Management information Question Anaysis ICAB KL

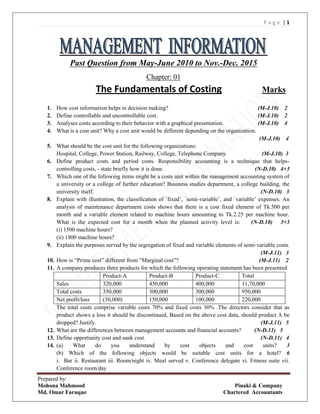

- 1. P a g e | 1 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Past Question from May-June 2010 to Nov.-Dec. 2015 Chapter: 01 The Fundamentals of Costing Marks 1. How cost information helps in decision making? (M-J.10) 2 2. Define controllable and uncontrollable cost. (M-J.10) 2 3. Analyses costs according to their behavior with a graphical presentation. (M-J.10) 4 4. What is a cost unit? Why a cost unit would be different depending on the organization. (M-J.10) 4 5. What should be the cost unit for the following organizations: Hospital, College, Power Station, Railway, College, Telephone Company (M-J.10) 3 6. Define product costs and period costs. Responsibility accounting is a technique that helps- controlling costs, - state briefly how it is done. (N-D.10) 4+3 7. Which one of the following items might be a costs unit within the management accounting system of a university or a college of further education? Business studies department, a college building, the university itself. (N-D.10) 3 8. Explain with illustration, the classification of `fixed‟, `semi-variable‟, and `variable‟ expenses. An analysis of maintenance department costs shows that there is a cost fixed element of Tk.500 per month and a variable element related to machine hours amounting to Tk.2.25 per machine hour. What is the expected cost for a month when the planned activity level is: (N-D.10) 3+3 (i) 1500 machine hours? (ii) 1800 machine hours? 9. Explain the purposes served by the segregation of fixed and variable elements of semi‐variable costs. (M-J.11) 3 10. How is “Prime cost” different from ”Marginal cost”? (M-J.11) 2 11. A company produces three products for which the following operating statement has been presented Product‐A Product‐B Product‐C Total Sales 320,000 450,000 400,000 11,70,000 Total costs 350,000 300,000 300,000 950,000 Net profit/loss (30,000) 150,000 100,000 220,000 The total costs comprise variable costs 70% and fixed costs 30% .The directors consider that as product shows a loss it should be discontinued, Based on the above cost data, should product A be dropped? Justify. (M-J.11) 5 12. What are the differences between management accounts and financial accounts? (N-D.11) 5 13. Define opportunity cost and sunk cost. (N-D.11) 4 14. (a) What do you understand by cost objects and cost units? 3 (b) Which of the following objects would be suitable cost units for a hotel? 6 i. Bar ii. Restaurant iii. Room/night iv. Meal served v. Conference delegate vi. Fitness suite vii. Conference room/day

- 2. P a g e | 2 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants (c) Give six examples of cost units applicable to different industries. (M-J.13) 4 15. Explain i. Fixed cost ii. Variable cost iii. Semi-variable cost . (M-J.13) 6 16. (a) Define cost object and cost unit. 4 (b) Give at least two examples of cost object and cost unit. (N-D.13) 4 17. Write briefly about the following items: (a) Semi‐variable Costs, (b) Responsibility Accounting, (c) Controllable costs. (M-J.14) 9 18. Define the following with suitable examples. i. Cost unit ii. Product cost iii. Period Cost (N-D.14) 9 19. Define the following cost with example? (a) Direct cost (b) Indirect cost (c) Product cost (d) Period cost (M-J.15) 3x4=12 20. Differentiate the followings? (a) Product vs Period Cost (b) Payback Period vs Net Present Value (N-D.15) 12 Chapter: 02 Calculating Unit Costs (Part-1) 1. The following information is provided by DOX Limited for the month of April, 2009: Man‟s dress: Stock on 01 April, 2009: 100 units at Tk. 5 per unit. Purchases: 5‐ Apr ‐09 300 units at Tk. 6 8‐ Apr ‐09 500 units at Tk. 7 12‐ Apr ‐09 600 units at Tk. 8 Sales: Price per unit is Tk. 15 6‐ Apr ‐09 250 units 10‐ Apr ‐09 400 units 14‐ Apr ‐09 500 units Required: (a) Calculate using FIFO and LIFO methods of pricing the issues: (i) the cost of sales during the period 4 (ii) the value of closing inventory on 30 April, 2009 (M-J.10) 4 2. a. Discuss the costing methods with their relevant advantage and disadvantages. (M-J.10) 4 b. Which method of costing should be appropriate for the following industries: 3 a. Chemical Industry b. Garments Industry c. Fitting Kitchen Industry d. Construction Company e. Electricity Company f. Paper Industry 3. Following are the information received from the store ledger of Modern fashions Ltd.: May 01, 2010 there was opening stock of materials 100 yds costing Tk.200;

- 3. P a g e | 3 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants May 03 the store received 400 yds costing Tk.840; May 04 the store issued 200 yds; May 09 the store again received 300 yds costing Tk.636; May 11 the store issued 400 yds; May 18 the store received 100 yds costing Tk.240; May 20 the store issued 100 yds. Using cumulative weighted average pricing, calculate the value of closing inventory. (N-D.10) 7 4. Indicate whether each of the following costs would be classified as a direct cost or an indirect cost of a car repairing garage. The repair was worked on in overtime hours due to an unusual repair loads. (i) The salary of the garage accountant. (ii) The cost of heating the garage (iii) A can of engine oil used in the repair (iv) A smear of grease used in the repair. (v) An overtime premium paid to the machine carrying out the repair. (vi) An idle time payment made to the machine while waiting for delivery of parts for a number of Job. (M-J.11) 6 5. On 1 March 2011, LM Ltd held 3 red shirts designed by Arong. These were valued at Tk.120 each. During March 2011, 12 more of the shirts were delivered as follows: Date Shirt received Purchased cost per shirt 10 March 4 Tk.125 20 March 4 Tk.140 25 March 4 Tk.150 A number of the red shirts were sold during March as follows: Date Shirt sold Sales price per shirt 14 March 5 Tk.200 21 March 5 Tk.200 28 March 1 Tk.200 Requirements: Calculate the closing inventory and gross profit from selling the shirts in March 2011, applying the following principles of inventory valuation. (a) FIFO, (b) Cumulative weighted average pricing. (N-D.11) 5+5 6. On 1st November 2011, Edge Limited held 3 pink satin dresses with orange sashes, designed by Mostafa Kamal. These were valued at Tk.120 each. During November 2011, 12 more of the dresses were purchased as follows: Date Dresses purchased Purchase cost per dress 10 November 4 Tk. 125 20 November 4 Tk. 140 25 November 4 Tk. 150 A number of the pink satin dresses were sold during November as follows:

