More Related Content

Similar to Copy of market slides (mar 17)

Similar to Copy of market slides (mar 17) (20)

Copy of market slides (mar 17)

- 1. 0

10,000

20,000

30,000

40,000

50,000

60,000

Jan-05

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Jan-15

Jan-16

Jan-17

1©2016 UBL Fund Managers. All rights reserved.

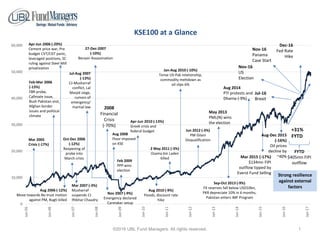

KSE100 at a Glance

2008

Financial

Crisis

(-70%)

Jul-16

Brexit

FYTD

$405mn FIPI

outflow

+31%

FYTD

Strong resilience

against external

factors

Nov-16

Panama

Case Start

Apr-Jun 2006 (-29%)

Cement price war, Pre

budget CVT/CGT panic,

leveraged positions, SC

ruling against Steel Mill

privatization

Aug 2006 (-12%)

Move towards No trust motion

against PM, Bugti killed

Mar 2007 (-3%)

Musharraf

suspends CJ

Iftikhar Chaudry

Apr-Jun 2010 (-13%)

Greek crisis and

federal budget

Jan-Aug 2010 (-10%)

Tense US-Pak relationship,

commodity meltdown as

oil slips 6%

Sep-Oct 2013 (-9%)

FX reserves fall below USD10bn,

PKR depreciate 10% in 6 months,

Pakistan enters IMF Program

Jun 2012 (-3%)

PM Gilani

Disqualification

27-Dec-2007

(-10%)

Benazir Assassination

Feb-Mar 2006

(-13%)

FBR probe,

Callmate issue,

Bush Pakistan visit,

Afghan border

issues and political

climate

Jul-Aug 2007

(-13%)

CJ-Musharraf

conflict, Lal

Masjid siege,

rumors of

emergency/

martial law

Mar 2005

Crisis (-17%)

Nov 2007 (-9%)

Emergency declared

Caretaker setup

Oct-Dec 2006

(-12%)

Reopening of

probe into

March crisis

Aug 2008

Floor imposed

on KSE

Feb 2009

PPP wins

election

2 May 2011 (-3%)

Osama bin Laden

killed

Aug 2010 (-9%)

Floods, discount rate

hike

Mar 2015 (-17%)

$134mn FIPI

outflow tipped by

Everst Fund Selling

Aug-Dec 2015

(-16%)

Oil prices

decline by

~40%

May 2013

PML(N) wins

the election

Aug 2014

PTI protests and

Dharna (-9%)

Nov-16

US

Election

Dec-16

Fed Rate

Hike

- 2. 2©2016 UBL Fund Managers. All rights reserved.

Nominal vs Real Returns on Asset Classes

• Notional Value of PKR 100

Bank Deposit, 247

T-Bill, 394

PIB, 766

SSC, 462

CPS, 1,005

Equity

3,171

-

500

1,000

1,500

2,000

2,500

3,000

3,500

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Dec-14

Dec-15

Dec-16

Bank Deposit T-Bill PIB SSC CPS Equity

Annualied Return 5.8% 8.9% 13.6% 10.0% 15.5% 24.1%

Annualized STDEV (Risk) 0.5% 1.2% 12.4% 6.6% 8.0% 25.9%

NOMINAL RETURN

- 3. 3©2016 UBL Fund Managers. All rights reserved.

Nominal vs Real Returns on Asset Classes

Bank Deposit, 72

T-Bill, 116

PIB, 225

SSC, 136

CPS, 295

Equity

930

-

100

200

300

400

500

600

700

800

900

1,000

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Dec-14

Dec-15

Dec-16

Bank Deposit T-Bill PIB SSC CPS Equity

Annualied Return -2.0% 0.9% 5.2% 1.9% 7.0% 15.0%

Annualized STDEV (Risk) 2.8% 2.9% 13.1% 7.8% 8.7% 26.2%

REAL RETURN

(Nominal Return - Inflation)

• Notional Value of PKR 100

- 4. 4©2016 UBL Fund Managers. All rights reserved.

