 15'214 16'421 - Selling, General & Admin Expenses 43'893 38'930 38'403 43'054 49'576 49'646 55'937 49'834 59'080 57'495 65'236 (Research & Dev Costs) 402 389 375 421 438 486 518 527 Operating Income 4'466 5'989 8'385 7'993 9'356 9'991 7'910 9'306 6'240 7'812 7'493 8'765 9'398 9'837 - Interest Expense 1'986 1'508 1'568 1'556 1'655 1'660 1'684 2'529 2'528 2'017 2'018 - Foreign Exchange Losses (Gains) 96 -24 59 -175 -36 72 66 9 -63 15 -2 - Net Non-Operating Losses (Gains) 983 2'003 5'075 1'844 819 634 933 1'562 1'827 1'057 334 Pretax Income 1'401 2'502 1'683 4'768 6'918 7'625 5'227 5'206 1'948 4'723 5'143 4'981 5'459 5'760 - Income Tax Expense 986 1'567 1'072 1'445 1'146 1'841 1'599 1'432 1'079 1'336 1'586 Income Before XO Items 415 935 611 3'323 5'772 5'784 3'628 3'774 869 3'387 3'557 - Extraordinary Loss Net of Tax 0 0 0 -5 -9 0 -311 -380 0 0 - Minority Interests -66 78 -13 93 172 175 144 183 229 239 241 Diluted EPS Before XO Items 0.53 0.38 1.96 3.07 3.08 1.91 1.97 0.34 1.70 1.80 Net Income Adjusted* 481 857 1'341 3'242 4'227 4'718 4'308 3'905 3'925 3'520 4'216 3'330 3'649 3'951 EPS Adjusted 0.00 0.00 0.38 1.97 2.33 2.59 2.37 2.14 2.12 1.91 2.29 1.75 1.91 2.06 Dividends Per Share 0.00 0.79 1.16 1.28 1.28 1.15 1.15 1.15 1.15 1.16 1.17 1.20 Payout Ratio % 0.0 0.0 44.6 37.7 41.6 66.8 59.2 331.6 67.5 64.1 0.67 0.61 0.58 Total Shares Outstanding 1'626 1'626 1'822 1'822 1'822 1'819 1'849 1'848 1'848 1'847 Diluted Shares Outstanding 1'626 1'626 1'648 1'822 1'822 1'823 1'824 1'848 1'847 1'847 EBITDA 9'881 12'523 13'227 13'010 14'719 15'619 13'624 16'102 15'688 14'097 14'342 15'997 16'909 17'756 *Net income excludes extraordinary gains and losses and one-time charges. Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 5. Company Analysis - Financials II/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Balance Sheet Total Current Assets 30765 31909 35784 47612 48262 51577 59154 60214 63670 67980 68085 + Cash & Near Cash Items 1'172 2'523 3'820 7'220 3'308 6'035 5'869 6'982 4'829 5'743 5'874 + Short Term Investments 2'511 11'966 17'010 14'876 12'450 16'788 16'980 16'433 + Accounts & Notes Receivable 12'368 14'394 13'733 16'107 15'716 16'100 19'144 19'633 19'524 20'908 22'497 + Inventories 8'102 6'924 6'678 6'695 7'431 8'678 9'290 12'662 12'685 13'581 14'213 + Other Current Assets 6'612 8'068 11'553 5'624 4'797 5'888 24'851 8'487 9'844 10'768 9'068 Total Long-Term Assets 114'074 114'991 115'675 123'524 130'824 134'572 141'338 179'821 176'889 163'982 182'033 + Long Term Investments 8'569 