- 4. P a g e | 4 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Date Dresses purchased Sales price per dress 14 November 5 Tk. 200 21 November 5 Tk. 200 25 November 1 Tk. 200 Calculate the gross profit from selling the pink satin dresses in November 2011, applying FIFO method of inventory valuation. (M-J.12) 10 7. (a) Describe advantages and disadvantages of cumulative weighted average pricing. 6 (b) A business buys and sells boxes of item. Opening inventory was 400 boxes valued at Tk 1,000. The transactions for latest quarter are shown below: Purchases Boxes Taka Sales Boxes January-2012 1,000 2,600 1,100 February-2012 1,200 3,300 900 March-2012 1,000 3,000 800 Selling price was Tk 3 per box throughout the quarter. Determine the value of closing inventory and gross profit at 31-03-2012 using periodic weighted average price and FIFO method. (N-D.12) 12 8. a) Describe the advantages and disadvantages of the LIFO method. 4 (b) ABC Company buys and sells cartoon boxes. Opening inventory was 500 boxes valued at Tk 1,000. The transactions for latest quarter are shown below: July-2013 August-2013 September-2013 Purchase : No. Of boxes 2,000 2,400 2,000 Taka 5,000 6,240 5,400 Sales: No.Of Boxes 2,200 1,800 1,600 Selling price was Tk 3 per cartoon box throughout the quarter. Determine value of closing inventory and gross profit at 30-09-2013 using periodic weighted average price and FIFO method. (N-D.13) 5+5 9. Khan & Company was formed on December 1, 2013. The following information is available from Khan‟s inventory record for Product X. Units Units Cost January 1, 2013 (beginning inventory) 16,000 Tk.18.00 Purchases: January 5, 2013 2,600 Tk.20.00 January 25, 2013 2,400 Tk.21.00 February 16, 2013 1,000 Tk.22.00 March 15, 2013 1,800 Tk.23.00 A physical inventory on March 31, 2013 shows 2,500 units in hand. Required: Prepare schedules to compute the ending inventory at March 31, 2013 under each of the following inventory methods: (a) FIFO, (b) LIFO, (c) Weighted‐average. Show supporting computations. (M-J.14) 4x3=12

- 5. P a g e | 5 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants 10. (a) During periods of rising prices, what will be the effect on the financial statements if FIFO method is used instead of LIFO method for valuation of inventory? 4 (b) Errors occasionally occur during physical counting of the inventory. Identify the effects on the financial statements of an overstatement of the ending inventory in the current period. If the error is not corrected, how does it affect the financial statements for the following year? 4 (c) Yesinia Company uses the periodic inventory system to account for inventories. Information related to Yesinia Company's inventory at October 31 is given below: October 1 Beginning inventory 400 units @ Tk. 10.00 = Tk.4,000 October 8 Purchase 800 units @ Tk. 10.40 = 8,320 October 16 Purchase 600 units @ Tk. 10.80 = 6,480 October 24 Purchase 200 units @ Tk. 11.60 = 2,320 Total units and cost 2,000 units Tk. 21,120 Requirement: (a) Show computations to value the ending inventory using the FIFO cost method if 550 units remain on hand at October 31. 4 (b) Show computations to value the ending inventory using the weighted-average cost method if 550 units remain on hand at October 31. 4 (c) Show computations to value the ending inventory using the LIFO cost method if 550 units remain on hand at October 31. (N-D.14) 4 11. (a) A business buys and sells boxes of item X. The transactions for the third quarter are shown below: Opening Inventory 400 boxes valued at Tk.1,000 Purchase Sales Boxes Value Boxes July 1.000 boxes 2,600 1,100 boxes August 1,200 boxes 3,300 9,00 boxes September 1,000 boxes 3,000 8,00 boxes The business values its inventories using a periodic weighted average price calculated at the end of each quarter. Calculate the value of inventory at the end of September. 5 (b) A wholesaler had an opening inventory of 330 units of product T valued at Tk. 168 each on 1 April. The following receipts and sales were recorded during April: (i) 4 April Received 180 units at a cost of Tk. 174 per unit (ii) 18 April Received 90 units at a cost of Tk. 186 per unit (iii) 24 April Sold 432 units at a price of Tk. 220 per unit Using the LIFO valuation method, what was the gross profit earned from the units sold on 24 April? (M-J.15) 6

- 6. P a g e | 6 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Chapter: 03 Calculating Unit Costs (Part-2) 1. What are the components to be included of a product costs over its life cycle? 3 2. (a) Mention two reasons for under or over absorbed overhead? 3 (b) A company produces two products, X and Y, in two production cost centers. The initial allocation and apportionment of Budgeted production overheads has been completed. Extracts from the budget are as follows: Machining Cost Centre Finishing Cost Centre Production overheads Tk.38,000 Tk.10,350 Machine hours per unit: Product X 6 2 Product Y 4 1 Production overheads are absorbed on a machine hour basis. Budgeted production is 800 units of X and 700 units of Y. Determine the budgeted production overhead cost per unit of X and Y. (M-J.12) 12 3. A manufacturing company has three production Departments and two Service Departments. Departmental expenses for the month of December 2012 were as follows: Production Department Service Department X 24,000 A - 7,020 Y 19,500 B - 9,000 Z 21,000 Service Department expenses are charged out on a percentage basis, viz. Service Department Production department Service Department X Y Z A B A 20 25 35 - 20 B 25 25 40 10 - Prepare a statement showing apportionment of expenses of the two service Departments to the Production Department. (M-J.13) 8 4. (a) Describe the problems with traditional absorption costing. (N-D.13) 3 5. What is scrap? How it is treated in the cost statement? Ascertain the cost and selling price from the following information: (N-D.10) 2+5 Materials consumed Tk.10,000/- Wages Tk.8,000/- Works on cost 25% on wages Office on cost 20% on works cost