2006-2009

Average return 12%

Average Volatility 23%

Sharpe Ratio 0.07

2012-2016

Average return 35%

Average Volatility 13%

Sharpe Ratio 2.5

Better Risk Adjusted Returns

Probability of Negative

Returns=24%

Probability of Negative

Returns=66%

Probability of Negative

Returns=88%

0

10

20

30

40

50

60

0

10,000

20,000

30,000

40,000

50,000

60,000

Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

KSE-100 30 Day Standard Deviation

Volatility above 40%

Annualized return -62%

when volatility was in

this range. Market has

remained in this range

only 6% of time (Mar-05,

Jun-06, 2008-09)

Volatility between 20-

40%

Annualized return -9%

when volatility was in

this range. Market has

remained in this range

for 24% of time

Volatility between 0-

20%

Annualized return of

36% when volatility was

in this range. Market has

remained in this range

for 70% time

Greater

Institutional

Participation

- 5. 5©2016 UBL Fund Managers. All rights reserved.

Spreads between Earning yield and 3 Year PIB

Interest Rate Differentials also playing its part

-

10,000

20,000

30,000

40,000

50,000

60,000

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

FY19E

3YPIB Earning Yield KSE100

2002-04

Average spread was as

wide as 9.3%

2005-09

Market continued upward

momentum despite rate hikes.

Average spread narrowed to ~1%

2010-13

Higher rates led to higher earning

yield/low PE multiple. Average

spread was maintained at ~2%

2013 till Date

Sequential rate reduction has resulted in lower

earning yield/higher multiples. However,

average spread of 3.5% is now being carried

8% 8% 7%

3%

-1% 0%

-1%

1%

0% -1%

2%

4%

1% 2%

4%

2% 3% 3%

-5%

0%

5%

10%

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

FY19E

- 6. 6©2016 UBL Fund Managers. All rights reserved.

GDP Growth expected to surpass projections

Sectors Units USD mn % of GDP

Power Capacities 10,000 MW 8,343 2.6%

Auto Expansions ~250k cars 3,571 1.1%

Cement Expansions 26mn tons 2,377 0.7%

Steel Expansions 1.1mn tons 715 0.2%

LNG Supply 1200 mmcfd 273 0.1%

OMC Storage 480k tons 249 0.1%

Total Contribution to GDP 4.9%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17E FY18E FY19E FY20E

IMF Projections Internal Projection

We expect GDP growth over the next 5 years to surpass

initial projections due to capacity building in industrial

sector, improved availability of energy and growth in trade

& consumption

- 7. 7©2016 UBL Fund Managers. All rights reserved.

-600

-400

-200

0

200

400

600

CY11 CY12 CY13 CY14 CY15 CY16

LIPI (USD mn)

INDIVIDUALS COMPANIES BANKS / DFI / NBFC MUTUAL FUNDS OTHER

Domestic Liquidity and

Institutional support

continues to sustain the

rally at a time of foreign

investment outflows

Expected CPEC related

FDI and Potential

Emerging market

inflows will continue to

support the market

despite near term

outflows

Improving Domestic Liquidity

-127

126

399 384

-316 -339 (45,000)

(35,000)

(25,000)

(15,000)

(5,000)

5,000

15,000

25,000

35,000

45,000

55,000

-400

-300

-200

-100

0

100

200

300

400

500

CY11 CY12 CY13 CY14 CY15 CY16

FIPI (USD mn)

FIPI USD mn (LHS) KSE100

Average return of 24%

despite cumulative outflow

of USD655mn

- 8. 8©2016 UBL Fund Managers. All rights reserved.

AUM Comparison – Equity surpassing Debt

-

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16

Industry Conventional Industry Islamic

-

50,000

100,000

150,000

200,000

250,000

300,000

Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16

AUM - Fixed Income AUM - Equity

PKR mn

PKR mn

- 9. 9©2016 UBL Fund Managers. All rights reserved.

Global Pension Fund Comparison (% of GDP)

-

20

40

60

80

100

120

140

160

180

Canada

USA

Switzerland

Australia

UK

Sweden

Finland

Japan

Korea

-

5

10

15

20

25

Brazil

Thailand

Nigeria

Turkey

Egypt

Indonesia

China

India

Pakistan

Emerging EconomiesDeveloped Economies

Pakistan has the lowest concentration

in private pension fund investments

among a sample of 80 countries

- 10. 10©2016 UBL Fund Managers. All rights reserved.

PSX – A case of Depth & Reform

• Growing institutional participation

• Chinese investment in PSX and injection of liquidity via brokers

• Regulatory reforms and formalization of products such as in-house badla

• Introduction of broad-based leverage products covering a larger pool of stocks

• Introduction of derivative products such as Options

• Expected Foreign Portfolio Investment Flows on account of Emerging market status

• Expected fiscal spending on large scale infrastructure projects to keep corporate earning growth profile intact

• Potential offering of Govt stakes in public sector to local and foreign institutions and HNWIs