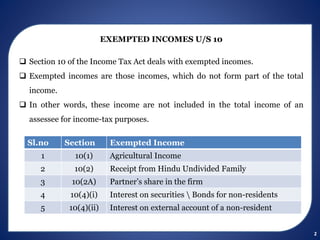

This document summarizes exempted incomes under Section 10 of the Indian Income Tax Act. It lists 87 exempted incomes across various sub-sections of Section 10. Some key exempted incomes include agricultural income, interest income from certain bonds/deposits, leave travel concession, provident fund payments, gratuity, family pension received by central/state govt. employees, scholarship amounts, and dividends received from Indian companies. The document was prepared by Dr. Sangeetha R of Hindusthan College of Arts and Science to outline various types of incomes that are exempted from taxable income calculations under the Income Tax Law in India.

![5

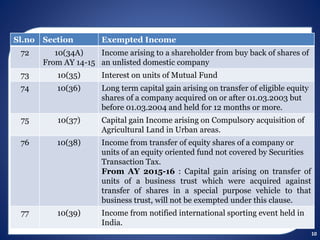

Sl.no Section Exempted Income

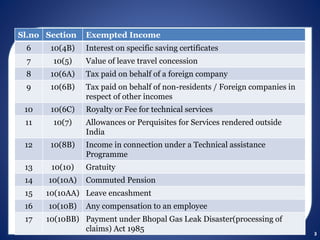

28 10(15)(iiic) Interest payable to European Investment Bank

29 10(15) (iv)

(i)

Interest on Retirement Benefits

30 10(15)(v) Interest on Securities and Deposits

31 10(15) (vi) Interest on Gold Deposit Bonds, 1999

32 10(16) Scholarships granted to meet the cost of education

33 10(17) Allowances to MPs and MLAs

[w.e.f AY 2007-08, Constituency allowance received is also

exempted without any limit]

34 10(17A) Amount in connection with cash or kind award instituted

by Central or State Government.

35 10(18) Pension or Family pension received by Central or State

Government employee

36 10(19) Family Pension received by a widow / children / nominated

heirs of a member of Armed Forces.

37 10(19A) Annual value of one place in the occupation of an ex-ruler.](https://image.slidesharecdn.com/28-200830151046/85/EXEMPTED-INCOME-5-320.jpg)

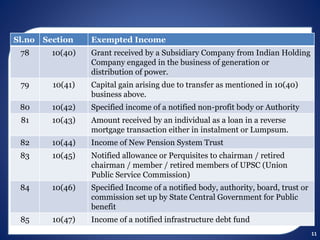

![6

Sl.no Section Exempted Income

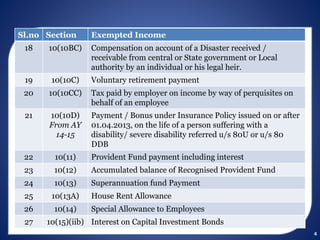

38 10(20) Income of local authorities [Municipality, Panchayat, District

Boards]

39 10(21) Income of an approved Scientific Research Association

40 10(22B) Income of a News Agency

41 10(23BB) Income of Khadi and Village Board

42 10(23BBA) Income of Religious Institutions, etc

43 10(23BBB) Income of European Economic Community

44 10(23BBC) Income of SAARC Fund for Regional Projects

45 10(23BBD) Income of the ASOSAI-SECRETARIAT [Asian Organisation

of Supreme Audit Institutions][From AY 2001-02 to 2010-11]

46 10(23BBE) Income of Insurance Regulatory and Development Authority

47 10(23BBF) Income of North-Eastern Devlopment Finance Corporation

Limited

48 10(23BBG) Income of Central Electricity Regulatory Commission [w.e.f.

AY 2008-09]](https://image.slidesharecdn.com/28-200830151046/85/EXEMPTED-INCOME-6-320.jpg)

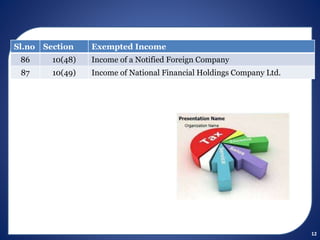

![7

Sl.no Section Exempted Income

49 10(23BBH) Income of the Prasar Bharati (Broadcasting Corporation of

India)

50 10(23C) Income of Certain Relief Funds

51 10(23C)(iiia) Income received by the National Foundation for Communal

Harmony

52 10(23C)

(iii ab, ac,

ad, ae) (vi)

(via)

Income of educational institutions, hospitals and medical

institutions.

53 10(23C)(iv)

and (v)

Income of notified fund, charitable / religious institution or

trust

54 10(23D) Income of Mutual Fund

55 10(23DA)

From AY 14-

15

Income of a Securitisation Trust from the activity of

Securitisation.

56 10(23EA) Income of notified Investor Protection Fund Set up by

recognised stock exchange in India [w.e.f AY 2007-08]](https://image.slidesharecdn.com/28-200830151046/85/EXEMPTED-INCOME-7-320.jpg)

![8

Sl.no Section Exempted Income

57 10(23EB) Income of Credit Guarantee Funds Trust for Small

Industries [AY 2002-03 to 2006-07]

58 10(23EC) Income of Investor Protection fund by way of Contributions

from Commodity exchange and members there of [w.e.f AY

2008-09]

59 10(23ED)

From AY 14-

15

Income of Notified Investor Protection Fund set up by a

depository, by way of contributions from a depository.

60 10(23EE)

From AY

2016-17

Specified Income of a Notified Settlement Guarantee Fund

(Recognized)

61 10(23FB) Income of Venture Capital Company (or) Venture Capital

Fund from investment in a Venture Capital undertaking

[w.e.f AY 2008-09]

62 10(23FBA)

From AY

2016-17

Income of an Investment Fund (Except Business or

Profession)](https://image.slidesharecdn.com/28-200830151046/85/EXEMPTED-INCOME-8-320.jpg)

![9

Sl.no Section Exempted Income

63 10(23FC)

From AY 15-

16

Income of a Business Trust by way of interest from a Special

purpose Vehicle.

64 10(23FD)

From AY 15-

16

Income received by a Unit Holder from the Business Trust

65 10(24) Income of Trade Union or Association of Trade Unions

66 10(25) Income of Statutory Provident Fund

67 10(26) Income of Member of Scheduled Tribes

68 10(26AAB) Income of an Agricultural Produce Market Committee or

Board regulating the marketing of agricultural produce

[w.e.f AY 2009-10]

69 10(30) and

(31)

Subsidy from Tea Board

70 10(32) Income of minor child upto a maximum of Rs.1500 per

minor child.

71 10(34) Dividends by a domestic company.](https://image.slidesharecdn.com/28-200830151046/85/EXEMPTED-INCOME-9-320.jpg)