7'315 8'118 9'012 13'094 15'805 18'103 24'498 24'921 24'260 30'471 Gross Fixed Assets 180'818 179'049 181'351 188'655 193'422 198'301 204'620 231'582 199'645 208'464 222'167 Accumulated Depreciation 85'396 80'037 83'706 86'988 89'541 93'360 97'045 103'540 92'445 96'496 99'925 + Net Fixed Assets 95'422 99'012 97'645 101'667 103'881 104'941 107'575 128'042 107'200 111'968 122'242 + Other Long Term Assets 10'083 8'664 9'912 12'845 13'849 13'826 15'660 27'281 44'768 27'754 29'320 Total Current Liabilities 33'583 35'356 37'278 39'932 44'922 48'692 58'217 57'177 49'651 51'409 58'368 + Accounts Payable 6'353 8'164 6'663 8'872 9'457 9'867 13'957 13'348 12'805 13'681 14'643 + Short Term Borrowings 8'146 9'890 9'759 11'933 15'110 16'918 18'958 16'560 12'766 12'789 17'521 + Other Short Term Liabilities 19'084 17'302 20'856 19'127 20'355 21'907 25'302 27'269 24'080 24'939 26'204 Total Long Term Liabilities 96'387 91'705 104'212 110'930 109'365 108'661 117'277 148'191 154'005 147'881 161'038 + Long Term Borrowings 21'366 19'714 20'636 23'511 19'983 17'607 25'584 44'755 40'646 42'688 46'980 + Other Long Term Borrowings 75'021 71'991 83'576 87'419 89'382 91'054 91'693 103'436 113'359 105'193 114'058 Total Liabilities 129'970 127'061 141'490 150'862 154'287 157'353 175'494 205'368 203'656 199'290 219'406 + Long Preferred Equity 0 0 0 0 0 0 0 0 0 0 0 + Minority Interest 986 915 897 961 1'490 1'586 1'801 4'776 5'586 4'189 4'854 + Share Capital & APIC 8'154 8'129 8'129 911 911 911 911 924 924 924 924 + Retained Earnings & Other Equity 5'729 10'795 943 18'402 22'398 26'299 22'286 28'967 30'393 27'559 24'934 Total Shareholders Equity 14'869 19'839 9'969 20'274 24'799 28'796 24'998 34'667 36'903 32'672 30'712 Total Liabilities & Equity 144'839 146'900 151'459 171'136 179'086 186'149 200'492 240'035 240'559 231'962 250'118 Book Value Per Share 11.64 5.58 10.60 12.79 14.93 12.75 16.17 16.94 15.42 14.00 17.17 17.73 18.45 Tangible Book Value Per Share 7.63 1.48 5.62 7.73 9.62 7.31 5.83 7.94 6.57 4.24 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 6. Company Analysis - Financials III/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Cash Flows Net Income 481 857 624 3'230 5'605 5'618 3'484 3'902 1'020 3'148 3'316 3'322 3'622 3'890 + Depreciation & Amortization 5'415 6'534 4'842 5'017 5'363 5'628 5'714 6'796 9'448 6'285 6'849 + Other Non-Cash Adjustments 2'753 -712 2'056 -1'179 173 -755 -1'415 1'983 977 849 2'149 + Changes in Non-Cash Capital 470 17 473 1'371 654 -269 -211 -1'468 -335 -1'785 -2'390 Cash