2013 Projected Income & Expenses Sheet

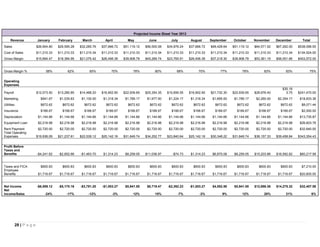

- 1. Projected Income Sheet Year 2013 Revenue January February March April May June July August September October November December Total Sales $26,904.80 $29,595.28 $32,285.76 $37,666.72 $51,119.12 $56,500.08 $34,976.24 $37,666.72 $48,428.64 $51,119.12 $64,571.52 $67,262.00 $538,096.00 Cost of Sales $11,210.33 $11,210.33 $11,210.34 $11,210.33 $11,210.33 $11,210.34 $11,210.33 $11,210.33 $11,210.34 $11,210.33 $11,210.33 $11,210.34 $134,524.00 Gross Margin $15,694.47 $18,384.95 $21,075.42 $26,456.39 $39,908.79 $45,289.74 $23,765.91 $26,456.39 $37,218.30 $39,908.79 $53,361.19 $56,051.66 $403,572.00 58% 62% 65% 70% 78% 80% 68% 70% 77% 78% 83% 83% 75% $12,073.50 $13,280.85 $14,488.20 $16,902.90 $22,939.65 $25,354.35 $15,695.55 $16,902.90 $21,732.30 $22,939.65 $28,976.40 $30,18 3.75 $241,470.00 Marketing $941.67 $1,035.83 $1,130.00 $1,318.34 $1,789.17 $1,977.50 $1,224.17 $1,318.34 $1,695.00 $1,789.17 $2,260.00 $2,354.17 $18,833.36 Utilities $672.62 $672.62 $672.62 $672.62 $672.62 $672.62 $672.62 $672.62 $672.62 $672.62 $672.62 $672.62 $8,071.44 Insurance $166.67 $166.67 $166.67 $166.67 $166.67 $166.67 $166.67 $166.67 $166.67 $166.67 $166.67 $166.67 $2,000.00 Depreciation $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $13,735.87 Equipment Loan $2,216.98 $2,216.98 $2,216.98 $2,216.98 $2,216.98 $2,216.98 $2,216.98 $2,216.98 $2,216.98 $2,216.98 $2,216.98 $2,216.98 $26,603.76 Rent Payment Total Operating Expenses $2,720.00 $2,720.00 $2,720.00 $2,720.00 $2,720.00 $2,720.00 $2,720.00 $2,720.00 $2,720.00 $2,720.00 $2,720.00 $2,720.00 $32,640.00 $19,936.09 $21,237.61 $22,539.12 $25,142.16 $31,649.74 $34,252.77 $23,840.64 $25,142.16 $30,348.22 $31,649.74 $38,157.33 $39,458.84 $343,354.43 Profit Before Taxes and Benefits -$4,241.62 -$2,852.66 -$1,463.70 $1,314.23 $8,259.05 $11,036.97 -$74.73 $1,314.23 $6,870.08 $8,259.05 $15,203.86 $16,592.82 $60,217.58 $600.83 $600.83 $600.83 $600.83 $600.83 $600.83 $600.83 $600.83 $600.83 $600.83 $600.83 $600.83 $7,210.00 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $1,716.67 $20,600.00 -$6,559.12 -$5,170.16 -$3,781.20 -$1,003.27 $5,941.55 $8,719.47 -$2,392.23 -$1,003.27 $4,552.58 $5,941.55 $12,886.36 $14,275.32 $32,407.58 -24% -17% -12% -3% 12% 15% -7% -3% 9% 12% 20% 21% 6% Gross Margin % Operating Expenses Payroll Taxes and FICA Employee Benefits Net Income Net Income/Sales 28 | P a g e

- 2. Projected Cash Flow Year 2013 January Cash Received February March April May June July August September October November December $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Cash Sales $26,904.80 $29,595.28 $32,285.76 $37,666.72 $51,119.12 $56,500.08 $34,976.24 $37,666.72 $48,428.64 $51,119.12 $64,571.52 $67,262.00 Subtotal Cash from Operations $26,904.80 $29,595.28 $32,285.76 $37,666.72 $51,119.12 $56,500.08 $34,976.24 $37,666.72 $48,428.64 $51,119.12 $64,571.52 $67,262.00 Additional Cash Received Sales Tax, VAT, HST/GST Received $1,345.24 $1,479.76 $1,614.29 $1,883.34 $2,555.96 $2,825.00 $1,748.81 $1,883.34 $2,421.43 $2,555.96 $3,228.58 $3,363.10 $25,000.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $53,250.04 $31,075.04 $33,900.05 $39,550.06 $53,675.08 $59,325.08 $36,725.05 $39,550.06 $50,850.07 $53,675.08 $67,800.10 $70,625.10 Cash Spending $21,108.93 $22,410.45 $23,711.97 $26,315.00 $32,822.59 $35,425.62 $25,013.49 $26,315.00 $31,521.07 $32,822.59 $39,330.17 $40,631.69 Bill Payments $11,210.33 $11,210.33 $11,210.34 $11,210.33 $11,210.33 $11,210.34 $11,210.33 $11,210.33 $11,210.34 $11,210.33 $11,210.33 $11,210.34 Depreciation $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $1,144.66 $33,463.92 $34,765.44 $36,066.96 $38,669.99 $45,177.57 $47,780.61 $37,368.47 $38,669.99 $43,876.06 $45,177.57 $51,685.16 $52,986.68 $1,345.24 $1,479.76 $1,614.29 $1,883.34 $2,555.96 $2,825.00 $1,748.81 $1,883.34 $2,421.43 $2,555.96 $3,228.58 $3,363.10 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $25,000.00 New Current Borrowing New Investment Received Total Cash Received Expenditures Subtotal Spent on Operations Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out Other Liabilities Principal Repayment Subtotal Cash Spent $1,345.24 $1,479.76 $1,614.29 $1,883.34 $2,555.96 $2,825.00 $1,748.81 $1,883.34 $2,421.43 $2,555.96 $3,228.58 $28,363.10 Total Cash Spent $34,809.16 $36,245.20 $37,681.25 $40,553.32 $47,733.53 $50,605.62 $39,117.28 $40,553.32 $46,297.50 $47,733.53 $54,913.73 $81,349.78 Net Cash Flow $18,440.88 -$5,170.16 -$3,781.20 -$1,003.27 $5,941.55 $8,719.47 -$2,392.23 -$1,003.27 $4,552.58 $5,941.55 $12,886.36 -$10,724.68 Cash Balance $18,440.88 $13,270.72 $9,489.52 $8,486.25 $14,427.80 $23,147.27 $20,755.04 $19,751.77 $24,304.34 $30,245.89 $43,132.26 $32,407.58 29 | P a g e