- 7. P a g e | 7 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Selling on cost 10% on works cost Profit 10% on cost. 6. Discuss the costing methods with their relevant advantage and disadvantages. (M-J.10) 4 7. A company has two production departments and two service departments with production overheads as shown in the following table: Production Department Service Department W X Y Z Production overheads (Tk. „000) 500 600 600 800 Service department Y divides its time between the other departments in the ratio of 3:2:1 (for W, X and Respectively) Department Z spends 40% of its time for servicing department W and 60% of its time for servicing department X. If all service department overheads are appointed to production department. Then calculate the total fixed cost of department W. (N-D.14) 6 8. A management consultancy absorbs overheads on chargeable consulting hours. Budgeted overheads were Tk. 615,000 and actual consulting hours were 32,150. Overheads were under-absorbed by Tk. 35,000. If actual overheads were Tk. 694,075, what was the budgeted overhead absorption rate per hour? (N-D.11,14) 5 9. ZA Limited marked three types of silver watch – the Diva (D), the Classic (c) and the Pose (P). A traditional product costing system is used at present. Although an activity based costing (ABC) system is being considered. Details of the three products for a typical period are: Hours per unit Labour hours Machine hours Materials Cost per unit (Tk.) Production Units Product D 0.5 1.5 20 750 Product C 1.5 1 12 1,250 Product P 1 3 25 7,000 Direct labour costs Tk. 6 per hour and production overheads are absorbed on a machine hour basis. The overhead absorption rate for the period is Tk. 28 per machine hour. Calculate the cost per unit for each product using traditional methods, absorbing 8 overheads on the basis of machine hours.

- 8. P a g e | 8 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Chapter: 04 Marginal Costing and Absorption Costing 1. (a)Absorption costing and Marginal costing the two techniques are not truly alternatives. Explain it. 3 (b)Why does Marginal costing technique excludes Fixed Costs. Explain briefly. (M-J.11) 2 2. ABC Ltd. manufactures a single product. The following figures relate to the product for one year period. Sales and production (units) 800 Taka Sales 16,000 Production costs Variable 6,400 Fixed 1,600 Sales and distribution costs Variable 3,200 Fixed 2,400 The normal level of activity for the year is 800 units. Fixed costs are incurred evenly throughout the year and actual fixed costs are the same as budgeted. A predetermined overhead absorption rate is used for the year. There were no inventories of the product at the beginning of the year. In the first quarter, 220 units were produced and 160 units sold. (i) Absorption costing, (ii) Marginal costing (N-D.11) 5+5 3. (a) In what situations is absorption costing more appropriate than marginal costing? 4 (b) The following budgeted information relates to Olympic company limited for the quarter ended September, 2010: Units Taka Production 14,000 Fixed Production costs 63,000 Sales 12,000 Fixed Selling costs 12,000 The normal level of activity is 14,000 units per quarter. Using marginal costing the profit for next period has been calculated as Tk.27,000. What would be the profit for the next quarter using absorption costing? (M-J.12) 11 4. Senjuti Kites Ltd. (SKL) produces and markets specialized kite. SKL follows a standard costing System and its standard cost card is as follows: Calculate the profit using:

- 9. P a g e | 9 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Standard cost card Taka Sales Price 80 Direct Material 11 Direct Labour 19 Variable Overheads 8 Budgeted data for September, 2013 Production in unit 20,000 Fixed production overhead Tk100,000 Fixed administration expenses Tk36,000 Fixed selling expenses Tk22,000 Variable selling expenses 5% of sales The actual data in unit for September, 2013 is as follows: Production Sales September, 2013 20,000 15,000 The opening inventory for the month of September, 2013 is 1000 units. With the help of the above information, calculate the profit of SKL under marginal Costing and absorption costing for September, 2013. (N-D.13) 10 5. A company manufactures Luxury and Standard items. The following information relates to period 1: Calculate the value of inventory under both marginal costing and absorption costing. (N-D.14) 10 6. (a) Explain the situation whether you are agree or not for the following two statements. (i) When closing inventory levels are higher than opening inventory levels and overheads are constant, absorption costing gives a higher profit than marginal costing. 5 (ii) A product showing a loss under absorption costing will also make a negative contribution under marginal costing. 5 (b) A new product has a variable material cost of Tk. 5.50 per unit, a variable labor cost of Tk. 2 per unit and a fixed overhead absorption rate of Tk. 3.50 per unit. Production during the first month was 23,000 units and sales were 21,000 units. Calculate the value of inventory under both marginal costing and absorption costing. 7 Luxury Standard Variable Materials per unit Tk. 16 Tk. 12 Variable labor per unit Tk. 21 Tk. 9 Variable production overhead per unit Tk. 10 Tk. 8 Budgeted Production 3,500 Units 3,300 Units Actual Production 3,500 Units 3,300 Units Closing Inventory 290 Units 570 Units Variable labor is paid Tk. 6 per hour. Total Fixed cost Tk. 120,400 are recovered on the basis of variable labor hours.