From Operating Activities 9'119 6'696 7'995 8'439 11'795 10'222 7'572 11'213 11'110 8'497 9'924 + Disposal of Fixed Assets 1'683 1'778 383 392 272 229 214 201 188 497 748 + Capital Expenditures -7'486 -4'963 -4'940 -5'168 -5'935 -7'490 -9'703 -11'777 -12'241 -11'134 -13'386 -12'750 -12'803 -13'035 + Increase in Investments 0 -1'413 -2'894 -8'797 -6'895 -6'272 -1'792 + Decrease in Investments 0 0 761 1'580 462 222 + Other Investing Activities -4'080 -557 -97 -2'951 691 253 -281 -14'120 3'398 3'624 20 Cash From Investing Activities -9'883 -5'155 -3'893 -10'621 -13'769 -5'428 -16'665 -25'234 -14'927 -6'791 -14'410 + Dividends Paid -378 -208 -321 -374 -1'439 -3'170 -2'438 -1'228 -2'163 -2'122 -2'125 + Change in Short Term Borrowings 0 0 + Increase in Long Term Borrowings 6'250 8'236 3'865 2'810 3'686 7'059 15'717 29'272 8'642 5'846 12'431 + Decrease in Long Term Borrowings -3'893 -9'287 -7'230 -3'247 -4'254 -6'357 -4'882 -15'244 -4'652 -4'071 -4'869 + Increase in Capital Stocks 0 33 43 6'377 24 178 249 12 + Decrease in Capital Stocks 0 0 -6 -180 -10 -14 -15 + Other Financing Activities 178 122 162 686 45 229 461 2'549 488 -1'176 -809 Cash From Financing Activities 2'157 -1'104 -3'481 6'252 -1'938 -2'067 8'927 15'361 2'305 -1'537 4'613 Net Changes in Cash 1'393 437 621 4'070 -3'912 2'727 -166 1'340 -1'512 169 127 Free Cash Flow (CFO-CAPEX) 1'633 1'733 3'055 3'271 5'860 2'732 -2'131 -564 -1'131 -2'637 -3'462 -1'683 -792 -653 Free Cash Flow To Firm 2'221 2'297 3'624 4'355 7'241 3'991 -962 1'269 -3 -1'191 -2'066 Free Cash Flow To Equity 5'673 2'460 73 3'226 5'564 3'663 8'918 13'665 3'047 -365 4'848 Free Cash Flow per Share 1.07 1.88 1.98 3.22 1.50 -1.17 -0.31 -0.61 -1.43 -1.87 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 7. Company Analysis - Financials IV/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Ratio Analysis Valuation Ratios Price Earnings 16.3x 17.9x 26.5x 21.7x 21.1x 89.1x 11.1x 7.8x 9.3x 8.5x 7.9x EV to EBIT 9.4x 12.5x 16.4x 14.7x 13.3x 15.1x 9.2x 9.7x EV to EBITDA 5.8x 7.9x 10.5x 8.5x 7.7x 6.0x 5.1x 5.1x 4.8x 4.6x 4.3x Price to Sales 1.0x 1.7x 2.5x 1.2x 1.3x 0.9x 0.5x 0.4x 0.4x 0.4x 0.4x Price to Book 3.0x 4.3x 5.5x 3.3x 2.6x 1.8x 1.2x 1.0x 0.9x 0.9x 0.9x Dividend Yield 2.5% 2.1% 1.6% 3.1% 2.8% 3.7% 6.1% 8.2% 7.2% 7.2% 7.4% Profitability Ratios Gross Margin 20.7% 21.7% EBITDA Margin 20.4% 27.9% 28.3% 25.5% 25.0% 26.2% 21.3% 27.2% 24.0% 21.6% 19.7% 21.8% 22.3% 22.7% Operating Margin 9.2% 13.3% 17.9% 15.7% 15.9% 16.8% 12.4% 15.7% 9.6% 12.0% 10.3% 11.9% 12.4% 