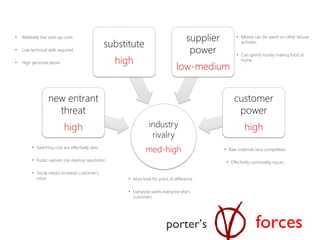

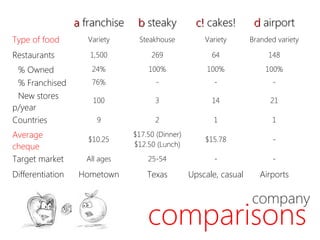

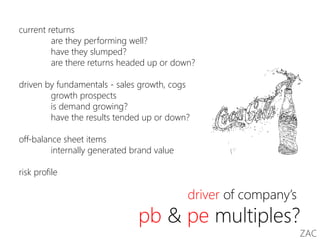

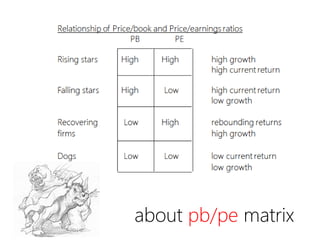

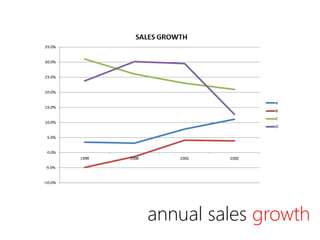

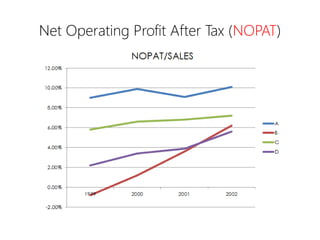

The document analyzes valuation ratios in the restaurant industry, comparing various companies and outlining the factors influencing their performance and growth potential. It highlights the challenges such as low technical skills required, competition in raw materials, and the impact of public opinion and social media on reputation. The analysis categorizes companies as rising stars, falling stars, dogs, or recovering firms based on their price-to-book and price-to-earnings ratios and emphasizes the importance of considering different business models and risk profiles.