- 10. P a g e | 10 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Chapter: 05 Pricing Calculations 1. (a) What are the pricing methods used? Discuss their comparative advantages and disadvantages. (b) The following variable costs are incurred for producing one unit of X : Tk. Per Unit Variable material 8.00 Variable labour at Tk. 14 per hour 42.00 Variable production overhead is incurred at the rate of Tk. 4 per hour. Fixed production Overheads of Tk. 60,000 are absorbed on the basis of 25,000 budgeted direct labour hours. Other overheads are recovered at 5% of total production cost. If the selling price are set to recover full cost plus 50%, what should be the selling price per Unit of product X ? (M-J.10),(M-J.15) 5+5 2. How can the transfer price influence management decisions? Why might a list price less discount be more appropriate as a transfer price than a list price without discount? (N-D.10) 3+3 3. What is mark‐ up and margin? Calculate the following 2+6 (i)If the full cost is Tk. 14 per unit, calculate the price to achieve a margin of 20% of the selling price (ii)The selling price is Tk.27 per unit, determined on the basis of full cost‐ plus, if the full cost is Tk.18 per unit, calculate the mark‐ up percentage. (iii)A selling price of Tk. 165 per unit earns a mark‐ up of 106.25% of the full cost. What is the full cost per unit? (iv)A product selling price is determined by adding 33.33% to its full cost. What percentage margin on sales price does this represent? (M-J.11) 4. (a) Define transfer pricing? 6+10 (b)Division M Manufactures product R incurring a total cost of Tk. 30 per unit. Fixed costs represent 40% of the total unit cost. Product R is sold to external customers in a perfectly competitive market at a price of Tk.50 per unit. Division also transfers product R to division N. If transfers are made internally then division M does not incur variable distribution costs, which amounts to 10% of the variable costs incurred on external sales. The total demand for product R exceeds the capacity of division M. From the point of view of the company as a whole, enter the optimum price per unit at which division M should transfer product R to division. Find out the transfer price per unit. (M-J.11,12) 10 5. What is marginal cost-plus pricing? Product R incurs direct variable production costs of Tk.9 per unit. Fixed production costs amount to Tk.18,500 each period. Variable selling and distribution costs are Tk.4.60 per unit and fixed selling, distribution and administrative costs amount to Tk.22,500 each period.

- 11. P a g e | 11 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Selling prices are determined on a marginal cost-plus basis, using a mark-up of 25% of the marginal cost of sales Calculate the selling price per unit of product R and the profit that will result from sales of Tk.20,400 units each period. (N-D.11) 3+7 6. What are the aims of a transfer pricing system? (M-J.12) 5 7. Product Y incurs direct variable production costs of BDT 6 per unit. Fixed production costs amount to BDT 19,000 each period. Variable selling and distribution costs are BDT 4.50 per unit and fixed selling distribution and administration costs amount to BDT 22,500 each period. Selling prices are determined on a marginal cost-plus basis, using a mark-up of 25% of the marginal cost of sales. Calculate the selling price per unit of product Y and the profit that will result from sales of 30,000 units each period. (N-D.13) 10 8. The following data relate to the Standard group, a company with several divisions. Division D produces a single product, which it sells to Division R and also to organizations outside the Standard group Division D sales to Division Division D external sales R (Amount in Tk.) (Amount in Tk.) Sales revenue at Tk. 70 per unit - 700,000 Sales revenue at Tk. 60 per unit 300,000 - Variable costs at Tk. 36 per unit (180,000) (360,000) Contribution 120,000 340,000 Fixed Cost (100,000) (240,000) Profit 20,000 100,000 Profit of the Standard group is Tk.550,000. A supplier offers to supply 3,000 units at Tk. 50 each to Division R. Divisional managers of Standard Group are given freedom of choice for selling and buying decisions, and their performance is judged solely according to divisional profitability. Calculate the profit for Division D and for Standard Group if Division D does not match the lower price offered by the external supplier and cannot increase its external sales, and Division R chooses to purchase from the external supplier. (M-J.15) 9. The following variable costs are incurred producing each unit of product F. Tk. Per Unit Variable material 8.00

- 12. P a g e | 12 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Variable labour at Tk. 14 per hour 42.00 Variable production overheads are incurred at the rate of Tk.4 per hour. Fixed production overheads of Tk. 60,000 are absorbed on the basis of 25,000 budgeted direct labour hours. Other overheads are recovered at five percent of total production cost. If selling prices are set to recover the full cost plus 50%, calculate the selling price per unit of product F? (M-J.10,15) 10 Chapter: 06 Budgeting 1. The costs of operating the maintenance department of a computer manufacturer, Bits and Dots Ltd. for the last four months have been as follows: Months Total costs (Tk.) Production volume Units 1 110,000 7,000 2 115,000 8,000 3 111,000 7,700 4 97,000 6,000 Calculate the costs that should be expected in months 5 when the output is expected to be 7,500 units. Ignore inflation. (N-D.10) 4 2. (a) Define forecast and budget. How does two differ from each other? What are the essentials of effective budgeting? 1+1+2 (b)What do mean by zero-based Budgeting? How it is prepared? What are the advantages of zero- based Budgeting? (N-D.10) 2+1+3 3. You are given the following budgeted cost information for Munk Arsfelt plc for November 2012 Sales Tk. 120,000 Unit selling price Tk. 2 Gross profit Tk. 30% margin on sales Opening inventory 6,000 units Sales volumes are increasing at 20% per month and company policy is to maintain 10% of next month‟s sales volume as closing inventory. Determine the value that represents the budgeted cost of production for November 2012. (N-D.12) 10 4. XYZ Company produces three products A, B & C. For the coming accounting period budgets are to be prepared based on the following information: Budgeted sales Product – X 2000 at Taka 100 each

- 13. P a g e | 13 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Product – Y 4000 at Taka 130 each Product – Z 3000 at Taka 150 each Budgeted usage of raw materials RM 11 RM 22 RM 33 Unit Unit Unit Product – X 5 2 - Product – Y 3 2 2 Product – Z 2 1 3 Cost per unit of materials Taka 5 Taka 3 Taka 4 Finished inventory budget Product X Product Y Product Z Opening 500 800 700 Closing 600 1000 800 Raw materials inventory budget RM 11 RM 22 RM 33 Unit Unit Unit Opening 21,000 10,000 16,000 Closing 18,000 9,000 12,000 Product X Product Y Product Z Expected hours per unit 4 6 8 Expected hourly rate (labour) Taka 9 Taka 9 Taka 9 (M-J.13) 12 5. Write short notes on the following: (i) Incremental Budgeting (ii) Zero based budgeting (M-J.14) 4 Chapter: 07 Cash Budgets and the Cash Cycle 1. (a)What are the two methods of preparing Cash Budgeting? 2 (b)Distinguish between Cash Budgeting and Cash Flow statement. 4 (c)ABC Co. wishes to arrange overdraft facilities with its Bankers during the period April to June, 2010, when it will be manufacturing mostly for stock. Prepare a cash budget for the above period from the following data, indicating the extent of the bank facilities the company will require at the end of each month:

- 14. P a g e | 14 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants (i) Sales Purchases Wages TK TK TK February 2010 180,000 124,800 12,000 March 2010 192,000 144,000 14,000 April 2010 108,000 243,000 11,000 May 2010 174,000 246,000 10,000 June 2010 126,000 268,000 15,000 (ii) 50% of credit sales are realized in the month of following the sales and the remaining 50% in the second month following. Creditors are paid in the month following the month of purchase. (iii) Cash at bank on 1‐ 4‐ 2010 estimated Tk. 25,000. (M-J.11) 5 2. i) M & M limited operates a retail business. Purchases are sold at cost plus 33⅓. Month Budgeted sales (Tk) Labour cost (Tk) Expenses incurred (Tk) January 40,000 3,000 4,000 February 60,000 3,000 6,000 March 160,000 5,000 7,000 April 120,000 4,000 7,000 ii) It is a management policy to have sufficient inventory in hand at the end of each month to meet half of the next month‟s sales demand. iii) Suppliers for materials and expenses are paid in the month after the purchases are made/expenses incurred. Labour is paid in full by the end of each month. iv) Expenses include a monthly depreciation charge of Tk.2,000. v) 1) 75% of sales are for cash 2) 25% of sales are on one month‟s credit. vi) The company will buy equipment costing Tk.18,000 for cash in February and will pay a dividend of Tk.20,000 in March. The opening cash balance at 1 February-2010 is Tk.1,000 Prepare a cash budget for February and March with comments on the result. (M-J.12), (M-J.14) 2012 3. (a) Discuss your understanding about cash operating cycle. 5 From the following extracts of the draft balance sheet, calculate the current ratio and quick ratio: (N-D.12) 5 Assets: Taka Taka Non-current assets 10.5 Stock in Trade 4.2 Accounts receivables 2.8

- 15. P a g e | 15 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Cash at bank 0.3 7.3 Total 17.8 Liabilities: Non- current liabilities 7.9 Accounts payables 2.6 Pre-paid and advances 0.8 Loan repayable in five years 6.5 9.9 Total 17.8 4. (a) What is the cash operating cycle? Describe the importance of cash operating cycle? 6 (b) QR Limited is a retail company that has average sales of Tk 14.6m per annum and earns a mark- up of 25% with the Inventory averages of Tk 2.0m, receivables average of Tk 0.9m and trade payables of Tk 0.6m If all sales and purchases are on credit, what is the length of company‟s cash operating cycle (to the nearest day)? (N-D.12) 6 5. What is a cash budget? How is it useful in managerial decision making? (M-J.13) 5 6. (a) What is cash operating cycle? 4 (b) A retailing company earns a gross profit margin of 37.5% on its monthly sales of Tk. 20,000. In order to generate additional cash, the following changes are proposed: Present Proposed Inventory holding period 1.5 months 1.0 month Trade payable payment period 1.0 month 1.3 months How much additional cash will be generated at the end of the month if the above proposal is materialized? (N-D.14) 6 7. Mahmud & Company has the following information: Cash Balance, June 30 50,000 Dividends paid in July 60,000 Cash paid for operating expenses in July 185,500 Depreciation in July 12,000 Cash collections on sales in July 510,000 Merchandise purchases paid in July 180,000 Purchase equipment for cash in July 94,500 Mahmud & Company wants to maintain a minimum cash balance of Tk.50,000. Assume that borrowing occurs at the beginning of the month and repayments occur at the end of the month. Interest of 1% per month is paid in cash at the end of each month debt is outstanding. Borrowing and

- 16. P a g e | 16 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants repayment is carried out in multiples of Tk.1,000. Required: Prepare a cash budget for the month of July. (M-J.15) 10 Chapter: 08 Performance Management 1. What do mean by the following: i) Cost centre ii)Revenue centre iii)Profit centre (N-D.10) 6 2. Following are the information picked up from the books of ABC Ltd.: 7 (1)The closing balance of inventory of the company is Tk.300,000 as on 31 December 2009 which is Tk.30,000 more than the opening balance of the year. (2)The total turnover for the year ended 31 December 2008 was Tk.450,000, while the cost of sales was Tk.270,000. (3)The year-end receivable was Tk.200,000 with a corresponding closing balance of last year Tk.180,000. Calculate rate of inventory turnover and receivable collection period. (N-D.10) 3. What is ideally indicated by ROI? A company has to investment centres, X and Y, which show results for the year as follows: 2+5 X Y Profit 60,000 30,000 Capital employed 400,000 120,000 ROI 15% 25% Comment on the performance of the investment centers. (N-D.10) 4. PQR‟s year end working capital comprises inventory valued at cost, trade receivables of Tk. 1,20,000 cash and trade payables. Its financial performance ratios include the following: Gross profit margin 21% Current ratio 2.7:1 Receivable Collection Period 25 days Payable payment Period 30 days Rate of inventory turnover 10 times The opening inventory, receivables and payable balance are the same as the closing balances. Calculate the yearend cash balance. (M-J.11) 8

- 17. P a g e | 17 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants 5. a) Explain any three control ratios. (M-J.11) 3 b)From the following information relating to the month of January, calculate production volume ratio, capacity ratio and efficiency ratio. (M-J.11) 4 Budget Actual Units Produced 12,000 12,600 Hours Worked 24,000 26,400 6. Division M is considering a project which will increase annual profit by Tk. 34,400 but will require average inventory levels to increase by Tk. 1,56,000. The Current return on investment for the division is 26% and the imputed interest cost of capital is 16%. Would the performance measures of ROI and RI motivate the manager of division M to act in the interest of the company as a whole? (M-J.11) 6 7. A company has a target ROI of 20% for each of its investment centers. Division G Division H Capital employed Tk.1000,000 Tk.100,000 Controllable profits: Year 1 Tk.200,000 Tk.20,000 Year 2 Tk.220,000 Tk.40,000 Which of the two divisions is performing better, using the following performance measure? (i) Residual Income (N-D.11) 4 (ii) Return on Investment (N-D.11) 4 8. (a) ABC Co. has a manufacturing capacity of 10,000 units. The fixed production budget of the company is as follows: Capacity 60% 100% Total Production (in Taka) 11,280 15,120 What is the budgeted total production cost if it operates at 85% capacity? 7 (c) A transport company has recorded the following maintenance costs for the last two years: (M-J.12) 8 Year 1 Year 2 Miles travelled 30,000 50,000 Maintenance cost per mile (Taka) 1.90 1.30 Determine the forecasted maintenance cost for the year 3, when 38,000 miles will be travelled. 9. (a) Describe the features of effective feedback. (b)Nicholson sells mobile telephones. The company has employed you as a consultant to install a balanced scorecard system of performance measurement and to benchmark the results. The

- 18. P a g e | 18 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants financial and operating data for the year ended 31 December 201X is available: Taka ‘000 Sales revenue 480 Sales attributable to new products 8 Average capital employed 192 Profit before interest and tax 48 Plant and machinery 13,200 Inventory 1,200 Trade creditors 1,400 Debtors 1,400 Cash 500 Calculate the following performance ratios: (N-D.13) (i) Return on Capital Employed 3 (ii) Return on Sales 3 (iii) Asset Turnover 3 (iv) Current Ratio 3 10. (a) What is flexible budget? Describe two advantages of flexible budget? 6 (b) Prepare a budget for 20X6 for the variable direct labour costs and overhead expenses of a production department flexed at the activity levels of 80%, 90% and 100%, using the information listed below. 14 (i) The variable direct labour hourly rate is expected to be BDT 7.50 (ii) 100% activity represents 60,000 direct labour hours (iii) Variable costs: Indirect labour BDT 0.75 per direct labour hour Consumable supplies BDT 0.375 per direct labour hour Canteen and other welfare services 6% of direct and indirect labour costs (N-D.13) (iv)Semi‐ variable costs are expected to relate to the direct labour hours in the same manner as for the last five years: Year Direct Labour (hours) Semi‐ variable cost 20X1 64,000 20,800 20X2 59,000 19,800 20X3 53,000 18,600 20X4 49,000 17,800 20X5 40,000 (estimate) 16,000(estimate) (v)Fixed Cost: Depreciation 18,000 Maintenance 10,000

- 19. P a g e | 19 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Insurance 4,000 Rates 15,000 Management Salaries 25,000 (vi) Inflation is to be ignored. (c) Calculate the budgeted cost allowance (ie expected expenditure) for 20X6 assuming that 57,000 direct labour hours are worked. 5 11. (a) Why have many managers in recent years moved toward emphasizing employee participation in the budgeting process rather than simply imposing the budget on the employees? 3 (b) Does a project that generates a positive internal rate of return also have a positive net present value? Explain. 3 (b) Define residual income. Evaluate residual income as a measure of performance. 4 (c) What are some common problems encountered in determining ROI? (M-J.14) 4 12. A retailing company‟s working capital consists of inventory, trade receivables, cash and trade payables. All working capital balances were the same at the beginning and at the end of the year. The sales revenue for the year was Tk.900,000. The financial ratios for the year include the following: Current ratio 3.4:1 Rate of inventory turnover 15 times per annum Receivables collection period 73.0 days Payables payment period 36.5 days Gross margin 20.0% Calculate the closing cash balance of the company. (M-J.14), (N-D.14) 10 13. From the following details, prepare the balance sheet of STS Ltd. (N-D.11) 8 Stock turnover 6 Gross profit 20% Capital turnover ratio 2 Debt collection period 2 months Fixed assets turnover ratio 4 Creditors‟ payment period 73 days The gross profit was Tk.60,000. Closing stock was Tk.5,000 in excess of the opening stock 14. Habib & Company has two divisions. The following information is available: North division South Division Revenue for year Tk. 300,000 Tk. 500,000 Operating income before taxes for year Tk. 100,000 Tk. 90,000 Average invested capital for year Tk. 100,000 Tk. 200,000

- 20. P a g e | 20 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Invested capital at end of year Tk. 200,000 Tk. 300,000 Tax rate 30% 30% After-tax cost of capital for year 20% 15% Required: (1) Using operating income after taxes as the income measure, compute the following for each division: (M-J.15) 6 a) Return on investment. b) Return on sales c) Capital turnover d) Residual income (2)Which division is more successful? Why? (M-J.15) 3 Chapter: 09 Standard Costing and Variance analysis 1. The following data relates to the production of Product Z: Extract from the standard cost card of product Z: Taka Direct labour 24 hours @ Taka 50 per hour 1,200 Actual result for wages: Production :1000 units produced 23,900 hours costing in total 1,314,500 Required : Calculate the labor total, rate and efficiency variances for product Z (M-J.10) 7 2. What do you mean by variance analysis? The standard costs on materials and labor for the making of unit of a certain products are estimated as under: Materials – 80 kg at Tk.1.50 per kg. Wages – 18 hours at Tk.1.25 per hour. On completion of unit of the product it was found that 75 kg of material costing Tk.1.75 per kg has been consumed and the time taken was 16 hours. The wages being Tk.1.50 per hour. Calculate the material and labor variances. (N-D.10) 3+8 3. a) What are the points to take into attention for effective variance reporting? 5 b) A company produces a certain chemical; the standard material cost being: (M-J.11) 5 40% of material X at TK. 20 per ton