12.6% Profit Margin 1.0% 1.9% 1.3% 6.3% 9.5% 9.4% 5.5% 6.6% 1.6% 4.8% 4.6% 4.5% 4.8% 5.1% Return on Assets 0.3% 0.6% 0.4% 2.0% 3.2% 3.1% 1.8% 1.8% 0.4% 1.3% 1.4% 2.7% 2.7% 1.9% Return on Equity 3.5% 5.2% 4.5% 22.8% 26.3% 22.2% 13.8% 14.7% 3.3% 10.5% 12.2% 10.6% 10.5% 10.6% Leverage & Coverage Ratios Current Ratio 0.92 0.90 0.96 1.19 1.07 1.06 1.02 1.05 1.28 1.32 1.17 Quick Ratio 0.48 0.48 0.47 0.88 0.80 0.76 0.43 0.68 0.83 0.85 0.77 Interest Coverage Ratio (EBIT/I) 2.25 3.97 5.35 5.14 5.65 6.02 4.70 3.43 2.27 3.44 3.07 Tot Debt/Capital 0.66 0.60 0.75 0.64 0.59 0.55 0.64 0.64 0.59 0.63 0.68 Tot Debt/Equity 1.98 1.49 3.05 1.75 1.42 1.20 1.78 1.77 1.45 1.70 2.10 Others Asset Turnover 0.34 0.31 0.31 0.32 0.34 0.33 0.33 0.27 0.27 0.28 0.30 Accounts Receivable Turnover 4.08 3.36 3.33 3.42 3.70 3.75 3.62 3.05 3.34 3.23 3.35 Accounts Payable Turnover Inventory Turnover Effective Tax Rate 70.4% 62.6% 63.7% 30.3% 16.6% 24.1% 30.6% 27.5% 55.4% 28.3% 30.8% Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 8. Company Analysis - Peers Comparision VEOLIA SUEZ EDF GDF SUEZ E.ON SE RWE AG CENTRICA PLC IBERDROLA SA SSE PLC ENEL SPA ENDESA EDP ELETROBRAS-PR B NATIONAL GRID PL FORTUM OYJ ENVIRONNE ENVIRONNEME Latest Fiscal Year: 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 03/2012 12/2012 12/2012 12/2012 12/2011 03/2012 12/2012 12/2012 52-Week High 17.91 20.35 19.80 36.47 394.30 11.35 4.29 1'553.00 3.30 19.53 2.61 23.42 809.00 16.69 10.93 52-Week High Date 03.07.2012 21.08.2012 14.09.2012 12.09.2012 23.04.2013 30.04.2012 02.01.2013 24.04.2013 14.01.2013 13.03.2013 24.04.2013 25.04.2012 24.04.2013 08.05.2012 02.05.2012 52-Week Low 13.39 14.05 12.42 25.83 301.20 7.38 2.63 1'286.00 2.02 11.30 1.63 7.05 636.00 12.81 7.81 52-Week Low Date 29.11.2012 01.03.2013 08.02.2013 19.04.2013 22.06.2012 16.11.2012 26.07.2012 25.07.2012 24.07.2012 25.07.2012 31.05.2012 22.11.2012 25.07.2012 23.07.2012 19.11.2012 Daily Volume 713'624 2'629'506 6'529'945 2'054'661 4'612'863 1'444'790 24'531'359 580'364 28'121'013 148'017 3'947'338 2'018'700 1'355'058 783'858 468'943 Current Price (4/dd/yy) 16.24 16.47 13.60 26.60 377.10 9.88 4.00 1'542.00 2.84 16.52 2.61 10.37 807.00 14.12 10.26 52-Week High % Change -9.3% -19.1% -31.3% -27.1% -4.4% -12.9% -6.8% -0.7% -13.9% -15.4% -0.2% -55.7% -0.2% -15.4% -6.1% 52-Week Low % Change 21.3% 17.2% 9.5% 3.0% 25.2% 33.9% 52.1% 19.9% 40.7% 46.2% 60.1% 47.1% 26.9% 10.2% 31.3% Total Common Shares (M) 1'846.7 2'357.3 1'906.8 614.7 5'199.0 507.8 6'053.2 944.7 9'403.4 1'058.8 3'624.6 1'352.6 