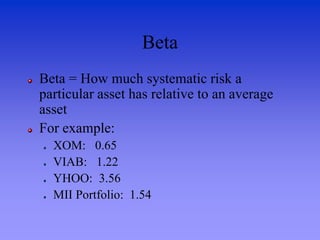

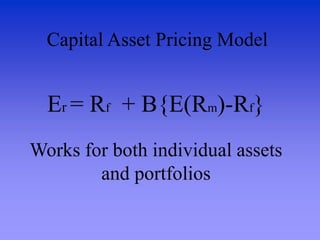

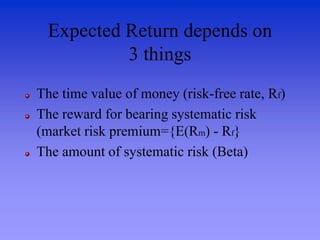

Total risk can be separated into systematic and unsystematic risk. Systematic risk cannot be eliminated through diversification while unsystematic risk can be reduced. Beta measures the amount of systematic risk an asset has relative to the market. The Capital Asset Pricing Model calculates the expected return of an asset as equal to the risk-free rate plus the product of the asset's beta and the market risk premium. It accounts for the risk-free rate, market risk premium, and the asset's systematic risk as measured by its beta.