- 21. P a g e | 21 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants 60% of material Y at Tk. 30 per ton. A standard loss of 10% is expected in production. During a month 171 tons of chemical was produced from the use of 90 tons of material X Tk.18 per ton and 110 tons of material Y at Tk.34 per ton. 4. (a) Write four advantages of standard costing. 4 (b)The following data have been extracted from the standard cost card of product T: Budgeted production 500 units Standard production per hour 2 units Standard rate of wage per hour Tk.1.50 Actual rate of wage per hour Tk.1.60 Total wage paid Tk.432 Actual production 510 units Abnormal idle time 30 hours Calculate the total labor cost, rate, efficiency and idle time variances for product T. (N-D.11) 8 5. The following information has been extracted from the books of a manufacturing company: Particulars Budget Actual Production 22,000 24,000 Fixed Overheads Tk.44,000 Tk.49,000 Variable Overheads Tk.33,000 Tk.39,000 Number of Days 25 26 Number of man hours 25,000 27,000 Calculate variances on variable overhead efficiency and fixed overhead efficiency. (M-J.12) 10 6. (a) Aramex Bangladesh has a budgeted materials cost of Tk. 7 per kg. During the month of November 2,500 kg of the material was purchased and used at a cost of Tk. 18,750 in order to produce 1,250 units of the product. The budgeted materials cost of Tk. 14,000 had been based upon budgeted production of 1,000 units of the product What was the materials total variance? 6 b) A toiletries product requires raw material with a standard cost of Tk. 0.50 per kg. In November, 2,500 kg of raw material were purchased at a cost of Tk. 1,500 of which 2,300kg of raw material were used in that month‟s production. If raw material inventory is valued at standard cost and there was no opening inventory of raw material. What is the material price variance for November? (N-D.12) 6 7. (a) The following information relates to labour costs for the last month: Budget Labour rate Tk.10 per hour Production time 15,000 hours Time per unit 3 hours

- 22. P a g e | 22 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Production units 5,000 units Actual Wages paid Tk.176,000 Production 5,500 units Total hours worked 14,000 hours There was no idle time. What were the labour rate and efficiency variance? 8 (b) A company has a budgeted material cost of Tk.125,000 for the production of 25,000 units per month. Each unit is budgeted to use 2 kg of material. The standard cost of material is Tk.2.50 per kg. Total cost of actual materials in the month was Tk.136,000 for 27,000 units and 53,000 kg were purchased and used. What was the material price variance? (M-J.13) 8 8. Rahman & Company has the following information available for the current year: Standard Material 3.5 ft. per unit @ Tk.2.60 per ft. Labour 5 direct labour hours @ Tk.8.50 per hour Actual Material 95,625 ft. used (100,000 ft. purchased @Tk.2.50 per ft.) Labour 122,400 direct labour hours incurred per unit @Tk.8.35 per hour Production 25,000 units were produced Required: From the above information compute the following: (M-J.14) (a) Material price variance 3 (b) Quantity variance 3 c) Labour rate variance and 3 (d) Efficiency variance. 3 9. S Limited has extracted the following details from the standard cost card of one of its products. Labor standard 4.5 hours @ Tk. 6.40 per hour During March, S Limited produced 2,300 units of the product and incurred wages costs of Tk. 64,150.The actual hours worked were 11,700. Calculate labor rate and efficiency variance. (N-D.14) 8 10. The following information relates to costs of Grade-III workmen of A Ltd.: Basic pay Taka 200 p.m. DA Taka 150 p.m. Fringe benefit Taka 100 p.m.

- 23. P a g e | 23 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Number of working days per year 300 Leave rules : 30 days earned leave with full pay. 20 days sick leave with half pay . Usually sick leave is fully availed by the employees. Required: Calculate the standard labor hour rate for workmen of Grade–III from the above data and also Calculate the labor cost per hour if no sick leave is availed during the year. Chapter: 10 Breakeven Analysis and Limiting Factor Analysis 1. A company has sales of Tk. 12,000,000 @ Tk. 100 per unit, marginal cost per unit Tk. 60 and Fixed costs Tk. 3,000,000. Calculate: (i) Break‐ even‐ point in units and value terms 2 (ii) Profit on the sales 2 (iii) Margin of safety in case the sales volume is reduced by 10%. (M-J.10) 2 2. GPL manufactures two products, the DCON and the ERON, using the same material for each. Annual demand for DCON is 18,000 units and for ERON is 24,000 units. The variable production cost per unit of DCON is $ 10 and that of ERON $ 15. The DCON requires 3.5 kgs of raw material per unit, the ERON requires 8 kgs of raw material per unit. Supply of raw material will be limited to 175,000 kgs during the year. A Sub contractor has quoted prices of $ 17 per unit for the DCON and $ 25 per unit for ERON to supply the product. How many of each product should GPL manufacture in order to maximize profits? (M-J.10) 7 3. The XYZ Company sales of TK. 2,00,000 and a margin of safety of 25%, p/v 33 %. A decrease of fixed expenses and a decrease of sales prices have changed to 40% and P/V to 30%. Required: (M-J.11) 9 (a)By what amount did sales decrease? (b)What is the new BEP? (c)What is the new net profit? 4. a) What is P/V ratio? How does it relate to the break-even point? b) The current sales of a manufacturing company is in average 40,000 units at Tk.10 each. The costs are: 3 Prime costs Tk.2,00,000

- 24. P a g e | 24 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Variable overhead Tk. 40,000 Fixed overhead Tk.1,00,000 Calculate: (i) The Break-even sales in units 3 (ii) The additional sales in units, required to maintain the current profits level if the selling price is reduced by 10%. (N-D.11), (M-J.14) 3 5. NT Ltd. makes two products, N and T. Unit variable costs are as follows: N (Taka) T (Taka) Taka Taka Materials 3 1 Labor (Taka 9 per hour) 9 18 Overhead 2 2 14 21 The sales price per unit is Tk.18 per N and Tk.27 per T. During March 2011 the available labor is limited to 8,000 hours. Sales demand in March is expected to be 5,000 units for N and 3,000 units for T. Requirement: Determine the profit-maximizing production mix, assuming that monthly fixed costs are Tk.26,000 and no inventories are held. (N-D.11) 8 6. (a) Write four limitations of breakeven analysis. 4 (b) The present cost of a product is as follows: Taka Variable costs per unit 450 Fixed costs per unit 100 Total costs per unit 550 The overhead charges were established taking normal operation of 20,000 units of production and sales during a year. The product is sold at Tk 1000 per unit less 5% commission to the dealers. You are required to: i)Calculate the break-even sales in units. 6 ii)Calculate the additional sales in units required to maintain the current profits level if the selling price is reduced by 10%. (N-D.12) 6 7. Expo Wings Limited manufactures three products, the selling prices, maximum demand and cost details of which are as follows: Particulars Products A B C Unit selling price 300 280 280 Unit costs:

- 25. P a g e | 25 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Materials (Tk. 20/kg) 40 20 60 Labor (Tk. 16/hr) 64 96 80 Variable overheads 32 48 40 Fixed overheads 96 144 120 Maximum demand (units) 1180 1680 1320 In the forthcoming period direct materials are restricted to 2,800 kg and the company has contracted to supply 200 units of C and 130 units of B to a client which is included in the maximum demand figures above What will be your profit maximizing production plan? (N-D.12) 16 8. (a) What is a limiting factor? 4 (b) What is cost volume profit analysis? (M-J.13) 4 9. X Company makes and sells a single product, for which variable costs are as follows: Taka Materials 10 Labour 8 Production overhead 6 24 The sales price is Taka 30 per unit and fixed cost per annum is Taka 68,000. The company wishes to make a profit of Taka 16,000 per annum. Required: Determine the sales required to achieve this profit. (M-J.13) 10 10. (a) What is margin of safety 4 (b) W Limited sells one product for which data is given below: Tk. per unit Selling price 10 Variable cost 6 Fixed cost 2 The fixed costs are based on a budgeted level of activity of 5,000 units for the period. Requirement: (i) How many units must be sold if W Limited wishes to earn a profit of Tk. 6,000 for one period? 4 (ii) What is W Limited's margin of safety for the budget period if fixed costs prove to be 20% higher than budgeted? 4 (iii) If the selling price and variable cost increase by 20% and 12% respectively, by how much must sales volume change compared with the original budgeted level in order to achieve the original budgeted profit for the period? (N-D.14) 6

- 26. P a g e | 26 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants Chapter: 11 Investment Appraisal Techniques 1. What is ARR and how is it calculated? An asset costing Tk.120,000 is to be depreciated over ten years to a nil residual value. Profits after depreciation for the first five years are as follows: Year Amount (Tk.) 1 12,000 2 17,000 3 28,000 4 37,000 5 8,000 Calculate the payback period to the nearest month. (N-D.10) 2+5 2. .(a) Explain the payback method of evaluating capital investments and indicate the circumstances in which this method is specially useful. (N-D.10),(M-J.13),(M-J.14) 3 (b) What is Cost of Capital? What is the relationship between Cost of Capital & IRR? 3 (c) Calculate the IRR of the project below. 6 Time Taka 0 Investment (4,000) 1 Receipts 1,200 2 Receipts 1,410 3 Receipts 1,875 4 Receipts 1,150 3. . Compute the payback period under (a) Traditional payback period (b) Discounted payback method and comments on the results: TK Initial Outlay 800,000 Estimated Life 5 Year Profit after Tax end of year 1 60,000 2 140,000 3 240,000 4 160,000 5 Nil Depreciation has been calculated under the straight line method. The cost of capital may be taken at least 20% p.a. and the present value of Tk.1 to 20% p.a

- 27. P a g e | 27 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants 4. A company with a cost of capital of 16% is considering two mutually exclusive options, option A and option B. The cash flows for each are as follows: (N-D.13) Year Option A Option B Tk. Tk. 0 Capital outlay (10,200) (35,250) 1 Net cash inflow 6,000 18,000 2 Net cash inflow 5,000 15,000 3 Net cash inflow 3,000 15,000 (iv) Calculate NPV and IRR 6 (v) Under what circumstances NPV and IRR may lead to conflicting rankings? 3 (vi) Which option (A or B) will be preferred and why? 5. You have two potential projects in hand. Projects are mutually exclusive. You have the following information about the projects: Year Cash flow of Project A Cash flow of Project B 0 (500,000) (500,000) 1 125,000 200,000 2 175,000 200,000 3 200,000 200,000 4 250,000 200,000 5 250,000 200,000 500,000 500,000 The cost of capital is 15%. You are required to: (a) Calculate Net Present Value (NPV) for both the projects. 5 (b) Calculate Internal Rate of Return (IRR) for both the projects. 5 (c) Which project will you choose considering NPV and IRR? (N-D.13) 5 6. Tk. 50,000 is to be spent on a machine having a life of five years and a residual value of Tk. 5,000. Operating cash inflows will be the same each year, except for year 1 when the figure will be Tk. 6,000. The accounting rate of return on the initial investment has been calculated at 30% pa. Calculate the payback period. (N-D.14) 8 7. a) In a net present value analysis, how can an analyst explicitly and formally consider the influence of risk on the present value of certain cash flows? 3 (b) Why is the profitability index a better basis than net present value to compare projects that require different levels of investment? 3 (c) Tom Bat became a cricket enthusiast at a very early age. All of his cricket experience has provided

- 28. P a g e | 28 Prepared by: Mohona Mahmood Pinaki & Company Md. Omar Faruque Chartered Accountants him valuable knowledge of the sport, and he is thinking about going into the batting cage business. He estimates the construction of a state-of-the-art building and the purchase of necessary equipment will cost Tk.630,000. Both the facility and the equipment will be depreciated over 12 years using the straight- line method and are expected to have zero salvage values. His required rate of return is 10% (present value factor of 6.8137). Estimated annual net income and cash flows are as follows: Revenue Tk. 329,000 Less: Utility cost 40,000 Supplies 8,000 Labor 141,000 Depreciation52,500 Others 38,500 280,000 Net income 49,000 Required to calculate: 3x3=9 (i) The net present value. (ii) The internal rate of return. (iii) The cash payback period. (M-J.15) 8. (a) What is payback period? State the drawbacks to the payback period. 3 (b) Messy has a cost of capital of 15% and is considering a capital investment project, where the estimated cash flows are as follows: Year of Cash flow Amount (Tk.) 0(i.e., now) (100,000) 1 60,000 2 80,000 3 40,000 4 30,000 Requirement: Calculate the NPV of the project and assess whether it should be undertaken. (M-J.15) 7