3'701.0 888.4 509.1 Market Capitalization 30'026 39'739 27'214 16'290 19'538 5'158 25'131 14'870 26'724 17'485 9'529 8'768 29'579 12'544 5'235 Total Debt 64'501.0 57'552.0 25'944.0 19'946.0 5'328.0 17'001.6 32'884.1 6'245.6 66'539.0 10'860.0 20'524.0 52'563.3 23'025.0 8'777.0 9'918.4 Preferred Stock - - - - - - - - - - - - - - - Minority Interest 4'854.0 11'462.0 3'862.0 1'613.0 - 1'973.6 324.8 - 16'387.0 5'716.0 3'239.0 196.6 7.0 616.0 1'995.3 Cash and Equivalents 22'307.0 11'383.0 6'097.0 5'276.0 938.0 5'547.8 6'575.5 189.2 9'891.0 7'423.0 2'123.0 11'456.3 2'723.0 963.0 2'270.8 Enterprise Value 77'074 97'370 50'923 32'573 23'928 18'585 52'788 20'116 99'759 26'638 31'169 50'071 50'514 20'974 14'878 Valuation Total Revenue LFY 72'729.0 97'038.0 132'093.0 50'771.0 23'942.0 29'438.5 34'201.2 31'723.9 82'699.0 33'933.0 16'339.9 39'538.9 13'832.0 6'159.0 15'101.6 LTM 72'729.0 97'038.0 132'093.0 50'771.0 23'942.0 29'438.5 34'597.8 31'337.3 82'699.0 33'781.0 16'048.9 39'232.5 13'605.0 6'159.0 15'101.6 CY+1 73'495.9 81'066.0 111'727.6 53'564.3 24'435.7 25'878.6 33'650.9 32'084.9 81'748.9 33'340.3 15'469.8 25'594.0 14'434.5 6'287.6 15'342.3 CY+2 75'671.3 81'882.3 112'918.9 53'835.1 25'406.1 26'477.5 34'720.8 32'589.7 82'355.9 34'293.1 16'114.8 28'261.5 15'051.6 6'472.2 15'916.0 EV/Total Revenue LFY 1.0x 1.0x 0.4x 0.7x 0.9x 0.6x 1.5x 0.6x 1.2x 0.8x 1.8x 1.3x 3.3x 3.4x 0.9x LTM 1.0x 1.0x 0.4x 0.7x 0.9x 0.6x 1.5x 0.6x 1.2x 0.8x 1.8x 1.3x 3.4x 3.4x 0.9x CY+1 1.0x 1.1x 0.4x 0.6x 1.0x 0.7x 1.6x 0.7x 1.0x 0.8x 2.0x - 3.6x 3.4x 1.0x CY+2 1.0x 1.0x 0.4x 0.6x 0.9x 0.6x 1.5x 0.7x 1.0x 0.7x 1.9x - 3.5x 3.3x 1.0x EBITDA LFY 14'342.0 18'401.0 8'443.0 9'055.0 3'698.0 2'684.9 7'177.7 1'946.8 16'150.0 7'005.0 3'612.0 3'443.4 4'777.0 2'360.0 2'246.9 LTM 14'342.0 18'401.0 8'443.0 9'201.0 3'698.0 2'684.9 7'639.5 2'073.9 16'150.0 7'031.0 3'720.6 3'443.4 4'991.0 2'403.0 2'246.9 CY+1 15'996.5 13'804.7 9'553.9 8'830.0 3'962.1 2'252.6 7'578.4 2'179.3 16'055.7 6'672.4 3'648.0 2'351.0 5'079.0 2'453.2 2'508.3 CY+2 16'908.5 13'953.3 9'743.5 8'600.0 4'176.9 2'398.0 7'826.3 2'323.9 16'115.8 6'811.7 3'859.3 3'500.0 5'444.0 2'440.7 2'676.5 EV/EBITDA LFY 5.1x 5.1x 6.0x 3.9x 5.9x 6.7x 7.0x 9.5x 6.3x 3.9x 8.3x 14.5x 9.6x 8.9x 6.4x LTM 5.1x 5.1x 6.0x 3.9x 5.9x 6.7x 6.6x 9.0x 6.3x 3.8x 7.9x 14.5x 9.2x 8.7x 6.4x CY+1 4.8x 6.2x 5.2x 3.8x 6.1x 7.5x 7.1x 10.0x 5.3x 4.2x 8.4x - 10.1x 8.6x 6.0x CY+2 4.7x 6.0x 5.1x 3.9x 5.7x 7.1x 6.7x 9.6x 5.1x 3.7x 7.8x - 9.6x 8.6x 5.7x EPS LFY 2.06 1.33 1.81 1.95 0.26 -0.04 0.46 1.29 0.09 1.93 0.28 2.36 0.51 - 0.72 LTM 1.80 0.71 1.14 2.13 0.25 0.02 0.44 0.25 0.09 1.92 0.30 -5.09 0.64 1.59 0.67 CY+1 1.75 1.36 1.32 3.89 0.28 0.51 0.40 1.13 0.33 1.76 0.26 0.37 0.54 1.29 0.65 CY+2 1.91 1.43 1.39 3.49 0.30 0.69 0.41 1.17 0.34 1.89 0.28 1.74 0.56 1.25 0.76 P/E LFY 9.0x 23.1x 11.9x 12.5x 15.3x 548.5x 9.1x 62.7x 31.6x 8.6x 8.7x - 12.7x 8.9x 15.4x LTM 9.0x 12.3x 7.5x 12.5x 14.5x - 9.1x 14.0x - 8.4x 8.8x 4.4x 14.8x - 11.2x CY+1 9.3x 12.1x 10.3x 6.8x 13.5x 19.6x 10.1x 13.6x 8.7x 9.4x 10.0x 28.3x 15.0x 11.0x 15.7x CY+2 8.5x 11.5x 9.8x 7.6x 12.7x 14.3x 9.7x 13.2x 8.4x 8.7x 9.4x 6.0x 14.5x 11.3x 13.5x Revenue Growth 1 Year 11.4% 7.0% 16.9% 3.3% 4.9% 3.0% 8.1% 12.0% 6.6% 3.8% 8.1% 16.5% (3.6%) (0.0%) 1.8% 5 Year 6.1% 7.2% 16.4% 4.1% 10.5% (2.9%) 8.2% 18.0% 9.1% 43.3% 9.5% 21.7% 8.6% 7.7% - EBITDA Growth 1 Year 1.7% 14.5% 97.8% 9.3% 11.7% 5.9% 2.5% 4.9% (5.6%) (3.6%) (3.8%) (37.9%) (1.4%) (1.5%) 8.1% 5 Year (1.7%) 20.7% (5.3%) 3.1% 8.1% (6.3%) 8.0% 5.7% 10.7% 1.1% 6.1% (4.7%) 7.5% 3.4% 4.3% EBITDA Margin LTM 19.7% 19.0% 6.4% 18.1% 15.4% 9.1% 22.1% 6.6% 19.5% 20.8% 23.2% 8.8% 36.7% 39.0% 14.9% CY+1 21.8% 17.0% 8.6% 16.5% 16.2% 8.7% 22.5% 6.8% 19.6% 20.0% 23.6% 9.2% 35.2% 39.0% 16.3% CY+2 22.3% 17.0% 8.6% 16.0% 16.4% 9.1% 22.5% 7.1% 19.6% 19.9% 23.9% 12.4% 36.2% 37.7% 16.8% Leverage/Coverage Ratios Total Debt / Equity % 249.4% 96.3% 74.2% 134.6% 89.9% 237.7% 97.4% 136.2% 181.0% 52.6% 250.5% 78.4% 249.2% 86.0% 203.9% Total Debt / Capital % 67.7% 44.7% 40.1% 54.8% 47.3% 65.1% 49.1% 57.7% 55.6% 29.2% 64.2% 43.9% 71.3% 44.8% 59.1% Total Debt / EBITDA 4.497x 3.128x 3.073x 2.168x 1.441x 6.332x 4.335x 2.961x 4.120x 1.545x 5.549x 15.265x 4.830x 3.653x 4.414x Net Debt / EBITDA 2.942x 2.509x 2.351x 1.594x 1.187x 4.266x 3.586x 2.530x 3.508x 0.489x 4.953x 11.938x 4.193x 3.252x 3.404x EBITDA / Int. Expense 5.871x 7.199x 2.900x 7.250x 7.441x 3.201x 4.822x 3.881x 5.508x 10.317x 3.460x 1.476x 2.040x 7.867x 4.979x Credit Ratings S&P LT Credit Rating A+ A *- A- BBB+ A- BBB+ BBB A- BBB+ BBB+ BB+ A- A- A- - S&P LT Credit Rating Date 17.01.2012 29.01.2013 27.07.2012 27.07.2012 29.05.2009 24.11.2000 28.11.2012 21.08.2009 08.03.2012 08.03.2012 01.02.2012 17.11.2011 24.08.2007 27.11.2012 - Moody's LT Credit Rating Aa3 A1 A3 A3 A3 Baa1 (P)Baa1 A3 Baa2 WR Ba1 Baa3 Baa1 A2 A3 Moody's LT Credit Rating Date 14.01.2009 03.07.2012 05.10.2011 19.07.2011 21.06.2006 07.02.2012 05.11.2012 22.09.2009 05.11.2012 25.02.2009 16.02.2012 19.12.2012 12.01.2007 15.07.2005 20.05.2009 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |